Each day Information Nuggets | At present’s prime tales for gold and silver buyers January fifteenth, 2026

Metals Rally Hits New Data Amid International Turmoil

Uncertainty is in all places proper now, and metals are thriving. Gold blasted previous $4,600 per ounce this week whereas silver hit a recent all-time excessive above $90.

The surge got here as geopolitical tensions boiled over. The U.S. captured Venezuelan chief Nicolas Maduro. Widespread protests in Iran turned lethal. Trump’s threats of army motion despatched buyers scrambling for security.

The chaos extends to Washington. The Justice Division launched a legal investigation into Fed Chair Jerome Powell. The probe targets price overruns on a headquarters renovation. Powell referred to as it a “pretext” for political stress on rates of interest.

This issues: Fed independence is now brazenly questioned. Institutional stability seems fragile. Traders are voting with their capital.

Gold is up 7% year-to-date. Silver has surged 26%. Each metals are capitalizing on provide constraints, geopolitical chaos, and eroding belief in establishments.

The Monetary System Isn’t Safer — And You Know It As dangers mount, see why gold and silver are projected to maintain shining in 2026 and past.

New Silver Buying and selling Guidelines Might Push Costs Larger

The CME simply made it costlier to commerce silver futures. Margin necessities shifted from mounted quantities to percentages this week. Merchants now must submit 9% of contract worth as collateral.

The change hits leveraged gamers hardest. As costs rise, collateral necessities mechanically enhance. That squeezes brief sellers. It may power liquidations amongst overleveraged merchants.

Bodily consumers aren’t affected. This solely applies to paper contracts.

The basics nonetheless assist larger costs. China’s export licensing is constraining provide. Industrial demand stays elevated. The market is operating a structural deficit.

Silver crossed $90 this week and sits 26% larger in 2026. With provide tight and geopolitical dangers rising, $100 per ounce seems more and more practical.

Trump Says “No Plans” to Take away Powell (For Now)

President Trump informed Reuters Wednesday he has no plans to fireside Jerome Powell. However he added it’s “too early” to say what he’ll in the end do. The 2 are in a “holding sample.”

Powell’s time period as Fed chair expires in Could. His seat on the Board of Governors runs by way of 2028. Trump floated names like Kevin Warsh or Kevin Hassett as potential replacements.

The assertion comes amid the continuing DOJ investigation into Powell. It additionally follows months of public criticism from Trump over rates of interest. The president needs sooner and deeper cuts than the Fed has delivered.

Nonetheless, you might wish to ttake this with a grain of salt. Trump has reversed course on Powell earlier than. The market is pricing only a 5% probability of a charge minimize on the Fed’s January assembly.

Investing in Bodily Metals Made Simple

Inflation Appears to be like Tame, However There’s a Catch

The headline appeared reassuring: CPI inflation got here in at 2.7% in December. Core CPI — which excludes meals and power — eased to 2.6%, barely beneath expectations.

However customers aren’t feeling aid. Meals costs jumped 0.7% in December. That’s the biggest month-to-month enhance in over two years. Grocery inflation now runs at 3.1% yearly. You can’t decide out of consuming.

Right here’s the disconnect most headlines miss. The Fed doesn’t set coverage based mostly on CPI. It watches PCE (Private Consumption Expenditures) as an alternative.

CPI makes use of a set basket of products. It locations heavy weight on housing prices. PCE adjusts as customers change their spending habits. It captures a broader vary of bills. That features healthcare paid on customers’ behalf. This flexibility makes PCE look cooler than CPI over time.

The Fed emphasizes core PCE. That strips out risky meals and power costs totally. It could make inflation simpler to handle on paper. However it’s chilly consolation for households paying extra for groceries, gasoline, and insurance coverage.

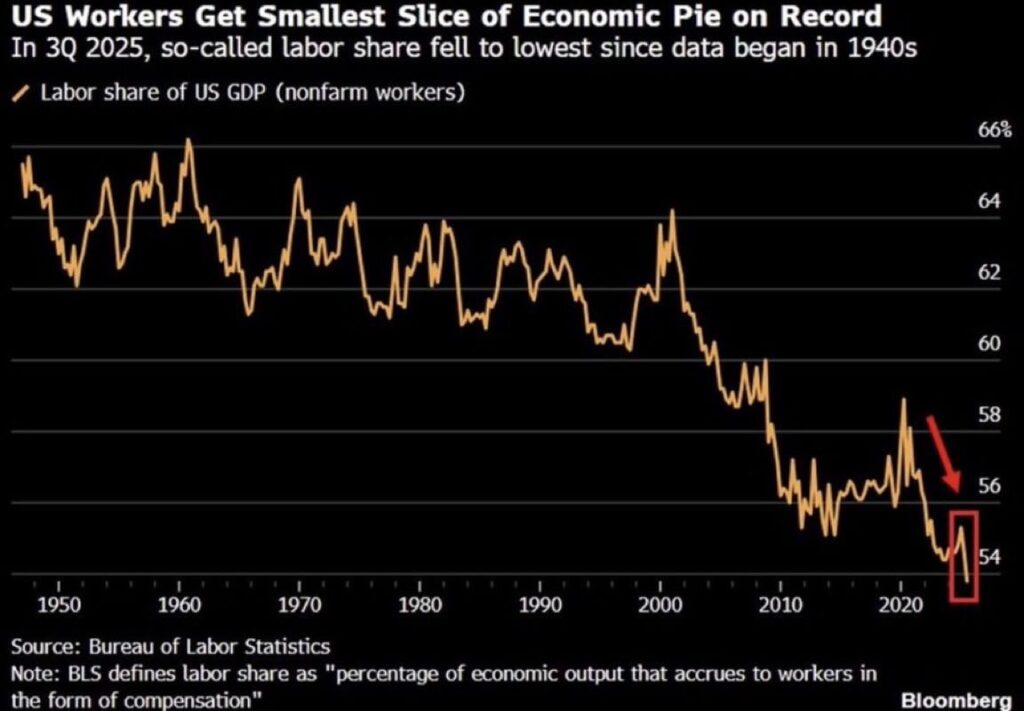

Staff Getting Report-Low Share of GDP

Right here’s a stark quantity: staff captured simply 54% of GDP in Q3 2025. That’s the smallest slice for the reason that authorities began monitoring this information within the Forties.

Labor share measures how a lot financial output goes to staff versus capital and earnings. Proper now, lower than ever is flowing to paychecks.

The decline has been brutal since 2000. The monetary disaster accelerated it, and the pattern has continued downward.

Why it issues: this isn’t nearly equity. When staff earn much less of what they produce, client spending weakens. Inequality grows. Financial fragility will increase.

For many years, labor claimed round 63% of GDP. Now it’s all the way down to 54%. That’s an enormous wealth switch from staff to capital.

This creates long-term dangers. Client spending drives 70% of the U.S. financial system. If staff hold shedding floor, progress turns into unsustainable.