Bitcoin is dealing with renewed promoting strain, however thus far, bears are struggling to push the value beneath the important thing $110,000 help. This degree has emerged as a essential battleground for the market, with traders carefully watching whether or not bulls can preserve management. Regardless of the broader volatility, Bitcoin’s resilience right here is fueling hypothesis that when the present wave of promoting strain fades, BTC could possibly be poised for one more surge.

Worry is creeping in as merchants weigh the dangers of additional corrections. Regardless of this, optimism lingers that Bitcoin’s underlying demand stays robust sufficient to maintain larger ranges in the long term.

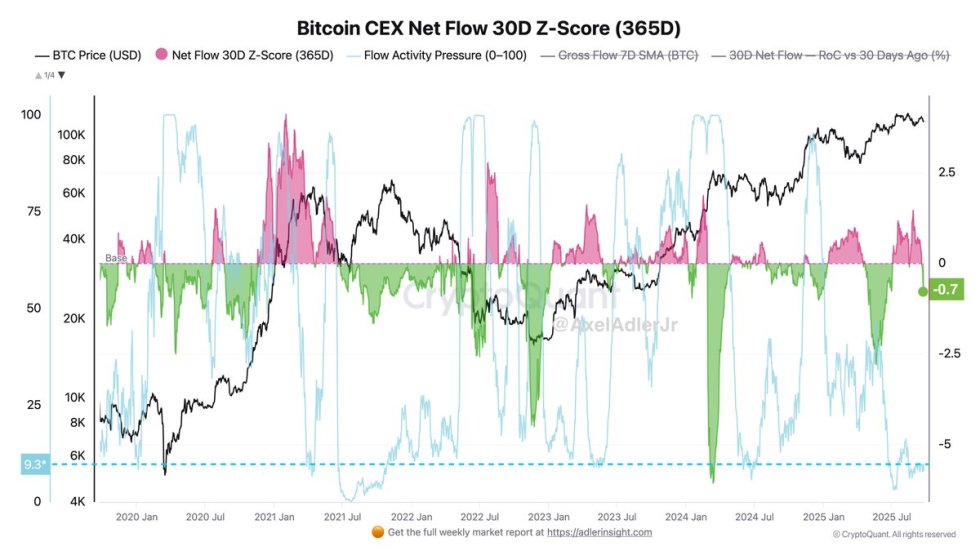

Prime analyst Axel Adler shared recent insights that will tilt the stability towards the bullish facet. In keeping with Adler, if we “take away the noise,” the centralized alternate (CEX) market at present appears cooled down when seen by way of alternate flows. Gross exercise has dropped sharply from earlier peaks, suggesting fewer speculative strikes and pointing towards what he describes as “HODL mode.” This cooling impact might restrict draw back dangers whereas setting the stage for accumulation-driven momentum.

Bitcoin Change Flows Present Indicators of Accumulation

In keeping with Adler, Bitcoin’s present alternate dynamics spotlight a big shift in market habits. Circulation Exercise Stress now stands at 9, which locations it within the decrease zone. This studying signifies that general movement exercise is subdued, signaling lowered speculative actions on centralized exchanges. Adler explains that the present common Gross movement (Influx + Outflow) is 70,000 BTC, a dramatic discount in comparison with the 266,000 BTC peak recorded in March 2024. This stark decline displays a market atmosphere that’s quieter and extra accumulation-driven, fairly than dominated by heavy buying and selling exercise.

As well as, Adler factors to the Web Circulation 30D Z-Rating of −0.7, which exhibits a average bias towards purchases relative to the annual baseline. Which means the cash coming into exchanges are largely being absorbed, with demand successfully consuming the accessible provide. Adler emphasizes that “the whole lot that involves exchanges will get purchased up,” whereas reserves proceed to be spent to fulfill this regular urge for food from consumers.

One of these exercise usually indicators underlying energy in Bitcoin’s construction. Whereas short-term volatility stays a priority, the lowered movement exercise and regular absorption of provide trace at an accumulation part. Within the greater image, this dynamic helps the thesis that BTC is getting ready for continuation as soon as market sentiment shifts again in favor of consumers.

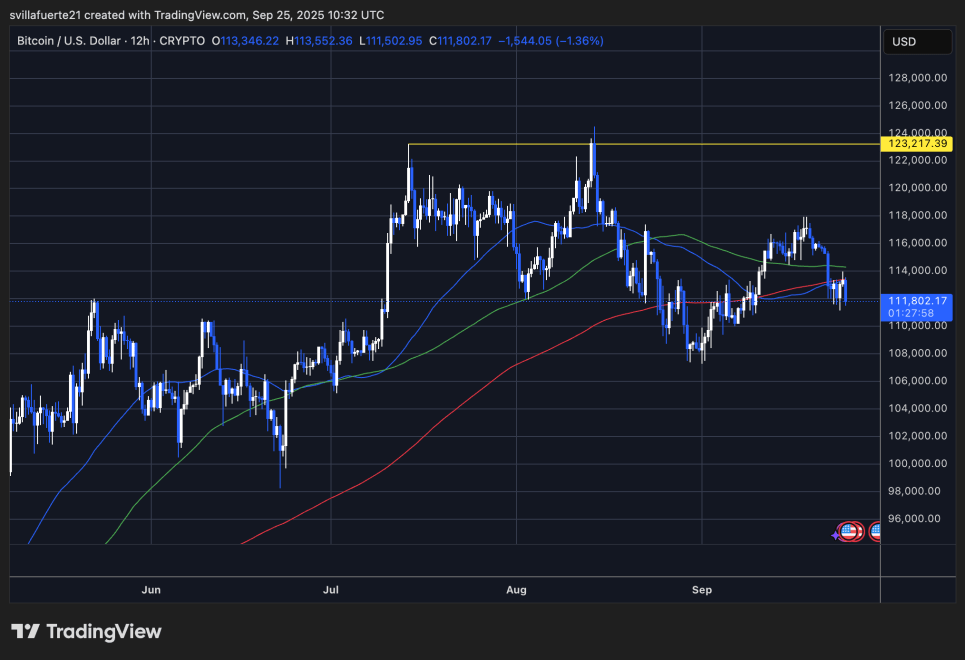

Technical Particulars: Testing Key Assist

Bitcoin (BTC) continues to battle promoting strain, with the value at present hovering round $111,802. The 12-hour chart exhibits BTC urgent in opposition to a essential help zone, simply above $111K, which has held a number of occasions over the previous few months. A breakdown beneath this degree might expose the market to deeper corrections towards the psychological $110K mark and even the 200-day shifting common close to $105K.

The shifting averages are reflecting combined momentum. The 50-SMA is rolling over, signaling near-term weak spot, whereas the 100-SMA and 200-SMA stay beneath the present value, nonetheless reflecting longer-term bullish construction. For now, this implies that whereas bears are urgent onerous, bulls haven’t totally misplaced management.

On the resistance facet, BTC continues to face a ceiling close to $118,000, a degree it failed to interrupt on a number of makes an attempt over the summer season. Solely a decisive breakout above this space would affirm renewed bullish momentum.

Within the brief time period, volatility is predicted to stay elevated as merchants check the sturdiness of this help zone. Holding above $111K would reinforce the bullish case, whereas a break decrease dangers shifting sentiment towards a extra prolonged correction.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.