You’ve acquired the Foreign exchange fundamentals. Monetary markets are in movement, providing alternatives for short-term buying and selling. That first article gave you the groundwork, however now it’s time for an actual playbook. This text gives you with particular short-term buying and selling methods and the instruments to navigate the fast-paced forex market confidently. The transition from understanding the “what” and “why” to mastering the “how” is a crucial step in a dealer’s journey, and this information arms you for that problem. Our objective: get sensible. We’ll transfer previous the speculation and present you the right way to apply time period buying and selling ideas in the true world. We’ll present you real-world methods that work, the right way to use indicators with intention—not only for ornament—and the right way to decide instruments that suit your buying and selling type. By the point you end, you’ll have a sport plan you possibly can depend on, constructed not on guesses, however on ability and assured execution.

Your Playbook for Foreign exchange: Core Quick-Time period Buying and selling Methods

If you wish to make cash from fast value actions, you’ve acquired a number of completely different choices. The very best short-term buying and selling methods for you rely in your persona, danger tolerance, and the way a lot time you possibly can spend watching the market. Listed below are the principle types you’ll see.

How you can do Quick-Time period Buying and selling?

Let’s break it down. If you wish to commerce short-term in Foreign exchange the best method, you want a technique—one thing like scalping or day buying and selling—plus instruments for recognizing alerts and a pointy deal with managing your danger. That’s what separates actual merchants from gamblers.

Scalping: The Quick and Livid Method

Scalping is fast-paced, high-pressure buying and selling. You’re out and in shortly, grabbing tiny earnings—generally just some pips at a time—time and again all through the day. This high-frequency strategy wants your full, undivided consideration. Profitable scalping depends on having a brokerage with extraordinarily tight spreads and speedy commerce execution to reduce prices and maximize effectivity.

Order Move Scalping:

Order Move Scalping includes monitoring the precise purchase and promote orders. You search for imbalances to foretell the place the value may transfer within the subsequent few seconds. Say you discover a cluster of pending purchase orders at a sure value. That may imply the value will bounce off that stage, supplying you with a fast shot at a worthwhile scalp.

Assist/Resistance Scalping:

Assist/Resistance Scalping is taken into account a traditional. This technique revolves round key value ranges. You watch for the value to the touch assist or resistance, then bounce in for a fast commerce. This technique is a traditional and a preferred type of one-minute scalping as a result of it really works finest on super-short charts the place even small strikes can add up quick.

Day Buying and selling: The Each day Grind

Day buying and selling is a step down in depth from scalping, as the principle rule is to shut all of your positions by the top of the day. This helps you keep away from in a single day dangers like sudden information or market gaps. Listed below are a number of short-term buying and selling methods that work effectively for day merchants:

Pattern Following (Intraday):

Pattern following means recognizing a short-term development on a 5 or 15-minute chart and buying and selling in that route. Many merchants additionally verify the larger image on a 1-hour chart first, then use indicators like Transferring Averages to substantiate the development earlier than coming into.

Counter-Pattern/Reversal:

Counter-Pattern/Reversal is taken into account a extra superior approach. Reversal buying and selling is all about catching a shift earlier than it occurs. You search for indicators {that a} development is dropping steam—like a change in momentum or an overbought RSI—and purpose to journey the bounce in the wrong way.

Breakout Methods:

Breakouts happen when the value pushes by way of a major assist or resistance stage. This transfer typically alerts an even bigger shift forward, which may result in quick earnings whether it is caught early.

Information Buying and selling:

Buying and selling the information will be wildly worthwhile—but it surely’s additionally dangerous. When a serious financial report is launched, the market can expertise vital volatility. To commerce efficiently, a dealer wants pace, sharp instincts, and a deep understanding of what the market expects.

Swing Buying and selling: The Longer Sport

Swing buying and selling is all about catching these greater strikes—holding trades for a number of days and even weeks to journey out stable traits. It’s much less intense than scalping or day buying and selling, making it a superb possibility for individuals who choose a extra considerate, strategic strategy with out being glued to the display all day.

Figuring out Chart Patterns:

Swing merchants zoom out to the larger charts—4-hour or day by day—and search for patterns like flags, triangles, or channels. These formations trace at the place the value may go subsequent and provide help to resolve the place to set your targets.

