The MT4 value motion indicator strips away that complexity. As an alternative of calculating derivatives of value knowledge, it highlights what truly issues: help and resistance zones, swing highs and lows, and candlestick patterns that institutional merchants watch. This instrument doesn’t predict the longer term. It merely organizes value construction so merchants could make knowledgeable selections based mostly on what markets are doing proper now.

What the MT4 Worth Motion Indicator Truly Does

In contrast to oscillators that calculate mathematical formulation from closing costs, the MT4 value motion indicator identifies and marks key value ranges instantly on the chart. Consider it as automated sample recognition. The indicator scans latest value historical past—sometimes 50 to 200 candles relying on settings—and flags important swing factors the place value reversed or consolidated.

Some variations mark help and resistance zones utilizing horizontal strains at value ranges that rejected strikes a number of instances. Others establish candlestick patterns like pin bars, engulfing candles, or inside bars that always precede directional strikes. The higher ones mix each approaches, giving merchants a visible map of market construction.

The core logic is easy. When value makes the next excessive adopted by a decrease excessive, that’s a swing excessive—potential resistance. When value makes a decrease low adopted by the next low, that’s a swing low—potential help. The indicator automates what skilled merchants do manually: marking these pivot factors to know the place provide and demand confirmed up beforehand.

How Worth Motion Indicators Calculate Key Ranges

Most MT4 value motion indicators use a swing detection algorithm. The indicator appears to be like again a set variety of bars (the “lookback interval”) to establish native peaks and troughs. For a swing excessive, value should make a excessive that’s better than the bars each earlier than and after it. A 5-bar swing excessive means the center candle’s excessive exceeds two candles on either side.

