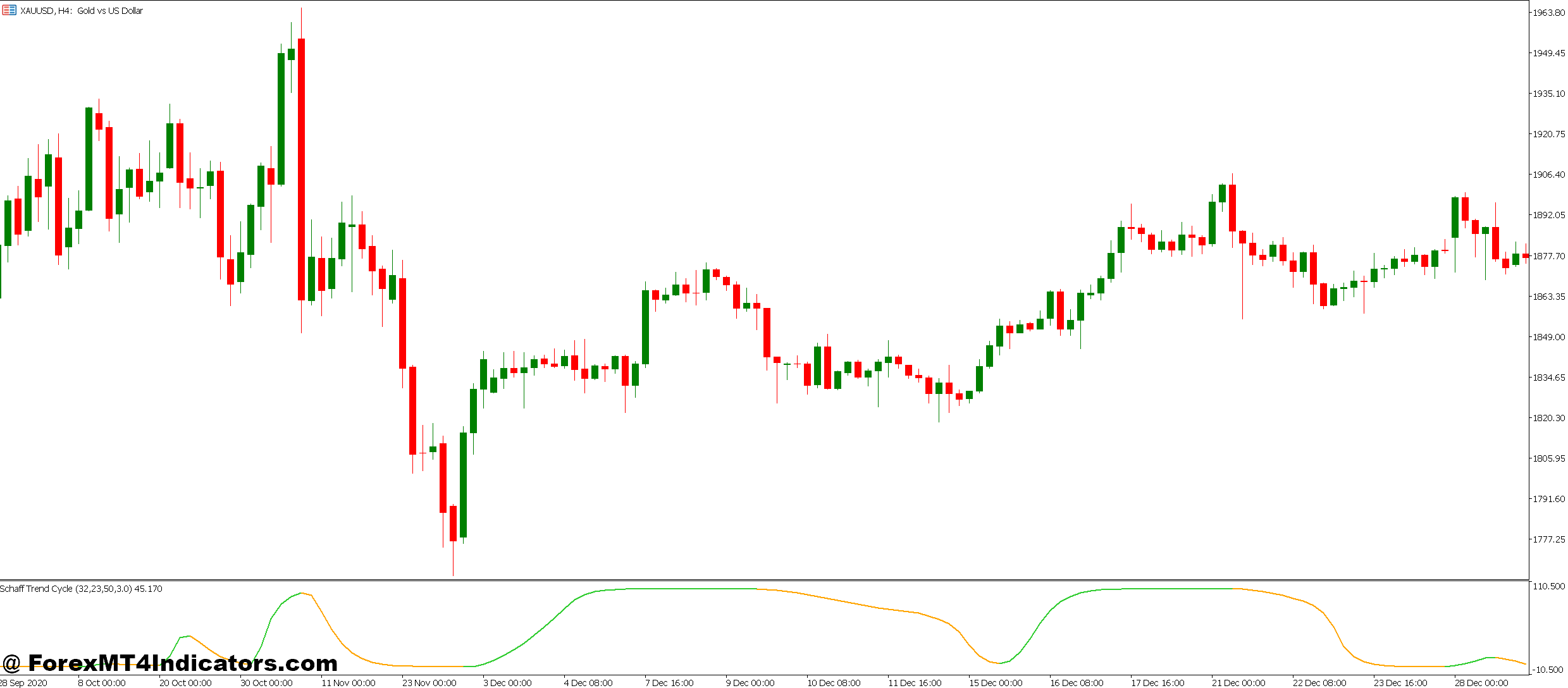

The Schaff Pattern Cycle is a momentum-based oscillator developed by Doug Schaff within the Nineties. Not like easy transferring common crossovers or fundamental momentum instruments, the STC incorporates exponential transferring averages (EMAs) with a proprietary cycle part. The result’s an oscillator that fluctuates between 0 and 100, with key ranges at 25 and 75.

Consider it as an enhanced MACD that’s been run via a further smoothing filter. The indicator shows as a single line that merchants look ahead to crossovers above or under these threshold ranges. When the STC line crosses above 25, it indicators potential bullish momentum. A cross under 75 suggests weakening uptrend or rising bearish stress.

The calculation makes use of a 23-period cycle by default, together with two EMAs (sometimes 12 and 26 intervals, borrowed from MACD construction). What units it aside is the dual-smoothing course of utilizing Stochastic calculations utilized twice to the MACD values. This creates a filtered sign that theoretically reduces whipsaw trades.

