Decentralized exchanges (DEXs) permit customers to commerce digital property instantly from their wallets with out counting on centralized platforms. In contrast to conventional exchanges, DEXs depend on good contracts to automate buying and selling, giving customers full management over their funds whereas sustaining transparency and safety.

With dozens of DEXs accessible throughout a number of blockchains, selecting the best one may be overwhelming. On this article, we overview the highest 10 decentralized exchanges, evaluate their options, charges, and supported networks, and supply insights to assist merchants make knowledgeable selections.

Prime Decentralized Crypto Exchanges In contrast

ExchangeSupported ChainsTypeTrading FeesBest ForHyperliquidNative Layer 1 solelyPerpetual Futures DEXLow charges and gas-free buying and sellingSuperior derivatives and leveraged buying and sellingUniswapEthereum, Arbitrum, Base, PolygonAMM spot buying and selling0.05 –0.30% Token swaps and liquidity provision0x ProtocolEthereum, Optimism, Arbitrum, AvalancheAggregator/InfrastructureVaries by integrating DEXAggregated liquiditydYdXEthereum L2 (dYdX Layer 2)Perpetual Futures DEX0–0.15% maker, 0.20% takerSuperior derivatives and margin buying and sellingSushiSwapEthereum, Polygon, Arbitrum, FantomAMM spot buying and selling0.25% per swapMulti-chain token swaps and decentralized finance (DeFi) optionsPancakeSwapBNB Chain, Avalanche, Fantom, PolygonAMM spot buying and selling0.25% per swapLow-cost swaps on a number of chainsCurve FinanceEthereum, Polygon, Optimism, AvalancheAMM Stablecoin DEX0.04%–0.50% relying on poolStablecoinsRaydiumSolanaAMM plus order e book hybrid0.25%Quick Solana swaps and DeFi optionsKuma (IDEX)Ethereum, Polygon, ArbitrumHybrid DEX (Off-chain match, on-chain settlement)0.1%–0.35%ERC-20 spot buying and selling with superior order sortsApeSwapBNB Chain, Polygon, AvalancheAMM spot buying and selling0.25%Multi-chain swaps, staking, and yield farming

10 Finest Decentralized Exchanges (DEXs) in 2026 for Crypto Buying and selling

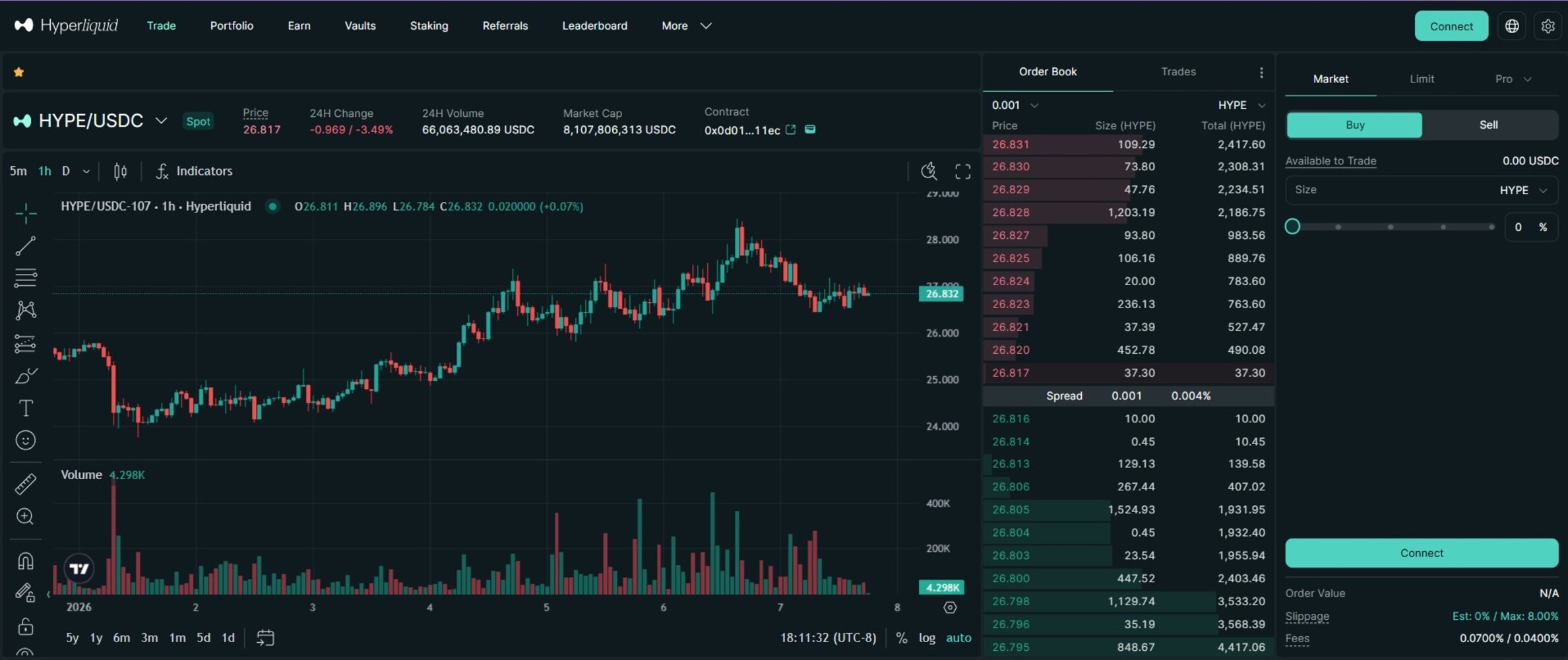

1. Hyperliquid – Finest decentralized trade for perpetual futures buying and selling

Hyperliquid is a decentralized trade targeted on perpetual futures buying and selling. The protocol combines an on-chain order e book with high-throughput infrastructure, enabling customers to commerce derivatives with out counting on a centralized authority or custodial accounts.

