The US CFTC has launched an initiative to discover the usage of stablecoins as collateral in derivatives markets, with public enter open till Oct. twentieth.

CFTC Launches Initiative For Tokenized Collateral & Stablecoins In Derivatives

As revealed in a press launch, Commodity Futures Buying and selling Fee (CFTC) Performing Chairman Caroline D. Pham has enacted an initiative for the usage of tokenized collateral in derivatives markets. Stablecoins, cryptocurrencies pegged to a fiat foreign money, are set to play a job within the effort.

“The general public has spoken: tokenized markets are right here, and they’re the longer term,” mentioned Pham. “For years I’ve mentioned that collateral administration is the ‘killer app’ for stablecoins in markets.”

The initiative is a part of CFTC’s “Crypto Dash” introduced in the beginning of August. Pham launched it to implement suggestions from the President’s Working Group report on digital belongings. The push mirrors the Securities and Change Fee’s (SEC’s) “Venture Crypto.”

The President’s Working Group report requested the CFTC to “present steering on the adoption of tokenized non-cash collateral as regulatory margin.” The most recent transfer is available in response to this suggestion and in addition builds on the regulator’s Crypto CEO Discussion board held again in February 2025.

The Performing Chairman famous:

At our historic Crypto CEO Discussion board, we mentioned how innovation and blockchain expertise will drive progress in derivatives markets, particularly for modernization of collateral administration and larger capital effectivity.

The regulator has invited stakeholders to offer written suggestions and ideas on its web site concerning the usage of stablecoins as collateral in derivatives markets by October twentieth. “The CFTC continues to maneuver full pace forward on the reducing fringe of accountable innovation, and I admire the help of our trade companions,” added Pham.

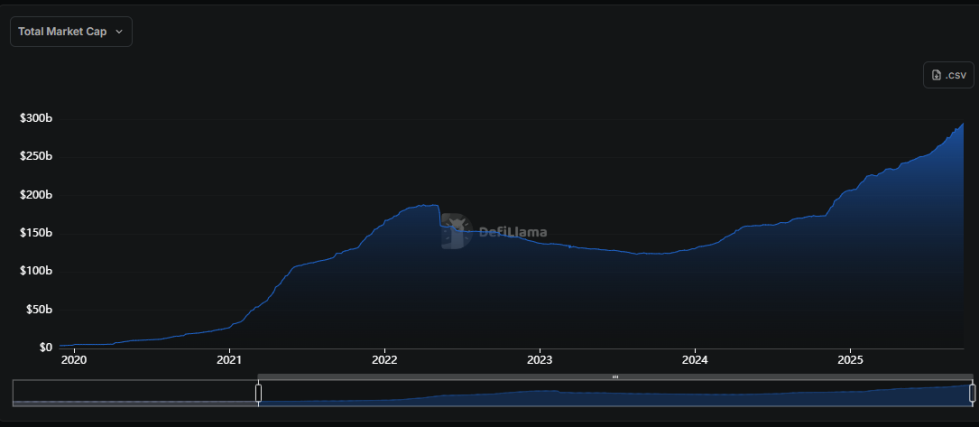

Stablecoins have been having fun with capital inflows lately, with their mixed market cap sitting on the $294 billion mark right this moment, a brand new all-time excessive (ATH). Beneath is a chart from DeFiLlama that reveals how the market cap of those cryptocurrencies has modified throughout the previous couple of years.

The worth of the metric seems to have been going up sharply in latest months | Supply: DeFiLlama

From the graph, it’s seen that stablecoins have been in a section of progress since 2024, with inflows solely accelerating lately. Through the previous week alone, the market cap of those fiat-tied tokens has elevated by over $4 billion.

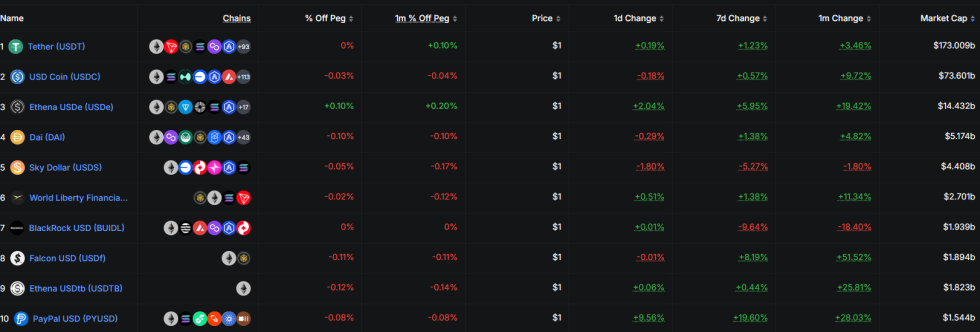

By way of the person cash, Tether’s USDT continues to be probably the most dominant, with its market cap of $173 billion accounting for nearly 59% of the sector.

The highest 10 stablecoins ranked on the idea of market cap | Supply: DeFiLlama

Circle’s USDC ranks second with a market cap of $73 billion, considerably under USDT, however nonetheless dominant in its personal proper contemplating its lead over the third largest stablecoin.

Bitcoin Worth

On the time of writing, Bitcoin is floating round $112,800, down greater than 3% during the last week.

Appears to be like like the worth of the coin has plummeted over the previous couple of days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, DeFiLlama.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our group of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.