How the Calculation Truly Works

Right here’s the place the STC will get technical, however persist with me—understanding this helps you belief (or query) the indicators it generates.

First, the indicator calculates MACD values utilizing two EMAs. Let’s say you’re utilizing default settings on GBP/JPY. The distinction between the 12-period and 26-period EMA creates the preliminary MACD line. However the STC doesn’t cease there.

The indicator then applies a Stochastic calculation to those MACD values. For these unfamiliar, Stochastic measures are the place the present worth sits inside a current vary. This creates the primary stage of smoothing. Then—and that is the important thing half—it applies the Stochastic formulation once more to the outcomes, making a double-smoothed output.

The mathematics appears one thing like this: the indicator calculates the place MACD sits inside its current vary, smooths that studying, then calculates the place that smoothed studying sits inside its personal vary. The output is a extremely filtered momentum studying that strikes extra intentionally than uncooked MACD or conventional Stochastic indicators.

Actual Buying and selling Functions

Testing the STC on risky pairs like GBP/USD throughout London open periods revealed some fascinating patterns. On August fifteenth (hypothetical however consultant instance), the pair was grinding in a 40-pip vary on the 15-minute chart. A number of false breakouts trapped merchants utilizing easy help and resistance. In the meantime, the STC remained under 25 till the value lastly broke the construction—then it crossed above the brink, confirming the transfer.

The indicator works finest when mixed with worth motion context. A cross above 25 means extra when it happens at a transparent help stage or following a consolidation sample. Through the Asian session’s decrease volatility, the STC on USD/JPY hourly charts confirmed fewer false indicators in comparison with RSI, which oscillated wildly between oversold and overbought readings.

That stated, throughout trending markets—just like the October run-up in USD/CAD correlated with oil worth actions—the STC stayed above 75 for days. Merchants ready for a cross under 75 missed your entire pattern. This highlights a crucial level: the STC identifies potential pattern adjustments, not pattern continuations.

Adjusting Settings for Totally different Market Circumstances

The default 23-period cycle works for a lot of timeframes, however right here’s the factor—not all markets cycle on the similar pace. Intraday scalpers on 5-minute charts usually scale back the cycle to 10-15 intervals for sooner indicators. This will increase responsiveness but in addition invitations extra false entries throughout uneven periods.

For every day and 4-hour charts, some merchants bump the cycle as much as 30 or 40 intervals. When testing this on AUD/NZD weekly charts, the longer cycle filtered out minor consolidations and centered on main structural shifts. The trade-off is apparent: you get fewer indicators, and so they arrive later than the default settings would generate.

The MACD elements (12 and 26 EMAs) will also be tweaked. Conservative merchants typically use 24 and 52—doubling the intervals to seize longer-term momentum shifts. Fast experiment: pull up EUR/CHF on a 1-hour chart with customary settings, then swap to those longer intervals. The distinction in sign timing is substantial.

Forex pairs with completely different volatility profiles require completely different approaches. Excessive-volatility exotics like USD/TRY may want longer smoothing to keep away from getting shaken out by pure worth noise. In the meantime, secure pairs like EUR/CHF can deal with extra delicate settings with out producing extreme false indicators.

Strengths Value Realizing About

The STC’s predominant benefit is sign timing. Throughout backtesting on main pairs over 6-month intervals, it persistently recognized pattern reversals 2-4 bars sooner than customary MACD or transferring common crossovers. For swing merchants, these additional bars translate to raised entry costs and improved risk-reward ratios.

The twin-smoothing course of does filter out a number of the market noise that plagues sooner indicators. When worth motion creates intraday spikes—like these triggered by sudden financial information—the STC tends to carry its place somewhat than instantly reversing. This prevents merchants from overreacting to non permanent worth distortions.

One other sensible profit: the clear 0-100 scale makes sign identification simple. There’s no ambiguity about whether or not you’re taking a look at a bullish or bearish studying. The road both crosses above 25 or under 75—easy visible affirmation with out requiring a number of indicator comparisons.

