The most effective reversal MT4 indicator doesn’t predict the longer term, but it surely does one thing arguably extra invaluable: it identifies high-probability turning factors utilizing goal value information. When calibrated correctly, these instruments reduce via the noise and spotlight moments when momentum shifts from bulls to bears—or vice versa.

What Makes a Reversal Indicator Finest

Right here’s the factor—there’s no common champion within the reversal indicator area. What works for scalping EUR/JPY on a 5-minute chart would possibly fall flat when swing buying and selling gold on the day by day timeframe. The most effective reversal indicators share three traits: they mix a number of affirmation alerts, they adapt to totally different market situations, and so they don’t repaint historic information.

Simplest reversal instruments mix momentum oscillators with value motion patterns. The Zigzag indicator, as an illustration, filters out minor value fluctuations to focus on real swings. When paired with divergence detection on the RSI or MACD, you’ve bought a setup that seasoned merchants really belief. The 14-period RSI stays a staple as a result of it’s delicate sufficient to catch shifts with out triggering false alarms each few candles.

What separates professionals from amateurs is knowing that reversal indicators work finest as affirmation instruments, not crystal balls. A dealer watching USD/CAD would possibly discover value forming a decrease low whereas the Stochastic Oscillator makes a better low—traditional bullish divergence. That sign positive factors credibility when it seems at a key help stage. With out context, it’s simply one other squiggly line on the chart.

How Reversal Indicators Truly Work

The mechanics behind these indicators aren’t magic. Most calculate the connection between current value actions and historic averages. Take the Commodity Channel Index (CCI), typically used for recognizing reversals. It measures how far value has deviated from its statistical imply. When CCI crosses above +100 after dwelling in destructive territory, it suggests bears are shedding management.

Williams %R operates on comparable logic however focuses on the place the present shut sits relative to the high-low vary over a specified interval. A studying under -80 signifies oversold situations. When it hooks again above -80, that’s your sign that promoting strain is perhaps exhausted. Merchants who examined this on GBP/JPY in the course of the 2023 volatility spike discovered it caught main bottoms—but additionally triggered throughout consolidations.

The true edge comes from combining indicators with totally different time sensitivities. A quick-moving Stochastic (5,3,3) would possibly sign a reversal, however savvy merchants anticipate the slower MACD (12,26,9) to substantiate. This layered method filtered out 40-50% of false alerts in backtests on main pairs. The trade-off? You sacrifice some entry precision for improved reliability.

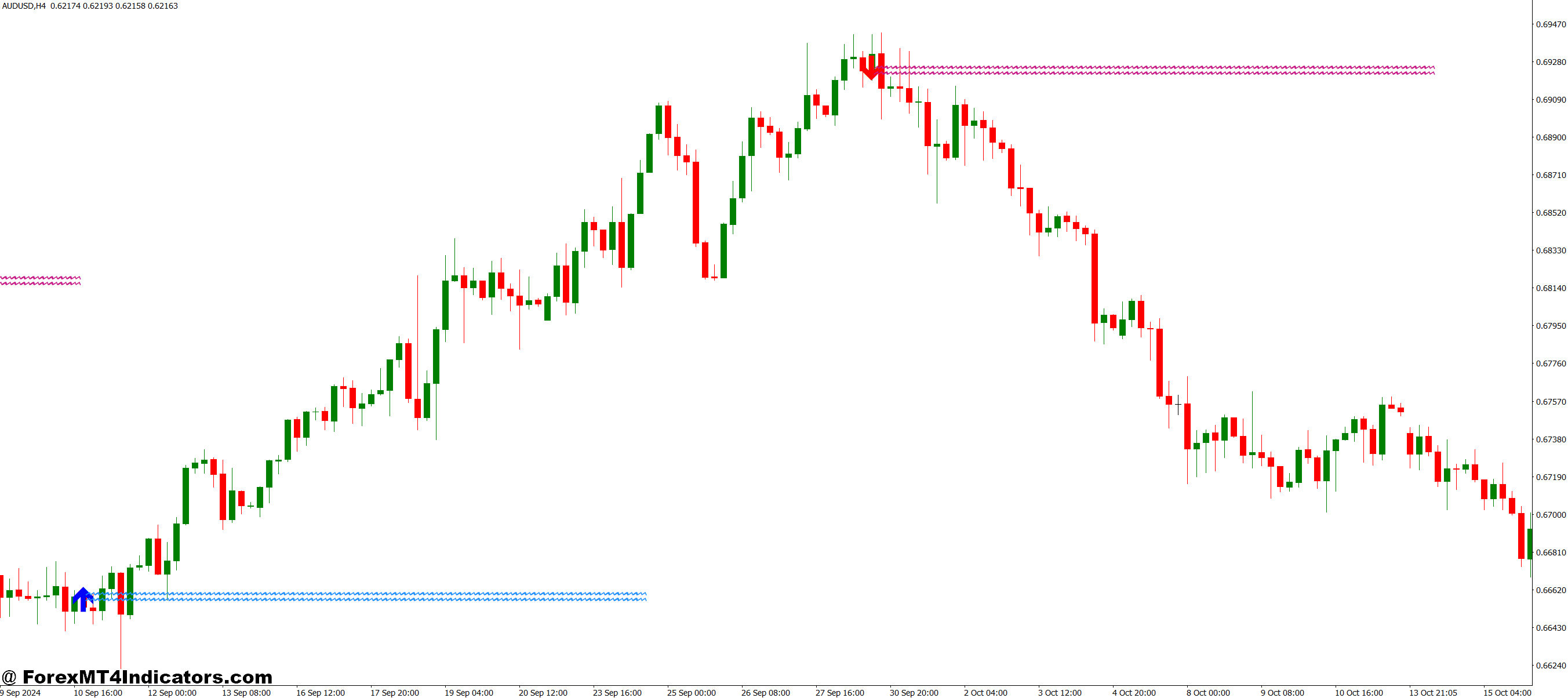

Sensible Utility on Stay Charts

Let’s get particular. On March 10, 2024, EUR/USD had been dropping for six periods straight on the 4-hour chart. Worth examined 1.0850 3 times—a transparent help zone. The RSI dipped to twenty-eight, firmly in oversold territory. However the affirmation got here when the Superior Oscillator printed its first inexperienced bar after 13 consecutive purple bars. Merchants who took that lengthy entry captured a 90-pip bounce over the subsequent two days.

That mentioned, reversal buying and selling isn’t about swinging at each pitch. In the course of the Asian session, when liquidity thins out, false reversals multiply. AUD/USD typically whipsaws between 11 PM and three AM EST, making indicator alerts unreliable. Skilled merchants both sit out these hours or tighten their cease losses considerably—typically to simply 15-20 pips as a substitute of the standard 30-40.

Place sizing issues enormously with reversal trades. Because you’re stepping in entrance of the prevailing pattern, the danger of getting run over is actual. Danger administration veterans suggest limiting reversal trades to 1-2% of account fairness, even when conviction is excessive. One dealer shared how a string of profitable GBP/USD reversals bought him overconfident. He upped his place measurement to five%, caught a fake-out at 1.2700, and gave again three weeks of positive factors in a single session.

