Merchants have lengthy sought the optimum time to commerce crypto, and at completely different factors over time, European, US, and Asian time zones have all had their flip, providing one of the best returns. Nevertheless, a newly proposed ETF now presents Bitcoin publicity with a twist.

The Nicholas Bitcoin and Treasuries AfterDark ETF goals to commerce Bitcoin-linked property whereas Wall Avenue sleeps. In keeping with a December 9 submitting with the SEC, the AfterDark ETF plans to buy BTC after US monetary markets shut and exit these positions shortly after the US market reopens every day.

Bitcoin is buying and selling at $90,090 on the time of writing, down 2.1% on the day after a interval of volatility that started with yesterday’s FOMC assembly, during which the US Fed minimize rates of interest by 25 bps. As soon as the mud settles, BTC might want to maintain above $90,000 and reclaim $96,00 for any hopes of climbing again above $100,000 earlier than the 12 months is out.

7d

30d

1y

All Time

Has the AfterDark ETF Discovered an Infinite Cash Glitch With Bitcoin Buying and selling?

The Nicholas Bitcoin and Treasuries fund wouldn’t maintain Bitcoin instantly. As an alternative, the AfterDark ETF would allocate at the least 80% of its property to buying and selling BTC futures contracts, BTC ETPs and ETFs, and choices on these ETFs and ETPs.

Knowledge from wealth supervisor Bespoke Funding Group present that an investor who purchased shares of the BlackRock iShares Bitcoin Belief ETF (IBIT) on the US market shut and bought them on the subsequent day’s open can be up about +222% since January 2024.

On the flip facet, an investor who purchased those self same IBIT shares on the open and bought them on the shut can be down -40.5% over the identical interval. This information helps the long-held perception that buying and selling crypto throughout Asian hours is probably the most worthwhile time zone.

A NEW ETF BUYING $BTC AT NIGHT IS COMING!

In contrast to regular ETFs, AfterDark ETF holds BTC solely at evening, shopping for when U.S. market closes and promoting earlier than they open.

Eric Balchunas says most BTC positive aspects occur after hours, so this ETF might present "higher returns." Launch in 75 days. pic.twitter.com/Ipg9DaHZAP

— Coin Bureau (@coinbureau) December 10, 2025

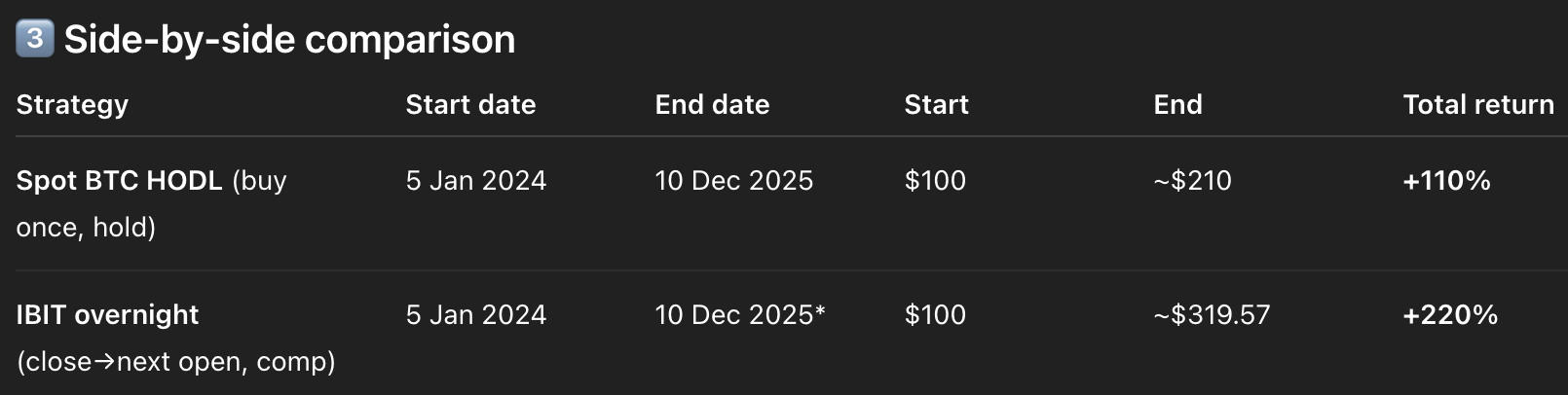

ChatGPT helps these claims and, when run on the dataset, produces outcomes similar to these from the Bespoke Funding Group information. Going one step additional, this technique outperformed shopping for and holding $100 value of Bitcoin over the identical interval. Holding spot BTC would have resulted in $100 changing into $210 by December 10, 2025, for a 110% return.

