The 100 Non Repaint MT4 Indicator guarantees one thing totally different: indicators that stick. As soon as it marks an entry, that mark stays put, whether or not the commerce wins or loses. No extra phantom indicators disappearing out of your chart historical past. No extra questioning for those who truly noticed what you thought you noticed. This indicator offers merchants the reliability they should backtest correctly, execute with confidence, and truly be taught from their buying and selling historical past as an alternative of chasing ghosts.

However does it ship? Let’s break down what makes this instrument work and the place it suits in your buying and selling arsenal.

What the 100 Non Repaint Indicator Truly Is

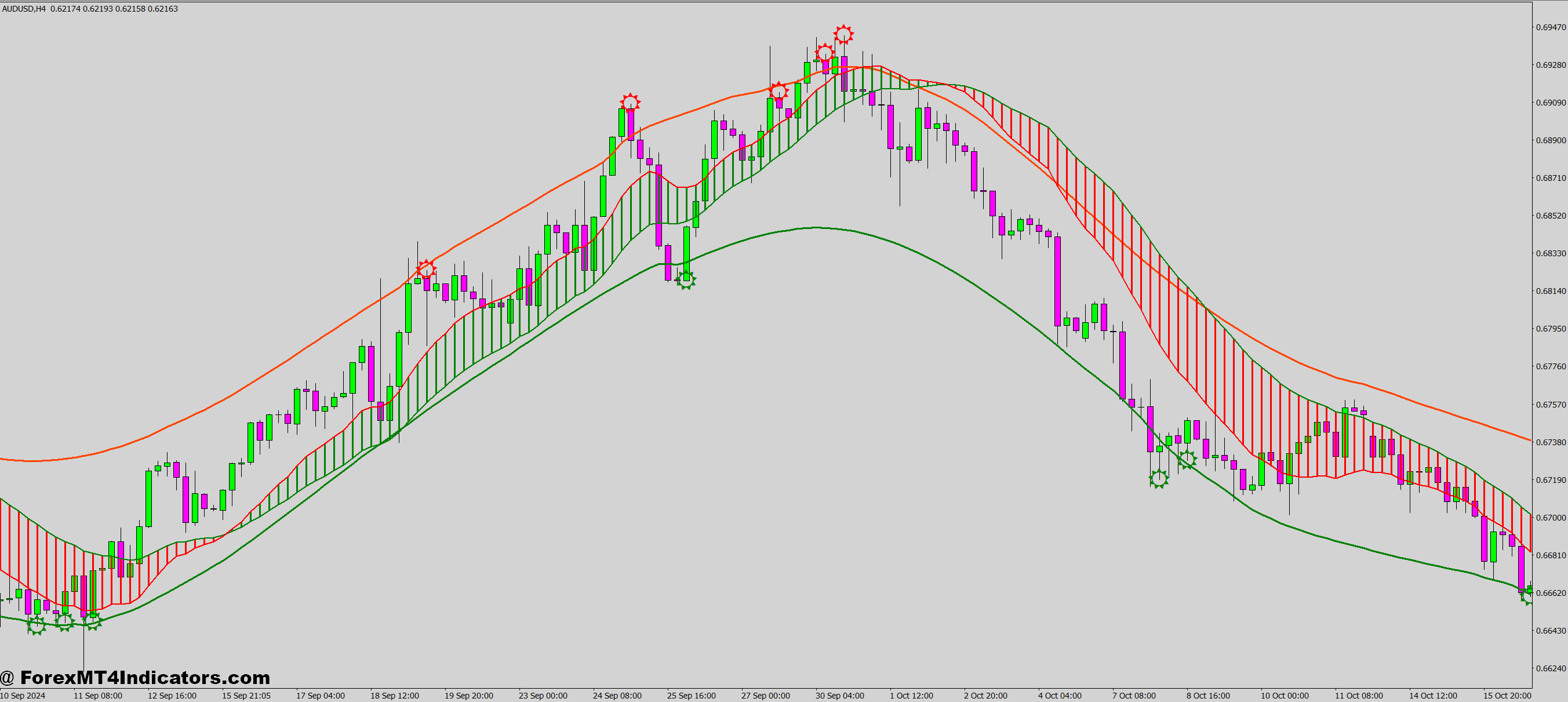

The 100 Non Repaint MT4 Indicator is a technical evaluation instrument designed to generate purchase and promote indicators with out redrawing previous indicators when new value knowledge arrives. Most indicators recalculate with every new candle, which might make historic indicators look good whereas real-time efficiency falls aside. This one locks in its choice at candle shut.

The “100” in its title refers to its complete method—it sometimes combines a number of affirmation components earlier than triggering a sign. We’re speaking development filters, momentum checks, and volatility assessments, working collectively. It’s not only a easy transferring common crossover that’ll get you chopped up in ranging markets.

Right here’s what makes it totally different: Once you see an arrow in your chart pointing up or down, that arrow gained’t disappear or shift positions later. Your chart turns into an trustworthy file of what the indicator truly known as in real-time, not a prettified model of hindsight.

The Logic Behind the Indicators

The indicator works by analyzing accomplished value motion relatively than forming opinions about incomplete candles. It waits for the candle to shut earlier than plotting something. This prevents the frequent difficulty the place an indicator reveals a bullish sign mid-candle, solely to flip bearish by candle shut.

