Be a part of Our Telegram channel to remain updated on breaking information protection

Bitcoin’s value remains to be flirting with the $90,000 degree, because the asset stays indecisive and is barred from the upside by the $94,000 degree from late November. BTC is down a fraction of a share during the last 24 hours, buying and selling at $90,336 as of 12:00 a.m. EST.

As BTC faces indecision round $90,000, Fundstrat’s Tom Lee stays optimistic on Bitcoin. In keeping with Lee, the digital asset may rally by the tip of January, pushed by improved liquidity, elevated institutional involvement, and clearer regulatory frameworks.

TOM LEE SAID #BITCOIN IS STILL GOING TO $180,000 IN THE NEXT 21 DAYS

HERE WE GO 🚀 pic.twitter.com/EdgnS1impk

— Vivek Sen (@Vivek4real_) January 9, 2026

Lee additionally sees elevated use of BTC ETFs (exchange-traded funds) as a catalyst, including to a shift towards mainstream adoption and never simply speculative buying and selling.

This comes even because the US spot BTC recorded its fourth day of outflows, totaling $250 million, whereas Constancy’s FBTC recorded the one optimistic worth of round $7.9 million, based on Coinglass information.

Bitcoin has maintained a gentle vary between $85,000 and $90,000 since early December 2025. BTC beforehand peaked at $126,000 in early October however later confronted downward stress amid world monetary uncertainty and diminished institutional exercise in the course of the vacation season.

The place does BTC go from right here?

Bitcoin Worth Evaluation: BTC Dangers Drop Under $89,000

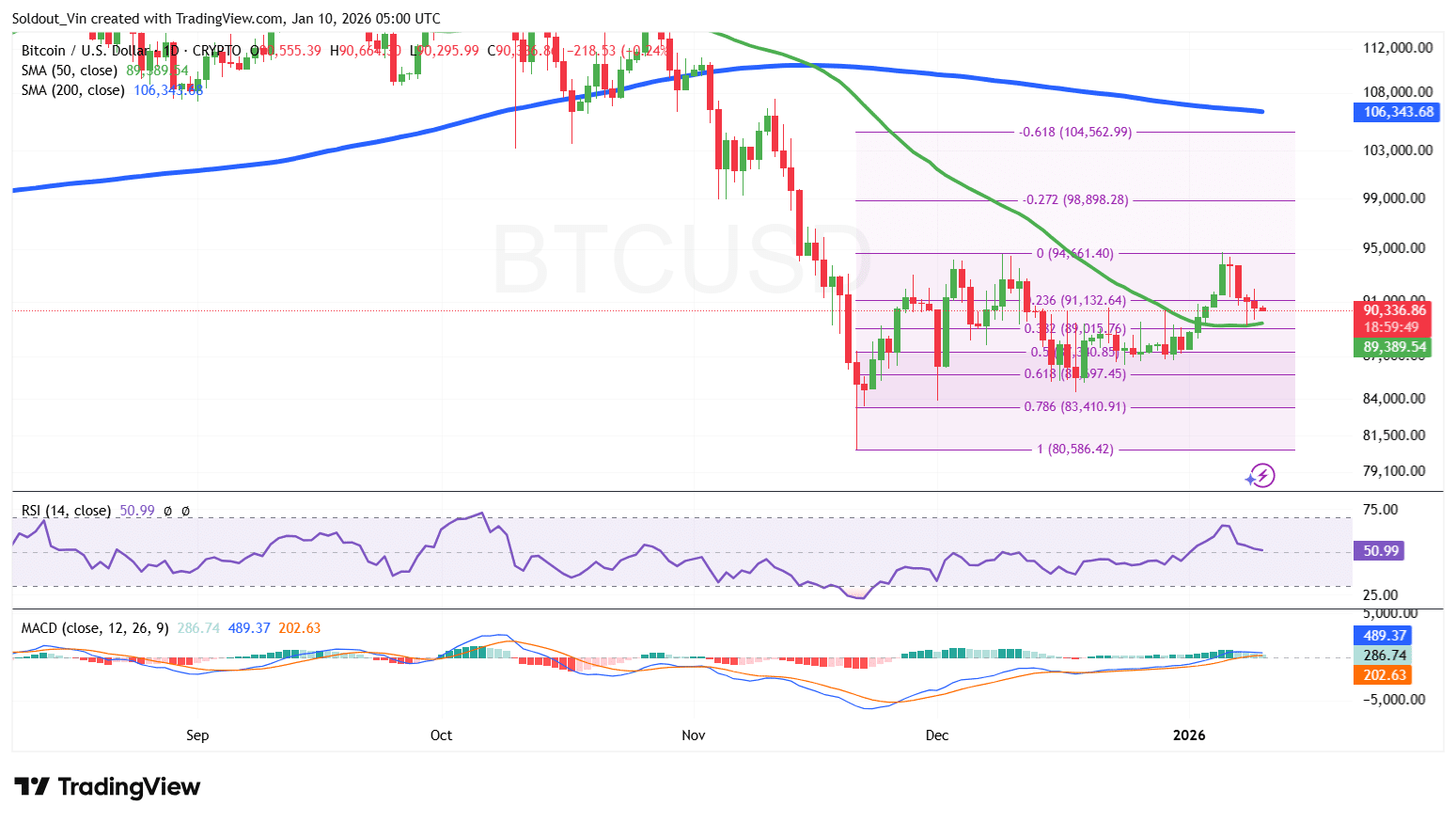

After going by means of a restoration surge from the beginning of the brand new 12 months, the BTC value has dropped within the final 4 candles, because the asset skilled bearish stress throughout the $94,000 space.

On the every day chart, Bitcoin trades effectively above the 50-day Easy Transferring Common (SMA), indicating the value stays bullish within the brief time period as buyers maintain regular above $90,000.

In the meantime, the value is effectively supported by key Fibonacci Retracement ranges at 0.382 and 0.5, at $89,015 and $87,340, respectively.

The Relative Energy Index (RSI) can be consolidating within the 50 space, at present at 50.99, a sign of a tug-of-war between bears and bulls.

Primarily based on the BTC/USD every day chart evaluation, the BTC value may nonetheless drop again to $89,389 (50-day SMA), however that degree is performing as robust help. This state of affairs exhibits that buyers stay cautious about any slight transfer.

If this bearish stress continues, Bitcoin is prone to falling beneath $89,000, with the 0.382 and 0.5 Fib ranges performing as instant help.

Nevertheless, if the 50-day SMA holds robust, the Bitcoin value may nonetheless surge in the long run, with $94,660 and $98,898 as the subsequent goal zones on the Fibonacci chart.

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

Straightforward to Use, Characteristic-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection