The Each day Breakdown takes a more in-depth have a look at Amazon, because the inventory’s valuation has come down and amid robust earnings development.

Earlier than we dive in, let’s be sure you’re set to obtain The Each day Breakdown every morning. To maintain getting our day by day insights, all you could do is log in to your eToro account.

Friday’s TDLR

Analysts anticipate robust development

AMZN’s valuation has fallen

However can the inventory acquire sufficient momentum?

Deep Dive

Many buyers consider Amazon as an internet retailer, nevertheless it’s develop into a behemoth within the cloud computing house — with its Amazon Net Providers unit — and has fashioned right into a digital promoting juggernaut. In fact, it’s ventured into different companies too, like on-line video streaming, audiobooks, music, pharmacy, and Entire Meals, amongst different issues.

For years, Amazon was often known as an ideal enterprise, however too costly of a inventory. Has that modified? Let’s dig into the basics and see what’s occurring beneath the hood of this $2.3 trillion big.

Ahead Progress

Trying forward, analysts anticipate roughly 9% to 10% annual income development in 2025, 2026, and 2027. For buyers who’ve adopted Amazon over time, that will appear low. However take into account that if these estimates come to fruition, the corporate would generate greater than $830 billion in gross sales in fiscal 2027.

On the earnings entrance, it’s extra spectacular. Estimates name for 20.5% development this yr, 17% development in 2026, and 22.7% development in 2027.

I need to stress that utilizing multi-year estimates is tough, and ought to be taken with a grain of salt. Nobody is aware of what’s going to occur in October…not to mention in October 2027. Nonetheless, if earnings development can outpace income development, it bodes nicely for Amazon’s margins.

Valuation and Dangers

Supply: Bloomberg, eToro

Amazon’s historical past is a case research in enterprise and inventory valuation. For years, this inventory was costly, however not many companies had the addressable market that Amazon did — and it allowed AMZN to develop into its wealthy valuation over time.

In that point, we’ve seen Amazon’s valuation decline as its earnings have accelerated. Actually, Amazon has a decrease ahead P/E ratio than Walmart!

Whereas the agency’s valuation has come down, many elements apart from earnings have elevated. As an illustration, working margins and return on property — the latter of which measures how successfully an organization makes use of its property to generate revenue — have greater than tripled during the last decade from roughly 3% in 2016 to greater than 11% at present.

Whereas Amazon’s cloud enterprise is a little more resistant to macro-related volatility, Amazon’s most important threat is the economic system. If the US have been to enter a recession and shopper spending took a significant hit, Amazon’s income and enterprise mannequin can be disrupted. Additional — and like most Magnificent 7 shares — Amazon faces potential antitrust and headline dangers, in addition to ongoing trade-war dangers.

Wish to obtain these insights straight to your inbox?

Join right here

The Setup — Amazon

For what it’s price, the consensus worth goal from analysts is at present close to $240.

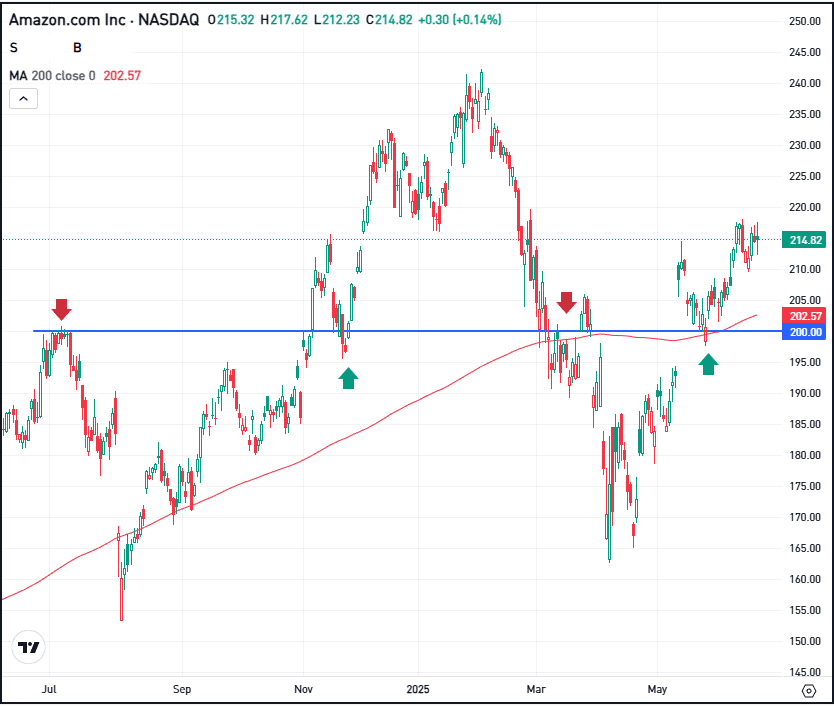

In July, Amazon struggled to interrupt via the $200 stage, then finally did so in November. It’s been a bumpy experience since then, however now shares are holding above this stage and the 200-day shifting common.

If it could actually proceed to take action, bulls might be able to preserve momentum.

On the one hand, shares are up simply 6% from the early July highs. Alternatively, the inventory remains to be down about 12.5% from its report highs within the $240s. Given its elevated development charges and robust secular companies, mixed with a declining valuation, some buyers could view Amazon inventory as engaging below these situations.

For different buyers although, they could cross on the inventory over sure macro- and company-specific considerations.

Choices

Buyers who consider shares will transfer increased over time could take into account collaborating with calls or name spreads. If speculating on a long-term rise, buyers would possibly think about using satisfactory time till expiration.

For buyers who would reasonably speculate on the inventory decline or want to hedge a protracted place, they might use places or put spreads.

To be taught extra about choices, take into account visiting the eToro Academy.

Disclaimer:

Please be aware that as a result of market volatility, a number of the costs could have already been reached and eventualities performed out.