Most variations use a mix of development detection (typically via transferring common relationships) and momentum affirmation (like RSI or MACD parts). The calculation runs on closed candles solely—that’s the key sauce. When EUR/USD closes a 4-hour candle above key resistance with sturdy momentum, the indicator marks it. That mark stays.

The filtering system sometimes requires a number of circumstances to align. A easy value cross above a transferring common gained’t set off it. You’d want that cross plus momentum affirmation plus maybe a volatility filter to keep away from false indicators throughout uneven London open classes. This multi-factor method cuts down on sign frequency however will increase reliability.

Placing It to Work: Actual Buying and selling Eventualities

Let’s discuss sensible utility. Say you’re buying and selling USD/CAD on the each day chart, ready for development continuation setups. The 100 Non Repaint Indicator flashes a promote sign as oil costs rally and the pair breaks help. You enter quick at 1.3420, place your cease above the final swing excessive at 1.3480, and goal the subsequent help zone at 1.3200.

The commerce strikes in opposition to you initially—value bounces again to 1.3450. Your indicator’s arrow stays proper the place it was, confirming this was a reputable sign, not some repainted fantasy. You both belief your setup otherwise you don’t. No ambiguity. The commerce ultimately works out, dropping to your goal over 5 days.

Distinction that with repainting indicators. When testing this on risky NFP days, I’ve seen indicators that seemed good in backtest produce utterly totally different indicators dwell. You suppose you’re following a 70% win price system, however you’re truly buying and selling a forty five% system with pretend historic efficiency.

For scalpers on the 5-minute chart, the non-repaint function issues much more. Once you’re out and in of GBP/USD inside 20 minutes, you might want to know that sign at 8:35 AM was truly there at 8:35 AM, not one thing your indicator dreamed up later.

