Be a part of Our Telegram channel to remain updated on breaking information protection

Solana (SOL) is holding agency above the $127 degree after every week of consolidation, even because the broader crypto market faces lingering bearish strain.

Whereas SOL has skilled regular promoting, it continues to draw sturdy institutional curiosity, setting it other than many main belongings. On the identical time, the broader market is displaying early indicators of stabilization, with Bitcoin hovering close to $89,000 and Ethereum buying and selling round $2,950.

Regardless of this tentative restoration, uncertainty stays elevated because the U.S. Senate quickly suspends classes to evaluation and mark up a crypto-related invoice, leaving regulatory readability unresolved within the brief time period. A key bullish sign for Solana is the surge in ETF inflows. Over the previous week, Solana-focused exchange-traded funds recorded greater than $11 million in internet inflows, outperforming each Bitcoin and Ethereum ETFs throughout the identical interval.

🚨BREAKING: SOLANA ETF INFLOWS OUTPERFORM ETHEREUM AND BITCOIN!!!🚨 pic.twitter.com/JoFpDl2N2u

— SolanaNews.sol (@solananew) January 23, 2026

Main institutional gamers, together with Constancy, Grayscale, and Bitwise, have pushed this demand. Constancy’s Solana ETF (FSOL) led the cost with a single-day influx of $9.85 million, pushing its cumulative inflows to roughly $148 million. In whole, Solana ETFs now handle round $1.08 billion in internet belongings, giving SOL a 1.50% internet asset ratio inside these merchandise.

In distinction, Bitcoin ETFs noticed outflows of about $38.5 million, whereas Ethereum ETFs declined by roughly $64.9 million, highlighting a transparent shift in institutional desire towards Solana. Past ETFs, Solana can be gaining momentum on the on-chain exercise entrance. Current knowledge reveals Solana main all blockchains in decentralized trade (DEX) quantity, recording roughly $4.4 billion in trades over 24 hours.

This determine considerably outpaced competing networks, underscoring rising person adoption and liquidity on the Solana ecosystem. With buying and selling exercise surpassing rivals like Binance Sensible Chain and Ethereum, analysts see this as a powerful indicator of Solana’s increasing function in decentralized finance and its potential for continued development, even amid broader market uncertainty.

Solana Value Consolidates Close to $127 Signaling Potential Reversal

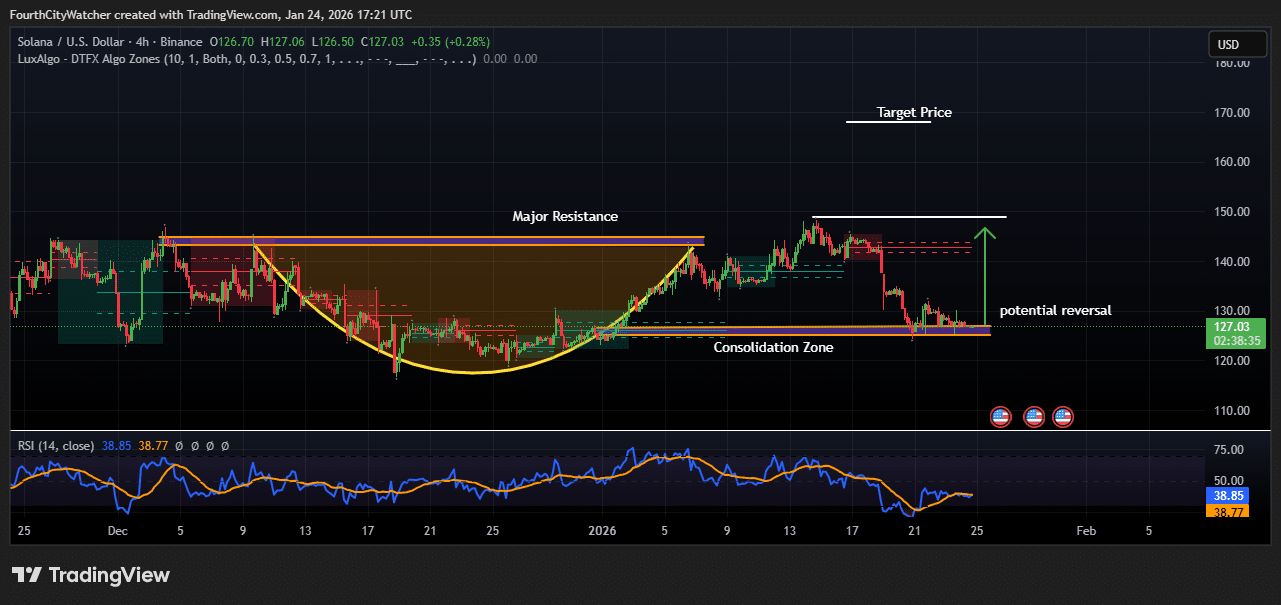

Solana Value buying and selling pair steadily trades on the $127 degree after experiencing a pointy pullback from latest highs. Regardless of ongoing weak point within the broader crypto market, SOL has managed to carry above a key help zone, signaling short-term stability. The worth motion reveals that sellers have slowed down close to the $125–$127 space, permitting Solana to maneuver sideways somewhat than proceed falling. This consolidation means that the market could also be making ready for its subsequent directional transfer.

Earlier, Solana confronted sturdy rejection close to the $145–$150 resistance vary, the place promoting strain elevated and pushed the worth decrease. That zone stays a serious barrier for any upside restoration. For the reason that rejection, SOL has returned to a traditionally necessary demand space, the place patrons have beforehand stepped in. The truth that this degree is holding provides confidence that the draw back could also be restricted for now.

SOLUSD Chart Evaluation. Supply: Tradingview

The Relative Power Index (RSI) on the 4-hour timeframe is hovering round 38–39, which locations SOL near oversold circumstances. Whereas the RSI has not but produced a transparent bullish sign, its flattening motion signifies that bearish momentum is weakening. In related previous conditions, this sort of RSI conduct close to sturdy help has typically led to short-term aid rallies.

If patrons proceed to defend the present consolidation zone, Solana might try a rebound towards the $140 degree. A break above that space would enhance the bullish outlook and open the door for a retest of the $145–$150 resistance vary. Such a transfer would seemingly require stronger market sentiment and elevated shopping for quantity.

Nonetheless, dangers stay on the draw back. A decisive transfer under the $125 help would invalidate the consolidation construction and expose Solana to additional declines towards the $120 psychological degree. Till a transparent breakout or breakdown happens, SOL is predicted to stay range-bound, with merchants intently waiting for affirmation of both a reversal or continued weak point.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

Straightforward to Use, Function-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection