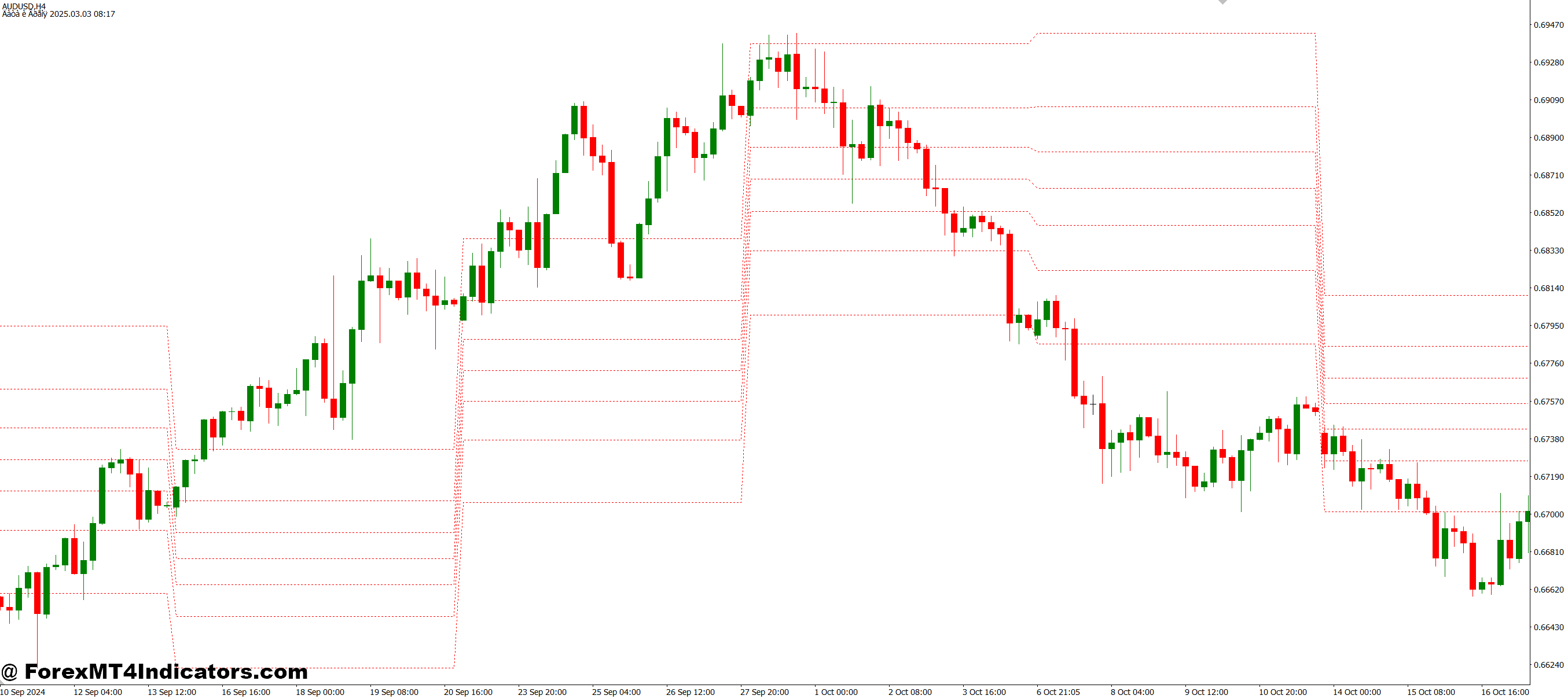

The Waddah Attar Weekly Fibo MT4 Indicator is designed to simplify weekly technical evaluation. It mechanically attracts Fibonacci retracement ranges primarily based on the earlier week’s worth actions. These ranges assist merchants perceive the place the value would possibly bounce, stall, or reverse. As a result of the traces are refreshed firstly of every buying and selling week, merchants all the time work with up to date knowledge with out doing handbook calculations.

Why Weekly Fibonacci Ranges Matter

Weekly Fibonacci ranges are stronger than these taken from shorter timeframes. They assist merchants see the larger image, making it simpler to filter out market noise. For U.S. merchants who observe swing trades or place trades, this indicator provides a clearer long-term construction. The zones it marks can present potential turning factors the place consumers or sellers might step again into the market.

How the Indicator Improves Evaluation

This instrument makes charting simpler by eradicating guesswork. Merchants can rapidly determine key worth ranges akin to 23.6%, 38.2%, 50%, and 61.8% retracements. These traces act like reference factors for planning entries and exits. Whether or not somebody trades foreign exchange pairs, metals, or indices, the indicator adjusts mechanically with no need further settings. Its simplicity makes it helpful for each new and skilled merchants.

Utilizing It in a Weekly Buying and selling Plan

The indicator works greatest when mixed with fundamental worth motion. Merchants can look forward to worth to succeed in a Fibonacci stage and observe whether or not it exhibits bounce alerts or breakout conduct. This helps them keep away from emotional choices and stick with a constant plan. By mapping weekly ranges, they acquire a transparent framework to trace tendencies, mark zones, and put together for upcoming market classes.

Easy methods to Commerce with Waddah Attar Weekly Fibo MT4 Indicator

Purchase Entry

Enter a purchase when worth pulls again to a weekly Fibonacci assist stage (38.2%, 50%, or 61.8%) and exhibits a bullish candle affirmation.

Purchase when the value breaks above a key weekly Fibonacci stage and closes strongly above it.

Enter lengthy if worth retests a damaged Fibonacci resistance (now appearing as assist) and rejects downward motion.

Search for bullish patterns akin to engulfing candles or pin bars fashioned at Fibonacci assist factors.

Keep away from shopping for if worth is under the weekly 50% Fibonacci stage and displaying sturdy bearish momentum.

Promote Entry

Enter a promote when the value retraces to a weekly Fibonacci resistance stage and varieties a bearish candle affirmation.

Promote when the value breaks under an vital Fibonacci assist stage and closes beneath it.

Enter quick if worth retests a damaged Fibonacci assist (now appearing as resistance) and fails to interrupt again above.

Look ahead to bearish candlestick patterns like bearish engulfing or capturing star at Fibonacci resistance zones.

Keep away from promoting if the value is trending strongly above the weekly 50% Fibonacci stage with out indicators of weak point.

Conclusion

The Waddah Attar Weekly Fibo MT4 Indicator provides merchants a straightforward strategy to perceive weekly market construction utilizing computerized Fibonacci ranges. It reduces chart muddle, saves time, and helps higher decision-making. With clear assist and resistance zones, merchants can keep targeted, plan, and commerce extra confidently all through the week.

Really helpful MT4/MT5 Dealer

XM Dealer

Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

Deposit Bonus as much as $5,000

Limitless Loyalty Program

Award Successful Foreign exchange Dealer

Extra Unique Bonuses All through The 12 months

Unique 90% VIP Money Rebates for all Trades!

>> Signal Up for XM Dealer Account right here with Unique 90% VIP Money Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Companion Code: VIP90