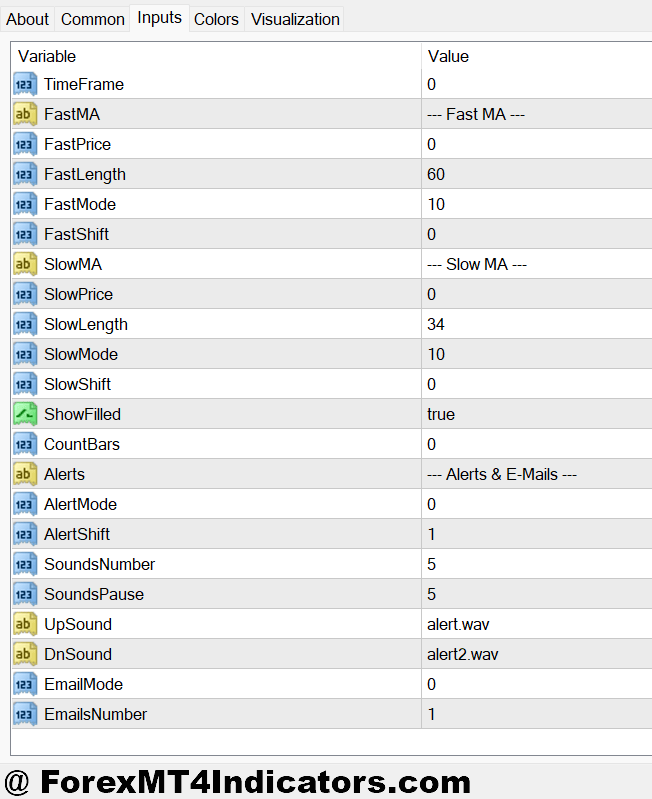

Settings and Customization for Completely different Markets

The usual settings work for trending pairs like EUR/USD and GBP/JPY on 1-hour to each day timeframes. However you’ll need to modify for various circumstances.

For ranging pairs like EUR/CHF, improve the sign threshold. Tighten your filters to keep away from getting chopped up. Many variations allow you to modify the lookback interval—bump it from 14 to 21 intervals in sideways markets to scale back sign frequency.

On the flip aspect, trending pairs throughout sturdy directional strikes (suppose USD/JPY throughout BOJ intervention rumors) can deal with extra delicate settings. Drop your affirmation necessities barely to catch earlier entries, although this will increase false indicators.

The volatility filter is your buddy throughout Asian session buying and selling. Once you’re coping with 20-pip ranges on EUR/USD at 2 AM EST, you need that filter tight. In any other case, you’re buying and selling noise. Throughout the London-New York overlap? Loosen it as much as catch the momentum strikes.

Completely different timeframes want totally different approaches. The 5-minute chart would possibly use a 50-period transferring common baseline, whereas the each day chart works higher with 200 intervals. Check totally on demo earlier than risking actual cash—that’s non-negotiable.

The Good, the Dangerous, and the Real looking

Right here’s the factor: No indicator solves all of your buying and selling issues. The 100 Non Repaint MT4 Indicator’s largest benefit is belief. You possibly can backtest it truthfully, journal your trades precisely, and construct actual buying and selling statistics. That’s large for growing constant execution.

It additionally forces self-discipline. When that sign seems, you both take it otherwise you don’t. There’s no “ready to see if it stays” as a result of it’ll keep, for higher or worse. This eliminates a typical type of cherry-picking the place merchants solely rely the indicators that labored out.

However—and that is essential—non-repaint doesn’t imply non-wrong. The indicators are everlasting, however they’re not magical. Throughout the 2023 banking disaster volatility, even strong non-repaint indicators acquired whipsawed. Quick-moving information occasions don’t care about your technical indicators.

The lag is actual, too. By ready for candle shut affirmation, you’re getting into later than indicators that bounce the gun mid-candle. On a 4-hour chart, that would imply lacking 50-100 pips of motion. Typically that saved motion catches up with you; generally you miss the most effective entry.

False indicators nonetheless occur, particularly in uneven markets. EUR/GBP throughout low-volume summer time buying and selling can produce indicators that instantly fail. The indicator isn’t studying market manipulation or cease hunts—it’s simply studying value and calculations.

How It Stacks Up In opposition to the Competitors

Evaluate this to straightforward MACD or RSI indicators, which recalculate continually. These instruments are helpful however require guide affirmation that what you’re seeing now was truly there then. With SuperTrend or Parabolic SAR indicators, you get non-repaint conduct too, however sometimes much less sophistication in sign filtering.

In opposition to Arrow indicators that repaint, there’s no contest for backtesting reliability. These repainters look unimaginable in historical past, however fail ahead testing each time. They’re principally buying and selling hindsight, which doesn’t pay payments.

Some merchants want absolutely customizable methods the place they mix non-repaint parts manually—like utilizing Heiken Ashi non-repaint candles with particular transferring averages. That works for those who’ve acquired the expertise to construct sturdy logic. The 100 Non Repaint Indicator packages that logic for you.

Buying and selling foreign exchange carries substantial danger of loss and isn’t appropriate for all buyers. No indicator, repaint or non-repaint, ensures income. Most retail foreign exchange merchants lose cash. This instrument is an assist to evaluation, not a crystal ball. Use correct danger administration, by no means danger greater than 1-2% per commerce, and perceive that even the most effective technical indicators fail throughout elementary shocks.

Tips on how to Commerce with 100 Non Repaint MT4 Indicator

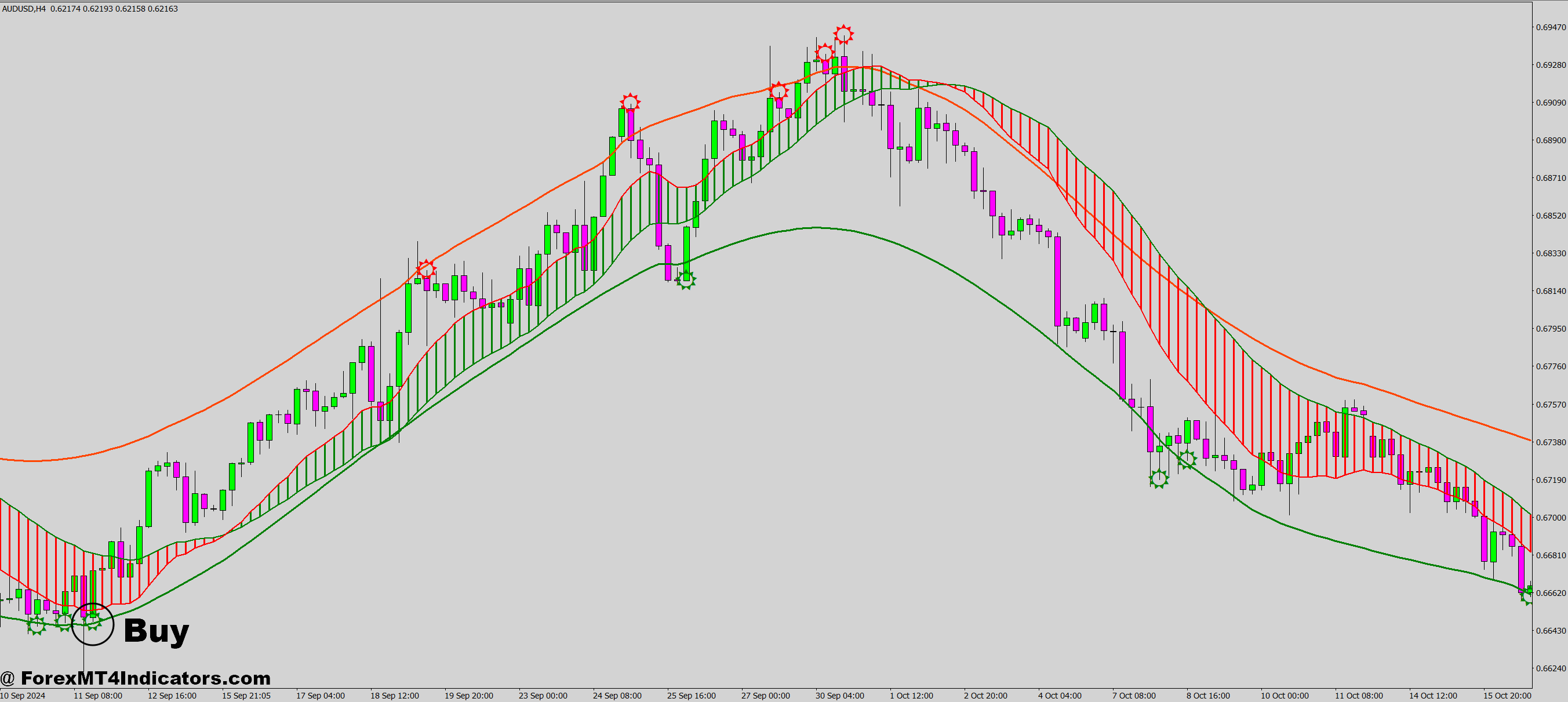

Purchase Entry

Watch for arrow affirmation – Enter solely after the 1-hour or 4-hour candle closes with an upward arrow; mid-candle indicators don’t rely and result in false entries.

Verify development alignment – Guarantee value is above the 200-period MA on each day charts earlier than taking purchase indicators on EUR/USD or GBP/USD for increased chance setups.

Set stop-loss 20-30 pips under sign – Place your cease beneath the latest swing low or the sign candle’s low, whichever offers you higher risk-reward on main pairs.

Skip uneven Asian classes – Keep away from purchase indicators between 12 AM – 4 AM EST when EUR/USD ranges below 30 pips; await London open volatility as an alternative.

Goal 2:1 risk-reward minimal – If risking 25 pips, goal for a minimum of 50 pips revenue; use earlier resistance ranges or spherical numbers (1.1000, 1.2000) as targets.

Verify with increased timeframe – Verify that the 4-hour or each day chart reveals bullish construction earlier than taking 1-hour purchase indicators to keep away from counter-trend traps.

Keep away from pre-NFP and FOMC indicators – Don’t take entries inside 2 hours of main information occasions; the indicator can’t predict elementary volatility spikes.

Danger just one% per sign – On a $10,000 account, danger most $100 per purchase entry no matter how “good” the sign seems to be.