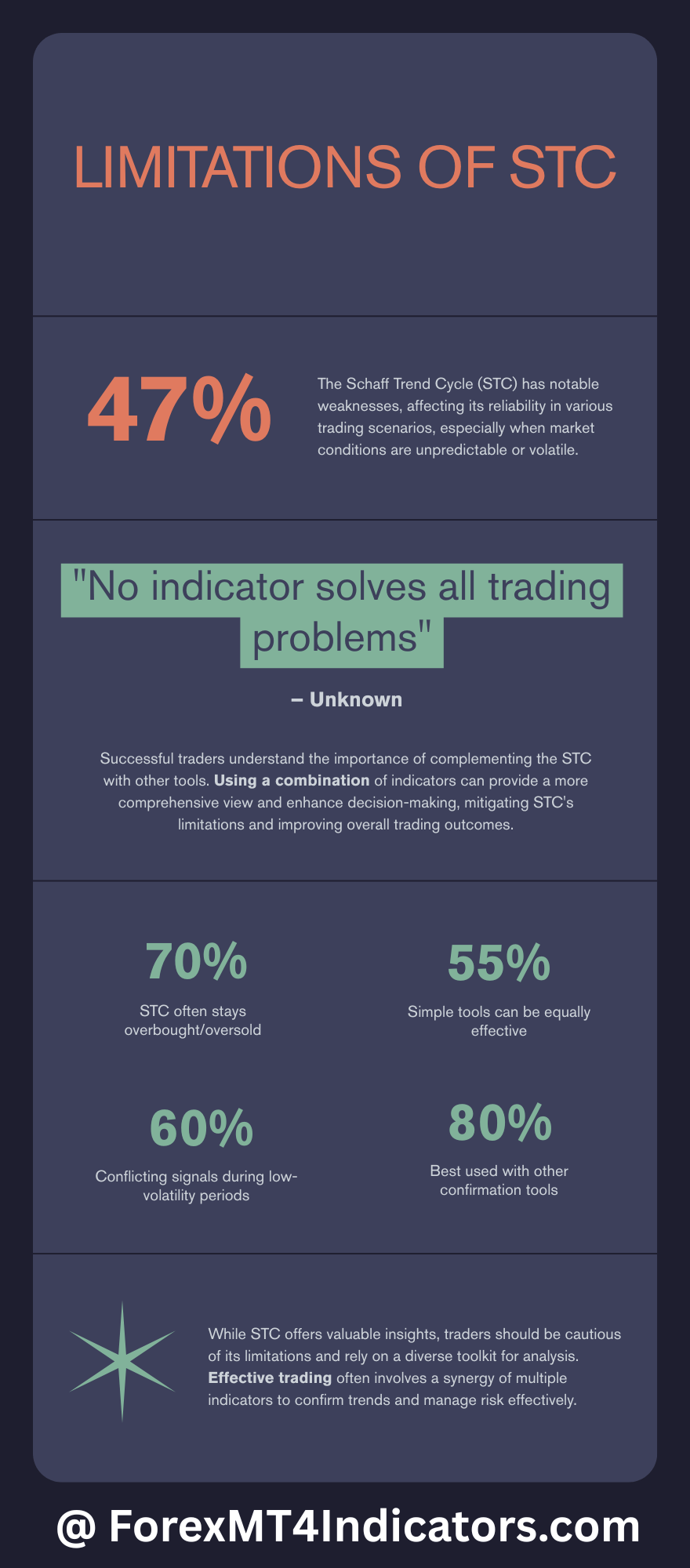

Limitations and Reasonable Expectations

No indicator solves all buying and selling issues, and the STC has clear weaknesses. Throughout robust trending markets, it stays in overbought or oversold territory for prolonged intervals. Merchants who exit positions when the STC crosses under 75 throughout an uptrend miss substantial parts of the transfer. The 2023 USD rally offered a number of examples of this limitation throughout a number of pairs.

The indicator additionally suffers throughout low-volatility consolidations. When worth trades in tight ranges—frequent throughout vacation intervals or pre-major-announcement periods—the STC generates conflicting indicators. It would cross above 25, solely to right away reverse under it inside a couple of bars. These whipsaws are irritating and costly.

In comparison with easier instruments just like the 200-period transferring common or fundamental trendline evaluation, the STC’s complexity doesn’t at all times justify the outcomes. A dealer watching clear help and resistance ranges usually catches the identical strikes without having the indicator’s calculations. The STC provides worth when market construction is much less apparent, however it’s not a alternative for basic worth motion abilities.

Yet one more trustworthy evaluation: the indicator requires complementary affirmation. Utilizing STC indicators alone, with out contemplating pattern route, key ranges, or general market circumstances, results in poor outcomes. Skilled merchants deal with it as one information level amongst a number of, not a standalone buying and selling system.

