Web3 privateness might be described as a long-overdue revolution within the period of ubiquitous surveillance, knowledge mining, and platform oversight. Web3, with its decentralized buildup, was supposed to place energy again into the fingers of customers, because it gives anonymity, possession of information and digital freedom. However because the ecosystem matures, that very same privateness has turned out to be a double-edged sword. It’s a proper, and but, undeniably, a danger.

On this article, we look at in depth why Web3 privateness isn’t only a function however a battleground for ethics, innovation, and regulation.

The Promise of Privateness in Web3

On the coronary heart of Web3 lies a daring imaginative and prescient: decentralization. Not like the centralized, surveillance-driven structure of Web2, Web3 provides a paradigm shift in how digital identification, knowledge, and privateness are managed. The Web2 vs Web3 comparability is not only technical; it’s philosophical.

In Web2, platforms like Meta, Google, and Amazon retailer person knowledge on centralized servers, profiting off our private info by means of promoting and knowledge analytics. Each click on, search, or scroll is monitored, creating detailed digital profiles that customers have little management over. Privateness, on this mannequin, is extra of an phantasm than a actuality.

In distinction, Web3 goals to return possession to the person. As an alternative of handing over private knowledge to firms, Web3 customers function by means of cryptographic wallets that function their digital identification. Transactions, interactions, and credentials are managed on-chain, with out requiring customers to surrender their private particulars. On this approach, the dialogue round Web2 vs Web3 highlights a radical shift—from platforms controlling customers, to customers controlling their knowledge.

This transformation is the inspiration of the Web3 privateness promise: a digital atmosphere the place individuals can transact, talk, and have interaction with out being continually watched or exploited. For communities equivalent to political dissidents, investigative journalists, and people residing beneath authoritarian regimes, this isn’t only a technical improve; it’s a survival device. And because the world begins to understand the complete extent of surveillance capitalism, the Web2 vs Web3 divide grows ever extra related, placing privateness again into the fingers of those that want it most.

Distinction Between Web2 vs Web3

ZK-Proofs, Mixers, and Privateness Cash: The Tech Behind the Curtain

On the coronary heart of Web3 privateness are applied sciences designed to obscure person identities and transaction knowledge:

Zero-Information Proofs (ZK-proofs): A zero-knowledge proof (ZKP) is a complicated cryptographic method that enables one celebration (the prover) to verify the reality of a press release to a different celebration (the verifier) with out revealing any underlying particulars concerning the assertion itself.Mixers: Privateness instruments like Twister Money assist obscure transaction histories by mixing customers’ funds collectively. These platforms pool deposits from a number of customers, shuffle them to interrupt the hyperlink between sender and receiver, after which return equal quantities to completely different pockets addresses. This makes it practically unattainable to hint the unique supply.Privateness Cash: Cryptocurrencies like Monero and Zcash are designed with native privateness options, making transactions untraceable by default. These privateness cash champion particular person rights, however they’ve additionally caught the attention of regulation enforcement companies worldwide.

These instruments are highly effective enablers of Web3 privateness, however in addition they take a look at the boundaries of what privateness compliance means in a decentralized world.

Regulatory and Authorized Backlash

As privateness instruments in crypto achieve traction, they’ve additionally drawn the watchful eye of regulators. With nice energy comes nice scrutiny. Governments all over the world are more and more involved that whereas privacy-enhancing applied sciences defend law-abiding customers, they will simply as simply be exploited by malicious actors.

A landmark instance is the U.S. authorities’s 2022 sanctioning of Twister Money, a crypto mixer accused of enabling North Korean hackers to launder stolen funds. The case was unprecedented, not simply due to the alleged misuse, however as a result of it marked the primary time a authorities blacklisted code itself moderately than a person. U.S. Congressman Sean Casten made headlines when he claimed that “half of North Korea’s nuclear program is funded by means of cryptocurrency theft made attainable by mixers.”

This occasion triggered a wave of authorized and regulatory motion. The U.S. doubled down with the introduction of the Blockchain Integrity Act, which proposes a two-year ban on crypto mixers. The penalties are extreme: violations may lead to fines of as much as $100,000. It’s a transparent sign that U.S. authorities are severe about clamping down on anonymity in crypto, at the least for now.

Different jurisdictions are additionally tightening their grip. In Japan, the Monetary Providers Company (FSA) has successfully banned the usage of mixers, alongside a broader crackdown on any crypto instruments that obscure transaction particulars. In the meantime, the European Union has taken a extra regulatory-heavy method, imposing strict Anti-Cash Laundering (AML) guidelines that concentrate on nameless crypto transactions. Whereas not explicitly banning mixers, the EU’s Markets in Crypto-Belongings (MiCA) regulation contains measures that might severely restrict their performance and compliance.