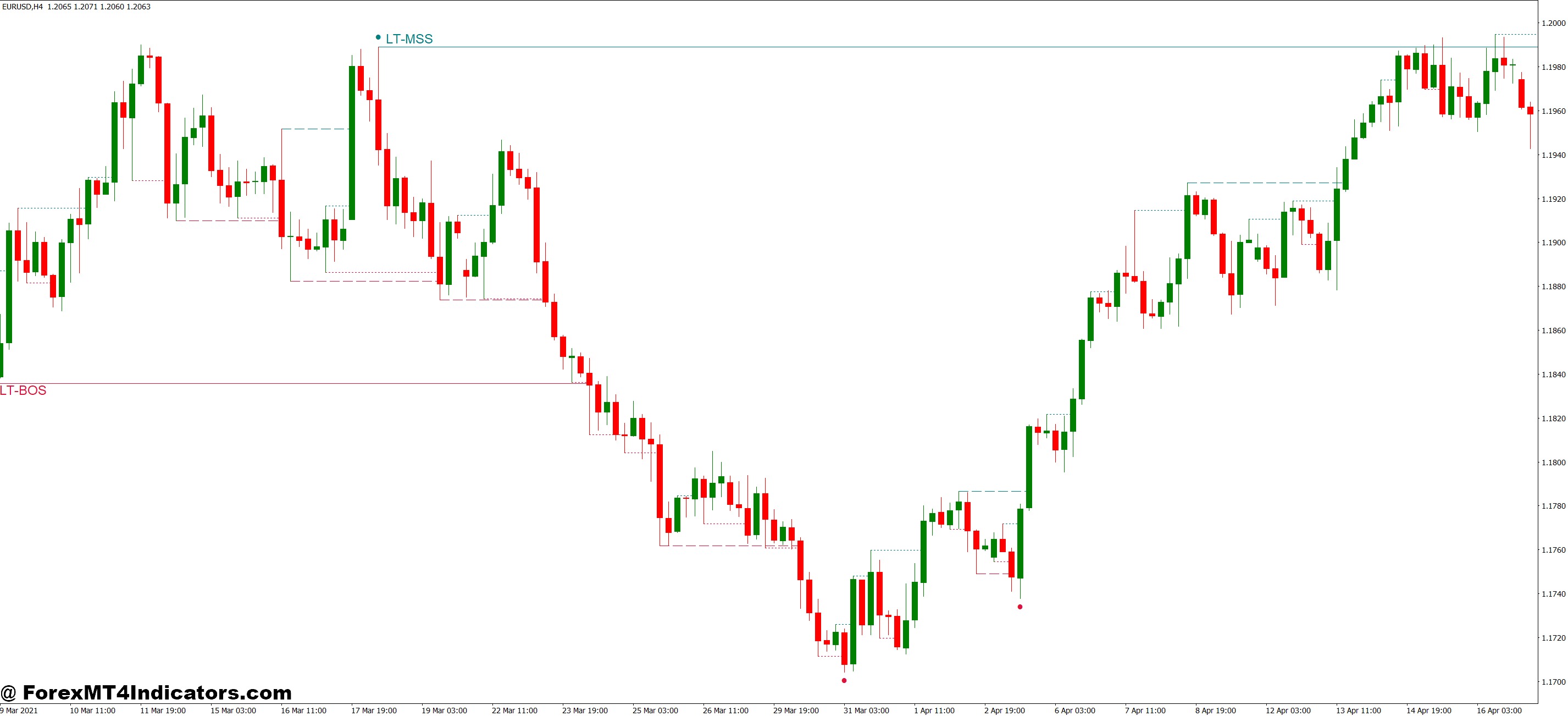

Right here’s the place it will get sensible. On a 4-hour GBP/USD chart with a 5-bar swing setting, the indicator may flag a swing excessive at 1.2750 from final Tuesday. That stage issues as a result of sellers beforehand overwhelmed consumers there. If value approaches 1.2750 once more, merchants look ahead to rejection—a clue that sellers may defend that zone once more.

The calculation for help and resistance zones varies. Some indicators draw rectangles round value clusters the place candles overlapped closely, indicating consolidation. Others use percentage-based proximity—if value touched inside 0.5% of a stage thrice in 100 bars, that’s a legitimate zone. The precise math issues lower than understanding the idea: these instruments establish the place value reminiscence exists.

Superior variations incorporate candlestick sample recognition. They scan for particular formations—a pin bar requires a small physique with an extended wick (a minimum of 2:1 ratio), positioned within the outer third of the full vary. When this sample varieties at a key help or resistance stage, the indicator generates an alert. That’s not a commerce sign. It’s a heads-up that value construction is exhibiting potential setup circumstances.

Actual Buying and selling Situations: The place This Device Shines

Testing this indicator on EUR/USD in the course of the September 2024 rally supplied clear examples. On the each day chart, the indicator marked swing lows at 1.0780 and 1.0820, zones the place value bounced a number of instances in August. When value pulled again to 1.0830 in early September, merchants watching these ranges had context—would this be one other bounce?

The indicator flagged a bullish pin bar at 1.0835 on September eleventh. The setup made sense: value examined help, rejected decrease, and closed close to the excessive. Merchants coming into lengthy at 1.0845 with stops beneath 1.0790 caught a 150-pip transfer to 1.1000 over the following week. The indicator didn’t predict that transfer. It merely highlighted favorable risk-reward construction at a confirmed help zone.

However the instrument isn’t magic. That very same month, GBP/JPY chopped sideways between 190.00 and 192.50 for 2 weeks. The indicator marked each ranges as legitimate help and resistance—which they had been. However value whipsawed between them each day, triggering six false breakout indicators. Merchants taking each setup acquired chopped up. The lesson? Worth motion indicators work finest in trending markets or at main swing extremes, not throughout tight consolidation.

On the 1-hour chart, the indicator helps with intraday timing. Throughout NFP releases, value usually spikes then retraces to a swing stage earlier than making the true transfer. In October 2024, USD/CAD spiked from 1.3580 to 1.3630 on sturdy jobs knowledge, then pulled again to check 1.3600—a swing stage the indicator had marked from earlier that week. The rejection at 1.3600 supplied a cleaner entry than chasing the preliminary spike.

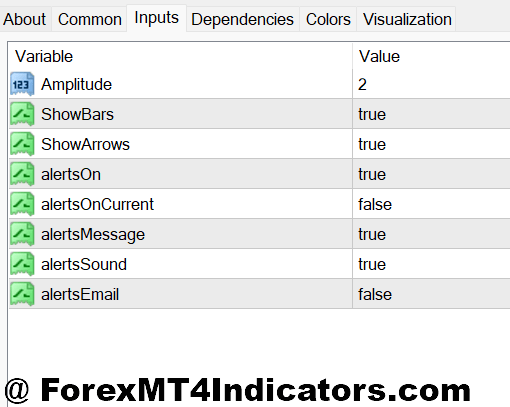

Customizing Settings for Totally different Types

The lookback interval determines what number of latest candles the indicator analyzes. Shorter intervals (20-50 bars) establish near-term swings, helpful for scalpers and day merchants. Swing merchants desire 100-200 bars to deal with weekly or month-to-month pivots. There’s no “appropriate” setting—it is determined by holding time desire.

