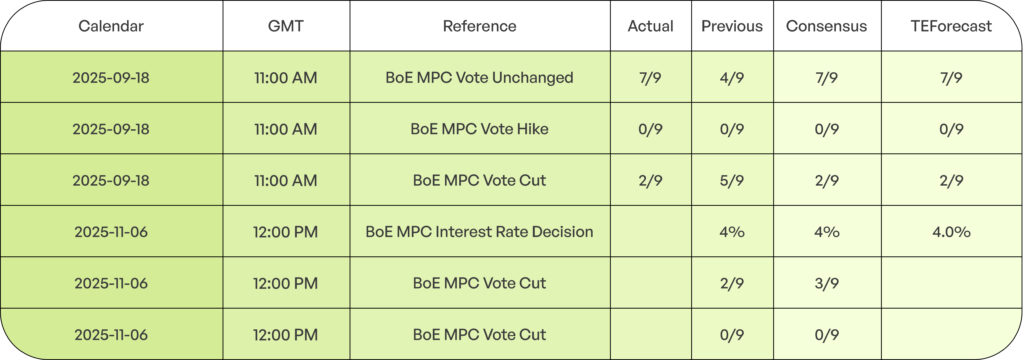

One of the vital delicate moments for the Financial institution of England (BoE) has simply arrived. On the one hand, although, value pressures stay too excessive within the UK, whereas however, it’s more and more clear that the tempo of financial progress is faltering. Value pressures are rising at a tempo enough to unsettle the BoE, regardless of simmering weak point in wages, job progress, and enterprise exercise indicators. Consequently, the BoE has determined to retain its benchmark fee unchanged at 4% as of its financial coverage resolution deadline of fifth Nov, 2025, with a 5-4 resolution, as 4 members referred to as for a lower to three.75%.

In response to the newest Financial Coverage Report from the BoE, “CPI inflation is judged to have peaked and underlying disinflation is underway, helped by eased wage progress, a pass-through of a fall in companies value inflation, and gradual labor market circumstances.” Alternatively, because the BoE indicated, financial progress stays weak as a result of weak exports, and a few sectors of the enterprise sector have begun to contract. Building output within the UK, for example, has decreased at its sharpest fee in additional than 5 years.

What emerges is a coverage atmosphere by which the BoE is caught between two conflicting imperatives: retaining financial coverage sufficiently tight to make sure inflation returns to the two% goal, whereas recognizing that the financial system could also be tipping right into a part by which demand is softening. Fee cuts might quickly be on the desk. Because the Financial Coverage Report places it: “If progress on disinflation continues, Financial institution Fee is more likely to proceed on a gradual downward path.”

In market phrases, the percentages of a fee lower have risen: latest commentary suggests the chance of a transfer to three.75% is now round 30–35%. Crucially, the BoE can also be watching the federal government’s upcoming Autumn Price range (scheduled for 26 November) and the way fiscal coverage—particularly tax hikes and spending plans—would possibly have an effect on progress, inflation, and family funds.

Briefly, slightly than signalling a hawkish readiness to hike charges additional, the BoE is signalling warning. The following transfer seems extra more likely to be a lower than one other hike—except inflation surprises to the upside or progress rebounds.

Impression on the British Pound (GBP)

For world merchants, this atmosphere makes the British Pound (GBP) much less compelling relative to currencies whose central banks seem extra assured about larger charges. When the BoE gives the look that it’s nearer to easing, the forex sometimes comes beneath strain.

Sterling’s worth tends to weaken when markets value in earlier fee cuts or see much less upside in yields. Given the BoE’s cautious stance and upward drift in lower chance, this units a headwind for GBP efficiency. Except upcoming knowledge (inflation, wage progress, employment) shock to the upside, the Pound’s upside is proscribed—and the danger of additional depreciation will increase.

To place it plainly: merchants might determine that GBP gives much less return potential than friends, so capital might as a substitute transfer towards currencies backed by central banks with firmer fee outlooks and stronger financial fundamentals.

