Shanghai Composite Elliott Wave technical evaluation

Operate: Counter Pattern.

Mode: Corrective.

Construction: Grey Wave 2.

Place: Orange Wave 3.

Course subsequent greater levels: Grey Wave 3.

Particulars: Grey wave 1 seems full; grey wave 2 is presently lively.

The Shanghai Composite day chart Elliott Wave evaluation outlines a counter-trend construction. The present worth motion is corrective, indicating a retracement section inside a broader upward pattern. Grey wave 2 is unfolding inside orange wave 3, suggesting a typical pullback earlier than continuation.

With grey wave 1 concluded, grey wave 2 represents a corrective section that usually partially retraces prior motion. As soon as grey wave 2 finishes, grey wave 3 is anticipated to renew the first pattern path.

The setup signifies the index is shifting by way of grey wave 2 after finishing grey wave 1. This sometimes results in range-bound buying and selling or reasonable pullbacks. Being positioned inside orange wave 3 confirms the broader wave sequence continues to be progressing.

Merchants ought to monitor grey wave 2 for indicators of completion. The counter-trend nature of the wave suggests momentary consolidation earlier than a possible breakout into grey wave 3.

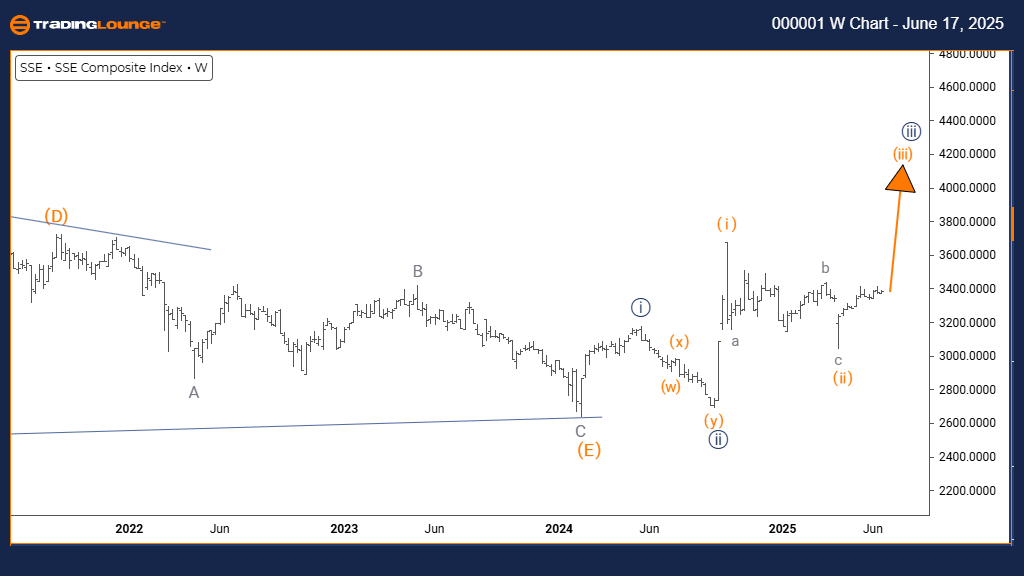

Shanghai Composite Elliott Wave technical evaluation

Operate: Bullish Pattern.

Mode: Impulsive.

Construction: Orange Wave 3.

Place: Navy Blue Wave 3.

Course subsequent greater levels: Orange Wave 3 (Began).

Particulars: Orange wave 2 seems full; orange wave 3 of three is now lively.

The weekly Elliott Wave evaluation for the Shanghai Composite exhibits a bullish pattern. Value motion is presently impulsive, with orange wave 3 unfolding inside navy blue wave 3. This sample signifies the index is in a robust bullish section, usually related to prolonged upward motion.

Orange wave 2 has seemingly ended its correction, transitioning into orange wave 3. This wave usually delivers essentially the most vital worth motion in an Elliott Wave cycle. As wave 3 continues creating, it’s more likely to generate sturdy upward strain.

The technical setup now suggests the Shanghai Composite is poised for doubtlessly giant good points. With orange wave 3 in progress, patrons seem lively and in management, supporting sustained bullish momentum within the close to time period.

![Shanghai Composite Index Elliott Wave technical analysis [Video] Shanghai Composite Index Elliott Wave technical analysis [Video]](https://i2.wp.com/editorial.fxsstatic.com/images/i/nvidia-01_Large.jpg?w=750&resize=750,375&ssl=1)