Stablecoins like USDC and USDT have develop into the spine of on‑chain settlement in decentralized finance (DeFi). They act like digital {dollars}, making it simple to maneuver cash out and in of cryptocurrency with minimal danger, however as their use spreads, new challenges round DeFi liquidity and regulatory danger are rising. As of mid-2025, the worldwide stablecoin market capitalization stands at roughly $252 billion, reflecting sustained demand as a core liquidity layer in crypto markets. The desk under summarizes key stablecoins’ market positions and stability metrics:

Let’s discover why this battle for dominance issues, the way it works, and what may occur subsequent.

What Are Stablecoins and Why Are They Vital?

Stablecoins are crypto property designed to remain pegged to a secure worth, often the U.S. greenback and meaning one USDC or USDT is all the time meant to equal one greenback. They’re used for fast, low cost transactions and as buying and selling instruments inside DeFi liquidity swimming pools. Should you wished to commerce tokens however didn’t need to take care of common {dollars} or euros, you’d seemingly use a stablecoin.

Two main choices are USDT, issued by Tether, and USDC, issued by Circle. USDT stays the most important, holding round 62% of the market cap, whereas USDC holds about 24%. These cash energy billions of {dollars} in each day on-chain exercise, serving to every little thing from lending and borrowing apps to NFT shopping for, gaming rewards, and even payroll programs.

DeFi Liquidity: Why Quantity and Stability Matter

In DeFi, liquidity is essential, it means there are all the time sufficient cash obtainable to commerce or borrow with out inflicting massive value jumps. Excessive liquidity ensures markets run easily, and

USDT’s enormous market share offers it deep liquidity within the crypto world, it’s extensively accepted on exchanges and DeFi platforms . That usually makes USDT the go-to for fast trades or swapping into and out of different tokens.

USDC, however, emphasizes compliance and security. Issued by Circle, it continues to develop because of month-to-month audits and strict monetary controls . With new legal guidelines just like the GENIUS Act making stablecoin laws clearer, USDC’s market share rose from 22% to 24.3%, exhibiting investor confidence. Briefly, USDT affords deep liquidity and market availability, whereas USDC affords belief and compliance, essential for institutional use.

On‑Chain Settlement: The Function of Pace and Belief

Stablecoins allow virtually instantaneous settlement for on-chain transactions. For instance, if you happen to swap one token for an additional on a DeFi market, the funds should transfer rapidly to keep away from value modifications. That is the place on‑chain settlement shines: when you hit “swap,” you see the end result inside seconds.

USDC helps this with dependable, quick settlements supported by sturdy infrastructure and compliance.

Regulatory Danger: Belief, Compliance, and the Risk of New Legal guidelines

Regulation is a significant component within the stablecoin wars, and USDT has confronted controversies as a consequence of restricted audits and regulatory scrutiny, regardless that it holds greater than $118 billion in reserves. Individuals fear it may not all the time be absolutely backed or clear, which may pose dangers throughout disaster moments. USDC, backed by Circle and audited constantly, goals to be a regulated stablecoin, making it extra interesting to banks and regulators.

In June 2025, the U.S. Senate handed the GENIUS Act, demanding stablecoins be absolutely backed with reserves, commonly audited, and liquidated first in case of chapter. It additionally requires issuers above $50 billion to publish audited monetary statements; strikes that favor absolutely clear cash like USDC. The Act encourages main banks like JPMorgan, Morgan Stanley, and Financial institution of America to launch their very own stablecoins, or to undertake USDC as a regulated choice. This might drive even higher confidence in on‑chain {dollars}.

USDC vs. USDT: Evaluating Regardless of Similarity

Although each goal to trace the greenback, USDC and USDT differ sharply. USDT affords distinctive liquidity and is usually used purely for buying and selling. It facilitates enormous quantity in DeFi however lacks sturdy audit help, which introduces regulatory danger. USDC emphasizes on-chain settlement, transparency, and compliance. This makes it engaging for customers and establishments who need stability and regulatory belief; even when liquidity is usually decrease .

