The EUR/USD weekly forecast is barely subdued amid danger aversion.

A hawkish Fed and Center East battle proceed to weigh on danger property.

Tariff issues are mounting because the July 9 deadline looms massive.

The EUR/USD weekly forecast stays mildly subdued because the week closed with a slight unfavorable change. The US greenback maintained its energy as international danger aversion rose amid the Iran-Israel battle.

–Are you curious about studying extra about subsequent cryptocurrency to blow up? Test our detailed guide-

The Center East state of affairs continues to deteriorate the danger sentiment, weighing on risk-sensitive property. The Iranian regime refused to drop the nuclear program whereas President Trump allowed two weeks for Iran to return to the negotiations earlier than the decisive US navy motion. In the meantime, each international locations proceed bombing for greater than eight days.

The Federal Reserve stored rates of interest unchanged as anticipated, with a slight hawkish shift in tone that stunned the market. So, the dollar gained floor partially. The Fed Chair Powell famous the inflation remains to be above targets and the danger of reacceleration additionally persists amid Trump tariffs. Nevertheless, he reaffirmed that the central financial institution will minimize charges twice by the top of 2025. In the meantime, the following fee minimize is linked to cooling inflation and labor market information.

However, the European Central Financial institution’s assembly in June’s first week revealed an finish to the easing cycle after delivering eight consecutive fee cuts. President Lagarde mentioned that they’re well-positioned and want no extra fee cuts. Within the final week, totally different ECB officers hit wires, with some carrying an optimistic tone whereas some confirmed issues about Eurozone development.

On the tariffs entrance, the looming deadline of July 9 continues to mood the worldwide danger sentiment. The commerce negotiations of the US and the Europe stay in air, with no evident progress. President Trump mentioned that Europe isn’t providing a good deal. The state of affairs with Japan and Canada can also be the identical. It means the tariff-related headlines will quickly dominate the markets.

Key Occasions for EUR/USD Subsequent Week

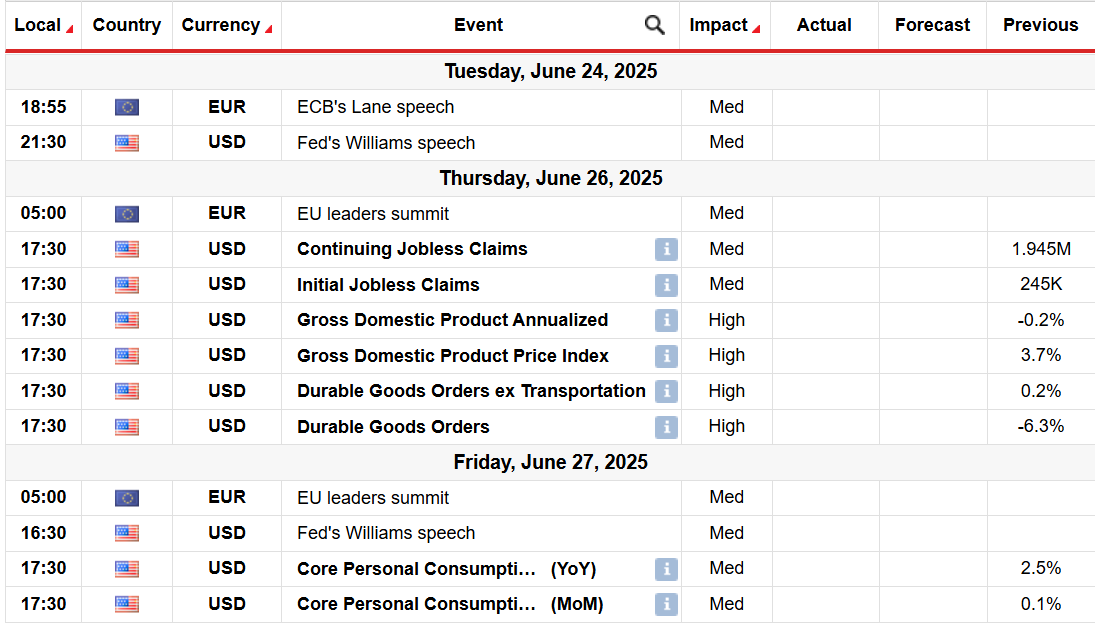

The following week brings key information from each side. The PMI readings from the EU and the US are due subsequent week. Furthermore, the US Core PCE, an vital gauge for inflation, can also be due on Friday. Different main occasions embody US GDP and Sturdy Items Orders.

Other than these information, some speeches from the ECB and Fed are due too that will present impetus to the market.

EUR/USD Weekly Technical Forecast: Pullback Inside Uptrend

The EUR/USD every day chart reveals a light pullback from multi-month highs in direction of the dynamic assist of the 20-day SMA. This assist is stable sufficient to maintain the bullish pattern intact. In the meantime, the every day RSI can also be on the 59.0 stage, suggesting an upside bias.

–Are you curious about studying extra about foreign exchange indicators? Test our detailed guide-

Alternatively, closing beneath the 20-day SMA can collect promoting traction. The pair might head to 1.1450 forward of 1.1400. Nevertheless, the trail of least resistance lies on the upside.

Seeking to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It is best to take into account whether or not you possibly can afford to take the excessive danger of dropping your cash.