The GBP/USD weekly forecast turns bearish after dipping to 7-week lows.

Upbeat US GDP and Jobless Claims, together with a cautious Fed, triggered a greenback restoration.

Markets now concentrate on labor market information due subsequent week for a recent impetus.

The GBP/USD weekly forecast has turned bearish after the value considerably declined final week, reaching 7-week lows close to 1.3320. The transfer was attributed to a stronger greenback after a cautious Fed and upbeat information.

–Are you to be taught extra about ECN brokers? Test our detailed guide-

A broad US greenback resurgence adopted stronger-than-expected US GDP progress, a restoration in sturdy items orders, and a decline in jobless claims. This strengthened the view that the Federal Reserve might not ship aggressive charge cuts this 12 months. The Fed’s cautious tone was echoed by Fed Chair Powell and different policymakers, which additional pushed the buck up.

However, softer UK PMI information revealed slower progress momentum, additional weighing on the demand for the pound. The Composite PMI fell to 51.0 in September from 53.5 in August, underscoring the fragility of the UK economic system. Weaker gilt demand and political uncertainty additionally saved the sterling subdued.

The Friday’s Core PCE Inflation information got here as anticipated at 2.9% y/y; the shortage of upside shock and a mildly higher danger mode helped the GBP/USD stabilize into the weekend. Nevertheless, the broader sentiment stays favorable for the US greenback as markets cut back bets for faster Fed easing, whereas the Financial institution of England retains its cautious stance.

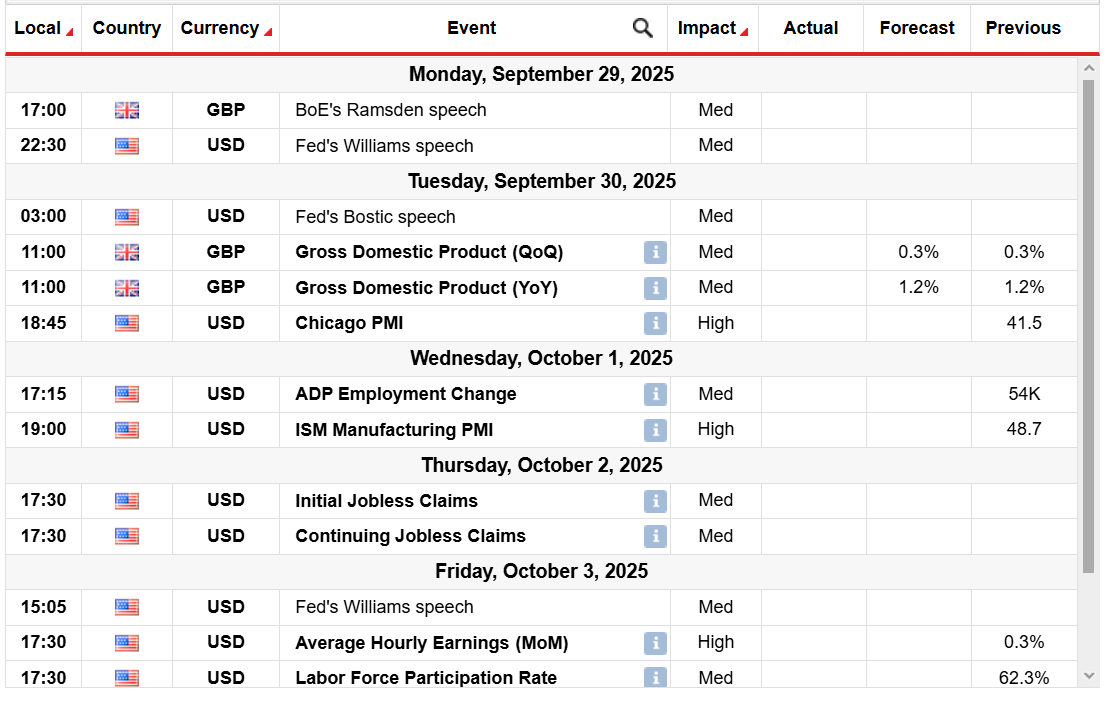

GBP/USD Key Occasions Subsequent Week

Shifting to the final week of the month, the main focus now shifts to the US labor market and the UK progress information, with the next important occasions:

UK GDP (Tuesday)

JOLTs Job Opening (Tuesday)

ADP Employment Change (Wednesday)

US Non-Farm Payroll (Friday)

One other spherical of robust US information might additional undermine the GBP/USD, whereas cooling labor market indicators might dampen the greenback’s restoration. Merchants may even monitor speeches by the Fed and BOE for recent coverage cues, together with tariff-related developments from the US.

GBP/USD Weekly Technical Forecast: Demand Zone Resisting Bears

The day by day chart for the GBP/USD reveals a impartial to bearish bias, because the draw back meets stable assist at 1.3340, with the value leaping to the 1.3400 mark whereas closing the week. Nevertheless, the costs are mendacity properly under the important thing transferring averages, which might collect promoting traction, pushing in direction of the 200-day MA at 1.3125. This wants a transparent breakout of the demand zone.

–Are you to be taught extra about being profitable in foreign exchange? Test our detailed guide-

However, if the costs stay supported by the demand zone, the pound might additional achieve and check the MA confluence zone at 1.3480–1.3500. The markets are more likely to consolidate, awaiting recent impetus.

Trying to commerce foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must take into account whether or not you may afford to take the excessive danger of shedding your cash.