The platform operates fully on its native blockchain, which is optimized for low latency and quick transaction finality. This design allows real-time order matching and execution speeds akin to centralized buying and selling platforms whereas sustaining on-chain settlement and transparency.

Professionals of Hyperliquid

Totally on-chain order e book with clear commerce executionPerpetual futures buying and selling with leverage as much as 50×No fuel charges for order placement or cancellationHelps superior order sorts and cross-margin buying and selling

Cons of Hyperliquid

Primarily targeted on derivatives, with restricted spot buying and selling choicesExcessive leverage will increase threat for inexperienced merchants

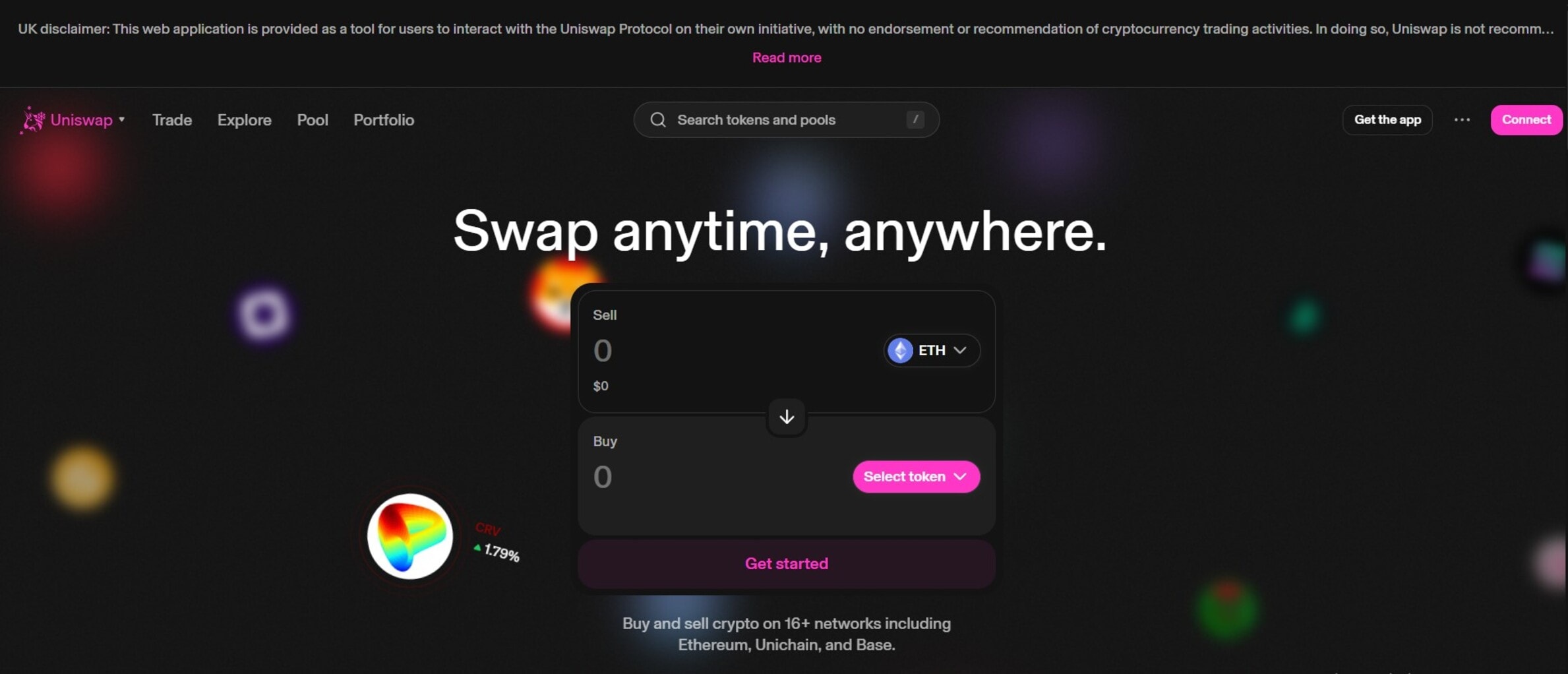

2. Uniswap – Finest decentralized trade for token swaps and liquidity provision

Uniswap is a decentralized cryptocurrency trade designed for permissionless token swapping on Ethereum and different supported blockchains. It operates utilizing an automatic market maker (AMM) mannequin reasonably than an order e book, permitting customers to commerce instantly towards liquidity swimming pools provided by different customers.

Along with token swaps, the protocol permits customers to offer liquidity to swimming pools and earn a share of transaction charges. Uniswap has additionally launched concentrated liquidity, which allows liquidity suppliers to allocate capital to particular value ranges to enhance capital effectivity.

