Chainlink (LINK) has come beneath intense stress, shedding greater than 33% of its worth since hitting native highs in Might. The mixture of escalating Center East tensions and rising macroeconomic uncertainty—fueled by rising US Treasury yields and a cautious Federal Reserve—has shaken investor confidence throughout crypto markets. On this surroundings, bulls have misplaced management of LINK’s pattern, and the worth now searches for a stable help base.

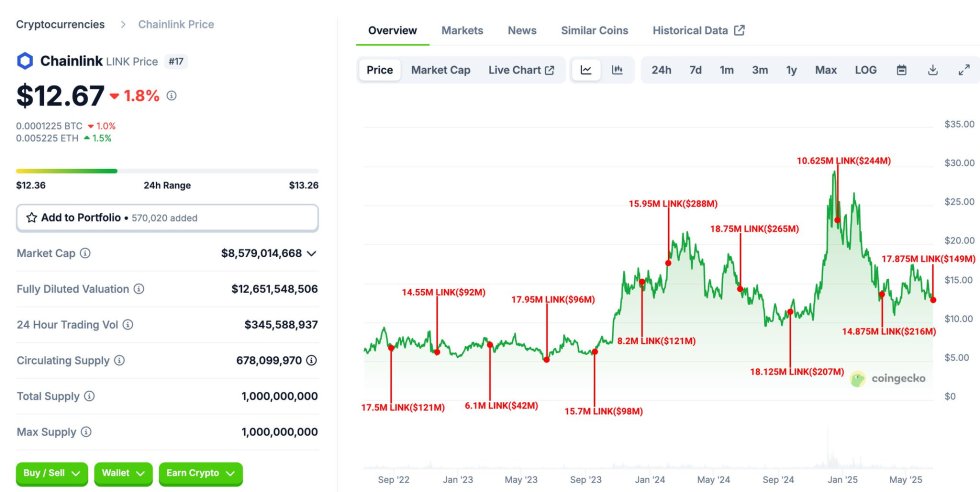

Including to the stress, recent on-chain information from Lookonchain reveals that noncirculating provide wallets related to Chainlink deposited 17.875 million LINK—value roughly $149 million—into Binance earlier in the present day. This massive influx to a centralized change raises issues about potential promoting exercise and has additional weighed on market sentiment. Traditionally, Chainlink’s unlocks have typically triggered unstable value motion. Whereas a few of these occasions have preceded value rallies, present market situations make any bullish response unsure.

The market is now intently watching how LINK will behave close to important help ranges because the token battles each technical weak point and a difficult macro backdrop. Whether or not accumulation resumes or draw back stress intensifies will rely on how international danger urge for food and on-chain conduct evolve within the coming days.

Chainlink Faces Important Help Take a look at Amid Market Stress

Chainlink continues to construct elementary power by means of key partnerships and regular improvement, at the same time as international tensions and macroeconomic instability weigh closely on altcoin markets. With rising adoption throughout conventional finance and Web3 infrastructure, LINK’s long-term outlook stays sturdy. Nevertheless, short-term value motion tells a unique story. Since peaking in Might, Chainlink has seen a steep retracement, now down over 33%, and should defend present ranges to keep away from triggering a deeper correction.

Towards the backdrop of escalating Center East battle and tightening monetary situations, most altcoins have misplaced floor relative to Bitcoin, and LINK has been no exception. Bitcoin dominance not too long ago hit new highs, siphoning capital away from smaller-cap property. Because of this, Chainlink bulls are beneath stress to guard key help ranges and forestall additional erosion of momentum.

Including to investor anxiousness, Lookonchain information exhibits that Chainlink non-circulating provide wallets transferred 17.875 million LINK—valued at roughly $149 million—to Binance earlier in the present day. These actions elevate issues of potential promoting stress. Nevertheless, historic information gives some optimism. Chainlink has performed 11 main unlocks up to now, and plenty of had been adopted by value will increase as liquidity was absorbed and demand recovered.

LINK Worth Evaluation: Breakdown Extends As Help Ranges Crumble

Chainlink (LINK) is at present buying and selling close to $11.98 after breaking under key help zones that had beforehand held all through Q2 2025. The each day chart clearly exhibits a persistent downtrend since mid-Might, marked by a sequence of decrease highs and decrease lows. LINK has now misplaced over 33% since its Might peak close to $18, and the newest candle confirms a clear breakdown under the $12 psychological stage.

The 50-day, 100-day, and 200-day easy transferring averages (SMAs) are all positioned above the present value, reflecting a powerful bearish momentum. The 50-day SMA not too long ago crossed under the 100-day SMA, reinforcing short-term weak point. Furthermore, LINK is now buying and selling at ranges not seen since early November 2024, exposing the asset to additional draw back danger if no robust demand emerges quickly.

This technical deterioration comes as Lookonchain information reveals that 17.875 million LINK (value $149M) from noncirculating wallets was deposited into Binance—fueling fears of additional promoting stress. Whereas traditionally many unlock occasions had been adopted by recoveries, the present macroeconomic surroundings, mixed with Bitcoin dominance surging and altcoins underperforming, could delay any bounce.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our workforce of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.