Gold is a wonderful buying and selling instrument. It provides excessive volatility and among the lowest futures commissions. Gold buying and selling is just not restricted to long-term trend-following methods. Scalping methods are additionally glorious for gold.

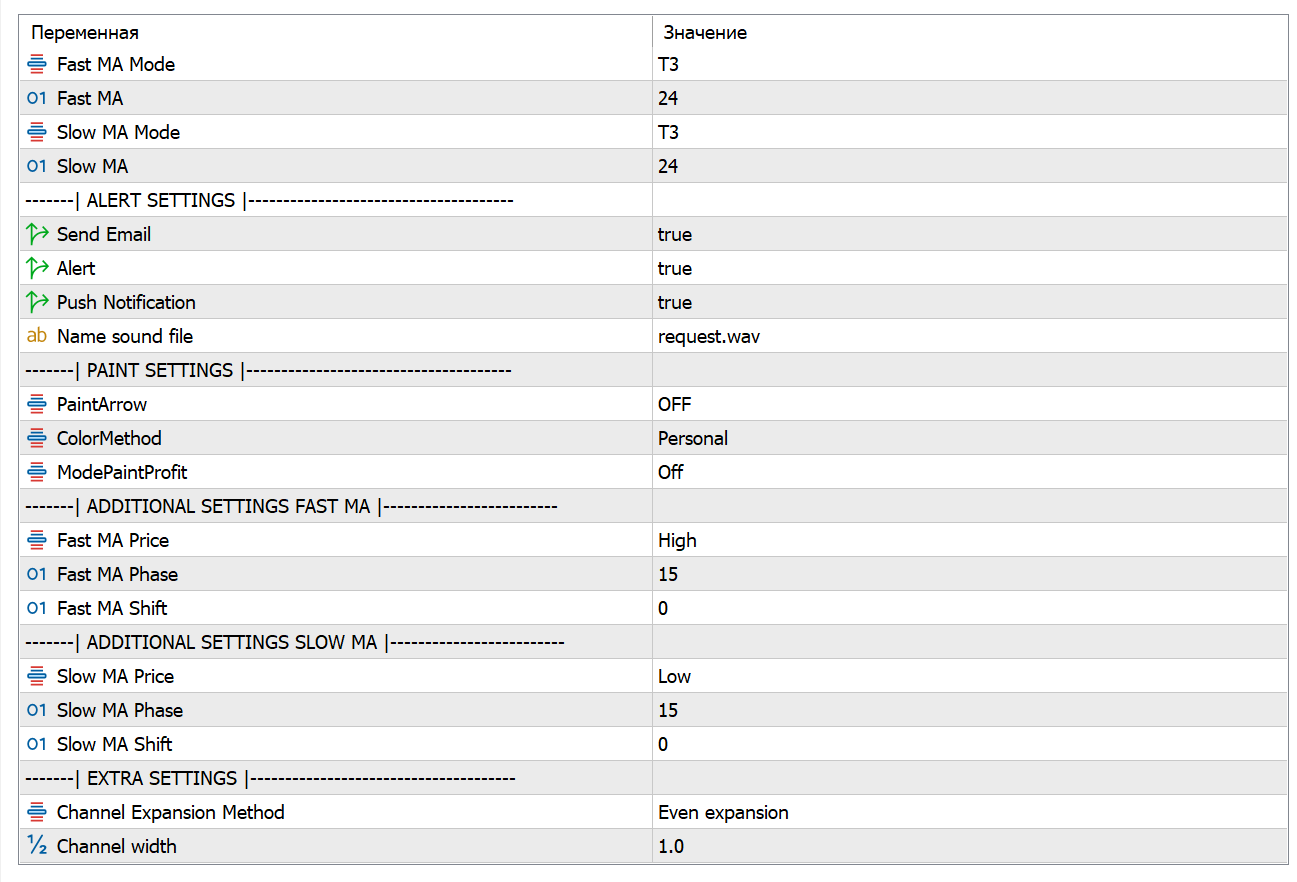

Take two shifting averages and construct a channel. We’re not solely within the channel itself, but in addition within the path of the shifting averages. You possibly can, after all, create such a channel from any indicators you could have; I am going to present the parameters on the finish of the article. However I like to recommend skipping the trouble and utilizing this free indicator .

The essence of the system: XAUUSD M1. To enter a scalping commerce, we’d like a one-minute bar that touches the decrease boundary of the channel and closes above the higher boundary. Throughout this time, the shifting averages forming the channel needs to be pointing upward. We’ll enter the commerce after breaking the excessive of this bar. Within the picture, I’ve marked the entry level with a white line. The system could be very intelligent. Discover the chart your self, and you will see how these easy circumstances filter out most shedding trades.

We’ll take revenue at a distance of 2-3 channel widths. A trailing cease can be utilized. Do not maintain the place if the worth breaks the low of the bar that generated the entry sign!

Here is a promote instance. I would wish to level out that that is through the sturdy uptrend we’re at present seeing.

Indicator parameters

Two shifting averages are a easy but highly effective device for figuring out exit factors. The important thing to success is their appropriate mixture and adherence to danger administration guidelines. This MQL5 indicator simplifies the method by sending indicators in actual time. All the time backtest your technique earlier than utilizing it.