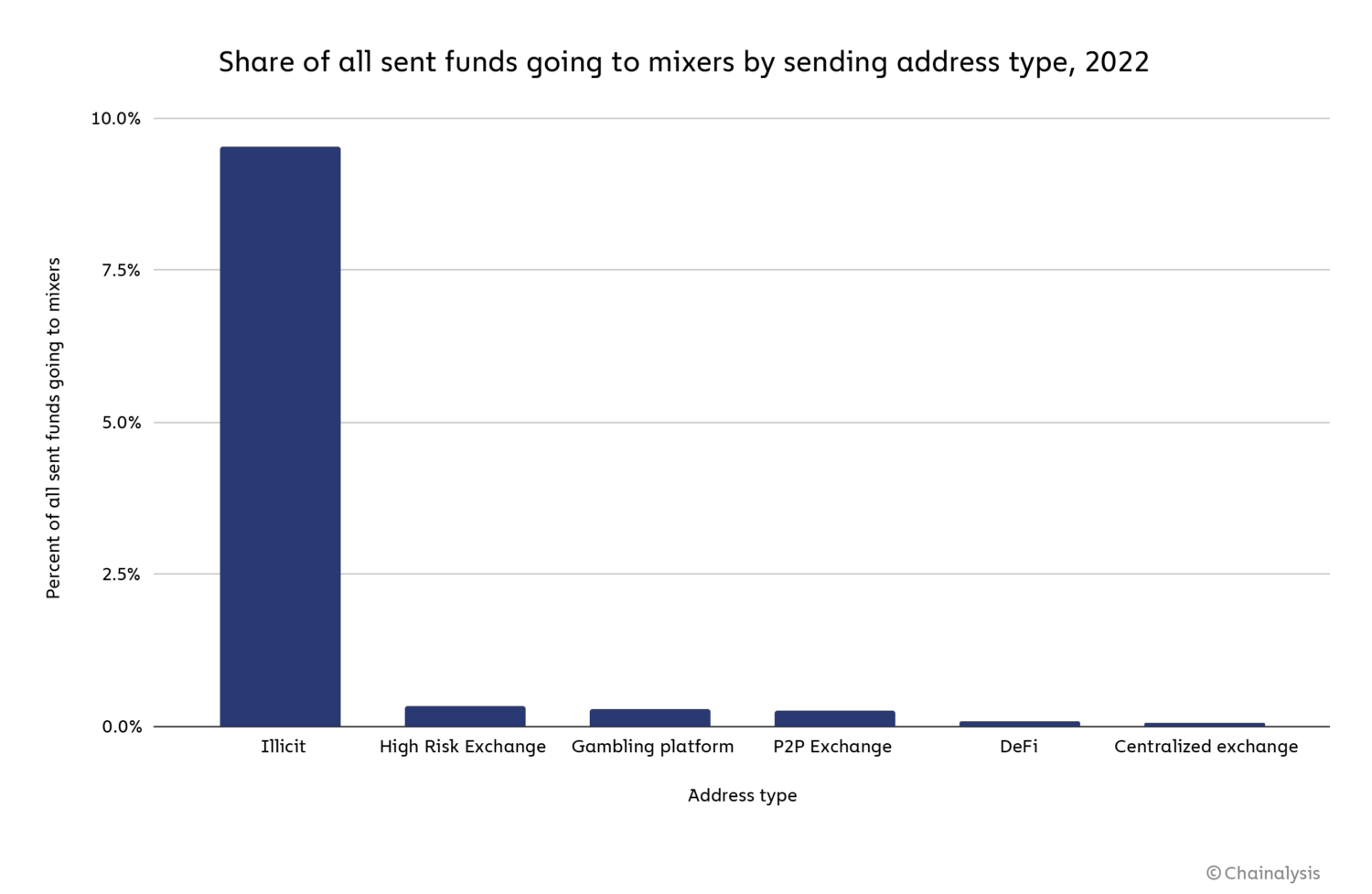

In keeping with Chainalysis, practically 10% of all crypto property held by illicit entities in 2022 have been funnelled by means of mixers, a statistic that solely fuels the regulatory hearth.

Nonetheless, the talk is way from one-sided. Many consider that sanctioning applied sciences like Twister Money is akin to banning encryption just because criminals use it. Privateness is a proper, not a pink flag. However for regulators, the query stays deeply advanced: how do you implement transparency in a system deliberately designed to keep away from oversight?

