Our software program is already established effectively past commodity market evaluation. Inventory indices, currencies, and even rates of interest — all this information is already within the app.

At the moment, we’re increasing the info providing with sector indices. I used to be personally on this information, as I commerce these indices via ETFs very often.

You may browse the brand new information within the enter subject within the app beneath the brand new “Sector indices” group.

We’ve coated all of the S&P sectors plus just a few essential trade sub-indices like Biotech, Semiconductors, or Oil & Fuel. You could find all of the contract specs on this CME Group web page.

Moreover charting the indices on their very own, this information could be extremely helpful in varied ratios. For instance, right here’s the Shopper Discretionary / Staples ratio that serves as an essential cyclically delicate measure of the broad US economic system. Its weak point typically marked the beginning of main corrections — like this spring.

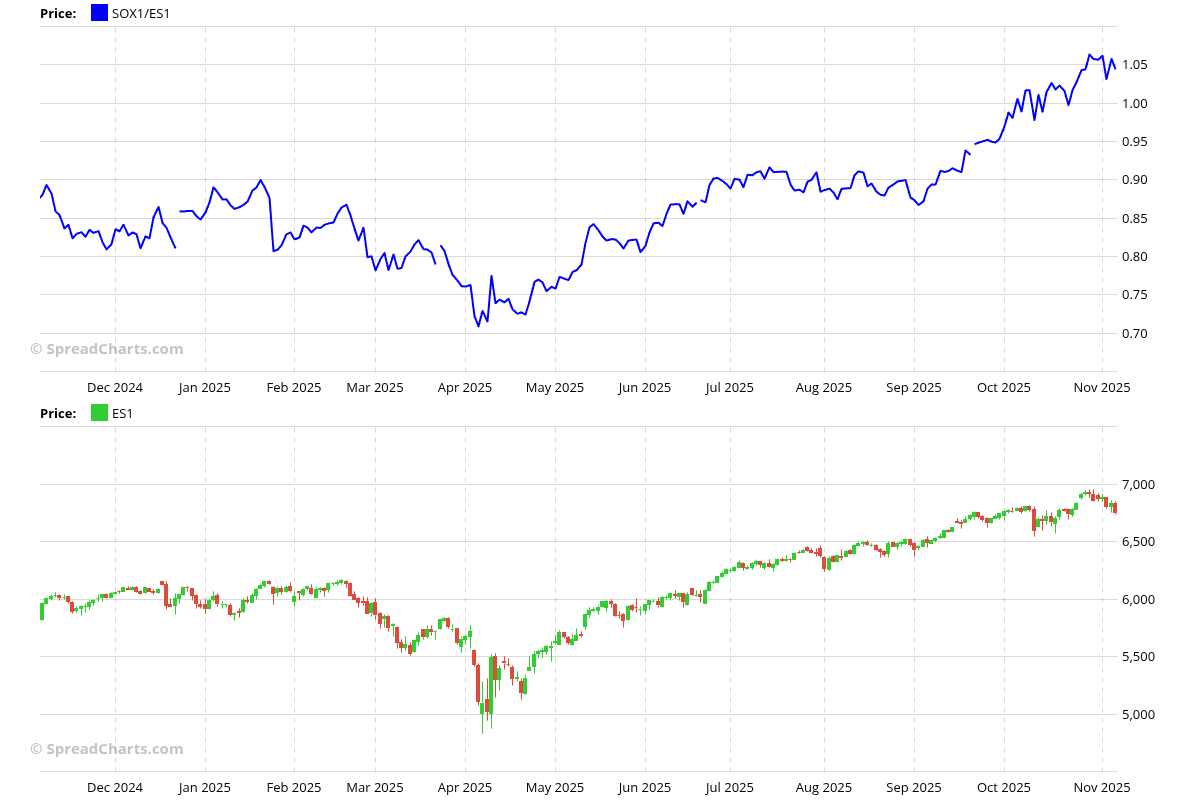

Or you’ll be able to monitor the relative efficiency of the “trendy oil” that powers the data economic system and the present inventory market bubble. Sure, I imply the Semiconductor trade. When this factor begins to wobble, you higher watch out.

