Picture supply: Getty Photos

With regards to shopping for shares, I intention to attempt to strike a steadiness. My portfolio comprises some comparatively small, speculative names, however I additionally prefer to personal shares in massive established firms.

These usually are likely to have sturdy aggressive positions with economies of scale or entrenched buyer relationships. However this doesn’t at all times include a correspondingly excessive share value.

Measurement issues

There are loads of benefits to proudly owning shares in companies which have been round a very long time. One of the vital apparent is that they usually profit from sturdy reputations.

Take Authorized & Common for instance. The primary factor anybody shopping for life insurance coverage desires to know is that the corporate’s going to have the ability to pay out in the event that they ever must make a declare.

One other massive distinction is dividends. Smaller companies usually look to make use of their money for development, however many swap to returning money to shareholders as they grow to be bigger over time.

This isn’t for everybody – some individuals would possibly favor higher development potential and there’s nothing in any respect mistaken with that. However for earnings buyers, massive firms may be enticing.

Goal Healthcare REIT

Goal Healthcare REIT‘s (LSE:THRL) a FTSE 250 inventory that I’ve had my eye on for a short while. I feel it’s in a very attention-grabbing sector with loads of long-term potential.

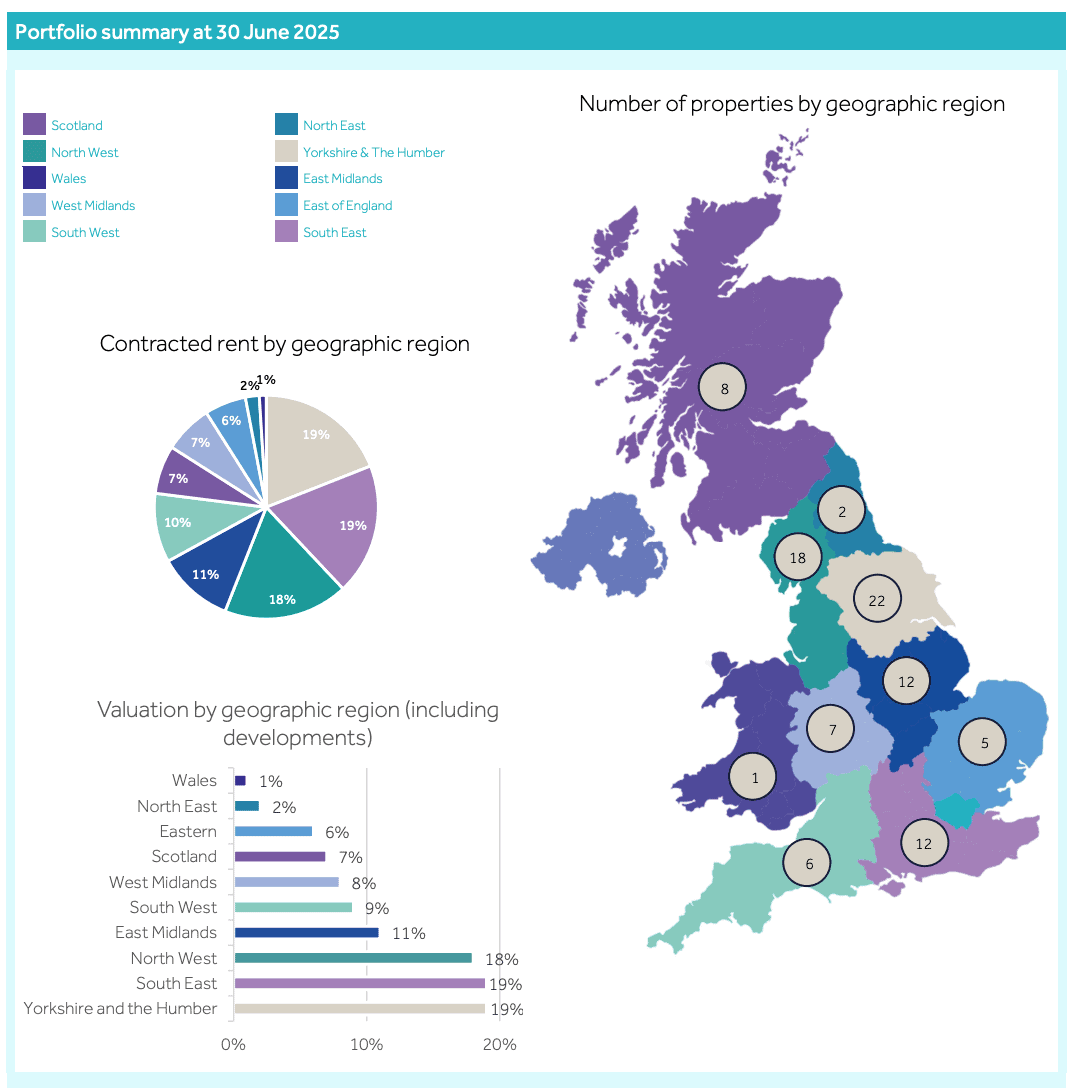

The corporate’s an actual property funding belief (REIT) with a portfolio of 93 care properties. And an ageing UK inhabitants ought to imply there’s loads of demand for its properties in future.

Supply: Goal Healthcare REIT Q2 Investor Presentation

It’s value noting that the care home-based business isn’t essentially the most simple. Rules hold altering and this has the potential to create future prices, which may weigh on returns.

A share value of 97p although, implies a dividend yield of 6%. And with inflation-linked rents defending this from larger prices, this can be a inventory that might be an amazing addition to my portfolio subsequent month.

Please notice that tax therapy relies on the person circumstances of every shopper and could also be topic to alter in future. The content material on this article is supplied for data functions solely. It isn’t supposed to be, neither does it represent, any type of tax recommendation.

Vodafone

After climbing virtually 25% to date this yr, Vodafone (LSE:VOD) shares are actually priced at round 89p. And the enterprise is perhaps in a a lot stronger place than it was in January.

The corporate’s merger with Three UK in Might might be the beginning of one thing thrilling. The deal each boosts the agency’s scale and reduces the variety of opponents available in the market.

All of that is very constructive. But it surely’s nonetheless fairly early to inform whether or not the transfer goes to be successful and there’s quite a bit to be completed by way of integration and capital investments.

That’s not likely what I search for in an enormous firm – I favor established corporations with clear strengths, somewhat than transformation potential. So I’m going to cross on this one for now.

Blue-chip bargains?

I’m at all times all for proudly owning shares in companies which have developed sturdy reputations over time and I just like the look of Goal Healthcare REIT very a lot. Since Care REIT was acquired again in Might it’s the one care dwelling inventory out there on the UK market.

The inventory would possibly simply provide me some priceless publicity to a market that’s prone to develop. And for lower than £1, I can’t consider too many issues I wish to purchase extra.