Canada’s Resilient Indicators — With a Facet of Warning

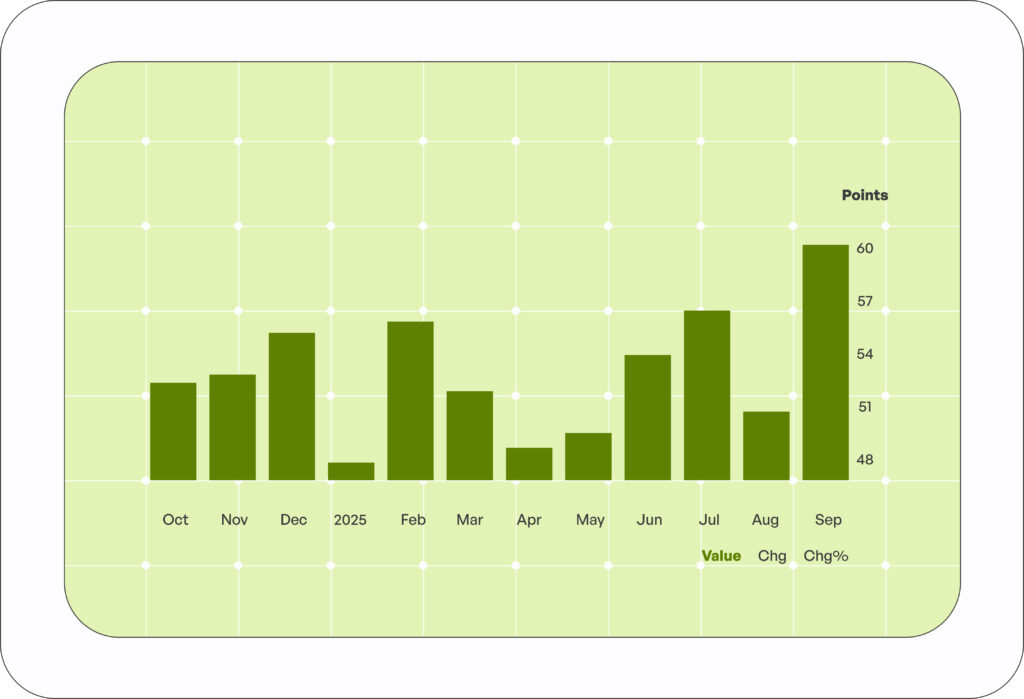

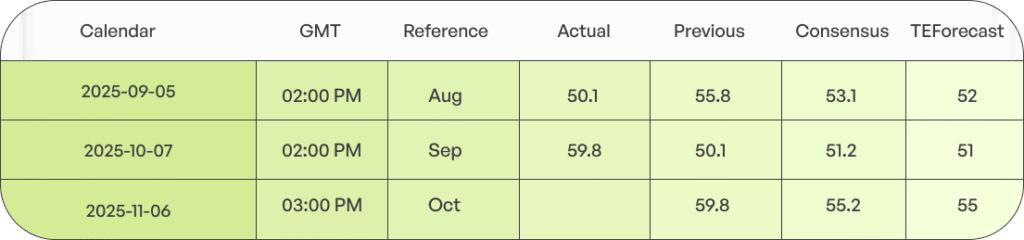

Turning to North America, the image for the Canadian financial system is nuanced. On the one hand, enterprise exercise indicators have been encouraging: a latest analyst ballot suggests the Canadian greenback (CAD) might strengthen by about 3% towards the US greenback over the following three months — because of expectations of US fee cuts and easing trade-uncertainty headwinds.

Alternatively, Canada’s federal authorities price range replace exhibits weaker progress: the financial system expanded simply 0.2% within the first half of 2025, and exports, enterprise funding, and labour markets are displaying strains as a result of commerce and world headwinds.

