Treasured metals buyers are watching market situations carefully as gold and silver hover at pivotal worth factors. Whereas each metals have already posted spectacular beneficial properties, a number of converging elements counsel we could also be witnessing the early phases of a gold and silver worth surge slightly than a market peak.

Understanding these catalysts can assist you place your portfolio to profit from the potential upside whereas managing danger appropriately. Listed here are seven compelling explanation why gold and silver might erupt from present ranges.

1. Central Financial institution Demand Stays at Document Highs

Central banks worldwide have shifted from internet sellers to aggressive consumers of gold — a basic change in how nations view financial reserves.

The numbers inform the story: Central banks bought over 1,000 tonnes of gold yearly in 2022, 2023, and 2024 — the best ranges since 1967.

International locations like China, India, Poland, and Turkey proceed increasing their gold holdings as they diversify away from dollar-denominated property. The Individuals’s Financial institution of China, for instance, elevated its gold reserves for 18 consecutive months by Might 2024.

This isn’t nearly portfolio diversification. It alerts rising issues about fiat forex stability and the long-term construction of the worldwide financial system. When the establishments managing nationwide wealth constantly purchase an asset, particular person buyers ought to concentrate.

How you can Add ‘Disaster-Proof’ Returns to Your Portfolio It is overwhelmed shares in each main downturn—and most buyers nonetheless do not personal sufficient.

2. Actual Yields Are Working in Gold’s Favor

Gold’s relationship with actual yields — rates of interest adjusted for inflation — stays one of the vital dependable predictors of worth actions.

When actual yields fall or keep unfavorable, gold turns into extra engaging as a result of it doesn’t carry the chance price of foregone curiosity funds. You’re not sacrificing a lot by holding a non-yielding asset when bonds barely beat inflation.

Present financial coverage suggests actual yields will keep compressed for the foreseeable future. Central banks face a tough balancing act between controlling inflation and supporting financial progress. This usually ends in rates of interest that fail to maintain tempo with precise inflation — precisely the atmosphere the place gold traditionally thrives.

Whilst inflation has moderated, actual yields (10-year Treasury yields minus inflation) have hovered close to zero or beneath. This compression creates a good backdrop for the gold and silver worth surge many analysts anticipate.

3. Silver’s Historic Rally Demonstrates Its Explosive Leverage

The gold-to-silver ratio measures what number of ounces of silver equal one ounce of gold. At roughly 57:1 right now, the ratio tells a exceptional story about what’s already occurred—and what might nonetheless unfold.

In April 2025, this ratio sat above 100:1, suggesting silver was undervalued relative to gold. Since then, silver has delivered precisely the form of explosive catch-up rally that traditionally happens when the ratio reaches extremes.

With costs surging from round $30 to over $78, silver has dramatically outperformed gold, validating the thesis that it affords larger upside potential throughout rallies.

The present 57:1 ratio now sits beneath the decade-long common of roughly 70:1. Historic patterns counsel the ratio might compress additional—within the 2011 peak, it reached 31:1—however buyers ought to acknowledge that silver’s volatility cuts each methods. The identical leverage that drives 150%+ beneficial properties can produce equally sharp corrections.

What this implies for positioning: For those who missed silver’s preliminary transfer, acknowledge that bull markets usually have a number of legs. The 2010-2011 rally noticed silver climb from $17 to $49 over 11 months with a number of 15-20% pullbacks alongside the way in which. For these already positioned, the compressed ratio suggests the rally has matured, making danger administration essential. For these contemplating entry, watch for pullbacks slightly than chasing prolonged strikes.

4. Industrial Demand for Silver Creates a Provide Squeeze

In contrast to gold, which serves primarily as a retailer of worth, silver performs a twin position as each an industrial metallic and funding asset. This creates distinctive provide dynamics which are tightening.

The inexperienced power transition is a game-changer for silver demand. Every photo voltaic panel requires about 20 grams of silver. Electrical automobiles use 25-50 grams per automobile for electronics and charging infrastructure. 5G networks, medical gadgets, and client electronics all require silver for its unmatched electrical conductivity.