Correlation Buying and selling:

Correlation Buying and selling includes understanding how particular forex pairs are correlated. If two pairs like EUR/USD and GBP/USD typically transfer collectively, a swing dealer may use one to substantiate a sign within the different. That added affirmation can increase your confidence within the commerce. So, which buying and selling type is finest for short-term buying and selling in Foreign exchange? The reality is, there’s no single reply. The very best strategy for you depends upon your type, schedule, and self-discipline. The secret’s to discover a technique that matches you and you can execute persistently.

Your Important Instruments: Indicators and Value Motion

Technical evaluation will be considered a buying and selling compass. It helps merchants make sense of the charts and plan their subsequent transfer. As soon as a dealer understands the instruments, they’ll begin buying and selling with function, not simply with guesses.

What’s the finest indicator for short-term buying and selling?

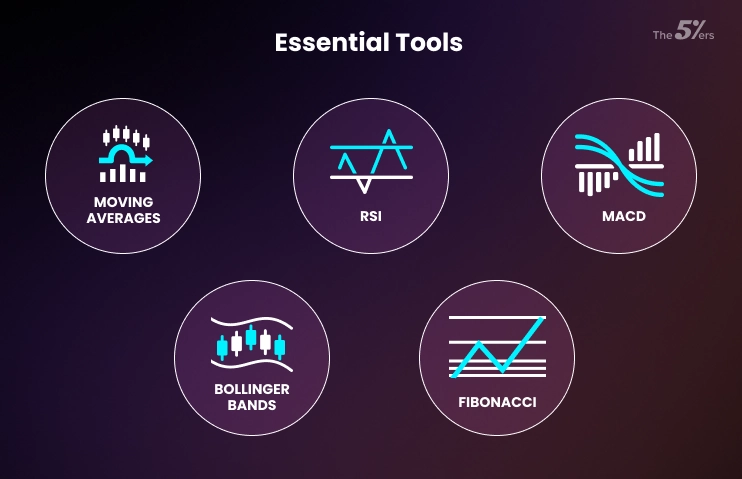

A typical false impression is {that a} single software will clear up all buying and selling issues. There isn’t any one “finest indicator for short-term buying and selling.” As an alternative, profitable merchants in 2025 mix a number of instruments like Transferring Averages, RSI, MACD, and Bollinger Bands to substantiate alerts and get an entire image of the market.

Value Motion: Studying the Chart Bare

Earlier than we get to indicators, it is advisable perceive value motion. That is the artwork of studying candlestick and chart patterns instantly from the chart with none further instruments. It’s the purest type of technical buying and selling evaluation and is the muse for a lot of profitable short-term buying and selling methods that work.

Your Go-To Indicators

Your go-to indicators are those you belief to assist information your selections. They’re not magic—they’re a part of your routine, your buying and selling language.

Transferring Averages (MA, EMA):

Transferring Averages assist easy out value motion so you possibly can spot traits extra simply. Look ahead to issues like value crossing above or beneath the typical, or how steep the road is.

Relative Power Index (RSI):

RSI tracks how sturdy a transfer is. If it’s over 70, the asset is perhaps overbought; if it’s underneath 30, it is perhaps oversold. Search for divergences too—they’ll sign an upcoming shift.

Transferring Common Convergence Divergence (MACD):

MACD combines development and momentum evaluation. The histogram visualizes the hole between the MACD line and its sign line, with crossovers signaling shifts in momentum. Merchants additionally look ahead to divergences towards value motion.

Bollinger Bands:

Bollinger Bands present you when the market is heating up or cooling off. When the value touches the outer band, it’d reverse—or get away if the momentum’s sturdy. Slim bands imply a major transfer might be on the horizon.

Fibonacci Retracements/Extensions:

The first Fibonacci instruments, akin to Retracements and Extensions, can assist you see potential reversal zones. Merchants use them to search out the place a value may pull again earlier than persevering with—or the place to position take-profits when driving a development.

What’s the rule for short-term buying and selling?

Good merchants don’t simply guess. They’ve a transparent plan, which incorporates when to enter, when to exit, how a lot to danger, and the right way to keep composure throughout unstable market situations. Whereas indicators assist assist that plan, they don’t seem to be there to make the choices for the dealer.