As regulatory readability grows, stablecoins with transparency and reserves in U.S. {dollars} or Treasurys might develop into the default selection for conservative or institutional customers.

Dangers: What Can Go Improper

No stablecoin is risk-free and because the S&P International examine warns: stablecoins can nonetheless de-peg or lose worth as a consequence of market points, reserve issues, or technical issues. USDT has had occasions when its peg slipped, and skepticism about its reserves has persevered . USDC remained secure throughout the Silicon Valley Financial institution collapse, however that occasion precipitated short-term market stress.

Each cash additionally depend on centralized reserves, which implies if Circle or Tether face bother, the cash may falter, favoring decentralized alternate options like DAI; however these nonetheless make up solely a small fraction of market exercise .

The Way forward for On‑Chain {Dollars} and DeFi

With the GENIUS Act and stronger world regulation, stablecoins are inching nearer to mainstream finance. One main signal of this shift is Circle’s IPO (preliminary public providing), which introduced much more consideration to USDC. Circle can also be forming massive partnerships with firms like Visa, Mastercard, and Stripe, serving to USDC get used for on a regular basis funds, not simply in crypto however in real-world outlets and on-line platforms and since USDC is backed by absolutely regulated U.S. greenback reserves and undergoes month-to-month audits, it’s profitable belief from banks, fintech firms, and governments alike.

USDC can also be making it simpler to ship cash throughout borders. Usually, cross-border funds can take days and contain excessive charges. With USDC and on‑chain settlement, individuals can ship cash globally in seconds with very low prices. That is particularly highly effective for companies in rising markets and employees who must ship remittances to members of the family again dwelling.

In the meantime, USDT continues to play an enormous position within the DeFi world. It nonetheless dominates when it comes to market share, particularly in buying and selling and liquidity swimming pools. Merchants depend on its deep liquidity and quick motion between exchanges. Many DeFi apps and crypto exchanges use USDT as their base stablecoin, and in high-volume environments, that benefit is difficult to beat.

Nevertheless, as crypto matures and extra regulation enters the scene, the stress on USDT’s transparency will improve. Buyers, governments, and monetary establishments need extra than simply liquidity, they need clear proof of reserves, sturdy audit practices, and compliance with monetary legal guidelines. To remain aggressive long-term, Tether (USDT’s issuer) might must observe Circle’s path by growing transparency and securing regulatory approval in main markets.

Trying forward, we’d additionally see government-backed stablecoins, like central financial institution digital currencies (CBDCs), coming into the dialog. If CBDCs are issued, they might coexist with USDC and USDT and even compete straight in some markets; however for now, on‑chain {dollars}, particularly non-public stablecoins are main the best way. Finally, the rise of stablecoins is about greater than crypto. It’s about getting cash transfer quicker, cheaper, and extra pretty all over the world. Whether or not it’s for DeFi, gaming, financial savings, or enterprise transactions, the stablecoin you utilize, USDC for belief or USDT for pace; will form your expertise within the evolving world of Web3 finance.

