MicroStrategy ($MSTR): The Company Bitcoin Treasury Pioneer

MicroStrategy, as soon as primarily an enterprise analytics software program agency, has radically reinvented itself because the world’s main publicly-traded company Bitcoin treasury. Underneath the imaginative and prescient of its government chairman and co-founder, Michael Saylor, the corporate has deployed an easy but highly effective technique: to accumulate and maintain Bitcoin as its main treasury reserve asset.

This daring company maneuver has created a brand new area of interest within the monetary world, providing conventional fairness buyers a well-recognized car for gaining publicity to Bitcoin’s value actions. Nonetheless, this technique is a high-stakes endeavor, tying the corporate’s destiny on to the unstable cryptocurrency market. The current sharp decline in Bitcoin’s value from its October 2025 peak has positioned MicroStrategy’s mannequin beneath a extreme stress take a look at, revealing each its inherent vulnerabilities and the steadfast conviction of its management.

Bitcoin/USD value chart illustrating the current drop

Supply: ProRealTime.com

The Mechanics of a Bitcoin Treasury Firm

A Bitcoin treasury firm allocates nearly all of its company reserves to Bitcoin. The core philosophy is to deal with Bitcoin not as a speculative asset, however as a long-term retailer of worth a hedge towards inflation and a diversifier away from conventional fiat currencies.

MicroStrategy’s execution of this mannequin entails a number of key mechanisms:

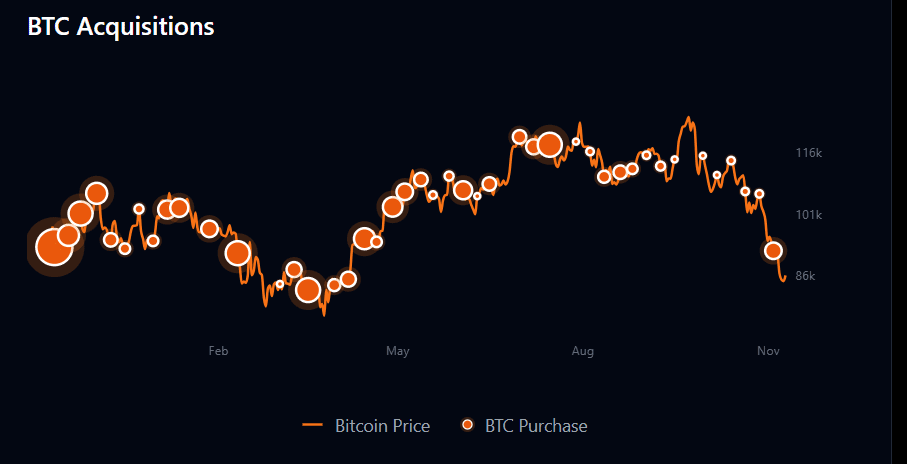

Capital Elevating and Acquisition: The corporate funds its Bitcoin purchases by elevating capital by means of fairness gross sales and issuing convertible debt. This money is then deployed to build up Bitcoin. For instance, in November 2025 alone, the corporate acquired over $1.5 billion price of Bitcoin.

The Strategic Flywheel: At its peak, MicroStrategy employed a self-reinforcing cycle. It could concern shares, use the proceeds to purchase Bitcoin, after which leverage the following rally in Bitcoin’s value to justify additional fairness issuance and accumulation. This as soon as allowed its market worth to commerce at a big premium to the underlying worth of its Bitcoin holdings.

Holding and Accounting: The corporate’s Bitcoin is recorded on its steadiness sheet. Underneath relevant accounting guidelines, the worth of those holdings is adjusted every quarter. A rising Bitcoin value results in unrealized positive factors, whereas a fall triggers unrealized losses, creating important earnings volatility.

As of mid-November 2025, MicroStrategy holds a staggering 649,870 BTC, acquired at a median value of $74,433 per Bitcoin. Regardless of the current downturn, this place nonetheless reveals an unrealized revenue of roughly $6.1 billion, highlighting the preliminary success of its aggressive accumulation.

Supply: https://saylortracker.com/?tab=residence

Supply: https://saylortracker.com/?tab=residence

Vital Dangers Uncovered by a Falling Bitcoin Worth

The current market correction has laid naked the acute dangers embedded in MicroStrategy’s mannequin.

1. Inventory Worth Correlation and Liquidity PressureMicroStrategy’s inventory (MSTR) is extremely correlated with Bitcoin. As Bitcoin fell from its all-time excessive of over $126,000 in October 2025 to round $91,600 in November, MSTR’s inventory value plummeted by practically 60% from its July highs. The corporate’s main asset is Bitcoin, making its inventory a direct proxy.

MSTR inventory value chart illustrating the current drop

Supply: ProRealTime.com

2. Dilution and Eroding PremiumTo proceed shopping for Bitcoin through the downturn, MicroStrategy has repeatedly issued new shares, resulting in important shareholder dilution. Its widespread inventory depend ballooned from 160 million to over 286 million shares in only one 12 months. Moreover, the premium buyers had been as soon as prepared to pay for MSTR’s strategic execution has largely evaporated. Its market internet asset worth (mNAV) has slipped to only under 1 (0.97), which means the inventory trades solely marginally decrease than the worth of the Bitcoin it holds . This means fading investor conviction within the firm’s strategic premium.

Supply: https://saylortracker.com/?tab=residence

3. A Pure, Unhedged BetUnlike another entities, MicroStrategy doesn’t use hedging methods (like choices) to guard towards draw back volatility. Its treasury depends “totally on the motion of the Bitcoin value,” making it a pure, unhedged guess. With out complementary income streams or yield-generating methods, the corporate is absolutely uncovered to market swings.

4. Regulatory and Index Exclusion RisksThere is rising scrutiny of firms holding huge digital property. Main index supplier MSCI is contemplating excluding Bitcoin-heavy corporations like MicroStrategy from its flagship fairness indexes, doubtlessly categorizing them as “funding funds.” JPMorgan warns this might set off as much as $2.8 billion in compelled promoting from passive funds, creating huge downward stress on the inventory.

The Deconstructed Threat Framework

Major Threat: Bitcoin Volatility: MSTR’s destiny is inextricably linked to Bitcoin’s value, with declines usually magnified attributable to leverage.

Solvency Threat: The Debt Spiral: The convertible debt used to fund purchases creates hazard. A extreme value drop might set off margin calls, doubtlessly forcing the corporate to promote Bitcoin at a loss and making a catastrophic suggestions loop.

Competitors from Spot Bitcoin ETFs: The appearance of low-cost, liquid, and debt-free Spot Bitcoin ETFs (e.g., from BlackRock, Constancy) challenges MSTR’s worth proposition. Traders can now achieve pure Bitcoin publicity with out MSTR’s company and leverage dangers.

Regulatory and Accounting Uncertainty: Hostile laws or adjustments in accounting requirements to implement “mark-to-market” reporting might cripple the treasury’s worth or introduce excessive earnings volatility.

Company Execution Dangers: The technique represents an excessive focus in a single asset, is extremely depending on Michael Saylor’s management, and dangers neglecting the core software program enterprise that generates operational money stream.

Potential Alternatives and the Bull Case

Regardless of the clear dangers, the mannequin presents compelling alternatives for its proponents.

Leveraged Bitcoin Publicity: For believers in Bitcoin’s long-term rise, MSTR presents a approach to achieve leveraged publicity by means of a conventional inventory, as every share represents a declare on a rising, debt-funded pool of Bitcoin.

The “Digital Gold” Conviction: Saylor and MicroStrategy are making a long-term guess on Bitcoin as “digital gold.” From this angle, short-term crashes are shopping for alternatives, not technique failures, as evidenced by the corporate’s continued purchases through the downturn.

Compelling Valuation Metrics: The current crash has pushed MicroStrategy’s price-to-earnings (P/E) ratio right down to a seemingly low 8.67. Worth buyers might even see this as a shopping for alternative, assuming the core software program enterprise retains worth and the Bitcoin thesis finally prevails.

The Street Forward

The way forward for MicroStrategy ($MSTR) hinges on Bitcoin’s value restoration. Till then, the inventory will seemingly stay beneath stress. The corporate should additionally navigate the potential fallout from attainable exclusion from main inventory indexes, which might shrink its investor base.

The current turmoil has sparked a debate in regards to the sustainability of “passive” Bitcoin hoarding versus extra lively, yield-generating methods. MicroStrategy’s unwavering, unhedged strategy is the final word take a look at of a single thesis: that Bitcoin’s long-term worth appreciation will eclipse all short-term volatility and dangers.

Disclaimer: This text is predicated on info accessible as of November 2025. The state of affairs surrounding MicroStrategy and cryptocurrency markets is extremely dynamic and topic to speedy change.

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any explicit recipient’s funding targets or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product should not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.