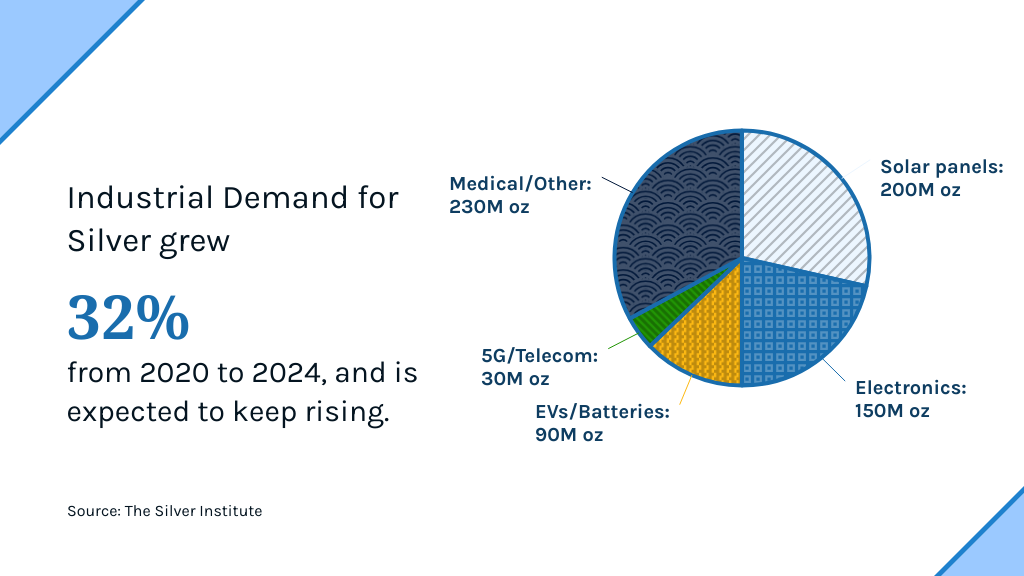

The numbers are climbing quick. The Silver Institute tasks industrial demand will attain roughly 700 million ounces this 12 months, up from round 530 million ounces in 2020. That’s a 32% enhance in simply 4 years — and the trajectory exhibits no indicators of slowing.

It’s additionally vital to notice that industrial consumption removes silver from the market completely. In contrast to funding demand, which may return throughout worth spikes when buyers promote, silver utilized in photo voltaic panels and electronics is gone endlessly.

Annual mine manufacturing sits round 850 million ounces, whereas whole demand (industrial plus funding) approaches 1.1 billion ounces. The deficit is at present crammed by recycling and above-ground shares, however that’s not sustainable long-term. This supply-demand imbalance might drive important worth appreciation.

5. Geopolitical Tensions Are Intensifying

World uncertainty has reached ranges not seen because the Chilly Battle. Ongoing conflicts, commerce disputes, and shifting alliances create an atmosphere the place safe-haven property thrive.

Gold and silver have carried out nicely throughout geopolitical instability for a easy purpose: they preserve worth no matter political outcomes. They can’t be sanctioned, frozen, or devalued by authorities decree.

Latest examples validate this safe-haven position. When Russia invaded Ukraine in February 2022, gold jumped from $1,900 to over $2,050 in a matter of weeks. Related spikes occurred through the Israeli-Hamas battle in October 2023 and through U.S.-China commerce tensions all through 2018-2019.

The present panorama consists of strained worldwide relations, issues concerning the stability of world establishments, and the fracturing of the post-World Battle II order. As geopolitical dangers present no indicators of abating, this safe-haven demand ought to proceed supporting costs.

6. Forex Devaluation Issues Are Rising

Large authorities debt ranges and continued financial growth have raised severe questions about long-term forex stability.

The numbers are staggering: U.S. federal debt now exceeds $38 trillion — greater than 120% of GDP. And it’s not simply the U.S. — Japan’s debt-to-GDP ratio sits above 260%. These are ranges traditionally related to forex crises or dramatic devaluations.

When confidence in fiat currencies erodes, buyers naturally flip to treasured metals. Gold and silver have maintained buying energy throughout centuries and civilizations. An oz of gold purchased a positive swimsuit in Roman instances, and it buys a positive swimsuit right now.

