Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

On-chain information reveals the trade inflows associated to the stablecoins USDT and USDC have seen a pointy plunge. Right here’s what this might imply for Bitcoin and different cryptocurrencies.

Stablecoin Alternate Inflows Have Dropped Beneath Yearly Common

In a brand new put up on X, CryptoQuant writer Axel Adler Jr has mentioned in regards to the newest development within the Alternate Influx of the highest two stablecoins within the sector, USDT and USDC.

The “Alternate Influx” refers to an on-chain indicator that retains observe of the entire quantity of a given asset that’s transferring into the wallets related to centralized exchanges.

Typically, buyers could deposit their cash into these platforms once they need to commerce them away, so a excessive worth on the Alternate Influx can point out demand for swapping the cryptocurrency. For unstable belongings like Bitcoin, that is one thing that may naturally be bearish for the worth.

Associated Studying

Within the case of stablecoins, nonetheless, their value doesn’t see any impression from trade deposits, because it all the time stays, by definition, secure round no matter fiat forex the asset is monitoring.

That mentioned, stablecoin inflows aren’t with out consequence. Traders normally deposit these belongings to swap right into a unstable cryptocurrency of their selection. As such, cash like Bitcoin can see a bullish impact from an Alternate Influx spike associated to those fiat-tied tokens.

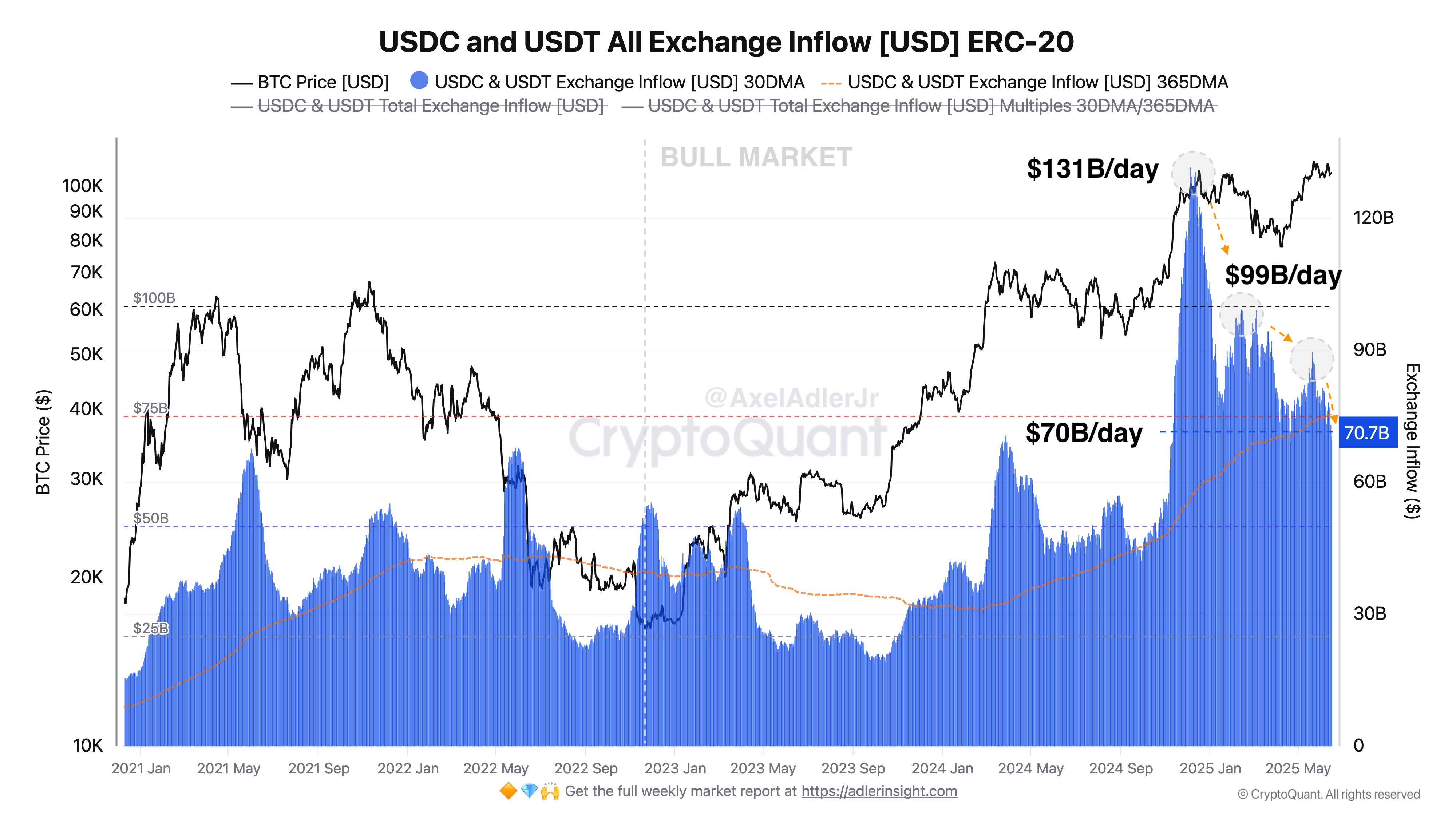

Now, here’s a chart that reveals the development within the mixed Alternate Influx of the highest two stablecoins, USDT and USDC, over the previous few years:

As displayed within the above graph, the Alternate Influx of USDT and USDC shot as much as a really excessive worth on the finish of final yr, an indication that the buyers had been making huge deposits of those stablecoins.

Alongside the spike within the indicator, the Bitcoin value noticed a rally to a brand new all-time excessive (ATH), a possible signal that the stablecoin inflows could have helped present the gas for the run.

On the peak of the spike, the metric reached a price of $131 billion per day. From the chart, it’s obvious that since then, the indicator has been following a downward trajectory and in the present day, its worth has come right down to $70 billion per day.

Associated Studying

This represents a big decline of $61 billion for the reason that excessive. Although, whereas the indicator is certainly notably down in comparison with the height, its present stage remains to be excessive within the context of the broader cycle to this point.

Naturally, if this drawdown within the stablecoin Alternate Influx retains up, it might doubtlessly develop into a bearish signal for Bitcoin and different digital belongings. That mentioned, despite the fact that BTC went down earlier within the yr, its value remains to be above the $100,000 mark proper now, a potential signal that buyers could merely be coming into a part of consolidation.

Bitcoin Value

Following a surge of about 2.5% over the past 24 hours, Bitcoin has managed to get well again to the $108,100 stage.

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com