Decentralized finance has reshaped cash transfers as we all know them. The brand new requirements for velocity and safety challenged conventional cost techniques, forcing them to adapt. That’s how PayFi got here to be. Combining the qualities of crypto funds with the accessibility and user-friendly interfaces delivered by common banks, PayFi is making its approach into individuals’s on a regular basis lives. And it’s not going to cease.

What Is PayFi? (Fee Finance Defined)

PayFi, brief for Fee Finance, describes utilizing blockchain for cost techniques. World monetary transactions could be processed with out intermediaries with the velocity and safety that we get from decentralized finance. There are not any correspondent banks concerned, and the method is totally managed by sensible contracts. This helps to cut back charges and bypass many points related to conventional cost techniques. This defines PayFi—seamless, programmable funds constructed for velocity and effectivity, which is why increasingly cost processors are turning to this observe.

How PayFi Works: From Funds to Financing

From the person’s viewpoint, it’d look like PayFi works identical to your common financial institution: you press “ship” and your cash goes to the recipient. However the interior mechanisms of economic transactions on this system are fully completely different. Under is a step-by-step clarification of how PayFi works.

Step 1: A Enterprise Points an Bill (a Future Fee)

The vendor creates an bill for items or companies, itemizing the quantity and due date. For the customer, it seems like a standard invoice, however for PayFi, it’s a file that may be moved and financed on-chain.

Step 2: The Bill Turns into a Tokenized Receivable (RWA)

The created bill is transformed right into a digital token representing the receivable (a real-world asset, or RWA). This course of known as tokenization, which makes the receivable tradable, traceable, and programmable on the blockchain.

Step 3: Sensible Contracts Join the Purchaser, Vendor, and Lender

The bill phrases are encoded in a wise contract that robotically hyperlinks all events. It enforces all of the situations—cost date, penalty, proof of supply—that in conventional funds could be offered on paper. The sensible contract additionally triggers further actions like funding or compensation with out handbook intervention. It primarily fills the position usually occupied by a 3rd get together, thus eliminating middleman prices.

Step 4: A Liquidity Supplier Funds the Receivable Upfront

A lender or liquidity supplier buys the tokenized bill, instantly paying the vendor (minus a payment or low cost). The supplier then holds the receivable and collects the complete cost from the customer later—successfully financing the vendor’s money move.

Step 5: Settlement with Stablecoins or On-Chain Foreign money

When the bill matures, the customer pays on-chain utilizing stablecoins or one other crypto. The sensible contract verifies cost and releases funds to the liquidity supplier. Any charges or settlements are executed robotically. Thus, PayFi offers a seamless cost expertise with clear transactions.

As a result of PayFi works on the ideas of decentralized finance (DeFi), it permits companies to ship and obtain cash by real-time funds with prompt settlement. Since all the pieces is programmable, PayFi tasks can add options like escrow, factoring, or recurring billing with out counting on a number of intermediaries.

How you can Get Free Crypto

Easy methods to construct a worthwhile portfolio at zero value

Key Elements of the PayFi Ecosystem

PayFi is used for various kinds of monetary transactions, like cross-border funds, crypto funds, and a lot extra. All these can’t exist and not using a few key parts. Each PayFi community depends on these parts for cost-efficiency and monetary inclusion.

Sensible Contracts

Sensible contracts are digital agreements that robotically execute when sure situations are met, guaranteeing safe and clear transactions. In PayFi, they take away the necessity for intermediaries present in conventional finance, lowering transaction charges and fraud dangers. Since transactions happen straight between events, companies and customers profit from prompt settlement and smoother cost processing with out hidden charges.

Actual-World Property (RWAs)

RWAs signify tokenized variations of belongings like invoices, actual property, or commodities. By bringing tangible belongings on-chain, PayFi connects conventional finance with world funds. RWAs additionally seize the time worth of cash, giving traders and enterprise house owners entry to usable funds sooner. This bridge between actual belongings and digital techniques permits companies to develop extra effectively in world finance.

Stablecoins

Stablecoins are digital currencies pegged to secure belongings just like the US greenback or euro. They make cross-border and crypto funds predictable by minimizing volatility. Inside PayFi, they assist obtain prompt settlement and easy foreign money conversion throughout the transaction course of. This lets enterprise house owners and customers make world funds simply, with out worrying about fluctuating charges or hidden charges.

Study extra: What Are Stablecoins?

Wallets and Custody

Wallets are important for holding and transferring digital belongings securely. In PayFi, they act like digital financial institution accounts, enabling customers to handle usable funds anytime with simply an web connection. Superior custody options and encryption improve safety, lowering fraud dangers. PayFi wallets simplify cross-border and conventional funds, making world transactions each secure and quick.

