Each day Information Nuggets | Right this moment’s high tales for gold and silver buyers January sixteenth, 2026

Metals Pause After the Dash

Gold and silver costs are pulling again at the moment after weeks of sturdy positive aspects. Gold is down about 1.5% on the time of writing, whereas silver is off roughly 5%.

Investing in Bodily Metals Made Simple

That sort of transfer would possibly sound dramatic. In context, it’s not. Valuable metals have surged over the previous a number of weeks, and short-term profit-taking is regular after sharp positive aspects. Markets not often transfer in straight strains.

Silver’s transfer stands out, however perspective issues. Even after at the moment’s drop, silver stays up about 24% 12 months to this point. That’s a strong efficiency for an industrial steel that’s additionally handled as a financial hedge.

Pullbacks like this usually reset momentum slightly than finish traits. They’ll cool overheated positioning and entice new consumers who missed the preliminary rally. For buyers, the important thing query isn’t at the moment’s dip — however whether or not the forces that drove metals greater have really modified.

Thus far, they haven’t. A kind of forces stays as sturdy as ever.

Central Banks Purchase Gold Regardless of Report Costs

Central banks are rewriting the foundations of reserve administration. And gold is at the middle.

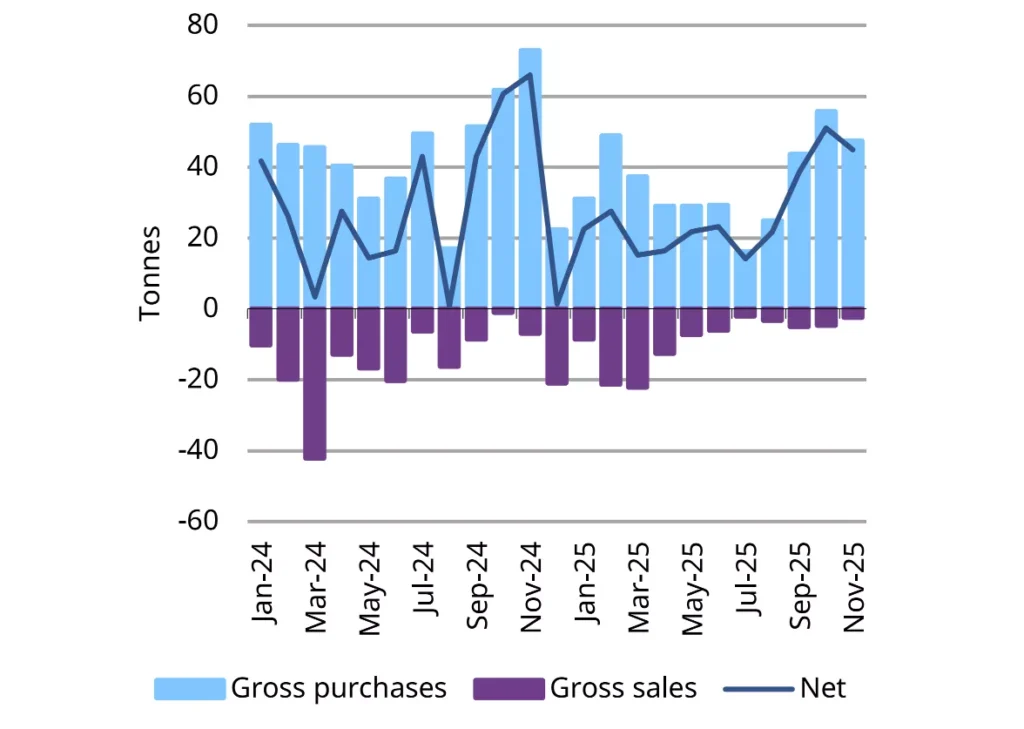

Institutional shopping for hit 45 tonnes in November, pushing year-to-date purchases to 297 tonnes. The chart tells the story clearly. Gross purchases are trending greater. Product sales stay minimal.

Central financial institution shopping for has accelerated in latest months

Month-to-month reported central financial institution exercise, tonnes* *Knowledge to 30 November 2025, the place out there. Supply: IMF, respective central banks, World Gold Council

Poland, Brazil, and China proceed to dominate. Surveys present 95% of central banks count on to extend gold reserves in 2026, with projected purchases round 755 tonnes.

That’s effectively above the pre-2022 common of 400-500 tonnes. It’s additionally a transparent sign. Central banks are diversifying away from dollar-denominated property, no matter gold’s value. They’re shopping for above $4,000 per ounce as a result of the purpose isn’t short-term positive aspects. It’s long-term stability.

For the gold market, this creates structural help. When the world’s largest establishments are constant consumers, it units a ground. And that issues greater than any single day’s value motion.

That stability is a part of gold’s attraction — and it exhibits up in sudden methods.

The Monetary System Isn’t Safer — And You Know It As dangers mount, see why gold and silver are projected to maintain shining in 2026 and past.

Trump’s First Oil Sale Goes to Marketing campaign Donor

Certainly one of Trump’s greatest donors simply secured a stake within the first U.S. sale of Venezuelan oil.

John Addison, a senior dealer at Vitol, gave roughly $6 million to Trump-aligned PACs in the course of the 2024 marketing campaign. Final week, he attended a White Home assembly the place Trump outlined his plans for Venezuela. Days later, Vitol — together with Trafigura — purchased $500 million value of Venezuelan crude.

U.S. forces detained Venezuela’s president, Nicolás Maduro, earlier this month. Trump says the U.S. will management the nation’s oil trade and promote as much as 50 million barrels. Critics are questioning the optics of main donors making the most of the deal.

World Gold Council CEO Shares Ideas on Gold Rally

Geopolitical uncertainty — from Venezuela to elsewhere — is driving gold’s present rally.

In a wide-ranging dialog, former World Gold Council CEO David Tait breaks down why gold’s bull market seems to be removed from completed. Tait factors to a uncommon alignment of forces: central financial institution shopping for, rising geopolitical danger, and rising mistrust in fiscal and financial coverage.

Not like previous cycles pushed primarily by Western buyers, at the moment’s demand is world and structural. Gold isn’t reacting to a single headline — it’s responding to a elementary shift in how governments, establishments, and buyers take into consideration cash and danger.