The EUR/USD weekly forecast signifies a bullish bias, with the greenback beneath strain amid rising financial considerations.

The chance of a December Fed lower decreased from 70% to 50% by Friday as a consequence of market warning and lack of visibility into financial knowledge.

Merchants stay up for the FOMC Minutes, NFP, and PMIs for contemporary impetus.

The EUR/USD forecast signifies a modestly bullish tone, because the pair trades above 1.1600 after advancing for the second consecutive week, amid regular Eurozone knowledge and blended Fed indicators.

-Are you in search of automated buying and selling? Examine our detailed guide-

The Eurozone knowledge provided little help to the shared foreign money. The Q3 GDP rose by 0.2% QoQ and 1.4% YoY, signaling a secure financial momentum. Industrial manufacturing and sentiment knowledge revealed blended figures.

In the meantime, some ECB officers and President Christine Lagarde reaffirmed that the central financial institution stays vigilant and the euro holds a powerful place by way of financial and financial coverage.

From the US, the greenback remained beneath strain final week, regardless of optimism surrounding the tip of the US shutdown. Markets awaited the delayed financial launch, which the shutdown had halted. Softer labor knowledge pressured the greenback. In the meantime, hawkish remarks from Fed officers, together with Schmid, Kashkari, Bostic, and others, decreased expectations of a December lower.

On Friday, markets priced in a 50% chance of a December Fed lower, down from 70% the earlier week. The event stemmed from policymakers emphasizing warning and transparency within the financial circumstances earlier than implementing additional easing measures. The Fed Chair Powell’s assertion concerning uncertainty over the December fee lower contributed to investor cautiousness.

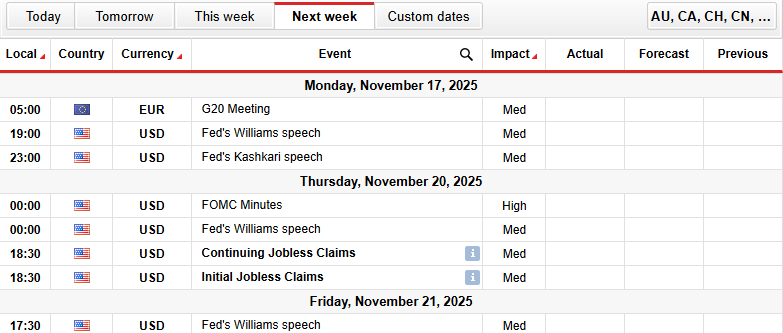

EUR/USD Weekly Key Occasions

The numerous occasions within the coming week embrace:

EUR G20 Assembly

Fed’s Williams Speech

Fed’s Kashkari Speech

FOMC Minutes

Persevering with Jobless Claims

Preliminary Jobless Claims

Subsequent week, merchants anticipate the FOMC minutes, the G20 assembly, and speeches by Fed officers for additional insights into coverage cues and international danger sentiment. Markets additionally anticipate the long-overdue US NFP report on Thursday. Nevertheless, the schedule is just not clear but.

EUR/USD Weekly Technical Forecast: Wobbling Close to Key DMAs

The EUR/USD each day chart reveals the pair in a slight bullish tone earlier within the week after stabilizing above the 1.1600 stage. Nevertheless, the broader development stays impartial. The upside momentum stays restricted, because the pair stays under the important thing 50-, 100-, and 200-day MAs.

-If you’re thinking about foreign exchange day buying and selling, then have a learn of our information to getting started-

The RSI holds close to the mid-50s, indicating fading promoting strain. Breaking above the 1.1650 stage may set off a sustained restoration in direction of yearly highs. Conversely, failure to carry above the 1.1600 stage may result in renewed draw back strain.

Assist Ranges

Resistance Ranges

Seeking to commerce foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It’s best to take into account whether or not you possibly can afford to take the excessive danger of dropping your cash.