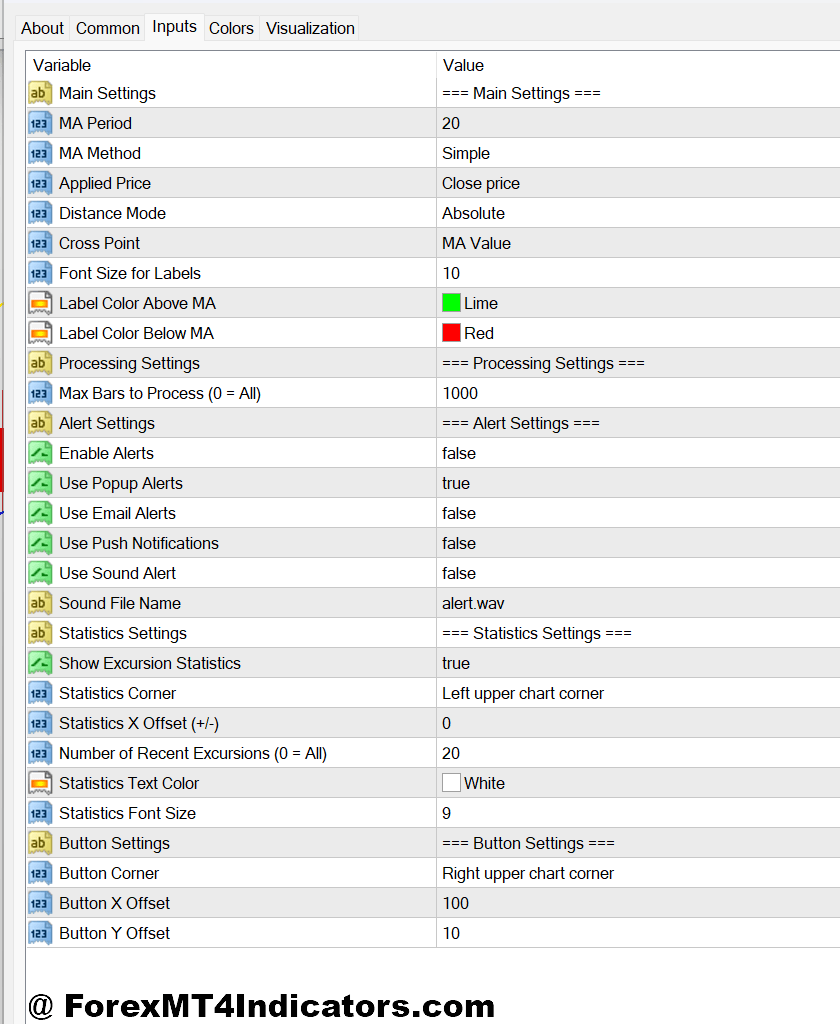

Settings and Customization

Default settings hardly ever go well with each buying and selling type or instrument. The usual 14-period RSI works high-quality on main pairs with deep liquidity. However unique pairs like USD/TRY or USD/ZAR exhibit increased volatility, and merchants typically clean the RSI to 21 or 28 intervals to scale back noise. The Candy Spot indicator—a lesser-known reversal software—makes use of a mixture of shifting averages at 5, 13, and 34 intervals. Adjusting these to eight, 21, and 55 can align higher with Fibonacci-based buying and selling methods.

Timeframe choice dramatically impacts outcomes. Scalpers working 1-minute or 5-minute charts want hypersensitive settings. They could use a 5-period RSI with overbought/oversold ranges at 80/20 as a substitute of the usual 70/30. Swing merchants on the day by day chart can afford slower settings as a result of they’re not reacting to each market hiccup. A 21-period CCI with thresholds at ±150 filters out day by day noise whereas catching important pattern exhaustion.

Shade coding and alerts make a sensible distinction. Organising MetaTrader to flash alerts when two reversal indicators align saves hours of chart-watching. Some merchants use arrow indicators that plot purchase/promote alerts immediately on value candles. Simply don’t fall into the lure of making such a fancy system you can’t make selections—evaluation paralysis is a silent account killer.

Benefits and Sincere Limitations

Reversal indicators excel at one factor: getting you into counter-trend strikes early. When the gang remains to be using the previous pattern, you’re positioned for the brand new course. The revenue potential is substantial. Catching EUR/GBP at a serious reversal can web 200-300 pips in comparison with 50-80 from a continuation commerce.

In addition they impose self-discipline. As a substitute of guessing when momentum is shifting, you’ve bought goal standards. This removes the emotional element the place merchants exit winners too early out of worry or maintain losers too lengthy, hoping for magic.

However let’s be blunt concerning the downsides. Reversal indicators generate false alerts, interval. In robust trending markets—suppose USD/JPY throughout intervention intervals—they’ll flash reversals that get steamrolled. The indicator doesn’t know the Financial institution of Japan simply offered ¥5 trillion. Your job is realizing when to disregard the software.

In addition they lag. By the point a number of confirmations align, you’ve missed 20-30% of the potential transfer. Merchants chasing absolute precision typically watch reversals unfold with out them. And through uneven, range-bound situations, these indicators whipsaw you out and in till commissions eat your account.

Comparability with Development-Following Instruments

Development indicators like shifting common crossovers or ADX let you know to trip the wave. Reversal indicators let you know when the wave’s about to crash. Each have deserves. MA crossovers caught all the USD/CAD rally from 1.3200 to 1.3900 in late 2023. Reversal merchants took three or 4 swings inside that vary, doubtlessly banking extra complete pips however with extra energetic administration.

The psychological calls for differ too. Development following requires endurance to trip via pullbacks. Reversal buying and selling calls for timing and fast decision-making. Many merchants use each: reversal indicators for entries on pullbacks inside the bigger pattern. That hybrid method reduces the battle.