Professionals of Uniswap

Helps a lot of tokens and buying and selling pairsLiquidity suppliers can earn charges from buying and selling exerciseTotally non-custodial and open-source protocol

Cons of Uniswap

Liquidity suppliers are uncovered to impermanent lossGasoline charges on the Ethereum mainnet may be excessive throughout congestion

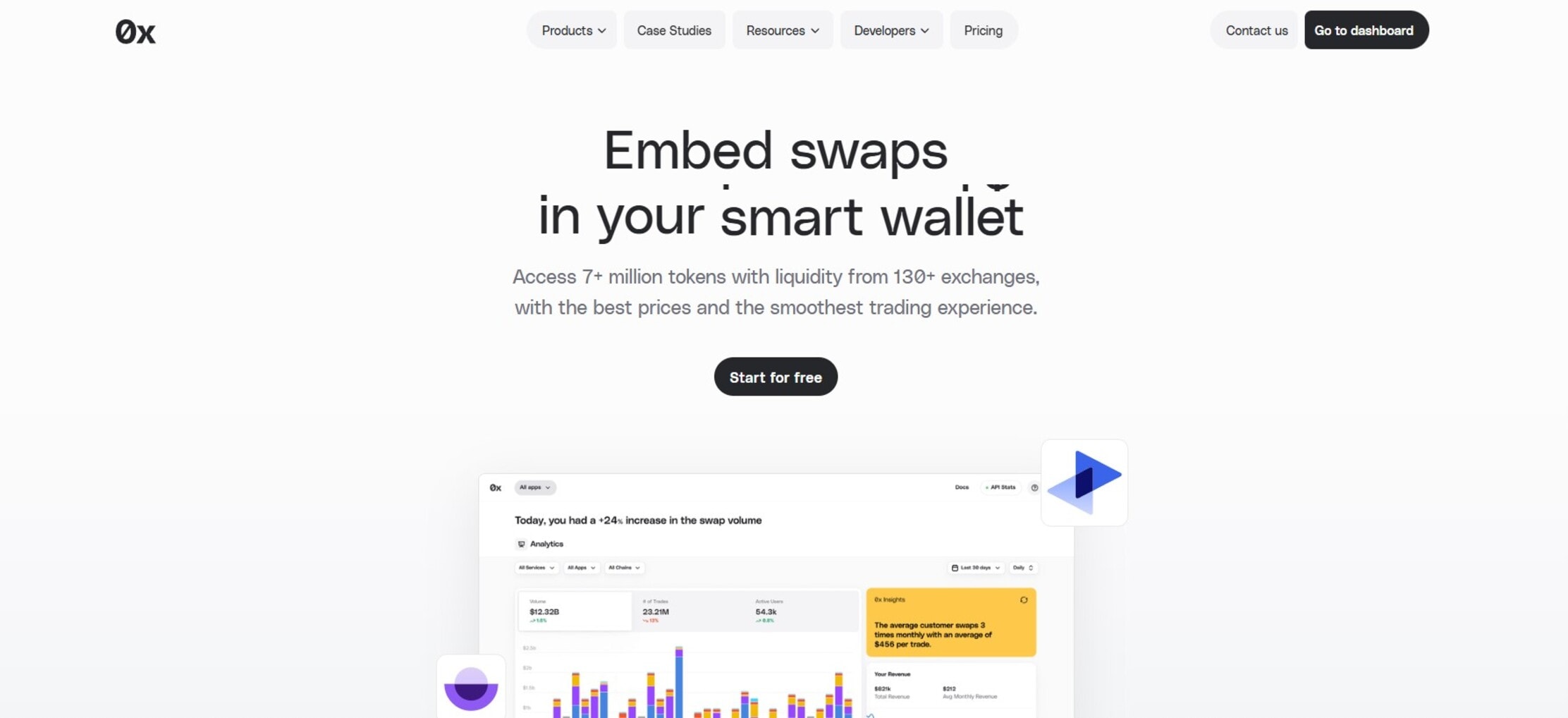

3. 0x Protocol – Finest decentralized trade for aggregated liquidity

0x Protocol is an open-source decentralized trade designed to facilitate token buying and selling throughout a number of liquidity sources. Reasonably than working as a standard DEX with a single interface, 0x gives a set of good contracts and APIs that builders and purposes use to construct buying and selling experiences on high of its protocol.

0x Protocol’s modular design permits builders to combine good order routing, value discovery, and transaction execution with out managing liquidity instantly. This makes it a key piece of infrastructure inside the decentralized finance ecosystem reasonably than a standalone shopper interface.

Professionals of 0x Protocol

Aggregates liquidity from a number of decentralized sourcesExtensively built-in into wallets and DeFi purposesDeveloper-friendly APIs and open-source structure

Cons of 0x Protocol

Not a consumer-facing trade by itselfRestricted management over liquidity in comparison with native DEXs

4. dYdX – Finest decentralized trade for superior derivatives buying and selling

dYdX is a decentralized trade targeted on perpetual futures and margin buying and selling. It’s constructed for merchants who want superior instruments with out counting on centralized custody. The protocol permits customers to commerce crypto derivatives instantly from their wallets, with all positions and settlements dealt with on-chain.

Professionals of dYdX

Order book-based perpetual futures buying and sellingSuperior buying and selling instruments appropriate for skilled merchantsCross-margin system for managing a number of positions

Cons of dYdX

Primarily targeted on derivatives reasonably than spot buying and sellingThe interface could also be advanced for novicesRestricted asset choice in comparison with spot-focused DEX crypto exchanges

