Ethereum is exhibiting resilience within the present market, holding above the $4,500 degree after weeks of regular momentum. The second-largest cryptocurrency has maintained a bullish construction, however patrons are actually struggling to interrupt previous the $4,750 resistance zone, a degree that has turn into a crucial short-term check. Whereas fundamentals stay strong, the hesitation at this threshold has prompted some analysts to warn of rising dangers as Ethereum approaches traditionally important ranges.

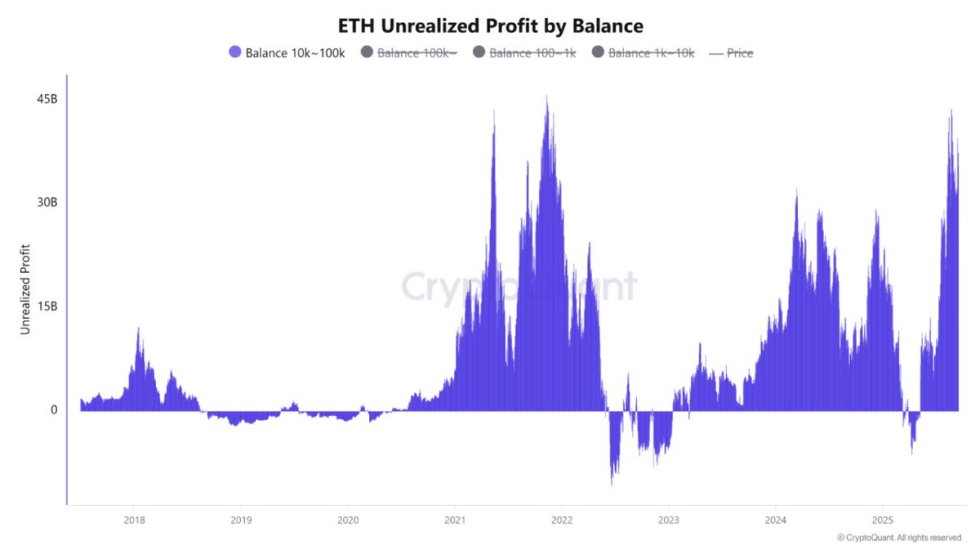

Knowledge from CryptoQuant provides weight to this cautious outlook. The agency stories that the unrealized revenue of Ethereum wallets holding between 10,000 and 100,000 ETH has surged to ranges not seen since November 2021, when ETH reached its all-time excessive. This implies mid-sized whales are actually sitting on important paper good points, much like situations noticed on the final cycle’s peak.

With bullish enthusiasm nonetheless robust however profit-taking dangers rising, Ethereum’s subsequent strikes might show decisive. A breakout above $4,750 could open the door to new highs, whereas rejection might set off a pointy correction.

Ethereum Whales Sign Important Stage

Ethereum has entered a pivotal section as mid-sized whales are actually sitting on important unrealized income. These paper good points have reached ranges akin to these seen on the November 2021 peak, when Ethereum touched its all-time excessive. The similarity in revenue situations has raised considerations amongst analysts, as such moments in earlier cycles usually preceded durations of profit-taking or heightened promoting strain.

Traditionally, when unrealized income for mid-sized whales reached such elevated ranges, markets tended to expertise elevated volatility. Some holders opted to lock of their good points, triggering a cascade of promoting that weighed on costs. This conduct doesn’t assure an instantaneous correction, nevertheless it underscores the psychological strain buyers face when sitting on substantial income. Market individuals, particularly bigger holders, usually affect broader sentiment and liquidity, creating ripple results throughout exchanges and buying and selling desks.

On the similar time, Ethereum stays basically robust. Institutional inflows, community exercise, and the broader optimism in crypto markets might mood aggressive promoting and lengthen the rally. Nonetheless, analysts warning that the stability between bullish momentum and profit-taking conduct will decide Ethereum’s trajectory.

The approaching weeks are decisive. A profitable push above resistance might reignite momentum and check new highs, whereas elevated promoting strain could set off a consolidation section or sharper correction. Ethereum’s destiny now hinges on whether or not whales select to carry for increased valuations or understand good points at present ranges.

Technical Insights: Key Ranges To Watch

Ethereum (ETH) is presently buying and selling round $4,599, exhibiting resilience above the $4,500 assist degree. The chart highlights a interval of consolidation after ETH did not maintain momentum above the $4,750 resistance zone, the place promoting strain has repeatedly capped rallies. Regardless of this, the general development stays constructive, with ETH sustaining increased lows since early September.

The 50-day SMA (blue) is trending upward and sits near $4,307, offering dynamic assist that has cushioned current pullbacks. In the meantime, the 100-day SMA (inexperienced) at $3,614 and the 200-day SMA (pink) at $2,846 mirror the broader bullish construction, suggesting that the market stays in a long-term uptrend. The shifting averages are aligned in bullish order, additional reinforcing constructive momentum.

Nevertheless, ETH is encountering robust resistance close to $4,750, which stays the important thing barrier earlier than a possible retest of all-time highs. A decisive breakout above this degree, accompanied by rising volumes, might open the trail towards $5,000 and past. On the draw back, a failure to carry $4,500 could set off a correction towards $4,300 and even the $4,000 psychological assist.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.