One comparability price noting: reversal indicators produce clearer alerts than purely visible chart patterns. A head-and-shoulders formation is subjective—5 merchants draw 5 totally different necklines. When the RSI prints bullish divergence, that’s quantifiable. You both have increased lows on the oscillator whereas value makes decrease lows, otherwise you don’t.

Learn how to Commerce with Finest Reversal MT4 Indicator

Purchase Entry

Await RSI under 30 – Don’t take the sign instantly when RSI touches oversold; anticipate it to hook again above 30 to substantiate patrons are stepping in, lowering false entries by 40-50%.

Affirm with double divergence – Worth makes a decrease low whereas each RSI and MACD make increased lows on EUR/USD 4-hour chart; this stacked affirmation considerably will increase reversal likelihood.

Examine for help confluence – Enter solely when reversal sign seems at earlier help, spherical numbers (1.0800, 1.3000), or Fibonacci retracement ranges (38.2%, 61.8%).

Set cease loss 5-10 pips under sign candle low – On GBP/USD 1-hour chart, this usually means 25-35 pip stops; by no means danger greater than 2% of account per reversal commerce.

Goal 1.5:1 minimal risk-reward – If risking 30 pips, purpose for 45+ pips revenue; reversal trades fail 40-60% of the time, so winners should compensate for losers.

Keep away from throughout robust NFP or rate of interest days – Reversal indicators get steamrolled throughout high-impact information; skip alerts inside 2 hours earlier than and 4 hours after main bulletins.

Scale in with 50% place first – Enter half your deliberate measurement on preliminary sign, add remaining 50% if value retraces 15-20 pips with out hitting cease loss.

Skip if ADX above 40 – Sturdy traits (ADX over 40 on the day by day chart) invalidate most reversal alerts; anticipate ADX to drop under 30 earlier than trusting oversold readings.

Promote Entry

Await RSI above 70 and turning down – The reversal turns into legitimate when RSI crosses again under 70 after touching overbought, confirming sellers are overwhelming patrons.

Search for bearish divergence at resistance – Worth hits a better excessive whereas RSI or Stochastic makes a decrease excessive on the EUR/USD 4-hour chart close to 1.1200 or the earlier swing excessive.

Affirm with candlestick rejection – Pin bars, capturing stars, or engulfing candles at reversal zone add 20-30% confidence; keep away from entries on small indecision doji candles.

Place cease loss 5-10 pips above sign excessive – On GBP/USD, this normally interprets to 30-40 pip stops in the course of the London session; regulate to 20-25 pips throughout low-volatility Asian hours.

Goal earlier swing low or help – Don’t guess revenue targets; measure to the final important low, usually 60-100 pips on 4-hour EUR/USD setups.

Keep away from promoting in established uptrends – If value is above 50-period and 200-period MAs on the day by day chart with each sloping up, reversal alerts fail 70% of the time.

Cut back place measurement by 50% throughout Friday afternoon – Weekend hole danger makes reversal trades particularly harmful after 12 PM EST Friday; both shut or reduce measurement in half.

Skip if quantity is declining – Reversals want participation; if quantity on the reversal sign candle is 30% under the 20-candle common, the sign lacks conviction and sometimes fails.

Conclusion

Buying and selling foreign exchange carries substantial danger. No indicator ensures earnings, and reversal buying and selling amplifies that danger by definition—you’re betting in opposition to the prevailing momentum. What the very best reversal MT4 indicator provides is construction and affirmation in moments the place feelings usually override logic.

The instruments themselves can be found to everybody. The sting comes from realizing when market situations favor reversal setups, customizing settings to match your timeframe and pairs, and having the self-discipline to attend for a number of confirmations earlier than pulling the set off. Merchants who grasp this steadiness don’t catch each reversal, however they catch sufficient high-quality setups to make the technique viable.

Begin with one or two indicators. Take a look at them on demo accounts throughout totally different market situations. Take note of what fails as a lot as what works. That real-world schooling is price greater than any article—or any indicator—can present by itself.

Advisable MT4/MT5 Dealer

XM Dealer

Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

Deposit Bonus as much as $5,000

Limitless Loyalty Program

Award Profitable Foreign exchange Dealer

Further Unique Bonuses All through The Yr

Unique 90% VIP Money Rebates for all Trades!

>> Signal Up for XM Dealer Account right here with Unique 90% VIP Money Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Accomplice Code: VIP90