Furthermore, newer knowledge present that Canada’s companies financial system rose to 50.5 in October (from 46.3 in September), indicating a return to enlargement after many months of contraction. Regardless of this constructive info, the Canadian greenback just lately fell to a seven-month low towards the US greenback because of the relative attractiveness of US yields and strain on oil costs.

Altogether, Canada’s progress indicators are constructive and help the CAD, however there are lingering dangers from weak export momentum, funding stalling, and world commerce uncertainty.

Impression on the Canadian Greenback (CAD)

From a forex perspective, the modestly upbeat Canadian enterprise knowledge and the likelihood that the Financial institution of Canada (BoC) will preserve charges larger for longer make the CAD extra interesting. When a central financial institution faces much less strain to chop and financial knowledge level to resilience, the native forex tends to strengthen.

The analysts’ forecast of a CAD rally (~3%) reinforces this view. Furthermore, looking forward to November 2025, primarily based on FX forecasts, one of many strongest currencies from high-income nations is recognized as CAD, adopted by the second-weakest, GBP, down roughly 2.4%.

Nonetheless, this progress of the CAD will not be assured, and forces that might reverse its pattern embody falling oil costs, weak exports, and tighter monetary circumstances worldwide.

Certainly, its latest near-seven-month low versus the USD exhibits that upside could also be muted within the brief time period.

For merchants, the CAD presently gives a extra enticing risk-return profile than GBP — particularly if the BoC maintains its stance and Canada continues to defy softer world progress.

The Relative Play: GBP vs. CAD

Placing all of it collectively, the distinction between the UK and Canada turns into clear, providing strategic perception for forex merchants. The BoE’s stance leans towards eventual easing, the UK financial system exhibits indicators of stagnation or worse, and GBP seems susceptible. In the meantime, Canada presents a extra balanced – although not flawless – story of resilience and pragmatic coverage, making CAD comparatively stronger.

In a world the place world traders more and more hunt for yield and relative stability, currencies backed by stronger progress and better anticipated charges have a tendency to draw capital flows. That dynamic favours the CAD over the GBP within the present part.

Nevertheless, this isn’t a one-way guess. If UK inflation unexpectedly accelerates or fiscal coverage surprises (positively) and progress picks up, the GBP might reverse its pattern. Equally, if Canada’s commerce atmosphere deteriorates additional or oil costs collapse, CAD might lose floor. However for now, the trail of least resistance seems to position GBP on the weaker aspect and CAD on the extra advantageous aspect within the foreign exchange enviornment.

What to Watch Subsequent

For the UK / BoE & GBP:

Future UK CPI figures (October/November releases) and wage progress can be important indicators of whether or not the BoE is more likely to lower or maintain.

The Autumn Price range on the twenty sixth of November – its tax/spending combine and progress implications will form financial coverage views and, by extension, GBP.

Present labour market and development/exercise statistics: weak numbers might hasten market forecasts of a fee lower, pressuring GBP.

For Canada / BoC & CAD:

Additional readings on exports, funding, and the labour market will decide whether or not Canada’s resilience holds.

Oil value dynamics and commerce uncertainty are key exterior dangers for CAD.

Market expectations for US fee cuts: If the US begins fee cuts ahead of anticipated, yield spreads might change, thereby affecting the CAD.

Price range 2025 and any commerce coverage modifications might affect market sentiment.

Backside Line

The up to date modifications prolong the divergence pattern between the UK and Canadian economies. They mirror that, regardless of its dovish stance, the BoE is primed for future easing, as progress indicators level to a UK financial stall. Alternatively, the BoC has a strong footing, because of a enterprise atmosphere that has continued to ship constructive surprises. From a foreign exchange dealer’s vantage, this implies: except the UK knowledge flip unexpectedly robust, the primary threat stays additional GBP weak point. In distinction, the CAD holds a conditional ‘edge,’ particularly if Canadian fundamentals keep on observe and there may be much less concern about fee cuts. In different phrases, there could also be extra draw back threat than upside for the Pound, and alternatives could also be forthcoming for the Canadian Greenback, so long as progress is sustained and shocks will be managed.