The unprecedented fiscal and financial responses to current financial challenges — from the 2008 monetary disaster by COVID-19 — have expanded cash provides globally. Whereas these insurance policies prevented instant crises, they’ve additionally sown seeds of concern about future forex valuations.

Treasured metals function insurance coverage in opposition to this financial uncertainty. As forex issues intensify, their worth will increase proportionally.

7. Technical Indicators Recommend a Breakout Is Imminent

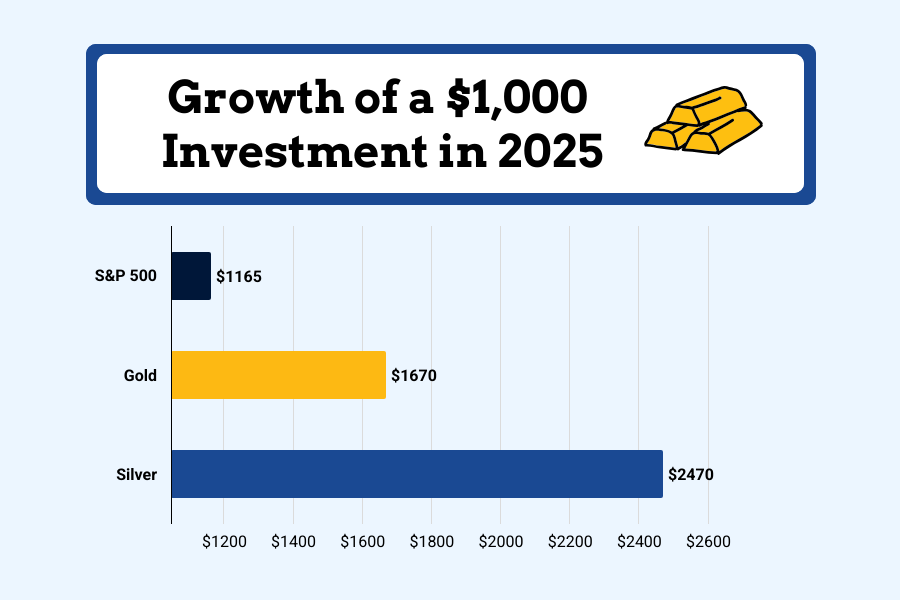

From a technical evaluation perspective, 2025 delivered precisely the form of explosive transfer that chart patterns urged was constructing. Gold surged 67%, whereas silver climbed an much more spectacular 147%.

These aren’t modest beneficial properties — they’re the form of strikes that outline bull markets. And whereas the preliminary breakout has clearly occurred, historic patterns counsel main treasured metals rallies usually unfold in a number of waves slightly than single parabolic strikes.

Gold’s climb from round $2,650 to over $4,400 represents a decisive break above earlier consolidation ranges. The metallic is now establishing new help zones round $4,200-$4,400, suggesting the market is digesting beneficial properties slightly than reversing them.

Silver’s 147% surge in 2025 validates every little thing we learn about its leverage throughout bull markets. When fundamentals align — industrial demand, financial situations, geopolitical danger — silver delivers outsized returns in comparison with gold.

The charts now present worth discovery zones with restricted historic resistance overhead. Quantity patterns throughout this rally point out institutional participation, not simply retail hypothesis. Pullbacks have been met with shopping for slightly than promoting — a bullish signal.

The 2010-2011 rally affords instructive precedent. Gold gained 80% over 18 months with a number of corrections alongside the way in which, whereas silver greater than tripled. If present fundamentals stay supportive, 2025’s beneficial properties might be the primary chapter slightly than the ultimate web page.

That stated, managing danger after such important strikes is essential. Think about taking partial earnings, dollar-cost averaging on pullbacks, or elevating stop-losses slightly than chasing prolonged rallies.

Positioning Your Portfolio for 2026

Understanding these catalysts is just beneficial if translated into acceptable motion.

For buyers trying to capitalize on potential treasured metals appreciation, think about a dollar-cost averaging method that builds positions steadily whereas managing danger. This technique smooths out volatility and prevents the remorse of poorly timed lump-sum purchases.