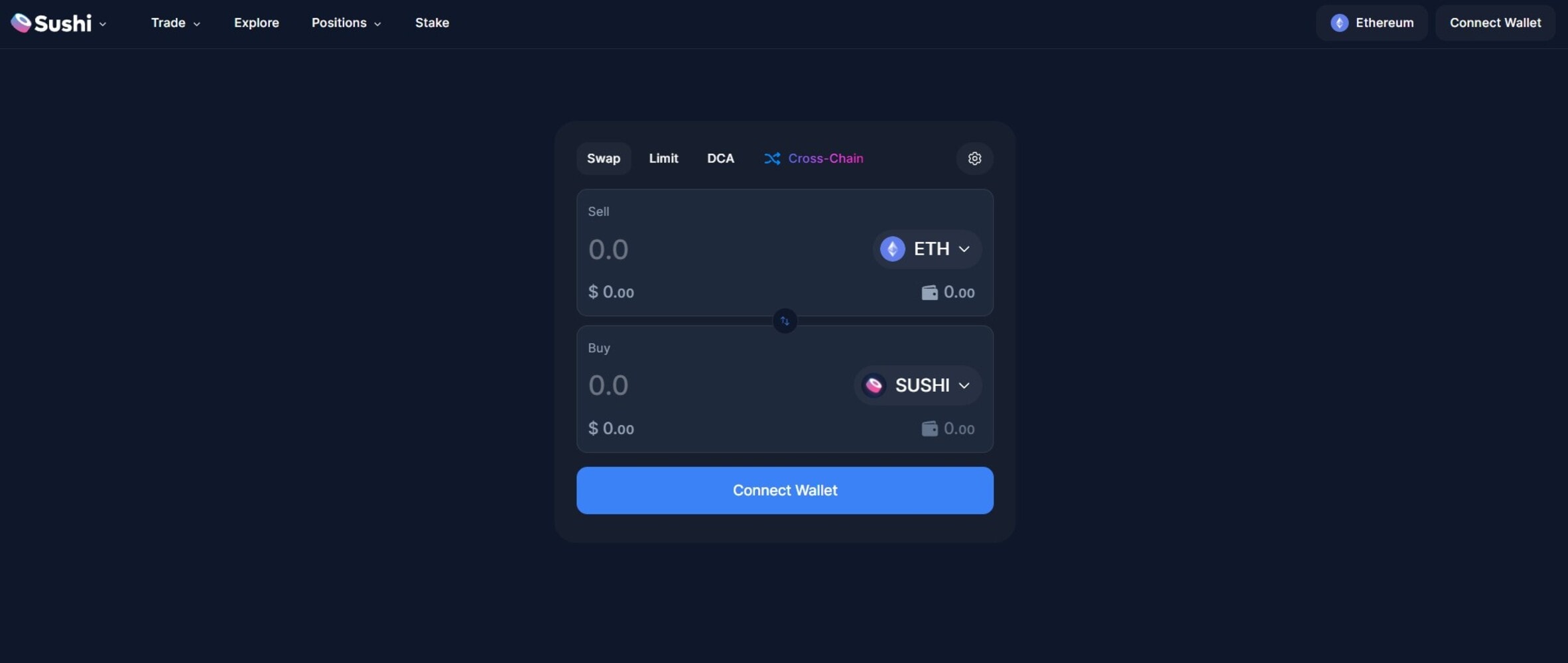

5. SushiSwap – Finest decentralized trade for multi-chain DeFi entry

SushiSwap is a decentralized trade protocol that allows customers to swap digital property and supply liquidity throughout a number of blockchains. Initially constructed on Ethereum, the platform has expanded to help a number of Layer 1 and Layer 2 ecosystems, permitting customers to entry decentralized finance companies past a single chain.

Professionals of SushiSwap

Helps a number of blockchains and Layer 2 networksLiquidity suppliers can earn charges and rewardsGroup-driven governance mannequin

Cons of SushiSwap

Gasoline charges could also be excessive on some supported chainsThe characteristic set could really feel fragmented in comparison with single-focus DEXs

6. PancakeSwap – Finest decentralized trade for low-cost buying and selling on BNB Chain

PancakeSwap is a decentralized trade constructed totally on BNB Chain. It’s designed to supply quick, low-cost token swaps utilizing an automatic market maker mannequin. Along with customary token swaps, PancakeSwap affords options equivalent to liquidity provision, yield farming, and staking, which permit customers to earn rewards by contributing property to the protocol.

Professionals of PancakeSwap

Low transaction charges in comparison with Ethereum-based DEXsQuick commerce execution on BNB ChainBig selection of supported tokens inside the ecosystem

Cons of PancakeSwap

Primarily centered across the BNB Chain ecosystemExtra options could introduce complexity for brand new customers