Liquidity Suppliers

Liquidity suppliers provide the capital that retains cost processing clean in PayFi’s ecosystem. They fund real-world belongings upfront, guaranteeing prompt settlement and fast entry to cash for enterprise house owners. By bridging lenders and debtors straight, PayFi removes a number of intermediaries, decreasing transaction charges and dashing up world finance operations.

Learn extra: What Is Liquidity in Crypto?

Retailers and SMEs

Retailers and small-to-medium enterprises (SMEs) are on the core of PayFi. It helps them obtain cash globally with out hidden charges or banking delays. PayFi’s decentralized construction permits enterprise house owners to broaden throughout borders, settle for crypto funds, and luxuriate in prompt settlement, all whereas chopping prices and lowering fraud dangers tied to conventional funds.

Off-Chain Information & Oracles

Oracles act as bridges between blockchain and the true world. They bring about off-chain knowledge—like change charges or credit score scores—into sensible contracts to make PayFi smarter. This ensures safe and clear transactions whereas permitting real-time choices in cost processing. By combining blockchain automation with exterior knowledge, oracles assist PayFi combine seamlessly with world finance techniques and conventional funds.

PayFi vs. Conventional Finance (TradFi) vs. DeFi

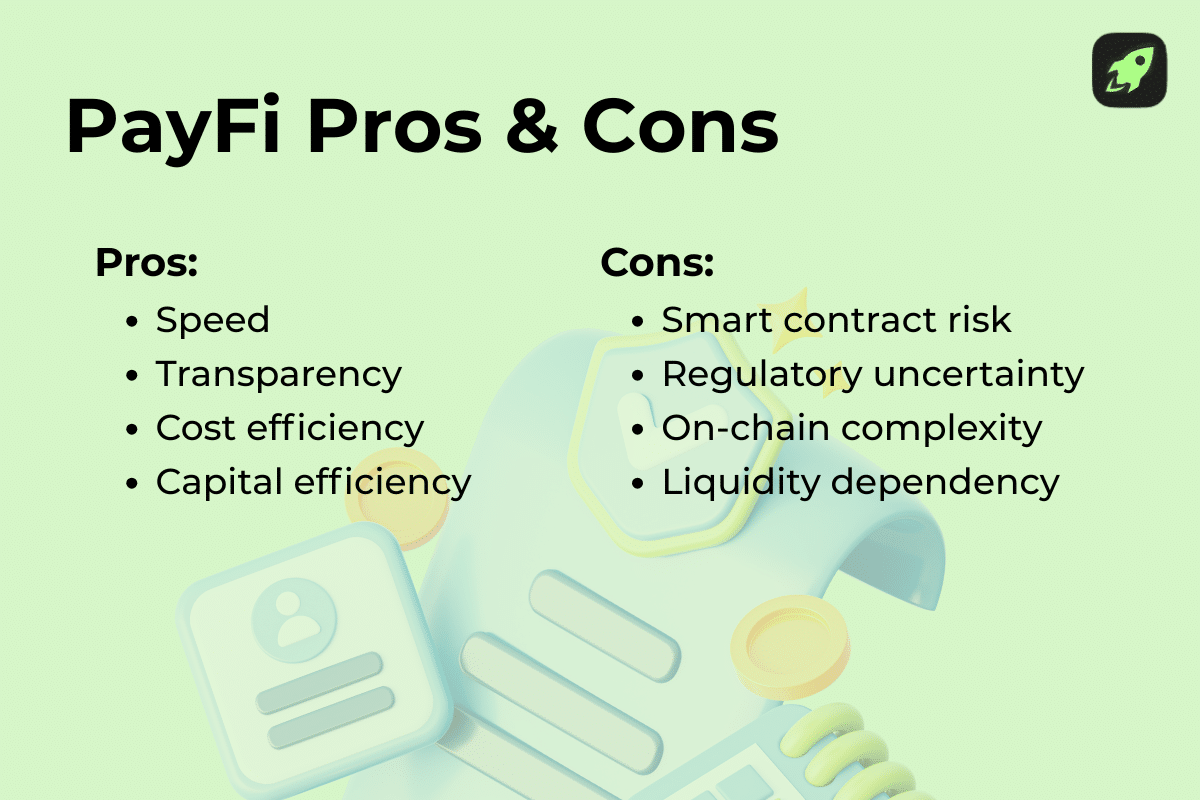

Advantages of PayFi for Companies and Builders

Like all new improvement, PayFi focuses on the largest problems with conventional finance and gives an answer. Alongside the way in which, it additionally gives some fascinating benefits.

Sooner Settlement & LiquidityPayFi has near-instant funds, giving companies speedy entry to funds as an alternative of getting to attend days for financial institution processing. Actual-time settlement improves money move, liquidity, and monetary planning. For builders, this velocity helps seamless world transactions inside apps, working 24/7—even on weekends and holidays.

