The crypto worth chart right now exhibits how Bitcoin worth is settling into a gradual vary at $90,000, whereas most main alts stay surprisingly robust, apart from pumping ASTER.

This stabilization follows weeks of a pointy downtrend, and now, the tone of the market feels noticeably calmer. Even with out main upside, the mix of a gradual crypto worth chart, a cooling Bitcoin decline, and alts’ resilience gives the look that the worst of the sell-off could also be fading.

7d

30d

1y

All Time

DISCOVER: 10+ Subsequent Crypto to 100X In 2025

Crypto Worth Chart and Bitcoin Worth: Technical Alerts Hinting at a Backside

Finding out the crypto chart, the Bitcoin worth is repeatedly defending the $90,000 zone, displaying power. Promoting quantity spiked final week, but the absence of a deeper breakdown exhibits that long-term consumers quietly absorbed stress.

The alt costs observe this conduct, particularly in Ethereum and Solana, each of which held key weekly ranges after leverage washed out. And to not neglect ASTER, which is posting a 20% acquire over the past 7 days.

7d

30d

1y

All Time

The technical alerts listed here are traditional “bottom-watch” markers. The RSI dipped into oversold territory on a number of timeframes, and this often coincides with mid-cycle resets.

The current dying cross on the crypto worth chart is definitely much less bearish than it seems to be, with comparable crosses in 2023 and 2024 coming proper earlier than 20–30% rebounds. If historical past is any information, a bounce towards $95,000–$98,000 stays very lifelike, quickly.

(supply – Crypto Relative Power Index, TradingView)

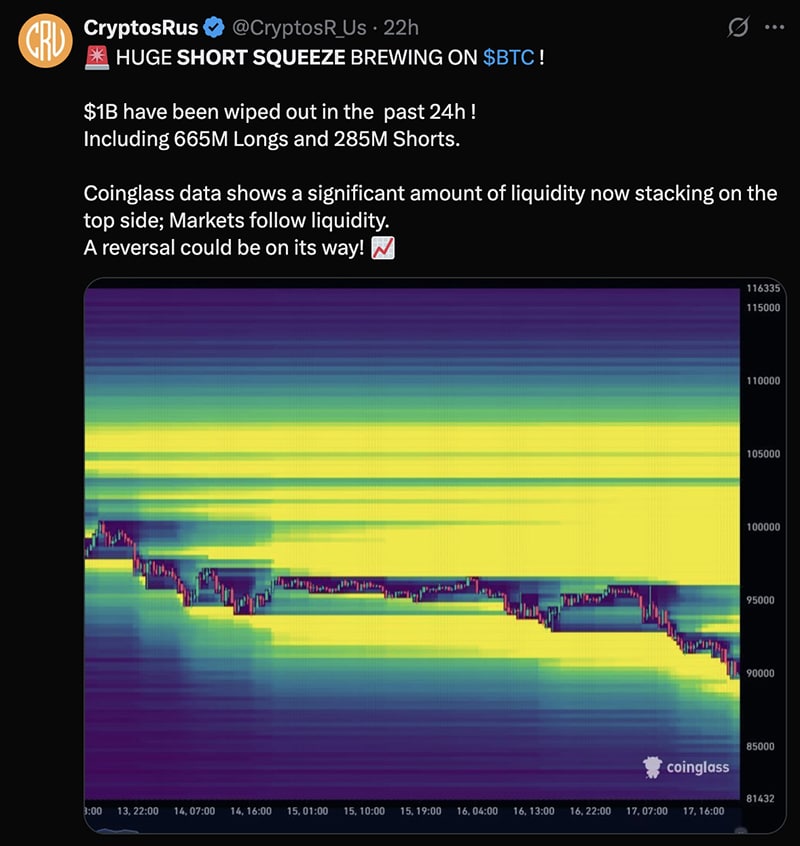

Deleveraging alone cleared greater than $1.1 billion in positions, wiping extra warmth from derivatives. That issues as a result of the Bitcoin worth typically turns upward after liquidity flushes, and the alts are inclined to observe as soon as funding charges normalize.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