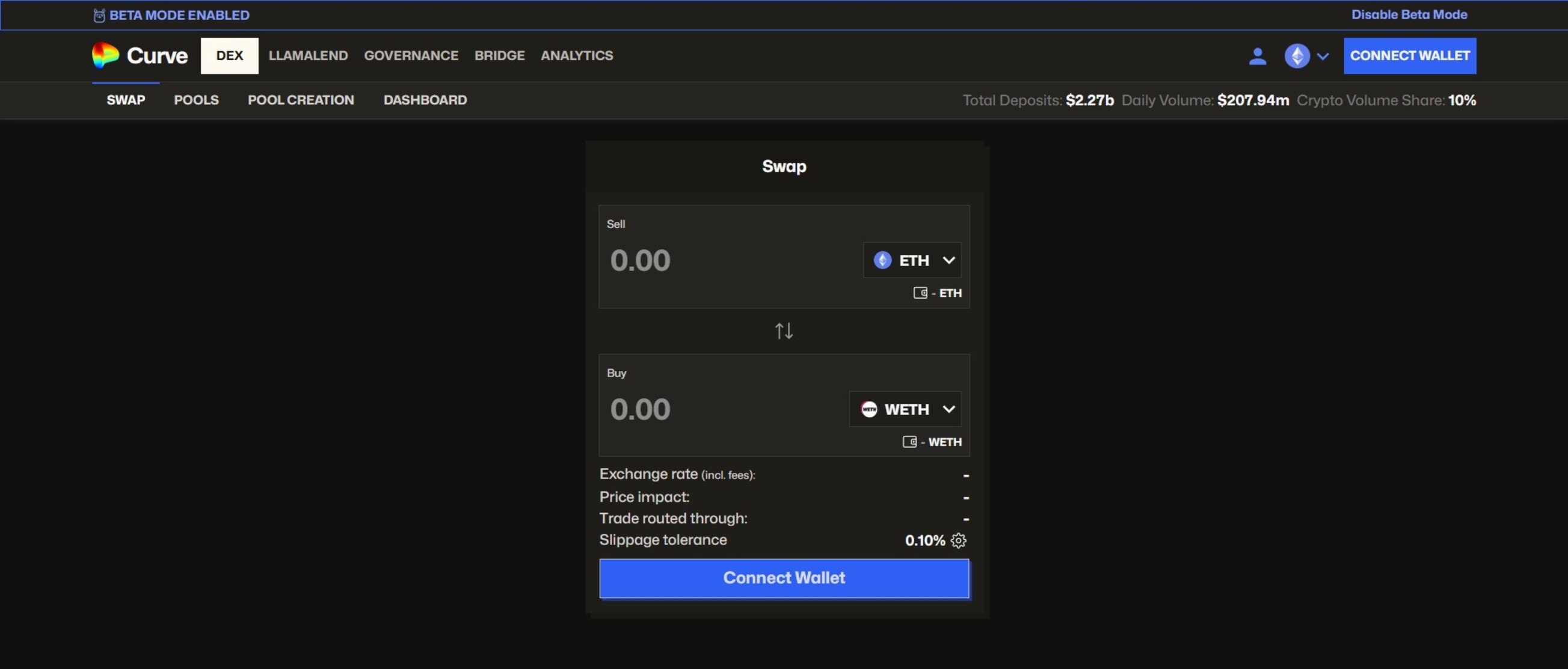

7. Curve Finance – Finest decentralized trade for stablecoins

Curve Finance is designed to effectively commerce property with related worth, equivalent to stablecoins and tokenized variations of the identical asset. The protocol makes use of a specialised automated market maker mannequin that minimizes slippage and value affect, making it appropriate for big trades involving stable-value tokens.

Professionals of Curve Finance

Extraordinarily low slippage for stablecoin and similar-asset tradesHelps a number of networks and Layer 2 optionsHelps governance via its native token (CRV), permitting customers to take part in decision-making.

Cons of Curve Finance

The interface could also be much less intuitive for brand new customersReturns for liquidity suppliers rely upon pool demand

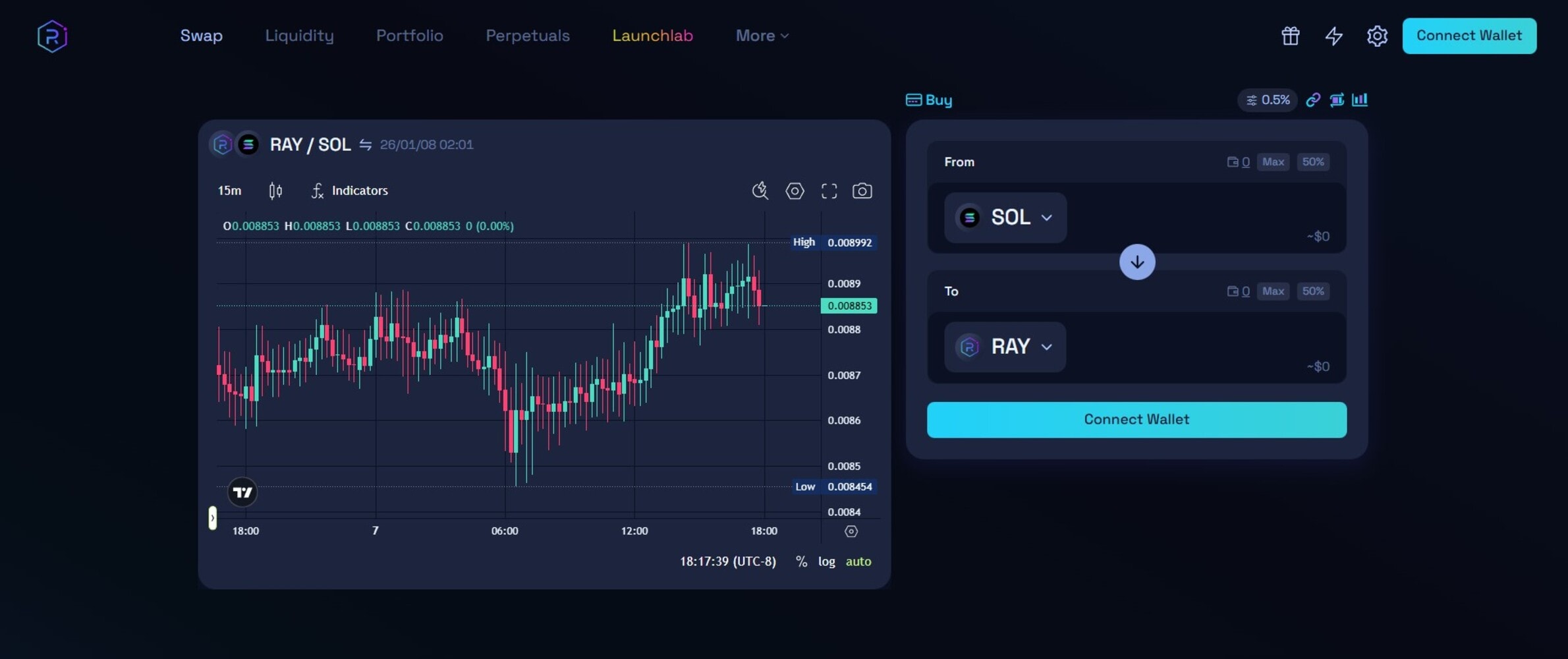

8. Raydium – Finest decentralized trade for Solana-based buying and selling

Raydium is a decentralized trade constructed on the Solana blockchain that gives quick, low-cost token swaps. It integrates instantly with Solana’s high-performance infrastructure to ship near-instant transaction confirmations and minimal charges.

