Gold forecast tilts to the upside as US inflation information exhibits core CPI cooling.

The greenback stays underneath strain amid considerations concerning the Fed’s independence.

Central financial institution shopping for stays a significant component, limiting the draw back for gold.

Gold (XAU/USD) has surged to contemporary report highs as markets lean tougher into the view that the Federal Reserve will begin chopping charges later this 12 months. Spot gold jumped to round $4,634 earlier than easing towards the $4,590 space. The transfer extends a strong 12-month rally, with bullion up roughly 70% over the interval, supported by persistent geopolitical dangers and a shift in international financial circumstances.

–Are you curious about studying extra about foreign exchange instruments? Verify our detailed guide-

The rapid catalyst was softer US inflation information. Headline CPI rose 0.3% month?on?month and a pair of.7% 12 months?on?12 months in December, according to expectations, however core CPI slowed to 0.2% month?on?month and a pair of.6% 12 months?on?12 months, under the 0.3% and a pair of.7% forecasts. This bolstered expectations that the Fed can pivot towards easing with out reigniting inflation. Decrease or anticipated decrease coverage charges scale back the chance value of holding non-yielding gold, making the XAU/USD extra engaging relative to bonds and money.

Political strain is amplifying that narrative. After the CPI launch, US President Donald Trump reiterated requires Fed Chair Jerome Powell to chop charges “meaningfully,” questioning his competence and integrity. Powell’s time period ends in Could, and the mix of looming management uncertainty and public assaults on the Fed provides to considerations over coverage independence. That uncertainty tends to weaken confidence within the US greenback and bolster demand for safe-haven property, equivalent to gold.

Past the cyclical story, structural demand stays robust. Central banks have been massive web consumers, diversifying away from greenback property amid sanctions danger, rising fiscal deficits, and broader geopolitical fragmentation. Inflation is slowing down, however actual yields are anticipated to fall, and political danger is excessive. Because of this the background stays favorable for XAU/USD. So long as expectations for the Fed to ease in 2026 keep the identical, dips are prone to appeal to extra strategic and tactical shopping for.

Gold Technical Forecast: Patrons Taking a look at $4,700

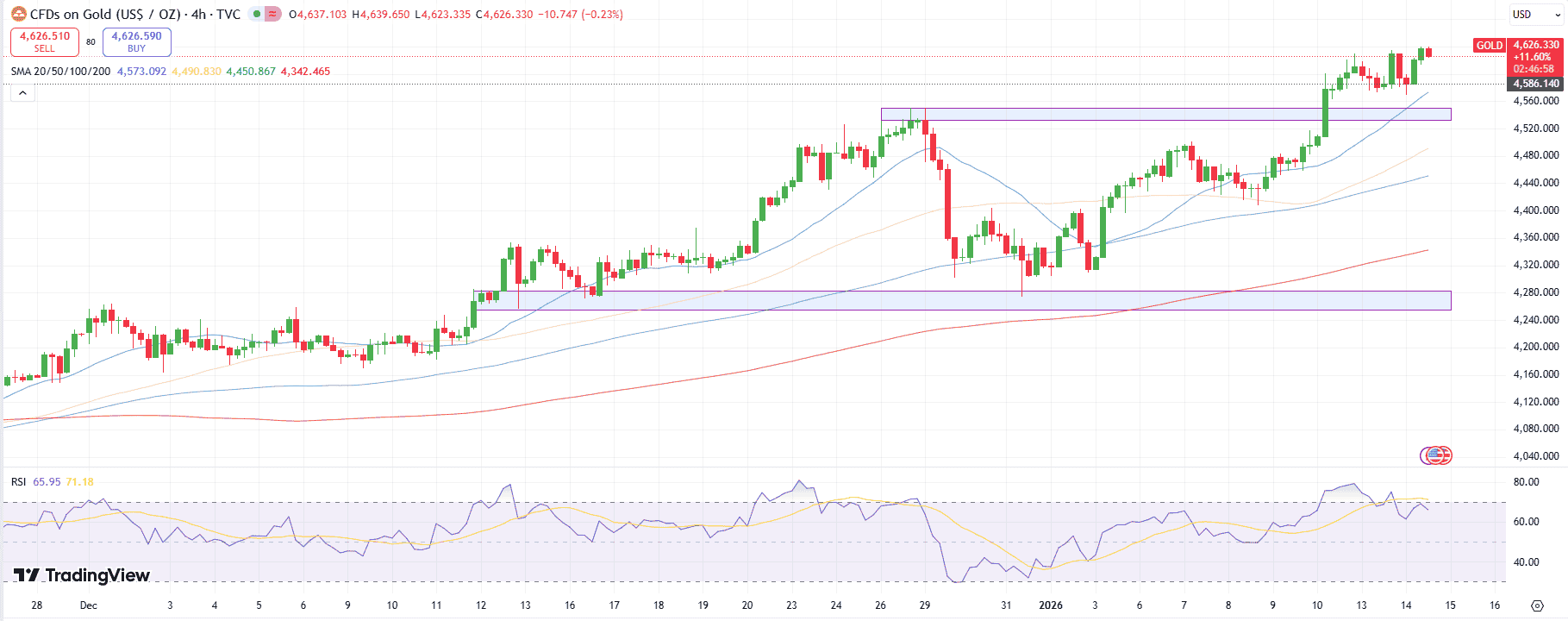

On the 4-hour chart, XAU/USD trades close to $4,626, comfortably above the 20-period MA ($4,573) and 50-period MA ($4,491), confirming bullish momentum. Rapid resistance lies at $4 640-45. A decisive break would open a run towards $4,700. Key help sits on the 20-period MA zone round $4,560-70, adopted by the 200-period MA at $4,342.

–Are you curious about studying extra about the most effective crypto change? Verify our detailed guide-

MAs stacked one on prime of one other reveal bullishness. RSI at 66 indicators approaching overbought territory, however nonetheless leaves room to increase features. Anticipate dips to $4,560 as shopping for alternatives; keep a bullish bias above $4,560, with stops under $4,550.

Trying to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must think about whether or not you’ll be able to afford to take the excessive danger of dropping your cash.