On December 17, Bitcoin noticed a pointy and chaotic two-hour stretch that despatched costs violently greater and decrease inside a brief window.

The transfer started with a quick rally, then flipped simply as shortly right into a steep drop. Either side of the market took hits. Every leg pushed Bitcoin roughly $3,000 in both course, highlighting how aggressive buying and selling had turn out to be through the session.

Bull Idea flagged the preliminary surge, noting that Bitcoin jumped about $3,300 in simply half-hour. That spike pressured the liquidation of roughly $106M in brief positions.

BREAKING: Bitcoin pumped $3,300 and liquidated $106 million price of shorts in simply half-hour.

However then it dumped $3,400 and liquidated $52 million price of longs in subsequent 45 minutes.

Insane stage of manipulation in crypto. pic.twitter.com/5zrlnsIhgj

— Bull Idea (@BullTheoryio) December 17, 2025

In line with the analyst, the velocity and scale of the transfer made it a textbook brief squeeze.

However the energy didn’t final. Over the following 45 minutes, Bitcoin gave again almost all of these positive aspects. Costs dropped round $3,400, triggering about $52M in lengthy liquidations.

Bull Idea described the reversal as a quick shift into a protracted squeeze, displaying how shortly sentiment flipped.

Different market watchers pointed to the identical episode from totally different angles. DEGEN NEWS described Bitcoin as printing “two straight risky hourly candles,” emphasizing how uncommon the back-to-back swings have been.

ZeroHedge tied the transfer to its long-running “10 am slam algo” thought, calling it a close to $5,000 swing inside about an hour on the time of its submit.

Each ZeroHedge and Bull Idea have pointed to a sample they are saying exhibits up round 10:00 a.m. EST. That timing traces up with the opening of US inventory markets. And it’s the place a few of these sharp Bitcoin strikes have a tendency to look.

DISCOVER: 9+ Finest Excessive-Danger, Excessive-Reward Crypto to Purchase in 2025

Bitcoin Value Motion and Liquidations

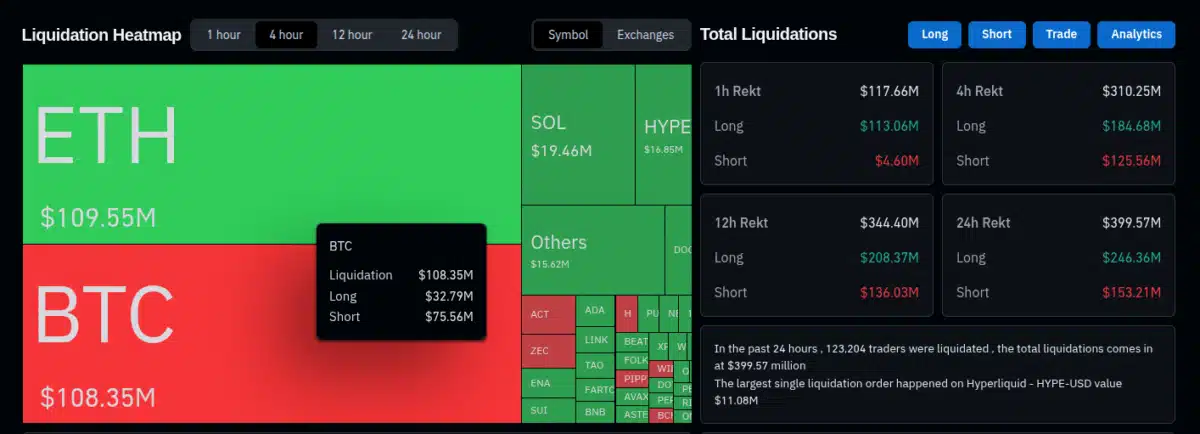

The most recent wave of volatility hit merchants exhausting. Over the previous 24 hours, greater than 120,000 positions have been liquidated. Complete losses got here near $400M.

Most of that injury occurred quick. Greater than $340M in liquidations occurred within the final 12 hours alone. Round $310M of that got here inside a single four-hour window.

That timing matches the short pump and dump that a number of analysts flagged through the session.

Wanting solely at Bitcoin, liquidations reached about $108M over 4 hours, primarily based on information from CoinGlass. Roughly $75M of these losses got here from brief positions. One other $32M got here from longs.

Ethereum noticed liquidations on an identical scale throughout the identical interval. However the construction was totally different.

A lot of the losses in ETH got here from lengthy positions, pointing to a clearer long-squeeze in Ethereum markets.

DISCOVER: The 12+ Hottest Crypto Presales to Purchase Proper Now

The submit Bitcoin Value Prediction: Why Did BTC Set off Again-to-Again Brief and Lengthy Squeezes in a Single Session? appeared first on 99Bitcoins.