The protocol helps buying and selling of SPL tokens and affords alternatives to offer liquidity, permitting customers to earn a share of transaction charges by contributing to liquidity swimming pools. Raydium additionally gives entry to its order e book by way of integration with the Serum decentralized trade, combining AMM liquidity with on-chain order-book depth for extra environment friendly buying and selling.

Professionals of Raydium

Excessive-speed transactions and low charges on SolanaCombines AMM liquidity with order e book depth by way of Serum integrationHelps yield farming and staking alternatives

Cons of Raydium

Restricted to the Solana ecosystem and SPL tokensAMM mechanics may end up in slippage for big trades

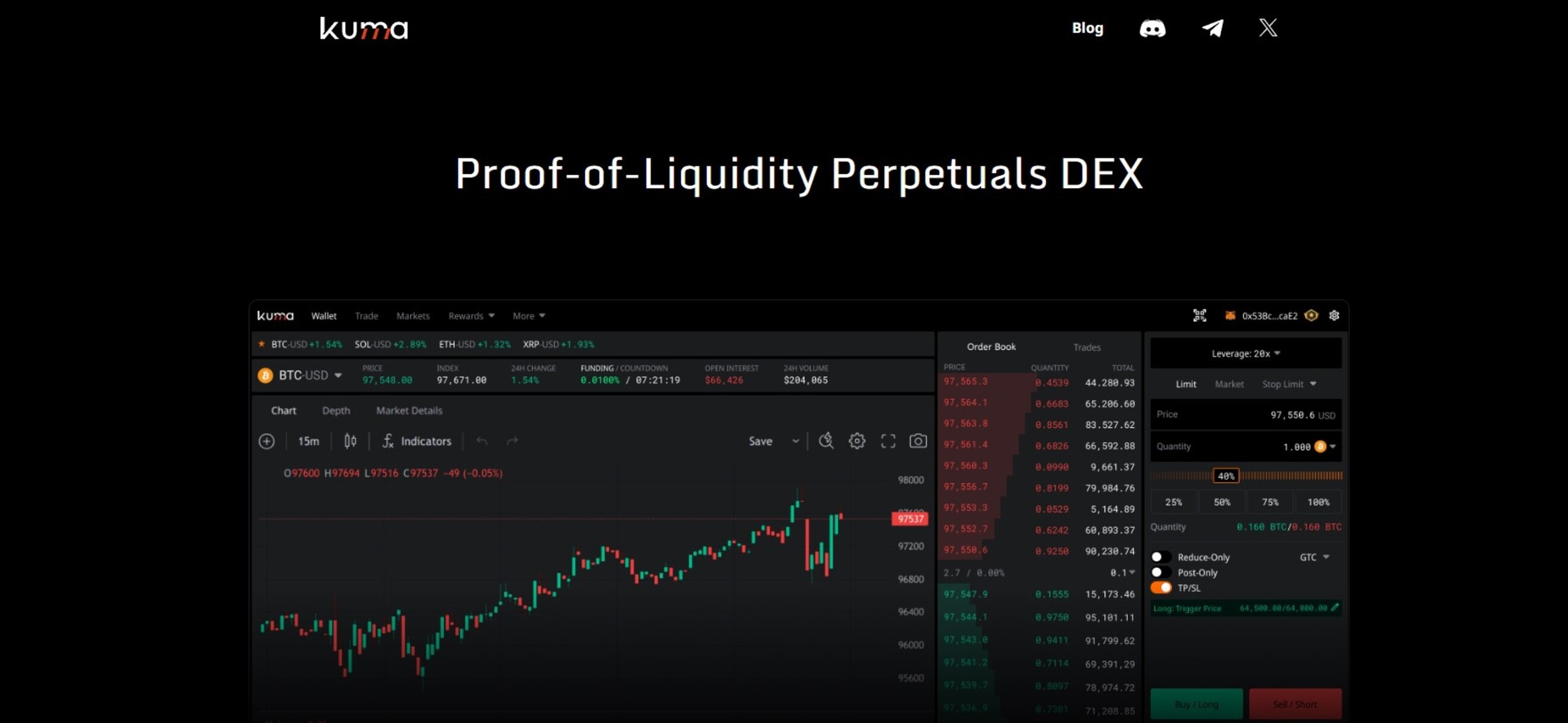

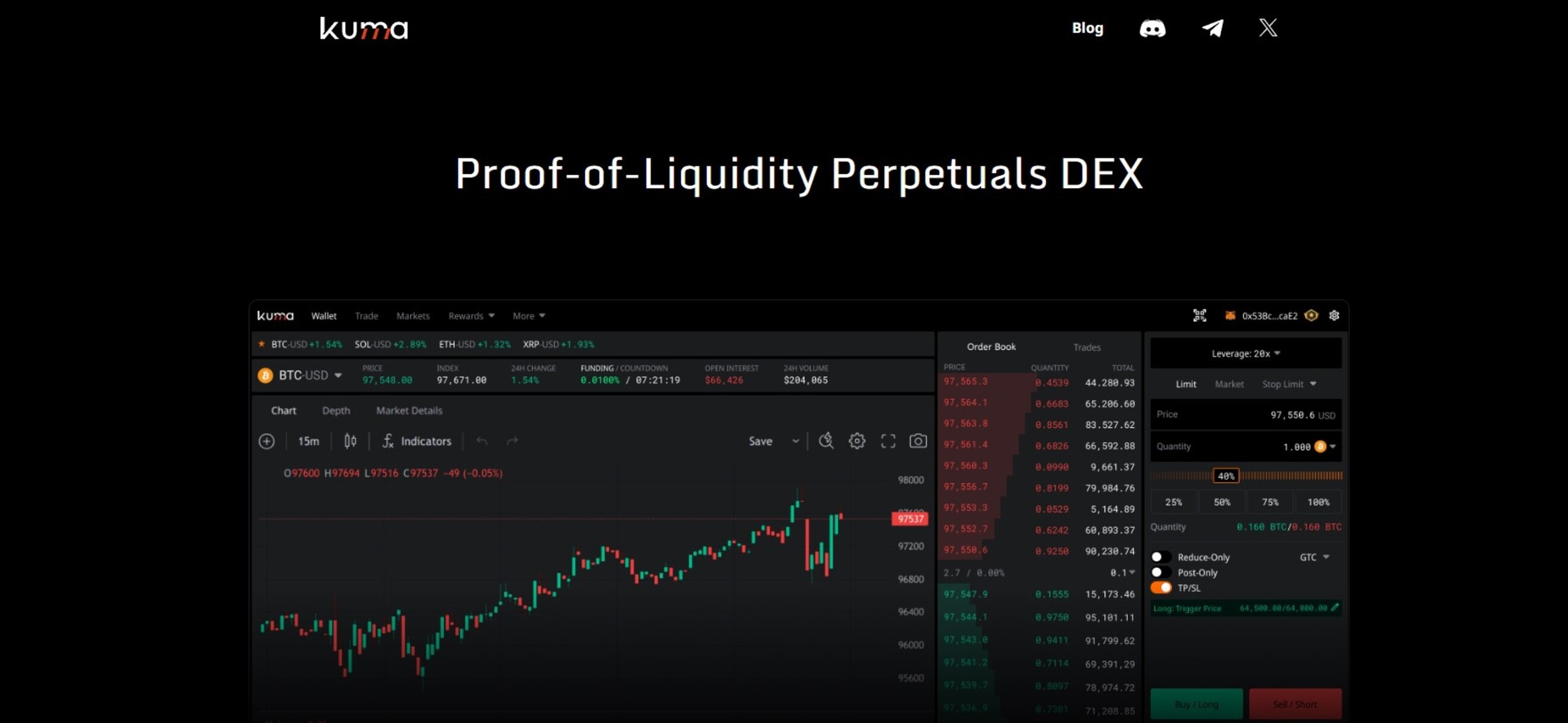

9. Kuma (previously IDEX) – Finest hybrid decentralized trade

Kuma combines on-chain settlement with an off-chain matching engine to allow quick, environment friendly buying and selling. This hybrid mannequin permits customers to commerce ERC-20 tokens with low latency whereas sustaining self-custodial management of their funds.

The DEX helps restrict, market, and superior order sorts, providing options just like conventional centralized exchanges. Kuma executes trades off-chain for pace after which settles them on-chain to make sure transparency and verifiability.

Professionals of Kuma (previously IDEX)

Hybrid mannequin combining off-chain matching with on-chain settlementSuperior order sorts, together with restrict and market ordersDecrease fuel prices on supported Layer 2 networks

Cons of Kuma (previously IDEX)

Primarily restricted to Ethereum and Layer 2 tokensOff-chain matching introduces dependency on Kuma infrastructure

10. ApeSwap – Finest decentralized trade for multi-chain DeFi

ApeSwap is constructed on the BNB Chain and affords token swaps, liquidity provision, and yield farming via an AMM mannequin. The platform gives quick and low-cost transactions for BEP-20 tokens and has expanded to help different chains, enabling multi-chain DeFi entry.

Professionals of ApeSwap