What’s the short-term buying and selling mannequin?

Having a structured strategy is crucial to staying constant. A brief-term buying and selling mannequin is a guidelines. It’s a scientific plan that mixes technical instruments, clear entry and exit guidelines, and danger administration parameters to execute trades inside quick timeframes. A easy buying and selling mannequin may sound like this: “I’ll commerce solely when the 9 EMA is above the 20 EMA to substantiate the development, and RSI dips beneath 30 to present me an entry. My stop-loss is 20 pips, and my take-profit is 40.” The “3-5-7 Rule” is an efficient instance of this, utilizing particular transferring averages to gauge development and momentum.

Fundamentals for Quick-Time period Buying and selling

Although you’re centered on short-term buying and selling, you possibly can’t ignore main financial information. These occasions trigger the large value swings that you just wish to reap the benefits of.

The Financial Calendar:

You completely should observe this. It lists all the main information releases, akin to inflation knowledge (CPI) or rate of interest selections. A shock quantity could cause the market to go wild, and that’s your alternative. Figuring out the market’s “anticipated” quantity beforehand is essential, because the volatility comes from a distinction between the precise launch and the market’s expectation.

Central Financial institution Bulletins:

When central bankers communicate, the market listens. Their feedback on rates of interest or financial coverage can immediately transfer a forex’s worth. You possibly can see sharp, instant strikes on the charts as merchants react to any new info.

A Phrase of Warning:

Buying and selling the information is extraordinarily quick and dangerous. The market can transfer towards you simply as shortly because it strikes for you. It’s finest to grasp different methods earlier than you even do that one.

Your Toolkit: Selecting Platforms and Apps

Your know-how is simply as necessary as your technique. For brief-term buying and selling, pace is all the things.

What’s the finest platform for short-term buying and selling?

Selecting the correct platform can provide you a critical benefit. You need one with tight spreads, lightning-fast execution, top-notch charting instruments, and entry to a variety of forex pairs. MT5 and cTrader are stable picks.

Quick Execution:

Slippage—getting stuffed at a worse value than anticipated—can kill your earnings. Quick execution helps cut back that danger, so it’s a must have if you’re buying and selling briefly timeframes.

Buying and selling Apps:

The comfort of short-term buying and selling apps is plain. Buying and selling apps allow you to keep within the sport if you’re away out of your desk. Simply ensure the app you decide has all of the options you want—not a watered-down model. The very best ones really feel identical to the desktop.

The Actuality Examine: Can You Make Cash?

Everyone seems to be drawn to the concept of fast earnings, but it surely’s important to be sensible.

Do short-term merchants make cash?

Let’s be trustworthy: short-term buying and selling is hard. Sure, individuals make cash doing it, however most don’t. It takes ability, emotional management, and a critical dedication to studying. In the event you chase quick earnings and not using a plan, you’re setting your self as much as fail.

How do day merchants make cash?

It’s a typical query, so let’s break down the method. Foreign exchange day merchants make cash by profiting from day by day value swings. They place many purchase and promote trades on forex pairs and shut all of them by the top of the day to keep away from in a single day charges and market gaps. They deal with making small, constant wins that add up over time. It’s a sport of consistency, not residence runs.

What’s short-term buying and selling earnings?

In terms of your earnings, it is best to understand how they’re categorized. Quick-term buying and selling earnings is simply the cash you make from fast, frequent trades. However consider—it’s nonetheless taxable as capital beneficial properties, so it’s important to maintain clear, correct data from day one.

Remaining Phrases: Construct Your Buying and selling Edge

In the long run, profitable short-term buying and selling isn’t a few single magic indicator or a secret trick. It’s about having a stable technique, utilizing your instruments well, and always bettering your self. We’ve lined a variety of short-term buying and selling methods that work, from scalping to swing buying and selling, and given you the instruments to construct your buying and selling mannequin. Your success in time period buying and selling will finally rely upon how disciplined you’re. Our trustworthy recommendation? Begin with a demo account. Follow till you’ve acquired a routine that works—one you possibly can observe with out second-guessing. Then, and solely then, take into consideration buying and selling with actual cash. Keep affected person, keep sharp, and deal with this like the intense problem it’s.