Clear & Auditable TransactionsEvery PayFi transaction is recorded on an immutable blockchain ledger. This transparency simplifies audits, reduces fraud, and ensures funds are totally traceable. Builders can construct instruments that confirm and observe funds in actual time with out counting on opaque intermediaries or legacy techniques.

Decrease Prices & Fewer IntermediariesTraditional techniques rely upon banks, card networks, and processors, every including their very own charges. PayFi permits direct transfers between sender and receiver, chopping out middlemen and decreasing transaction prices. This effectivity advantages companies managing high-volume funds and builders integrating cost-effective monetary APIs.

Capital Effectivity for SMEs & MerchantsSmall and medium-sized companies typically wrestle with delayed funds. PayFi’s real-time settlements enhance liquidity and permit for sooner reinvestment, lowering reliance on loans or credit score strains. Builders constructing fintech instruments can supply higher person experiences with clear and predictable money flows.

Limitations of PayFi

Regardless of its advantages, PayFi can’t at all times assure absolute safety. Builders want to remain alert when constructing PayFi techniques. Not all techniques handle to keep away from issues, even after a number of audits. Understanding what would possibly go improper might assist customers preserve their cash secure.

Sensible Contract RisksSmart contracts automate PayFi operations, however they’re solely as secure as their code. Bugs or vulnerabilities could be exploited, even after audits. Builders should comply with strict coding requirements, carry out audits, and use safe frameworks.

Liquidity & Default RisksPayFi techniques typically rely upon liquidity suppliers. In occasions of market stress, liquidity shortages or collateral drops can delay or block transactions. Clear reserves and sensible contract safeguards assist scale back these dangers.

Regulatory UncertaintyDigital asset laws differ throughout areas. Companies and builders should keep knowledgeable, use compliant companions, and be able to adapt as legal guidelines evolve.

Adoption ChallengesMainstream customers stay cautious of decentralized techniques. Clear UX, schooling, and partnerships with conventional establishments may help construct belief.

RWA Valuation RisksTokenized real-world belongings could also be mispriced or poorly audited. Initiatives ought to depend on unbiased, clear audits and repeatedly publish valuation studies to make sure confidence and investor safety.

Actual-World PayFi Use Circumstances and Examples

Actual-world PayFi use instances are rapidly increasing throughout industries. In e-commerce, retailers use PayFi to just accept crypto and stablecoin funds immediately, avoiding excessive transaction charges and delays from conventional processors. Cross-border companies profit from real-time settlements with out hidden prices or foreign money conversion hassles. Freelancers and gig staff obtain world funds in seconds, bettering money move. In DeFi, PayFi permits tokenized invoices and on-chain lending, permitting companies to entry liquidity sooner. Even remittance companies are being reinvented—households can ship cash worldwide with minimal prices. General, PayFi bridges conventional finance and blockchain, making world funds sooner, fairer, and extra inclusive.

Ultimate Ideas

PayFi represents a significant shift in how we deal with funds and monetary transactions. By combining blockchain expertise, sensible contracts, and tokenized real-world belongings, it gives sooner settlements, decrease charges, and better transparency than conventional techniques. Companies, SMEs, and builders profit from improved liquidity, capital effectivity, and seamless integration with trendy purposes. Whereas there are nonetheless some challenges, like sensible contract dangers and regulatory uncertainty, PayFi’s potential to make funds extra inclusive, safe, and environment friendly is simple. As adoption grows and expertise advances, PayFi is poised to redefine world finance for each individuals and companies.

FAQ

Can I exploit PayFi at present, or is it nonetheless new?

Sure, PayFi is operational and gaining traction. It permits real-time, low-cost funds utilizing blockchain and stablecoins, facilitating 24/7 world transfers with out intermediaries.

Why would anybody use PayFi as an alternative of PayPal or a financial institution?

PayFi gives prompt settlement, decrease charges, and world accessibility with out the necessity for conventional banking intermediaries. It integrates decentralized finance (DeFi) protocols, permitting customers to earn yield whereas making funds.

Does PayFi use actual cash, or simply crypto?

PayFi helps each fiat currencies and cryptocurrencies. Customers can transact utilizing stablecoins, reminiscent of USDC, or convert between crypto and fiat seamlessly.

Do I would like crypto to attempt PayFi?

Not essentially. Whereas PayFi facilitates crypto transactions, many platforms supply user-friendly interfaces that enable people to interact with out prior cryptocurrency data.

Is PayFi just for firms, or can common individuals use it too?

Common people can use PayFi. It offers entry to world funds, permitting customers to ship and obtain cash, pay payments, and even earn yield by DeFi protocols.

Disclaimer: Please observe that the contents of this text will not be monetary or investing recommendation. The knowledge supplied on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native laws earlier than committing to an funding.