Low-cost token swaps on BNB Chain and different supported networksAMM-based liquidity swimming pools with fee-earning alternativesStaking, yield farming, NFT, and launchpad options

Cons of ApeSwap

Primarily targeted on BNB Chain and BEP-20 tokensLiquidity depth varies throughout buying and selling pairs and chains

What Is a Decentralized Crypto Alternate (DEX)?

A decentralized crypto trade is a peer-to-peer market that lets customers commerce cryptocurrencies instantly from their wallets with out counting on intermediaries. In contrast to centralized exchanges (CEXs), which maintain person funds and match orders on their servers, DEX crypto exchanges use good contracts to automate swaps.

This non-custodial mannequin provides customers full management of their non-public keys, decreasing the chance of hacks or platform failures. Advantages of DEXs embody enhanced privateness, since many don’t require Know Your Buyer (KYC) or Anti-money Laundering (AML) verification.

Additionally they present censorship resistance and world entry, aligning with crypto’s decentralized ethos. Nonetheless, DEXs face challenges equivalent to excessive fuel charges on congested networks, decrease liquidity for area of interest tokens, and front-running dangers by way of MEV (Miner Extractable Worth).

DEX vs CEX: Key Variations Defined

DEXs and CEXs are two main methods to commerce cryptocurrencies, however they function otherwise. Right here’s a side-by-side comparability:

FeatureDEXCEXCustodyCustomers retain management of personal keysAlternate holds customers’ fundsOrder ExecutionAutomated by way of good contractsMatched off-chain by the platformLiquidityRelies on liquidity swimming poolsOften excessive, supported by the platformChargesCommunity/fuel charges; buying and selling charges could differPlatform charges; no fuel for customersPrivatenessNo KYC requiredKYC verification requiredSafety DangersProtocol dangers, good contract vulnerabilitiesPlatform hacks, custodial threatBuying and selling OptionsRestricted derivatives; principally spot buying and sellingSuperior instruments, together with margin, derivatives, and lending.AccessibilityWorld, permissionlessMight limit some nationsExamplesCurve Finance, Uniswap, and dYdX.Binance, Bybit, and MEXC.

