The GBP/USD weekly forecast is mildly bearish amid central financial institution divergence.

The Center East disaster continues to weigh on the pound, including positive aspects to the US greenback.

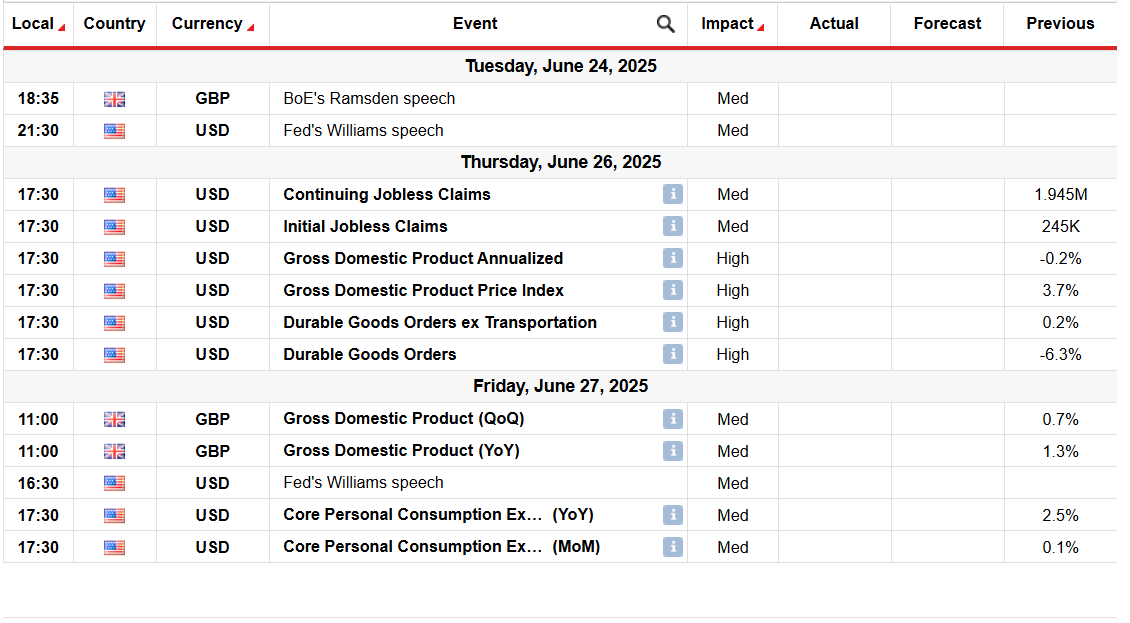

Market contributors set eyes on PMI readings and US GDP and inflation information.

The British pound managed to partially get well its losses in opposition to the US greenback after the pair plunged to the month-to-month low of 1.3400. The draw back got here after the greenback picked up energy amid escalating Center East rigidity. Furthermore, the diverging central financial institution indicators additionally weighed on the GBP/USD.

–Are you curious about studying extra about subsequent cryptocurrency to blow up? Examine our detailed guide-

The week started with the shockwaves coming from the Iran-Israel conflict that deteriorated the worldwide danger sentiment. The fears of oil provide disruption by way of the Hormuz Strait triggered a broader danger aversion that pushed safe-haven flows to the US greenback. The greenback’s restoration was additional supported by the hawkish Fed tone because the Fed held charges unchanged and reiterated information dependence for the subsequent fee cuts.

President Trump maintained an aggressive stance in opposition to Iran, calling for unconditional give up. He accredited navy motion in opposition to Iran however stored it on maintain for 2 weeks earlier than taking a decisive motion. This quickly de-escalated the stress and supplied some non permanent help to the chance property.

This sentiment shift allowed the pound to get well from the month-to-month lows. In the meantime, the Financial institution of England’s dovish tone was already priced in. The central financial institution held charges on maintain at 4.25%, with the BoE governor hinting at future cuts. Nonetheless, the MPC vote cut up gave a hawkish sign as six members voted in favor of a maintain whereas three members voted for a lower.

However, the pound’s restoration was overshadowed by the weaker UK retail gross sales information that confirmed a 2.7% decline in Might, elevating issues in regards to the UK’s shopper demand.

Key Occasions for the GBP/USD Subsequent Week

Trying ahead, the merchants will primarily concentrate on central financial institution commentary and PMI readings from either side of the Atlantic. The US Core PCE Index, US GDP, and Sturdy Items Orders information are additionally necessary to observe.

GBP/USD Weekly Technical Forecast: Patrons Exhausted Below 20-SMA

The GBP/USD day by day chart reveals a slight bearish state of affairs as the value stays under the 20-day SMA degree. Earlier within the week, the value briefly broke the important thing help zone at 1.3400 however managed to get well. Nonetheless, the value examined the 20-day SMA and reversed the positive aspects on Friday. It reveals an indication of patrons’ exhaustion. Nonetheless, the most important help of 1.3400 continues to help the pair.

–Are you curious about studying extra about foreign exchange indicators? Examine our detailed guide-

Breaking the 1.3400 degree could convey the 1.3340 degree as a goal forward of 1.3265. The day by day RSI is close to 50, displaying no clear bias in the meanwhile. Nonetheless, the likelihood of a draw back breakout is larger.

Trying to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must think about whether or not you possibly can afford to take the excessive danger of dropping your cash.