The AUD/USD weekly forecast signifies bearish momentum regardless of the resilient Australian greenback.

Australia’s unemployment knowledge fell to 4.3% in October, with an addition of 42.2k jobs.

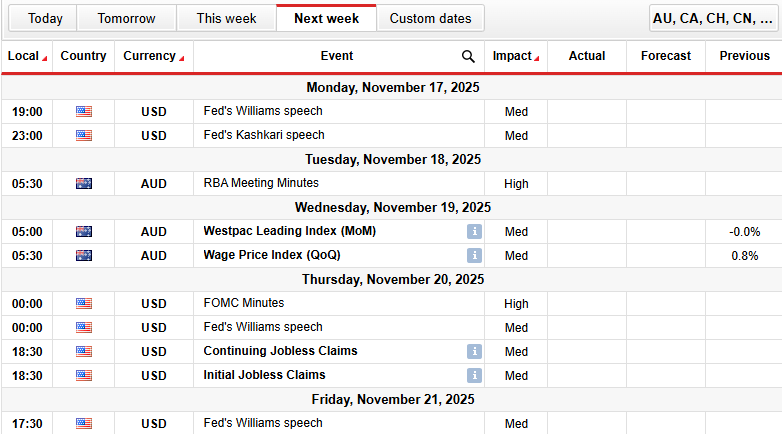

Merchants anticipate the FOMC and RBA assembly minutes together with speeches by Fed officers subsequent week.

The AUD/USD weekly forecast displays a broader promoting strain, because the pair closed underneath 0.6550 by the tip of the week. Regardless of an earlier rebound, the lifted buck and an unsure Fed coverage stance weighed on the pair. Nonetheless, the Australian greenback remained resilient amid sturdy home knowledge and a stabilizing state of affairs with China.

-Are you in search of automated buying and selling? Verify our detailed guide-

The earlier week’s unemployment knowledge revealed a drop to 4.3% in October, with a rise in employment by 42.2k. In the meantime, 55.3k full-time positions have been added to the economic system. These figures level in direction of a cautious RBA stance for 2025.

China’s upbeat knowledge, displaying a 4.9% rise in industrial manufacturing and a couple of.9% progress in October retail gross sales, additional lifted the Aussie. Nonetheless, if China’s financial progress declines, it might weigh on the AUD.

From the US, the greenback remained pressured as a result of unsure financial outlook this week. The federal shutdown had halted the discharge of main financial knowledge, resulting in a unstable and unsure state of affairs relating to inflation and employment figures.

In the meantime, lowered expectations for a December Fed reduce, down from 70% this week to 50% on Friday, barely lifted the buck. Hawkish Fedspeak revealed warning about additional financial easing, boosting the greenback regardless of prevailing financial issues.

AUD/USD Key Occasions Subsequent Week

The numerous occasions within the coming week embrace:

RBA Assembly Minutes

Westpac Main Index (MoM)

Wage Worth Index (QoQ)

Fed’s Williams Speech

Fed’s Kashkari Speech

FOMC Minutes

Persevering with Jobless Claims

Preliminary Jobless Claims

Within the coming week, merchants will sit up for the continuation of preliminary jobless claims and the Fed’s official speeches for additional coverage path. Moreover, subsequent week’s RBA assembly minutes and FOMC minutes will information merchants on the financial outlook and future rate of interest choices.

AUD/USD Weekly Technical Forecast: Consolidation Above 0.6500

The AUD/USD day by day chart signifies the pair is in a impartial section, buying and selling above 0.6500. The worth stays above the 50- and 200-MA, suggesting some assist close to the 0.6500 and 0.6460 ranges.

-In case you are enthusiastic about foreign exchange day buying and selling, then have a learn of our information to getting started-

The RSI holds close to 50, indicating a consolidation, as markets await a catalyst to provoke a breakout. A break above 0.6550 might ignite the upside continuation. Quite the opposite, a break under 0.6500 might set off draw back strain in direction of 0.6400 and 0.6350.

Help Ranges

Resistance Ranges

Trying to commerce foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It’s best to contemplate whether or not you may afford to take the excessive danger of shedding your cash.