Arthur Hayes says Zcash is now his second-largest liquid holding after Bitcoin, and the market took discover.

The BitMEX co-founder shared the replace on X late Friday. He stated his household workplace, Maelstrom, now holds extra ZEC than the rest besides Bitcoin.

As a result of fast ascent in worth, $ZEC is now the 2nd largest *LIQUID* holding in @MaelstromFund portfolio behind $BTC.

— Arthur Hayes (@CryptoHayes) November 7, 2025

He posted the remark after a pointy leap in Zcash, which has sparked contemporary speak about whether or not main merchants are warming as much as privateness cash once more.

Why Has ZEC Turn into the Second-Largest Asset in Hayes’ Portfolio?

7d

30d

1y

All Time

Hayes didn’t say he bought Bitcoin to construct the place. He described it extra as a shift pushed by current worth motion moderately than a giant portfolio reshuffle.

By early Monday, ZEC traded within the mid-$600s whereas Bitcoin sat close to $105,000. In a put up on X, Hayes stated ZEC climbed to the second-largest spot in his portfolio “as a result of fast ascent in worth,” hinting that the token’s sturdy transfer shifted his total allocation.

Maelstrom, his household workplace, says it invests in liquid tokens and personal offers.

Hayes has spoken usually about ZEC in current weeks. He has shared long-term targets for the token on social platforms and through interviews.

He additionally recommended Zcash might declare a part of Bitcoin’s worth if privateness turns into a stronger theme once more.

These remarks coincided with outsized ZEC positive factors since October and contemporary media protection over the weekend highlighting its climb into large-cap territory.

Zcash is a Bitcoin-like asset with a 21M coin cap that provides shielded transactions by zero-knowledge proofs. This lets customers preserve quantities and addresses non-public after they select.

That function set has returned to the highlight as curiosity in on-chain privateness picks up once more.

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

Zcash Value Prediction: Is Rising Open Curiosity Displaying Stronger Bullish Momentum?

Zcash has been gaining traction over the previous month. Futures exercise picked up sharply, and Futures Taker CVD stayed optimistic for 30 days straight, an indication that patrons have been in management.

(Supply: Coinglass)

Most merchants within the futures market leaned towards the purchase facet, opening positions on each lengthy and quick trades to capitalize on the strikes.

Lookonchain pointed to 1 massive purchaser after ZEC fell to $509.

A mysterious whale created a brand new pockets (0x6EF9) 14 hours in the past and deposited 6.27M $USDC into Hyperliquid, inserting a restrict lengthy order at $509.5 on $ZEC.

9 hours in the past, the order absolutely crammed — now holding 20,833 $ZEC($12M) with an unrealized revenue of $1.44M.… pic.twitter.com/eZt2TrirgV

— Lookonchain (@lookonchain) November 9, 2025

In accordance with the tracker, the whale despatched $6.27 million to Hyperliquid and positioned a limit-long order for 20,800 ZEC, price roughly $ 12.12 million.

Because the market moved larger, the dealer’s place briefly confirmed roughly $1.51 million in unrealized positive factors. They later closed the commerce and walked away with roughly $1.25M in revenue.

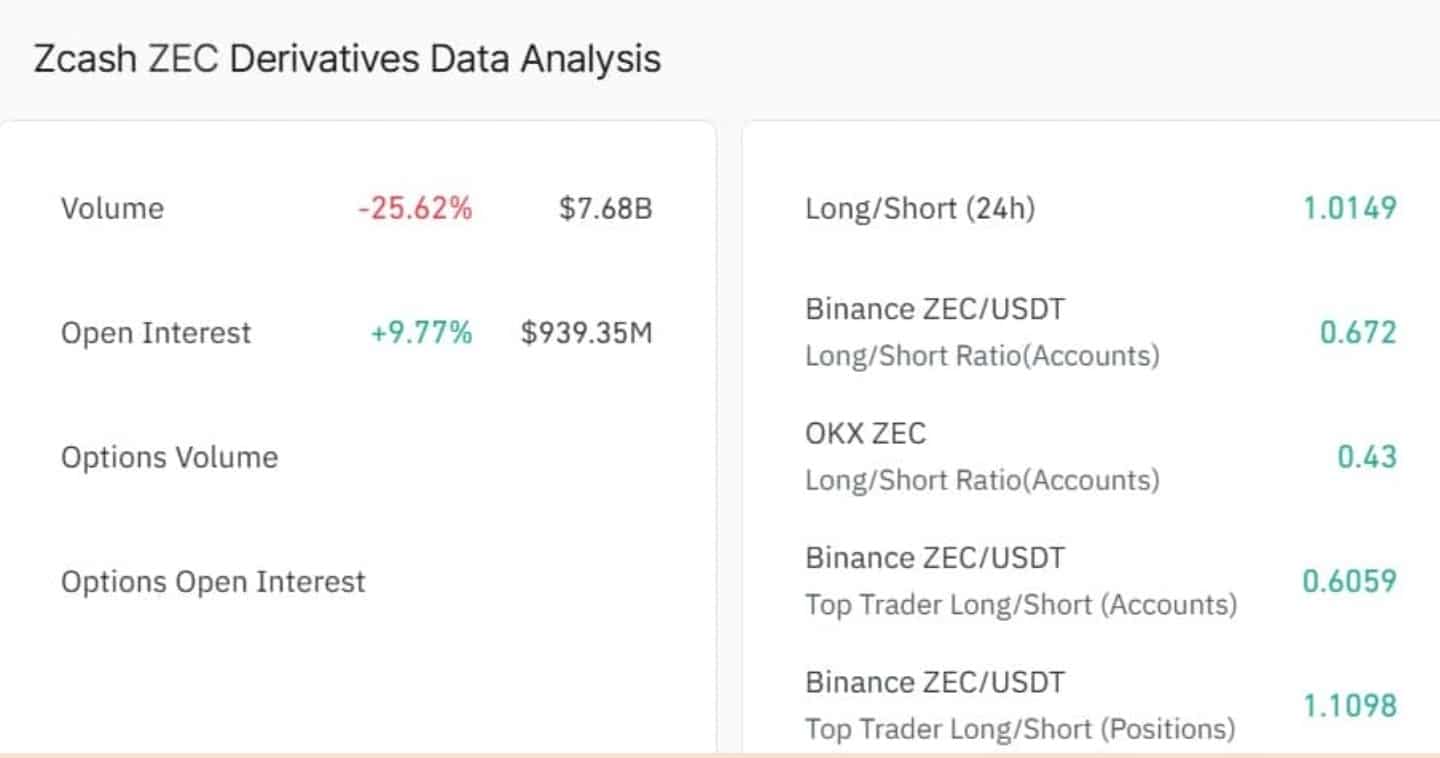

Futures exercise additionally picked up. CoinGlass information reveals Zcash open curiosity rose about 9.8% to $939.31M, suggesting extra money is flowing into ZEC futures.

(Supply: Coinglass)

Lengthy-short positioning additionally leaned barely bullish. CoinGlass listed a 24-hour Lengthy/Brief Ratio close to 1.01.

On Binance, prime merchants posted a better studying of 1.11, exhibiting extra merchants have been nonetheless favoring lengthy bets.

EXPLORE: The 12+ Hottest Crypto Presales to Purchase Proper Now

The put up Is Arthur Hayes Rotating His Bitcoin Into ZCash? appeared first on 99Bitcoins.