Be part of Our Telegram channel to remain updated on breaking information protection

The Ethereum worth plunged 5% within the final 24 hours to commerce at $3,315 as of two:26 a.m. EST on buying and selling quantity that rose 46% to $71 billion.

That ETH worth drop comes as 10x Analysis really useful shorting Ether as a possible hedge in opposition to Bitcoin.

Based on the agency, there are structural dangers throughout the Ethereum community. The analysis agency additionally famous a decline in institutional demand as key elements influencing technique. This comes at a time when Bitcoin continues to draw treasury capital, and Ethereum-focused corporations are on the verge of operating out of capital to spend money on the asset.

Based on 10X Analysis, that makes ETH a possible shorting alternative for buyers seeking to hedge their publicity to the digital asset sector.

LATEST: ⚡ 10x Analysis has recognized Ethereum as a possible shorting alternative, highlighting structural weaknesses as Bitcoin continues to seize the vast majority of institutional treasury capital. pic.twitter.com/s79Jgc0fy8

— CoinMarketCap (@CoinMarketCap) November 5, 2025

The analysts stated that “digital asset treasury” narratives round Ethereum have led establishments to build up ETH and later distribute it to retail buyers, a sample now breaking down amid a scarcity of transparency in personal funding in public fairness (PIPE) disclosures and unsure capital flows.

10x Analysis then referred to BitMine, noting that the agency’s technique has allowed for institutional buyers to build up ETH at par and later distribute it to retail patrons at a premium, a suggestions loop that continued to drive costs larger.

Ethereum Worth Exams Key Assist After Rounded Prime Breakdown

The ETH worth has just lately entered a bearish section following a robust rally earlier in 2025.

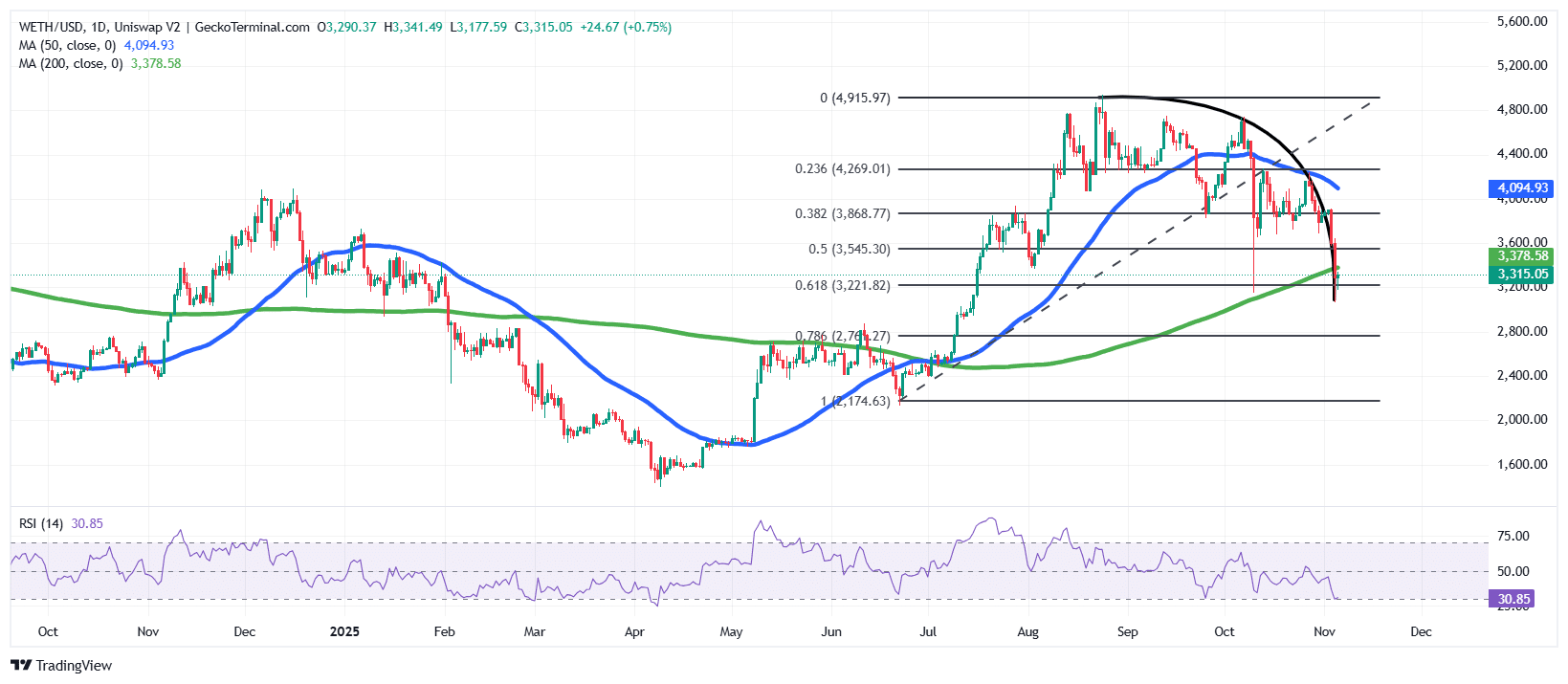

After reaching a neighborhood excessive close to $4,915, the Ethereum worth shaped a rounded high sample, which signifies a shift in momentum from bullish to bearish.

The value of ETH has since declined sharply, breaking under each the $4,400 and $3,800 ranges, and is now testing the $3,200–$3,300 assist zone.

That zone aligns with the 0.618 Fibonacci retracement stage ($3,221) from the earlier rally, which is an important level the place patrons typically try and regain management.

The 1-day chart additionally exhibits that ETH has fallen under its 50-day Easy Transferring Common (SMA) at $4,094, whereas at the moment sitting close to the 200-day SMA at $3,378, an necessary long-term development indicator. If bulls handle to defend this assist and push costs again above $3,500, it may affirm a possible rebound and stop a deeper correction.

The Relative Power Index (RSI) at the moment stands round 30.86, close to the oversold area, which exhibits that bears have management of the worth.

In the meantime, the Transferring Common Convergence Divergence (MACD) indicator continues to assist the bearish momentum, with the blue MACD line nicely under the orange sign line.

ETH Worth Outlook: Bears In Management, However Bounce Attainable

From a technical perspective, the development stays bearish so long as the ETH worth trades under each the 50-day and 200-day SMAs. The rapid resistance lies round $3,545 (the 0.5 Fibonacci stage), adopted by $3,868.

A day by day shut above these ranges may mark the beginning of a short-term restoration towards $4,000–$4,200.

Conversely, if the $3,200 assist stage fails to carry, the following draw back goal lies close to $2,780–$2,800.

Total, Ethereum’s chart construction signifies a market at a crucial juncture, with bears in management, but technical indicators trace at an upcoming oversold reduction bounce.

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

Simple to Use, Characteristic-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection