Bitcoin’s sell-off this week has reignited the query of whether or not the market has already printed an area backside. Chris Kuiper, CFA, VP of Analysis at Constancy Digital Belongings, argues that a number of on-chain and sentiment gauges now resemble prior bull-market corrections, whereas stressing that nothing is for certain.

“I in addition to anybody by no means is aware of for positive,” Kuiper wrote on X, “however one chart I do like to make use of to assist gauge the chances is the short-term holder MVRV chart together with their price foundation.”

Is The Bitcoin Backside In?

The Glassnode chart he shared tracks Bitcoin towards the realized value of short-term holders (STHs) and their MVRV ratio – a measure of whether or not this cohort is in combination revenue or loss. In earlier uptrends, native lows have typically occurred when STH MVRV dipped beneath 1, briefly placing current consumers underwater earlier than value recovered.

Kuiper notes that the present drawdown has pushed STHs again into loss territory in a method that appears just like earlier mid-cycle pullbacks. “If this certainly is an everyday 20–30% drawdown inside the present bull market, then the MVRV ratio is exhibiting an analogous valley as earlier than, testing the mettle of short-term holders earlier than resetting to maneuver greater,” he wrote.

Associated Studying

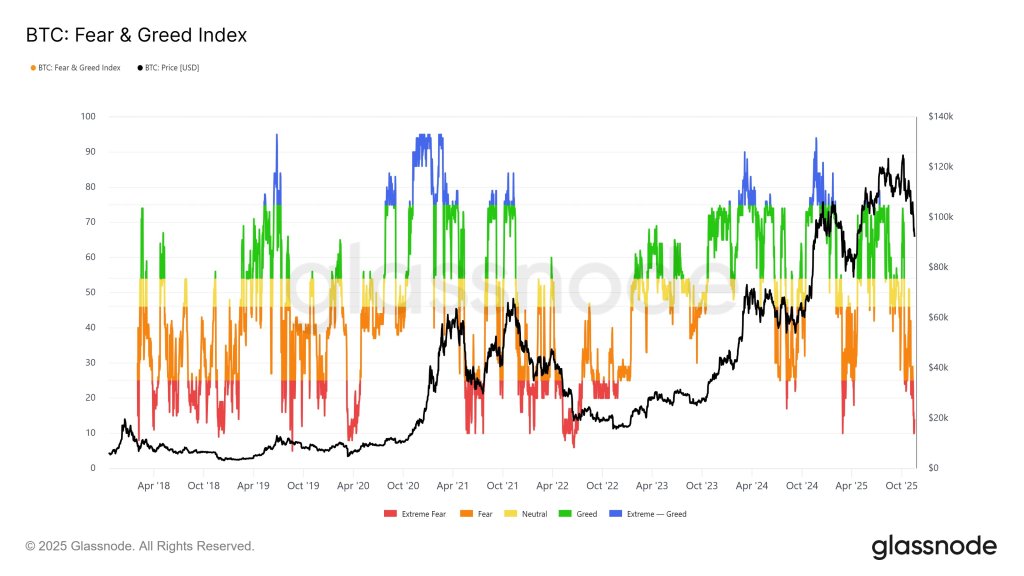

His second reference level is the Bitcoin Worry & Greed Index, which has swung from sustained “greed” and “excessive greed” again into “concern,” with episodes of “excessive concern.” In keeping with Kuiper, the index “tends to hit excessive ranges at these native tops and bottoms,” suggesting sentiment has reset after the current euphoria. At the moment, the index sits at 11.

“This isn’t a prediction,” he cautioned, “however given the dearth of damaging basic information or modifications (and actually the alternative these days), this knowledge ideas my assessed possibilities in favor of this being an everyday and wholesome drawdown.”

Associated Studying

Different analysts are extra cautious. Bitwise senior analysis affiliate Max Shannon flagged “additional doable draw back re. correlation to fairness markets, decrease Dec charge lower prob., LTH proceed promoting in BTCs ‘IPO second’.” Nonetheless, he added that “risk-return profiles [are] bettering at these ranges imo. Issues are stretched and many contrarian indicators flashing inexperienced.”

Crypto investor Richard Haas pointed to a deviation from earlier bull-market corrections, warning that “prior bull corrections by no means closed greater than 10% beneath the 200ma cloud, and by no means let the 50dma curl down.”

For now, Kuiper’s view is that on-chain stress amongst short-term holders and a pointy sentiment reset are in line with a typical bull-market shakeout. Whether or not that marks a sturdy backside or solely a pause in additional draw back stays unresolved – and, as he emphasizes, in the end comes right down to possibilities, not certainties.

At press time, BTC traded at $92,019.

Featured picture created with DALL.E, chart from TradingView.com