Privateness vs Compliance in DeFi: A Tug of Warfare

The rise of DeFi has ushered in a brand new period of permissionless entry, the place anybody can take part with out counting on conventional monetary intermediaries. However because the ecosystem matures, it’s going through mounting strain from regulators who insist on Know Your Buyer (KYC) and Anti-Cash Laundering (AML) compliance.

RELATED: What’s AML and KYC in Crypto?

This places DeFi builders and platforms in a tough place. To adjust to KYC and AML guidelines means compromising on Web3 privateness, which is a core worth for a lot of within the crypto group. It dangers alienating privacy-conscious customers who turned to DeFi particularly for anonymity and autonomy.

But ignoring these regulatory necessities isn’t with out penalties. Tasks that select to forgo compliance face the specter of being blacklisted, sued, and even shut down completely. The stakes are excessive on either side.

In an try to strike a stability, initiatives like Aave Arc have launched permissioned swimming pools tailor-made for institutional buyers. These efforts purpose to fulfill regulatory requirements whereas sustaining some parts of decentralization. Nonetheless, critics argue that such options inch dangerously near Web2-style gated finance, undermining the open ethos of DeFi.

This ongoing battle has sparked a crucial industry-wide query: What’s privateness compliance—and may it exist with out compromising decentralization? Because the tug of warfare between regulation and innovation continues, the seek for solutions is shaping the way forward for finance itself.

Associated: Is the Push to Ban Crypto Mixers an Assault on Monetary Privateness?

Implications for Customers and Builders

Web3 privateness is a robust device—it places customers answerable for their knowledge, funds, and digital identification in a approach that Web2 by no means may. However with that empowerment comes a brand new degree of duty. In a decentralized world, there’s no “Forgot Password” button in case you misplace your non-public key. For those who fall sufferer to a rip-off, there could also be no customer support to show to. Full privateness usually comes with full accountability.

But it’s not all doom and gloom. This similar degree of management might be liberating. Customers now not should depend on third events to safeguard their funds or identification. They’ll transact, talk, and construct freely—with out concern of surveillance or centralized censorship. For a lot of, that’s the purpose of Web3: not simply privateness, however autonomy.

Nonetheless, there are dangers. In some jurisdictions, merely utilizing privacy-enhancing instruments like mixers could elevate pink flags. that work together with sure privateness instruments may be flagged, restricted, and even banned from main exchanges. This implies customers should weigh the advantages of privateness in opposition to the potential for elevated scrutiny.

Builders, too, face a high-stakes balancing act. Ought to they construct censorship-resistant instruments that champion person freedom and uphold the ethos of decentralization? Or ought to they proactively combine compliance options to make sure their tasks can survive in a tightening regulatory local weather?

The arrest of Alexey Pertsev, a developer of Twister Money, introduced this dilemma into sharp focus. Charged within the Netherlands over his involvement with a privateness protocol, his case has ignited a worldwide dialog about developer legal responsibility and the boundaries of free expression in code. Ought to builders be held liable for how their instruments are used? Or is code, as argued, a type of protected speech?

As Web3 continues to evolve, customers and builders alike should navigate these complexities. Privateness is each a protect and a duty—and discovering the stability between safety, freedom, and accountability stands out as the defining problem of the decentralized period.

Bridging the Divide: Can We Have Each?

The way forward for Web3 privateness could lie in programmable privateness options that enable for selective disclosure. Tasks like Aztec Community are experimenting with public–non-public hybrid zkRollup community that may execute each private and non-private good contracts.

Furthermore, Zero-Information Id options like Polygon ID could enable customers to show compliance with out revealing private particulars.

Regulators are additionally adapting, as many nations are exploring crypto-specific privateness rules as a substitute of blanket bans.

Conclusion: The Path Ahead

Web3 privateness is each a protect and a sword. As with all highly effective device, its impression is dependent upon intent and design. The purpose shouldn’t be to eradicate privateness, however to stability it with accountability.

We should resist falling again into the surveillance traps of Web2, whereas additionally recognizing that unregulated privateness can breed abuse. That’s why the following period of Web3 should prioritize privateness with duty, freedom with safeguards, and innovation with ethics.

Whether or not you’re a builder, investor, regulator, or person, the privateness query is now not elective; it’s existential. The strains are being drawn now.

And the alternatives we make at this time will form the Web3 of tomorrow.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein ought to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial danger of monetary loss. At all times conduct due diligence.

If you wish to learn extra market analyses like this one, go to DeFi Planet and comply with us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Neighborhood.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”