For GBP/USD on the 15-minute chart, a 30-bar lookback identifies swing ranges from the previous seven to eight hours—related for London session merchants. The identical 30-bar setting on a each day chart appears to be like again six weeks, extra acceptable for place merchants. Matching the lookback to buying and selling timeframe prevents the indicator from cluttering charts with irrelevant ranges.

The swing sensitivity setting controls how strict the pivot detection is. A 3-bar swing (value should exceed one bar on either side) generates extra ranges however consists of minor fluctuations. A ten-bar swing (5 bars on either side) produces fewer, extra important pivots. Newbies usually begin with decrease sensitivity, then improve it as they study to differentiate main from minor construction.

Coloration coding helps. Some merchants set main help in inexperienced, main resistance in purple, and minor ranges in grey. Others use zones as a substitute of strains—a 10-pip rectangle round every stage accounts for unfold and slippage. On risky pairs like XAU/USD (gold), wider zones (20-30 pips) make extra sense than precise strains.

Alert settings deserve consideration. Too many notifications create noise and result in alert fatigue. Setting alerts just for value approaching main swing ranges or confirmed candlestick patterns retains indicators actionable. The aim is relevance, not fixed pings.

Benefits Over Lagging Indicators

The first profit is immediacy. Transferring averages lag by definition—a 20-period EMA displays the place value was 10 intervals in the past. Worth motion indicators reply to present construction. When GBP/USD varieties a pin bar at 1.2650, that info is accessible now, not three candles later after an oscillator crosses a threshold.

Visible readability issues too. As an alternative of deciphering whether or not RSI at 45 is bullish or bearish, merchants see direct proof: value rejected at prior resistance. That’s concrete. There’s much less ambiguity, which reduces emotional decision-making. Newer merchants particularly profit from this directness—they’re studying market footprints, not mathematical transformations of footprints.

These indicators additionally work throughout all timeframes with out adjustment. The identical rules of help and resistance apply whether or not analyzing a 5-minute or month-to-month chart. That universality helps merchants keep constant evaluation no matter buying and selling fashion. An oscillator may want completely different settings for various timeframes; value construction doesn’t.

Limitations Each Dealer Ought to Perceive

Worth motion indicators are reactive, not predictive. They present the place value reversed earlier than, not the place it’s going to reverse subsequent. That’s essential. Markets evolve. A help stage that held thrice may break on the fourth take a look at. The indicator can’t forecast that change—it solely is aware of historic knowledge.

Throughout ranging markets, these instruments generate extreme indicators. When EUR/JPY bounces between 160.00 and 162.00 for weeks, the indicator marks each ranges as legitimate. And they’re. However taking each contact leads to dozens of small losses from failed breakouts. The indicator wants context from greater timeframe tendencies or basic catalysts to filter high quality setups.

False patterns create issues. A candlestick may appear to be an ideal pin bar however type throughout ultra-low quantity Asian hours when value drifts randomly. The indicator flags it mechanically as a result of the geometry matches—lengthy wick, small physique. However that sample lacks the conviction of 1 shaped throughout London-New York overlap with actual quantity behind it. Merchants should add discretion.

Subjectivity nonetheless exists. What constitutes a “main” versus “minor” swing stage? The indicator makes use of mathematical standards, however merchants finally determine which ranges benefit consideration. Two merchants utilizing similar settings may interpret outcomes otherwise based mostly on their broader market evaluation. That’s not a flaw—it’s the character of discretionary buying and selling.

How It Compares to Different Approaches

Fibonacci retracement instruments and value motion indicators overlap conceptually—each establish potential reversal zones. However Fibonacci requires manually drawing from swing excessive to swing low, whereas value motion indicators automate stage detection. The tradeoff: Fibonacci ranges usually align with psychological spherical numbers (like 1.3000 on USD/CAD), whereas indicator-generated ranges may land at 1.3047—technically legitimate however much less watched by the broader market.

Conventional help and resistance indicators draw horizontal strains at latest highs and lows. Worth motion indicators go additional by incorporating candlestick sample recognition and zone width calculations. They’re extra nuanced but in addition extra complicated. For merchants preferring simplicity, manually marking ranges could be clearer.

Ichimoku Cloud supplies dynamic help and resistance that adjusts with value motion. Worth motion indicators sometimes use static ranges—as soon as drawn, they don’t transfer except value creates new swing factors. Static ranges provide consistency (you recognize the place to look at), whereas dynamic methods adapt to altering volatility. Neither method is superior; they serve completely different philosophies.

Tips on how to Commerce with MT4 Worth Motion Indicator

Purchase Entry

Watch for bullish pin bar at help – Enter 2-5 pips above the pin bar excessive when value rejects a marked help zone on EUR/USD 4-hour chart, with cease loss 5 pips beneath the pin bar low for tight risk-reward.

Affirm the swing low maintain – Solely take lengthy entries after value assessments a swing low stage marked by the indicator a minimum of twice and bounces; single touches on GBP/USD usually fail throughout ranging circumstances.

Examine greater timeframe alignment – Earlier than coming into on 1-hour bullish indicators, confirm the each day chart exhibits value above a significant swing help zone; counter-trend trades in opposition to each day construction have 60-70% failure charges.

Enter on bullish engulfing at resistance-turned-support – When value breaks above resistance, anticipate a pullback to that stage the place a bullish engulfing candle varieties, then enter 3 pips above candle shut with 30-40 pip cease loss.

Keep away from purchase indicators throughout main resistance clusters – Skip lengthy entries when the indicator exhibits 3+ resistance ranges inside 20 pips above present value on EUR/USD; value sometimes stalls and reverses in these zones.

Measurement down throughout Asian session setups – Minimize place dimension by 50% for purchase indicators that type between 11 PM – 5 AM EST when quantity is skinny and value motion patterns produce extra false breaks.

Path stops to breakeven after 20 pips – As soon as a purchase entry strikes 20 pips in revenue, transfer cease loss to entry value to get rid of threat; value motion setups usually retrace 40-50% earlier than persevering with.

Require momentum affirmation above 1.5% each day vary – Don’t take purchase indicators on days when EUR/USD has moved lower than 60 pips whole; low volatility days produce weak follow-through even on legitimate patterns.

