Bitcoin is buying and selling round $107,000 after its current flash crash, sustaining stability to stop additional decline however is but to return to buying and selling above $110,000. Notably, well-liked crypto analyst Titan of Crypto shared an in depth Gaussian Channel evaluation on X that factors to Bitcoin’s macro bull construction remaining intact regardless of short-term volatility. His publish, which was accompanied by a Bitcoin worth chart, exhibits how Bitcoin’s place relative to the Gaussian Channel presents a transparent view of the continuing cycle.

Associated Studying

Bull Market Intact Above Gaussian Channel

Titan of Crypto famous that Bitcoin’s placement above the Gaussian Channel represents power within the long-term pattern. As proven within the weekly candlestick worth chart under, the inexperienced channel corresponds to bullish phases, whereas crimson areas signify bearish downturns, a chief instance being the 2022 bear market.

On the time of writing, the higher band is positioned round $101,300 and trending upward. Due to this fact, Bitcoin’s worth motion round $107,000 signifies that it’s but to interrupt into the Gaussian channel and its general market construction remains to be strong. From this, it may be inferred that Bitcoin’s present pullback from the October 6 all-time excessive above $126,000 is just a short lived pause inside a bigger bull market.

Bitcoin Gaussian Channel. Supply: Titan of Crypto on X

Nonetheless, though the Gaussian Channel studying seems favorable, Titan of Crypto famous that the indicator shouldn’t be handled as a buying and selling set off. “It’s not a purchase sign, it’s a macro context indicator,” he acknowledged. Being above the Gaussian Channel doesn’t essentially equate to purchasing extra. It merely means the bull market construction remains to be intact.

The Gaussian Channel works finest when mixed with different indicators akin to buying and selling quantity, transferring averages, and on-chain accumulation developments to verify directional momentum.

Coinbase Premium Hole Turns Crimson

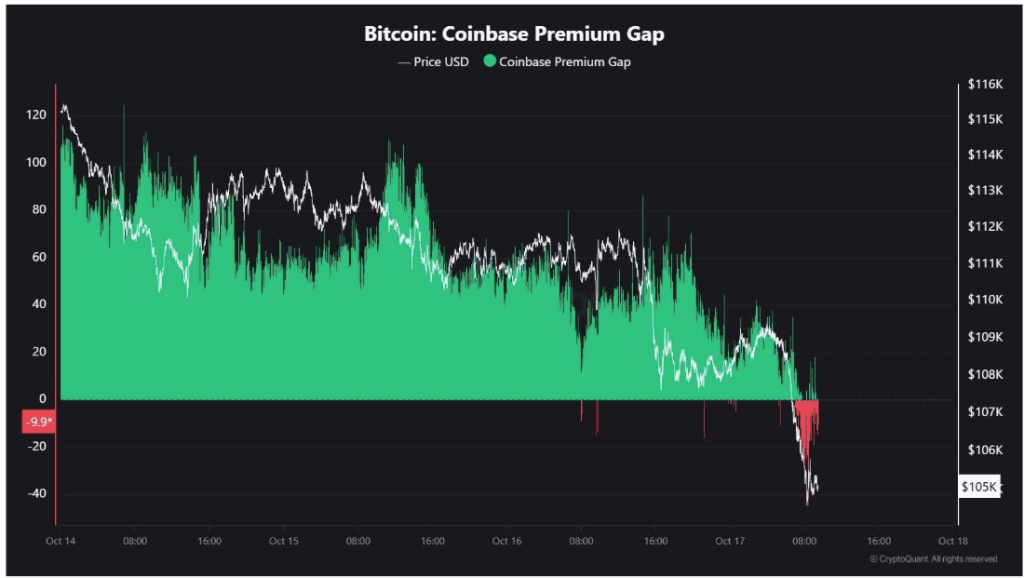

Talking of different indicators, on-chain knowledge from CryptoQuant exhibits that the Coinbase Premium Hole, a metric evaluating Bitcoin’s worth on Coinbase versus different exchanges, has turned crimson. As proven within the chart under, Coinbase’s Premium Hole went on a pointy decline from optimistic premium ranges above +60 earlier within the week to as little as -40 when the Bitcoin worth fell to $101,000.

Bitcoin: Coinbase Premium Hole

Apparently, the Coinbase Premium Hole has elevated to round -10 on the time of writing, which means US buyers are beginning to flip bullish once more. This may be seen as a bullish sign, as comparable dips in US demand had been recorded between March and April earlier than the Bitcoin worth ultimately rallied greater than 60% to achieve new all-time highs.

Associated Studying

Nonetheless, a crimson Coinbase Premium Hole alone isn’t decisive. It ought to be interpreted alongside different knowledge factors, together with ETF inflows, buying and selling quantity, liquidity, and derivatives funding charges. On the time of writing, Bitcoin was buying and selling at $107,120.

Featured picture from Vecteezy, chart from TradingView