Or if we stick with the standard oil, evaluating it with the efficiency of the Oil & Fuel trade might present essential insights.

Even for those who want to comply with the long-term efficiency of US actual property, it’s no downside with the Dow Jones Actual Property index.

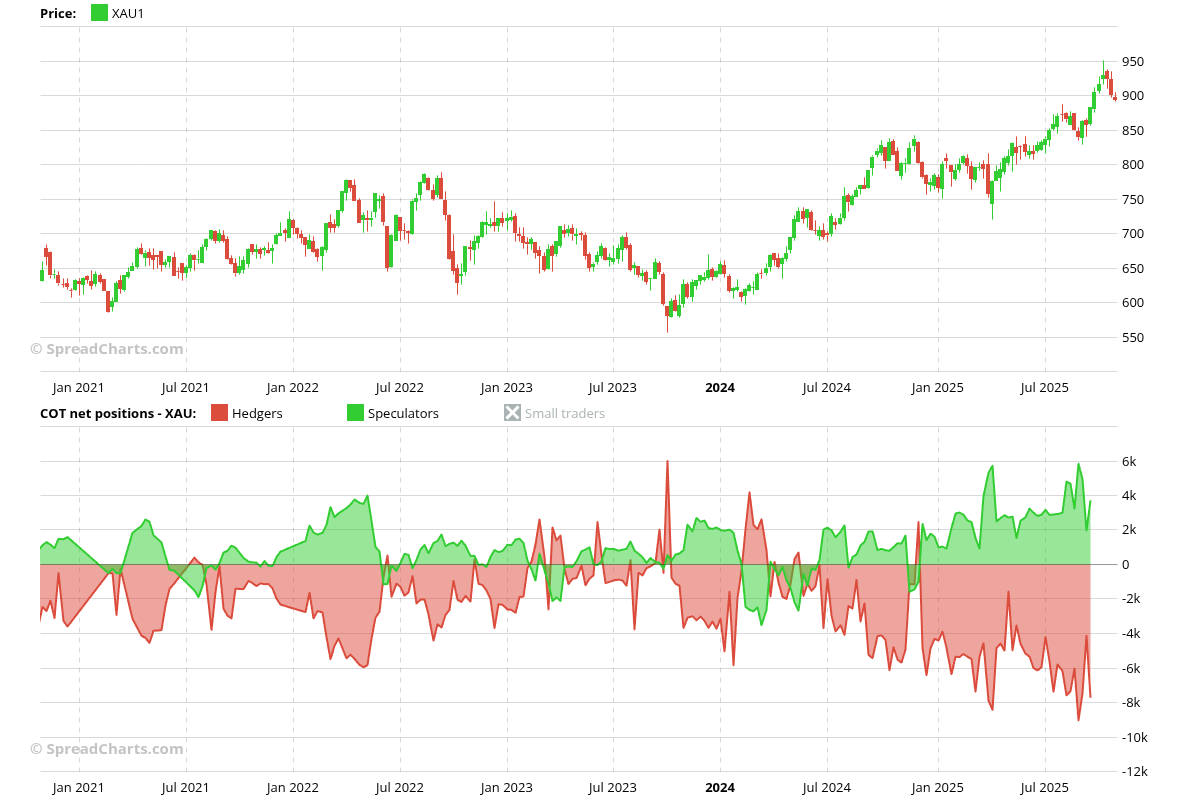

And we even have Commitments of Merchants information for many of those futures. Simply take the Utilities sector for instance.

I hope you’ll take pleasure in the brand new information as a lot as I do. I can promise you we’ll be including extra attention-grabbing datasets within the close to future.

The put up New information: Sector indices appeared first on SpreadCharts.com.