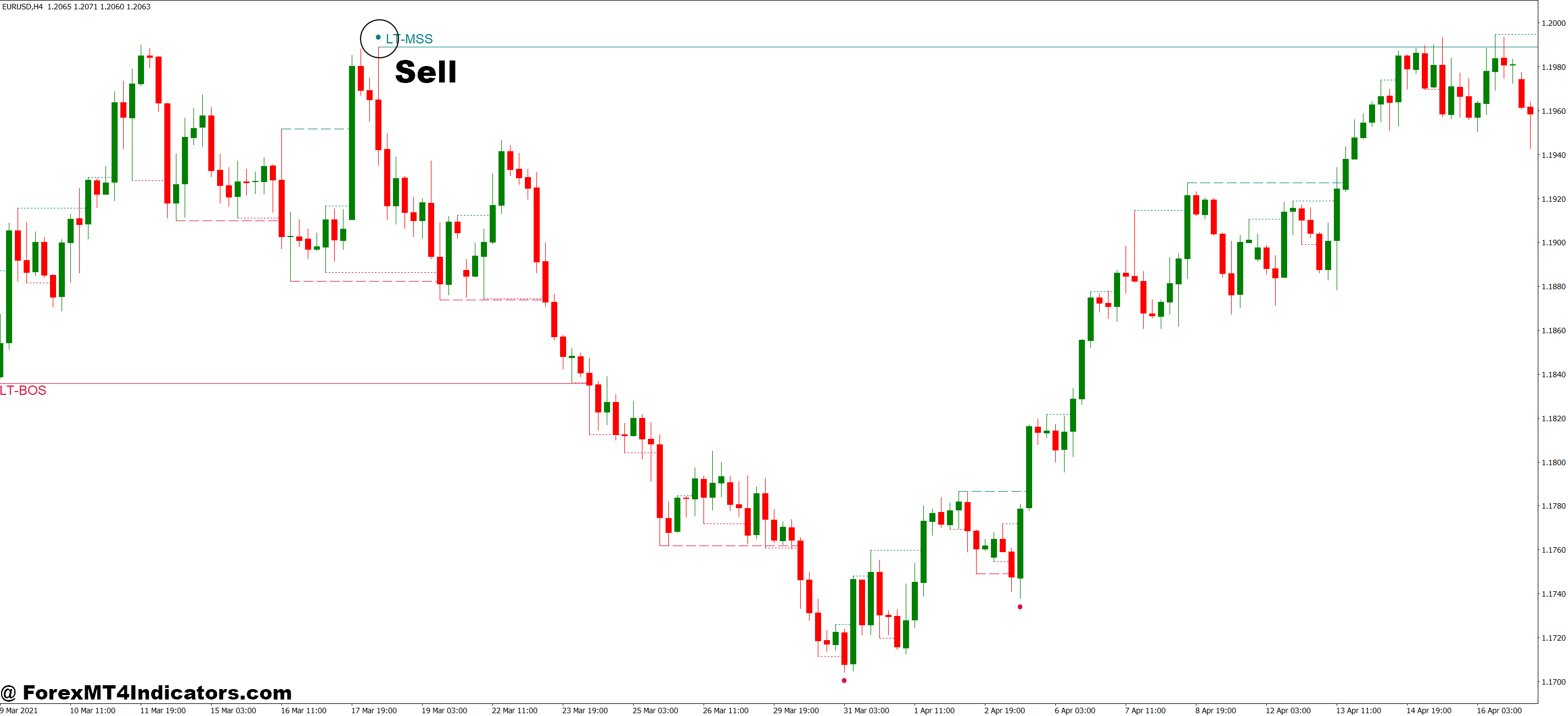

Promote Entry

Enter beneath bearish pin bar at resistance – Promote 2-5 pips beneath the pin bar low when value rejects indicator-marked resistance on GBP/USD 4-hour chart, putting cease loss 5 pips above the wick excessive.

Watch for double-top rejection affirmation – After value assessments resistance twice and varieties decrease excessive, enter brief on break beneath the valley between peaks with cease 15 pips above second rejection level.

Confirm downtrend on each day earlier than shorting – Solely take 1-hour promote indicators when each day chart exhibits value beneath main swing resistance; buying and selling in opposition to each day development course reduces win fee to 35-40%.

Promote bearish engulfing at damaged help – When help breaks, anticipate value to rally again and type bearish engulfing candle at former support-turned-resistance, then brief 3 pips beneath candle shut.

Skip promote indicators close to main help clusters – Keep away from shorting when indicator exhibits 3+ help ranges inside 20 pips beneath value on EUR/USD; these zones sometimes produce sturdy bounces that cease out sellers.

Cut back dimension by 50% earlier than high-impact information – Don’t take full place brief entries inside half-hour of NFP, CPI, or central financial institution bulletins; value motion patterns fail throughout risky whipsaws.

Transfer cease to breakeven after 25 pips revenue – Defend brief positions by adjusting cease loss to entry as soon as commerce features 25 pips; resistance rejections usually see 30-40% retracements earlier than persevering with down.

Ignore promote indicators throughout Friday afternoon – Keep away from new brief entries after 12 PM EST on Fridays when liquidity dries up and Monday gaps often reverse Friday’s late-session strikes by 40-60 pips.

Key Takeaways for Implementation

The MT4 value motion indicator works finest when merchants perceive its objective: organizing market construction visually to help knowledgeable selections. It identifies the place provide and demand beforehand appeared, giving context for present value motion. That context helps assess risk-reward, not predict future course. Merchants utilizing this instrument ought to deal with main swing ranges throughout trending circumstances whereas staying selective throughout consolidation. Combining the indicator with quantity evaluation, greater timeframe context, or basic consciousness improves outcomes past utilizing it in isolation. The actual worth comes from sample recognition—seeing how value behaves at key ranges repeatedly—which builds instinct over time. That’s one thing no automated instrument can shortcut, although this indicator actually accelerates the educational course of.

Beneficial MT4/MT5 Dealer

XM Dealer

Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

Deposit Bonus as much as $5,000

Limitless Loyalty Program

Award Successful Foreign exchange Dealer

Extra Unique Bonuses All through The Yr

Unique 90% VIP Money Rebates for all Trades!

>> Signal Up for XM Dealer Account right here with Unique 90% VIP Money Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Accomplice Code: VIP90