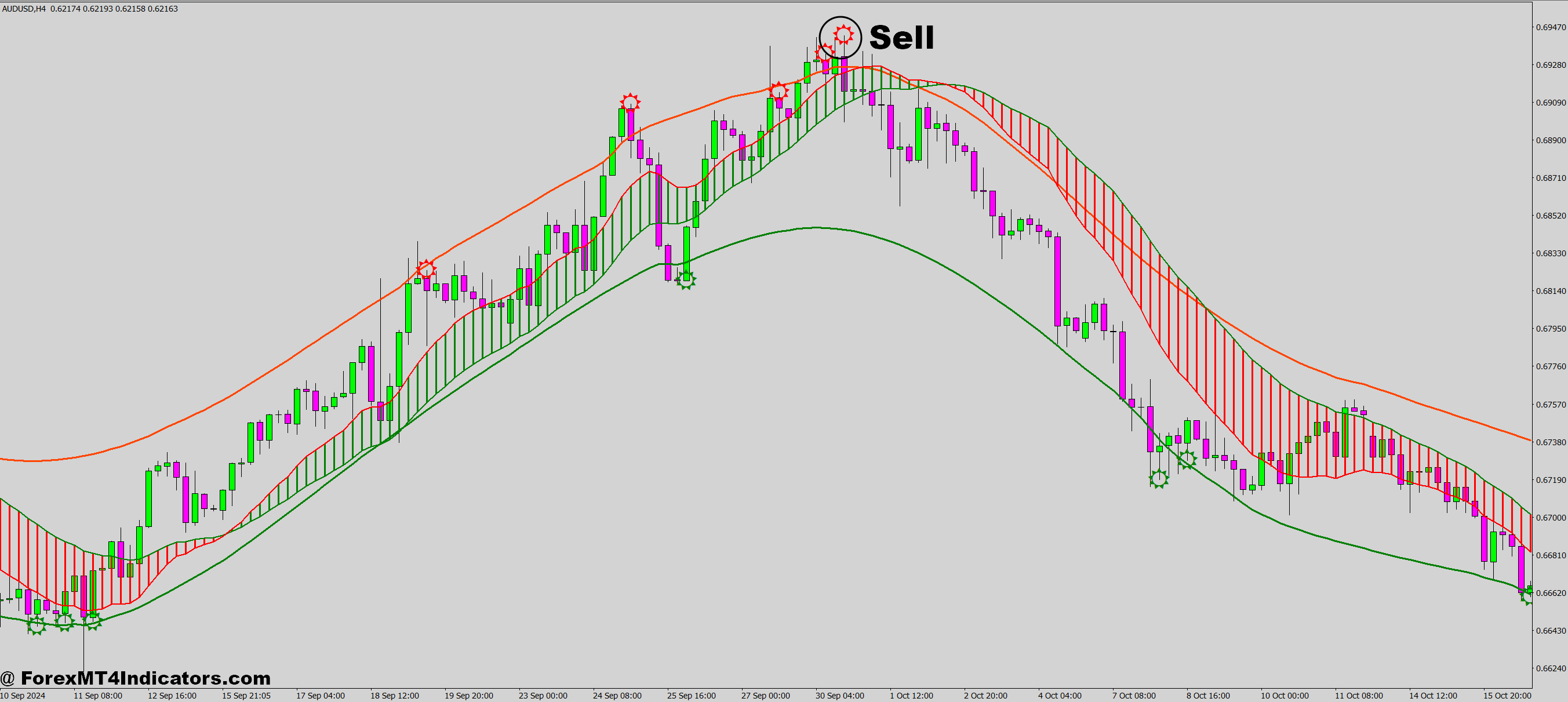

Promote Entry

Watch for full candle shut – Solely enter quick when the downward arrow seems after candle shut; by no means anticipate indicators on 15-minute or 5-minute charts.

Confirm downtrend on each day chart – Verify value trades under the 200-period MA on each day timeframe earlier than taking promote indicators on GBP/JPY or USD/CAD.

Place stop-loss above sign excessive – Place stops 25-35 pips above the sign candle’s excessive or most up-to-date swing excessive for correct safety on risky pairs.

Ignore indicators throughout breakout strikes – Skip promote indicators when the value simply broke main help with heavy quantity; await retest affirmation as an alternative.

Use pending orders for precision – Set sell-stop orders 5-10 pips under sign candle low on 4-hour charts to keep away from rapid whipsaw reversals.

Verify RSI under 50 – Add confluence by confirming RSI reads below 50 when promote arrow seems; above 50 suggests weakening bearish momentum.

Keep away from Friday afternoon indicators – Don’t take promote entries after 12 PM EST on Fridays; weekend gaps can set off stops on even legitimate technical indicators.

Scale out at resistance ranges – Shut 50% of the place on the first main help, transfer cease to breakeven, and let the rest run towards the three:1 goal.

Conclusion

The 100 Non Repaint MT4 Indicator delivers on its core promise: trustworthy indicators that don’t disappear into the ether. That reliability helps you backtest legitimately, execute confidently, and be taught from precise outcomes relatively than algorithmic revision. For merchants uninterested in phantom indicators and faux backtests, it’s a strong basis.

That stated, it gained’t repair poor danger administration or prevent from buying and selling in opposition to sturdy elementary developments. It’s a instrument, not a buying and selling plan. Works greatest whenever you’ve already acquired the self-discipline to observe indicators persistently and the knowledge to keep away from buying and selling throughout high-impact information. Mix it with correct help and resistance evaluation, perceive your pairs’ typical conduct, and hold place sizing conservative.

Beneficial MT4/MT5 Dealer

XM Dealer

Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

Deposit Bonus as much as $5,000

Limitless Loyalty Program

Award Successful Foreign exchange Dealer

Extra Unique Bonuses All through The 12 months

Unique 90% VIP Money Rebates for all Trades!

>> Signal Up for XM Dealer Account right here with Unique 90% VIP Money Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Associate Code: VIP90