XRP has spent the previous week on the continuation of a downtrend from the earlier week, slipping from above $2.50 earlier than rebounding round $2.12 and now hovering round $2.30. The value motion displays a market struggling to search out path, caught between bullish optimism and lingering promoting strain.

Regardless of the broader slowdown in its value motion, technical evaluation exhibits that XRP remains to be displaying a resilient construction on the charts that maintains its essential assist ranges. In line with Egrag Crypto, a preferred analyst recognized for his long-term technical outlooks on XRP, the token might quickly enter what is going to develop into probably the most explosive fifth wave but.

Associated Studying

XRP Elliott Wave Evaluation: ‘The Energy Of 5’

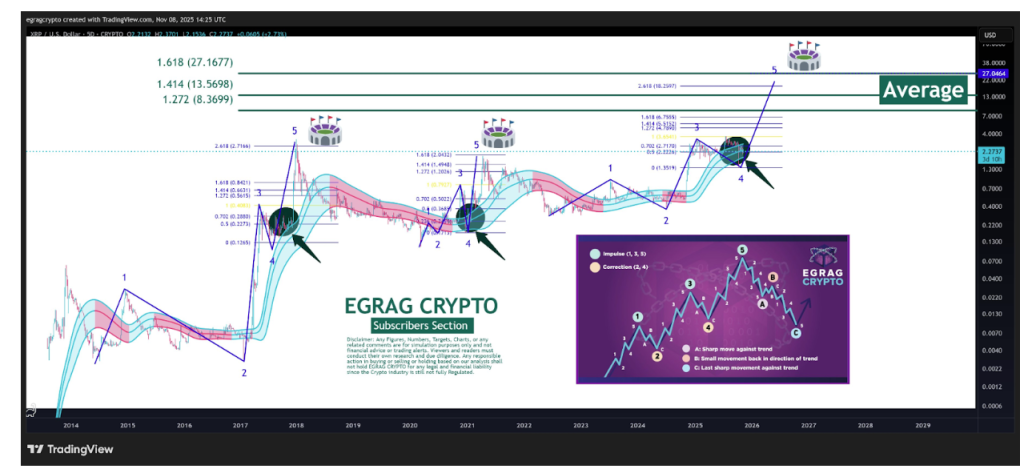

Egrag Crypto’s newest technical evaluation on the social media platform X factors to the truth that XRP is within the ultimate phases of its fourth impulse wave, which is a corrective wave based mostly on the favored Elliott Wave Idea. Notably, this motion is now establishing for the start of the fifth wave, which is a bullish impulse below the identical concept.

earlier cycles on the 5-day candlestick timeframe chart, significantly throughout 2017 and 2021, confirmed that comparable setups got here earlier than large upward surges in XRP’s value. The analyst’s chart shows a repeating construction of five-wave patterns, every representing main bullish impulses within the token’s historical past.

The chart additionally displays the distinct cyclical rhythm of XRP’s value conduct over time. Every main impulsive part (waves 1, 3, and 5) has at all times been adopted by smaller corrective waves (2 and 4), a construction that continues to repeat with precision.

The overlapping bands in cyan and pink, representing exponential transferring averages, now level to XRP consolidating inside a robust assist area round $2.20, which signifies that the fourth impulse wave is coming to an finish.

XRP Technical Evaluation: Supply @egragcrypto on X

Analyst Says Don’t Battle It

By Egrag Crypto’s measure, the continuing consolidation is likely to be setting the stage for a comparable transfer to double-digit costs if the fifth wave unfolds as projected.

The visible projection marks potential Fibonacci extensions of 1.272, 1.414, 1.618, and a couple of.618 at $4.789, $5.515, $6.755, and $18.259 as potential long-term targets as soon as the fifth wave takes maintain. These ranges might act as resistance factors within the impending bull part as a result of they resemble the wave geometry that drove XRP’s earlier rallies in 2017 and 2021.

Curiously, the analyst additionally referenced how skepticism usually peaks earlier than main rallies. He reminded followers of a dealer who misplaced $30 million shorting XRP throughout its final main uptrend in 2024. As such, the analyst concluded by urging merchants to not “battle the fifth wave” however to “trip it.”

Associated Studying

On the time of writing, XRP is buying and selling at $2.27, down by 1.6% and 9.2% prior to now 24 hours and 7 days, respectively.

Featured picture from Unsplash, chart from TradingView