Conservative buyers would possibly allocate 8-10% to gold and 2-3% to silver, specializing in stability and wealth preservation. This offers significant publicity with out extreme volatility.

These with larger danger tolerance might emphasize silver extra closely — doubtlessly 7-10% to silver and 3-5% to gold — to seize its larger upside potential throughout rallies. Simply do not forget that silver’s volatility cuts each methods.

The convergence of central financial institution demand, favorable financial situations, provide constraints, geopolitical uncertainty, and technical setups creates a compelling case for treasured metals appreciation from present ranges.

Whereas timing market peaks and troughs completely stays not possible, positioning your self earlier than these catalysts totally manifest might show rewarding for affected person buyers centered on long-term wealth preservation and progress.

Investing in Bodily Metals Made Simple

Individuals Additionally Ask

What are the important thing elements driving gold and silver costs larger?

Central banks are shopping for document quantities — over 1,000 tonnes yearly — as they diversify away from greenback reserves. Actual yields stay compressed, making non-yielding gold extra engaging. Silver faces a novel provide squeeze: industrial demand from photo voltaic panels, EVs, and 5G infrastructure is surging whereas mine manufacturing struggles to maintain tempo. Add geopolitical tensions, forex devaluation issues, and bullish technical patterns, and you’ve got a number of catalysts converging to push costs larger.

Is now a superb time to put money into gold and silver?

After gold’s 67% achieve and silver’s 147% surge in 2025, timing turns into tough. Fairly than attempting to catch excellent entry factors, think about dollar-cost averaging to construct positions steadily. This smooths out volatility and prevents poorly timed lump-sum purchases. Conservative buyers would possibly favor gold’s relative stability (8-10% allocation), whereas these snug with volatility might emphasize silver’s leverage potential (7-10% allocation). The secret is aligning your allocation along with your danger tolerance and recognizing that bull markets usually have a number of legs larger separated by corrections.

How does the gold-to-silver ratio affect funding choices?

The gold-to-silver ratio exhibits what number of ounces of silver equal one ounce of gold. At roughly 57:1 right now, the ratio has compressed considerably from the 80:1+ ranges seen earlier this 12 months — validating silver’s explosive leverage throughout bull markets. Traditionally, the ratio averages round 70:1, with bull market bottoms usually reaching 30-40:1. A compressed ratio like right now’s suggests silver has already delivered sturdy outperformance, although historic precedent exhibits it might compress additional if the bull market continues. Use the ratio as a tactical timing software, however don’t let it override your core allocation technique.

What position do central banks and industrial demand play within the worth surge?

Central banks bought over 1,000 tonnes of gold yearly in 2022-2023 — the best ranges since 1967. China alone added to reserves for 18 consecutive months by mid-2024. This institutional shopping for creates persistent upward strain and alerts issues about fiat forex stability. For silver, industrial demand tells an equally compelling story. The Silver Institute tasks 700 million ounces of commercial consumption in 2024, pushed by photo voltaic panels (~20 grams every), electrical automobiles (25-50 grams per automobile), and electronics. In contrast to funding demand that may return to the market, industrial consumption completely removes silver from circulation — creating provide deficits that drive costs larger.

What are the dangers of investing in gold and silver at present ranges?

After 2025’s explosive beneficial properties (gold +67%, silver +147%), volatility danger is elevated. Sharp 15-25% corrections are regular even inside bull markets — silver’s leverage cuts each methods. Rising actual yields might make bonds extra engaging than non-yielding gold. Geopolitical tensions might ease, lowering safe-haven demand. Silver faces extra dangers if financial slowdown weakens industrial demand or if new applied sciences substitute away from silver use. Most consultants suggest limiting treasured metals to 5-15% of a diversified portfolio slightly than making them a concentrated guess. After such sturdy strikes, danger administration—by stop-losses, partial profit-taking, or smaller place sizes — turns into essential.

Previous efficiency doesn’t assure future outcomes. This text is for informational functions solely and shouldn’t be thought-about funding recommendation. All the time conduct thorough analysis or seek the advice of with a monetary advisor earlier than making funding choices.