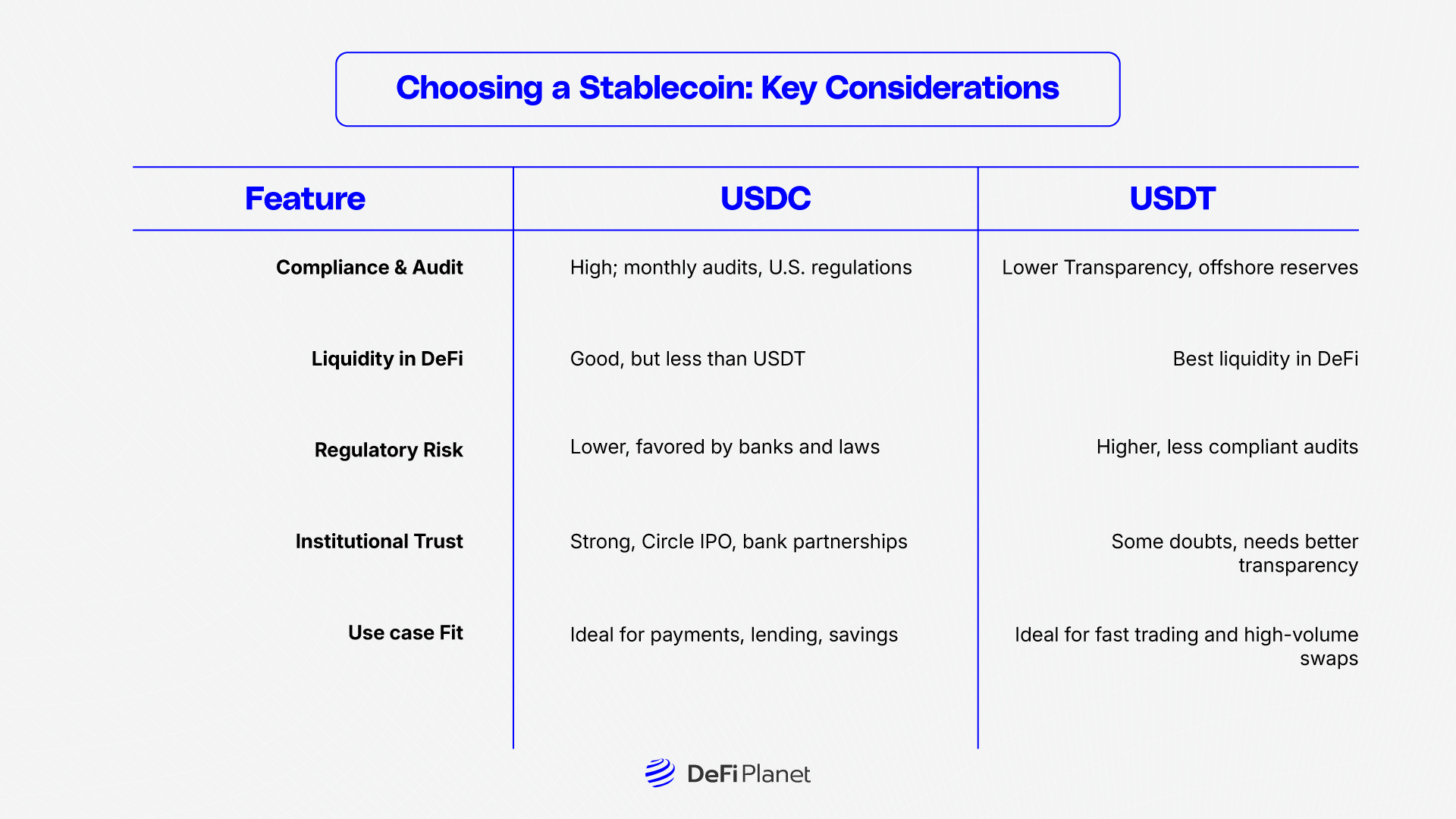

Selecting a Stablecoin: Key Issues

In Closing: The Rise of On‑Chain {Dollars}

Stablecoin wars are removed from over. However right here’s what appears seemingly:

USDC will proceed to shine as a regulated, compliant stablecoin, perfect for institutional gamers and world settlement.USDT will hold dominating DeFi liquidity and buying and selling, so long as its backers enhance transparency.New laws just like the GENIUS Act will push issuers to show their reserves and stability, shifting the market towards trusted, audited choicesOn‑chain {dollars} will form the way forward for DeFi and Web3, making finance extra open, quicker, and accessible.

Stablecoins like USDC and USDT are revolutionizing how we transfer cash on-line, USDT brings unmatched liquidity to DeFi platforms, whereas USDC focuses on security and belief by means of sturdy compliance. With the backing of regulators and massive banks, USDC appears like the following massive factor in official finance, whereas USDT stays the service provider of quick, decentralized swaps. As legal guidelines evolve, stablecoins will proceed remodeling digital cash, and whoever wins the stablecoin wars may assist decide the form of tomorrow’s world economic system.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein ought to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial danger of monetary loss. At all times conduct due diligence.

If you wish to learn extra market analyses like this one, go to DeFi Planet and observe us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Neighborhood.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”