Why put money into decentralized crypto exchanges?

Decentralized exchanges are extra non-public and safe than CEXs, making them good for long-term holding. Because you maintain and handle your non-public keys and your property, there isn’t a threat of shedding your stability to platform hacks. The one factor to be cautious of is protecting your keys secure as a result of anybody who has this key can use them to entry your account.

The best way to Use a Decentralized Alternate (Step-by-Step)

Step 1: Join Your Pockets

Open the DEX web site and join a appropriate self-custodial crypto pockets, equivalent to MetaMask, Belief Pockets, or Phantom. This lets you commerce instantly out of your pockets with out giving up custody of your funds.

Step 2: Choose Token Pair and Community

Select the tokens you wish to swap and the blockchain community you wish to use. Ensure that each tokens are supported on that community.

Step 3: Assessment Gasoline Charges and Slippage

Examine the community charges (fuel) for the transaction. Set your acceptable slippage tolerance to keep away from surprising value variations throughout execution, particularly for risky or low-liquidity tokens.

Step 4: Affirm and Execute the Swap

Double-check the small print, then verify the transaction in your pockets. As soon as accredited, the good contract executes the swap, and the tokens seem in your pockets after the transaction is finalized.

Advantages and Dangers of Utilizing Decentralized Exchanges

Advantages

Non-Custodial Management: On a DEX crypto trade, customers maintain their non-public keys, decreasing the chance of hacks, theft, or insolvency that may happen on centralized buying and selling platforms.Privateness and Anonymity: Most decentralized cryptocurrency exchanges don’t require customers to finish KYC or present private info. This protects person identification, making buying and selling extra non-public, and is especially helpful for people in areas with restrictive monetary rules.World Accessibility: Anybody with an web connection and a appropriate pockets can entry a DEX. There aren’t any geographical restrictions, and customers from nations excluded by CEXs can nonetheless commerce freely.Censorship Resistance: Transactions on a DEX are executed via good contracts on the blockchain. This implies no single entity can block trades, freeze accounts, or reverse transactions.Liquidity Provision Alternatives: Customers can contribute tokens to liquidity swimming pools and earn a portion of buying and selling charges. This permits for passive revenue whereas supporting the trade’s operations. Some DEXs additionally provide incentives, equivalent to native token rewards for liquidity suppliers.

Dangers

Sensible Contract Vulnerabilities: Any bug, flaw, or exploit within the contract can probably lead to lack of funds.Excessive Community Charges: Buying and selling on blockchain networks like Ethereum may be costly throughout congestion. Gasoline charges could typically exceed the worth of small trades, decreasing profitability for frequent or small-scale merchants.Slippage and Value Influence: When buying and selling low-liquidity tokens, the executed value can differ considerably from the anticipated value. Massive trades can transfer the market, inflicting slippage and probably greater prices.Restricted Buyer Assist: There’s normally no centralized help workforce. If a commerce fails as a result of community errors or should you ship tokens incorrectly, there may be little to no recourse.

Methodology: How We Selected the Finest Decentralized Alternate

To determine the very best decentralized exchanges, we reviewed 20 of the most well-liked decentralized exchanges throughout a number of blockchains. Our overview targeted on the components that affect person expertise, together with privateness, safety, liquidity, person expertise, and extra.

We thought of liquidity as a result of greater liquidity not solely reduces slippage but in addition permits trades to execute sooner and extra effectively. On the similar time, we examined the vary of supported tokens and networks, as platforms that function throughout a number of chains present customers with larger flexibility and buying and selling alternatives.

As acknowledged earlier, safety is one other essential issue. We examined whether or not every protocol had undergone skilled good contract audits and maintained a constant security report. Alongside this, we evaluated further options, together with derivatives buying and selling, staking, yield farming alternatives, and liquidity provision, since these choices add worth past primary token swaps.

Conclusion

Decentralized exchanges (DEXs) provide a safe method to commerce cryptocurrencies instantly out of your pockets. They mix privateness, self-custodial management, and world accessibility to ship clean and safe buying and selling experiences for crypto buyers.

Whereas they could not at all times match CEXs in liquidity or superior buying and selling options, DEXs excel in transparency, censorship resistance, and offering alternatives to discover the decentralized finance world.

Selecting the very best decentralized trade will depend on your buying and selling objectives, the crypto property you wish to commerce, and your consolation stage with blockchain networks and costs. However by understanding what every platform affords, you may navigate the decentralized ecosystem confidently and make knowledgeable selections.

FAQs

What’s the finest decentralized crypto trade?

The very best DEX will depend on your buying and selling wants. For spot buying and selling and token swaps, Uniswap or PancakeSwap are standard selections. For derivatives and perpetual futures, Hyperliquid or dYdX provide superior instruments and leverage. Contemplate components like supported property, charges, community, and person expertise when deciding.

Are Decentralized Exchanges Secure?

DEXs are typically secure as a result of they provide you extra management of your funds. Nonetheless, they depend on good contracts, which may have vulnerabilities. At all times verify for audited protocols and keep away from unverified tokens to scale back threat.

What are fuel charges on DEXs?

Gasoline charges are community transaction prices paid to blockchain validators. On networks like Ethereum, these charges may be excessive throughout congestion. Some DEXs on Layer 2 networks or various blockchains, like Binance Sensible Chain or Solana, provide a lot decrease charges.

Which decentralized trade has the bottom charges?

DEXs constructed on low-cost blockchains normally have the bottom charges. PancakeSwap (BNB Chain) and Raydium (Solana) are identified for quick trades with minimal transaction prices in comparison with Ethereum-based DEXs.