Which means that the AfterDark ETF technique of shopping for IBIT shares on the NY market shut and promoting on the subsequent NY market open would have outperformed the ‘spot and chill’ play by greater than +100%.

The AfterDark ETF is scheduled to go stay in roughly 75 days, in mid-February 2026. Whereas a bigger dataset is required, with 23 months of knowledge, this technique of shopping for BTC or Bitcoin-linked TradFi merchandise, such because the iShares ETF, seems to be a free-money glitch that avoids probably the most important intervals of market volatility.

(SOURCE: ChatGPT)

DISCOVER: Subsequent 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

ChatGPT Confirms Asian Buying and selling Hours are Prime for Steady Bitcoin Value Motion

When asking ChatGPT to investigate completely different buying and selling periods for crypto, it broke it down as follows;

“US Buying and selling Hours (13:00–20:00 UTC) – Highest buying and selling quantity globally, typically probably the most volatility with extra alternative and extra threat. Many main bulletins from U.S. corporations and regulators happen right here.

Widespread view: “Finest for volatility-based methods.”

European Session (07:00–16:00 UTC) – Robust liquidity, typically begins each day momentum earlier than US session ramps up.

Widespread view: “Finest for pattern merchants, fewer worth shocks than U.S. hours.”

Asia Session (23:00–06:00 UTC) – Liquidity varies. Traditionally decrease volatility (however adjustments relying on Japan/Korea exercise and China-related information)

Widespread view: “Finest for vary buying and selling and low-noise setups.”

This ChatGPT breakdown of buying and selling time zones emphasizes that Asian hours are perfect for buying and selling methods such because the AfterDark ETF, as decrease liquidity and decrease volatility allow steadier positive aspects by shopping for on the NY shut and promoting on the following NY open.

If the technique stays worthwhile over the subsequent 75 days main as much as the Bitcoin

.cwp-coin-chart svg path {

stroke-width: 0.65 !necessary;

}

.cwp-coin-widget-container .cwp-graph-container.constructive svg path:nth-of-type(2) {

stroke: #008868 !necessary;

}

.cwp-coin-widget-container .cwp-coin-trend.constructive {

shade: #008868 !necessary;

background-color: clear !necessary;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.constructive {

border: 1px strong #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.constructive::earlier than {

border-bottom: 4px strong #008868 !necessary;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: clear !necessary;

}

.cwp-coin-widget-container .cwp-graph-container.damaging svg path:nth-of-type(2) {

stroke: #A90C0C !necessary;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.damaging {

border: 1px strong #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.damaging {

shade: #A90C0C !necessary;

background-color: clear !necessary;

}

.cwp-coin-widget-container .cwp-coin-trend.damaging::earlier than {

border-top: 4px strong #A90C0C !necessary;

}

2.05%

Bitcoin

BTC

Value

$92,587.60

2.05% /24h

Quantity in 24h

$43.84B

<!–

?

–>

Value 7d

// Make SVG responsive

jQuery(doc).prepared(perform($) {

var svg = $(‘.cwp-graph-container svg’).final();

if (svg.size) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘top’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘top’);

svg.css({‘width’: ‘100%’, ‘top’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

Study extra

AfterDark ETF launch, it’s prone to grow to be a particularly well-liked funding product. It could even spawn different variations that make the most of different worthwhile methods.

EXPLORE: Finest Meme Coin ICOs to Put money into 2025

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

The submit AfterDark ETF Solves Bitcoin’s Timezone Puzzle: Counter-Commerce Individuals To Unlock Hidden 222% Return Pattern appeared first on 99Bitcoins.