Historic November Patterns for Bitcoin and Alts Worth

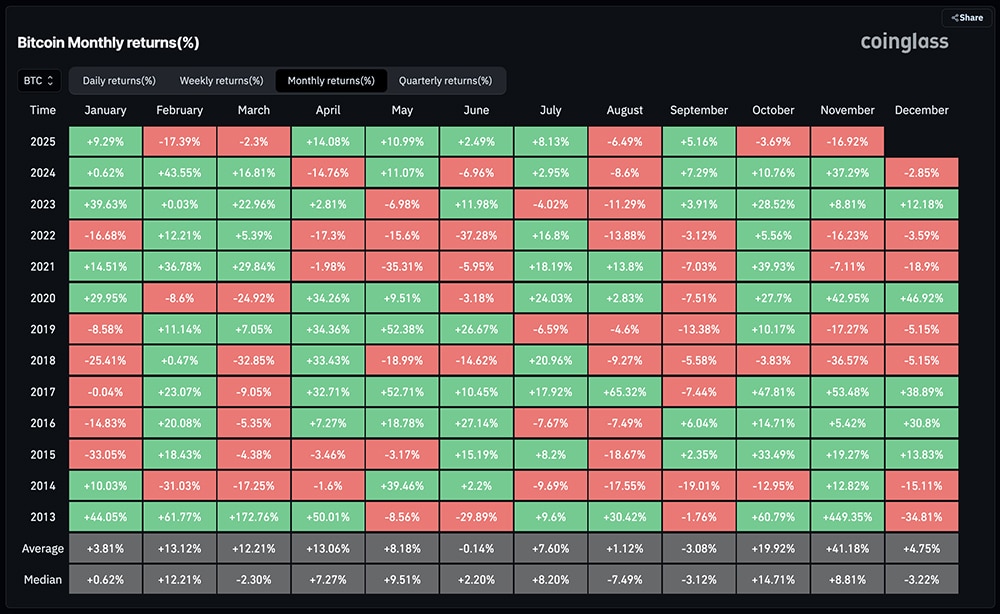

Wanting again throughout each November since Bitcoin started buying and selling, the month has delivered surprisingly robust outcomes. On common, the Bitcoin worth gained over 40% throughout all previous Novembers.

The crypto worth chart has seen a number of notable catalysts in the course of the month: the 2012 halving aftereffects, Taproot activation in 2021, and varied macro-driven rallies. The exceptions, after all, are essentially the most notorious, resembling November 2022 with the FTX collapse. Though this was tied to extraordinary occasions somewhat than typical seasonal conduct.

(supply – Bitcoin Month-to-month Returns, CoinGlass)

This 12 months, leverage-driven volatility dominated. Greater than $280 million in longs and shorts have been flushed on November 11 in what regarded like an intentional squeeze to wipe either side, and let’s not neglect the October 10 flash crash.

Huge-wallet exercise helps this suspicion as giant gamers appeared to soak up provide at the same time as positions have been compelled out. Traditionally, such squeezes in 2017 and 2021 led to large reversals, and right now’s crypto worth chart seems to be eerily comparable.

(supply – X)

No matter macro correlations, post-halving shortage continues to tighten provide. With no structural break on the crypto worth chart, and each Bitcoin and alts behaving extra constructively. The crypto worth chart leans towards the underside being in, or a minimum of extraordinarily shut. The following break above $95,000 will verify the subsequent upside flip. For now, we wait.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Be a part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Billionaire Bitcoin Miners Are Abandoning The Community: Is Bitfury’s New Tech Fund Subsequent 1000X Crypto?

The race to seek out the subsequent 1000x crypto has intensified as billionaire Bitcoin miners quietly retreat from the community, triggering hypothesis about the way forward for mining, institutional involvement, and high-growth alternatives. The shift is prime. All through 2025, mining economics have been crushed by the April 2024 halving, hovering power costs, and Bitcoin’s incapacity to maintain new highs lengthy sufficient to offset decreased block rewards.

The consequence has been a wave of miners shutting down rigs, liquidating {hardware}, or reworking huge mining farms into AI and high-performance computing facilities. Amid this structural shift, Bitfury (probably the most influential corporations in Bitcoin’s historical past) has now made a shocking announcement that immediately sparked rumors throughout crypto social media.

Learn the complete story right here.

The submit Crypto Information Right this moment, November 19: Crypto Worth Chart Exhibiting a Signal of Backside as Bitcoin and Main Alts Holding appeared first on 99Bitcoins.