Bitcoin (BTC) worth has closed 2025 buying and selling beneath essential help ranges round $100k and 90k. The flagship coin dropped over 1% up to now 24 hours to commerce at about $87,255 at press time.

Key Midterm Degree To Look ahead to Bitcoin

After closing 2025 in a uneven consolidation, Bitcoin will start 2026 on a excessive bullish notice. The robust fundamentals for 2025, together with the spectacular efficiency of spot BTC ETFs and treasury firms, are anticipated to gas bullish sentiment within the coming months.

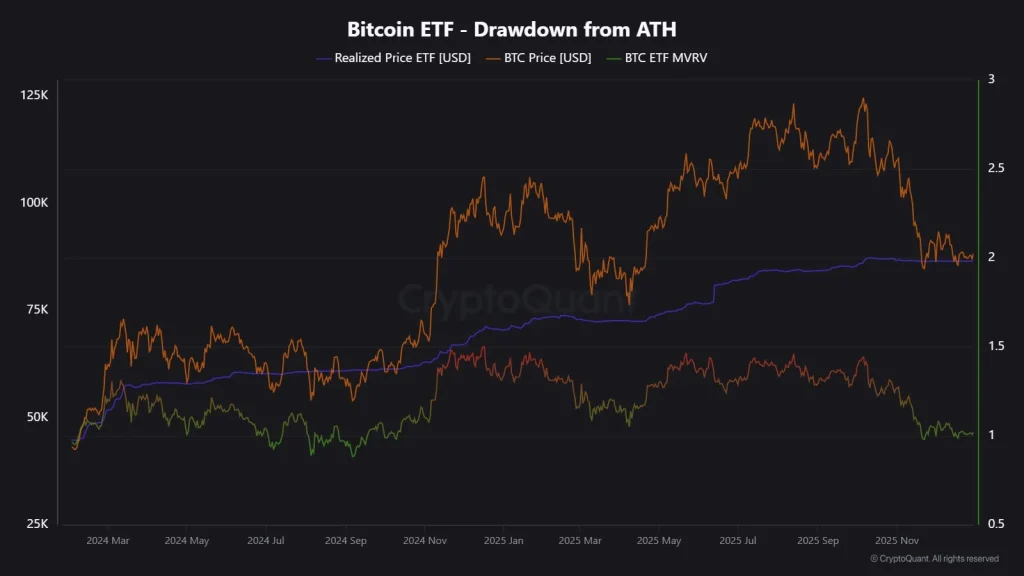

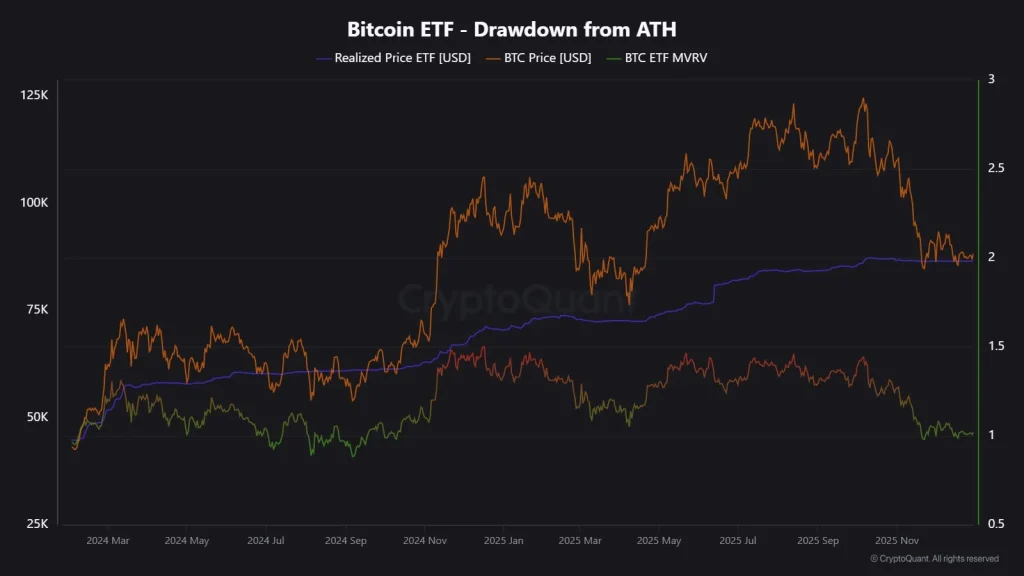

From a technical evaluation standpoint, CryptoQuant’s knowledge confirmed that BTC worth has been retesting a vital help stage round $86.5k. In keeping with CryptoQuant, this help stage is the typical value foundation for spot Bitcoin ETF consumers.

With U.S. spot BTC ETFs recording a cumulative web money influx of over $56 billion, the help stage round $86.5k is nicely positioned to carry in 2026.

Supply: X

Wall Road Anticipates a Bullish Outlook in 2026

2025 was marked by a big adoption of crypto by institutional buyers catalyzed by regulatory readability. Nevertheless, the broader crypto market closed 2025 in losses, thus underplaying the sturdy fundamentals.

Nevertheless, Tom Lee, Chairman of BitMine, believes that 2026 might be bullish for crypto after underperforming the valuable metals business in 2025. Lee said that Gold strikes lead crypto, based mostly on the liquidity stream throughout prior bull markets.

The upcoming regulatory readability in america via the Readability Act is anticipated to additional appeal to extra capital to the crypto market. With the continued world money printing amid financial coverage easing, Bitcoin is well-positioned to rally exponentially in 2026.

Belief with CoinPedia:

CoinPedia has been delivering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our knowledgeable panel of analysts and journalists, following strict Editorial Pointers based mostly on E-E-A-T (Expertise, Experience, Authoritativeness, Trustworthiness). Each article is fact-checked towards respected sources to make sure accuracy, transparency, and reliability. Our overview coverage ensures unbiased evaluations when recommending exchanges, platforms, or instruments. We attempt to offer well timed updates about all the pieces crypto & blockchain, proper from startups to business majors.

Funding Disclaimer:

All opinions and insights shared characterize the writer’s personal views on present market situations. Please do your individual analysis earlier than making funding choices. Neither the author nor the publication assumes duty on your monetary decisions.

Sponsored and Ads:

Sponsored content material and affiliate hyperlinks might seem on our website. Ads are marked clearly, and our editorial content material stays totally unbiased from our advert companions.