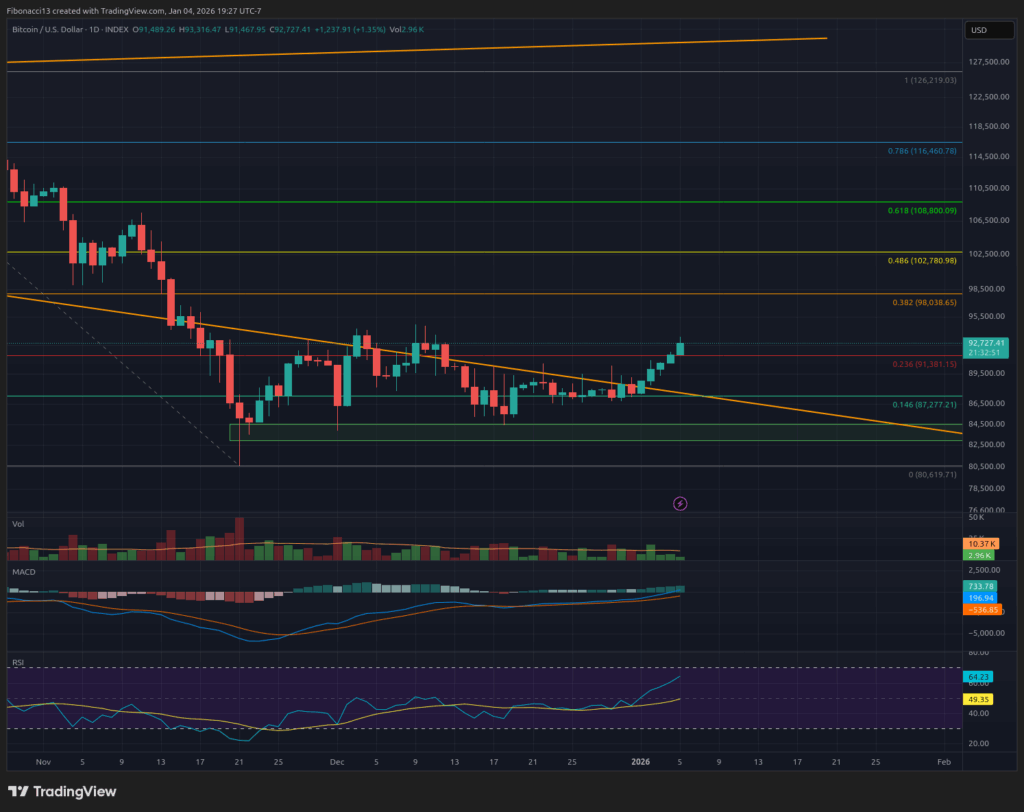

After remaining comparatively sideways via the Christmas and New Yr’s weeks, the bitcoin worth made a small transfer increased over this previous weekend. Bitcoin worth closed the week at $91,489, simply above the short-term resistance degree at $91,400. If bulls can maintain above this degree, they need to take one other run on the $94,000 resistance degree this week, which has stored a lid on the value since mid-November. $98,000 is inside attain this week as nicely.

Key Assist and Resistance Ranges Now

Bulls will attempt to carry some momentum into the New Yr right here and take out the $94,000 resistance degree. Above $94,000, we’ve $98,000, the place resistance actually begins to select up, and stretches from there all the way in which as much as $103,500. This space is poised nicely to reject the value if it will probably climb above $94,000. $109,000 offers a possible ultimate ceiling for the value that will probably be extraordinarily robust to beat. If the value will get above $109,000, we are able to begin speaking about doubtlessly seeing new highs.

The bulls will wish to maintain help at $87,000 if the bears can handle to drive the value down there. $84,000 remains to be sturdy help beneath there, however it’s going to weaken with additional touches. If $84,000 help fails, we are going to look right down to the $72,000 to $68,000 help zone as a robust degree to provide a bounce.

Outlook For This Week

Sleepy bears have let up slightly over the previous few weeks. This week, the bulls will doubtless attempt to make the most of this by persevering with to push the value increased into the following resistance degree, so search for the bulls to make one other try at $94,000. $98,000 ought to preserve a lid on issues this week if bulls can handle to push previous $94,000. If bulls fail to carry the $91,400 degree this week, search for them to defend the $87,000 degree to present themselves one other try at getting above it and taking over $94,000 as soon as once more.

Market temper: Impartial – Bulls have managed to carry help ranges over the previous few weeks and have a little bit of upward momentum this week. The bearish temper has softened to a extra impartial degree.

The subsequent few weeksThe weekly chart has been sandwiched between the decrease development line of the broadening wedge above and the weekly 100 SMA beneath for a number of weeks now. One in every of them needed to break, and for now, it’s the development line resistance that has eroded away to present the bulls an opportunity to push increased. Lengthy-term bias remains to be bearish, nevertheless, so search for any bullish transfer to discover a prime over the approaching weeks and are available again down to check help at $87,000 to $84,000. Closing any weeks beneath $84,000 at this level will set bears as much as drop the value right down to the following help degree within the low $70,000 vary. On the upside, the bulls might want to maintain weekly closes above $100,000 to attempt to flip the long-term development round.

Terminology Information:

Bulls/Bullish: Consumers or traders anticipating the value to go increased.

Bears/Bearish: Sellers or traders anticipating the value to go decrease.

Assist or help degree: A degree at which the value ought to maintain for the asset, at the very least initially. The extra touches on help, the weaker it will get and the extra doubtless it’s to fail to carry the value.

Resistance or resistance degree: Reverse of help. The extent that’s more likely to reject the value, at the very least initially. The extra touches at resistance, the weaker it will get and the extra doubtless it’s to fail to carry again the value.

SMA: Easy Transferring Common. Common worth based mostly on closing costs over the required interval. Within the case of RSI, it’s the common energy index worth over the required interval.

Broadening Wedge: A chart sample consisting of an higher development line performing as resistance and a decrease development line performing as help. These development traces should diverge away from one another so as to validate the sample. This sample is a results of increasing worth volatility, sometimes leading to increased highs and decrease lows.

Fibonacci Retracements and Extensions: Ratios based mostly on what is called the golden ratio, a common ratio pertaining to progress and decay cycles in nature. The golden ratio relies on the constants Phi (1.618) and phi (0.618).