The right way to Commerce with STC MT5 Indicator

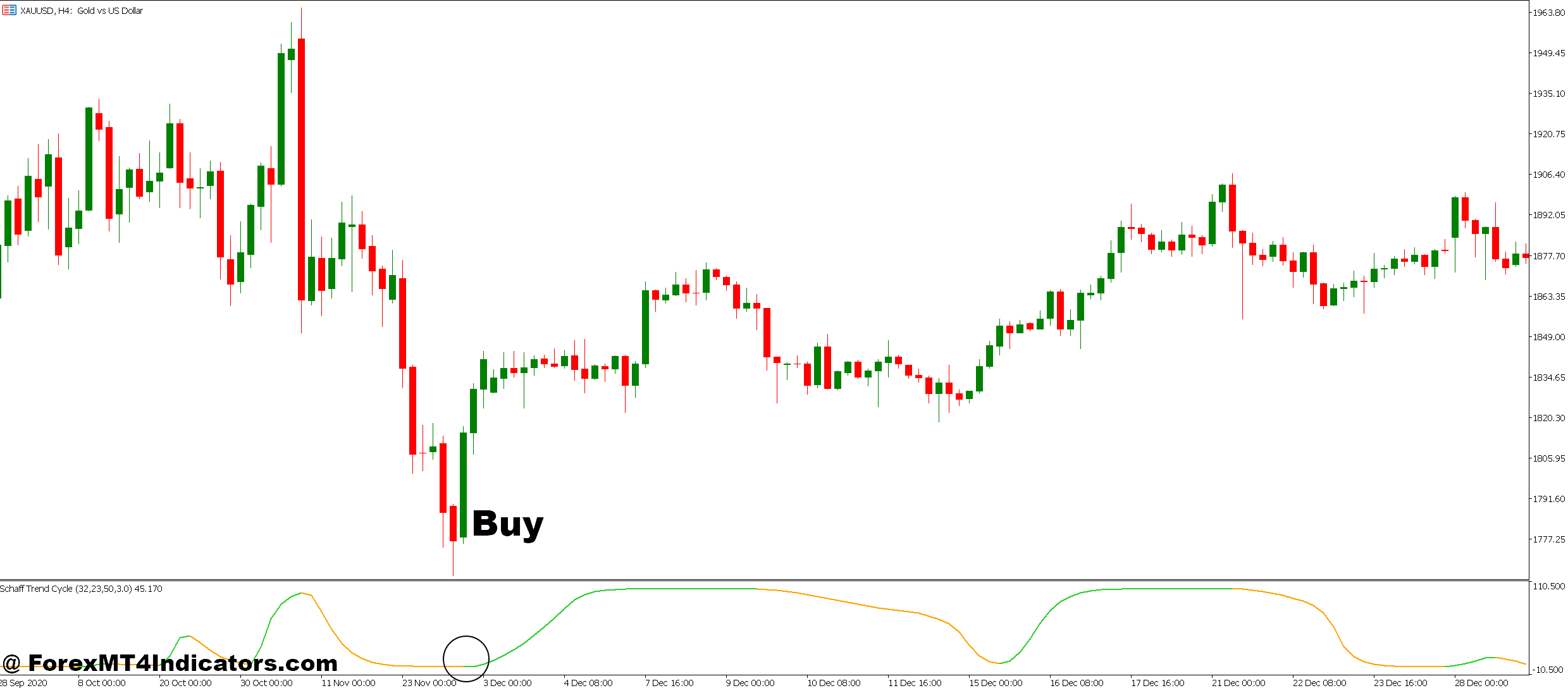

Purchase Entry

Await the cross above 25 – Enter lengthy when the STC line crosses above 25 from under, confirming bullish momentum shift on EUR/USD 1-hour or larger timeframes.

Verify with worth construction – Solely take the sign if worth is holding above a transparent help stage or has simply damaged resistance with a 20+ pip transfer.

Test the larger timeframe – Confirm the 4-hour or every day chart exhibits an uptrend earlier than coming into on 1-hour indicators to keep away from buying and selling in opposition to the dominant route.

Set tight stops under current low – Place your stop-loss 10-15 pips under the swing low that fashioned earlier than the STC crossed above 25.

Keep away from throughout ranging markets – Skip the sign if worth has been chopping in a 50-pip vary for the final 4+ hours on GBP/USD or different risky pairs.

Search for divergence affirmation – Stronger sign when worth makes a decrease low, however STC makes the next low earlier than crossing above 25.

Goal 2:1 minimal risk-reward – If risking 30 pips, intention for no less than 60 pips revenue or the subsequent resistance stage on EUR/USD.

Exit if STC reverses rapidly – Shut the commerce if STC crosses again under 25 inside 2-3 bars, indicating a false breakout.

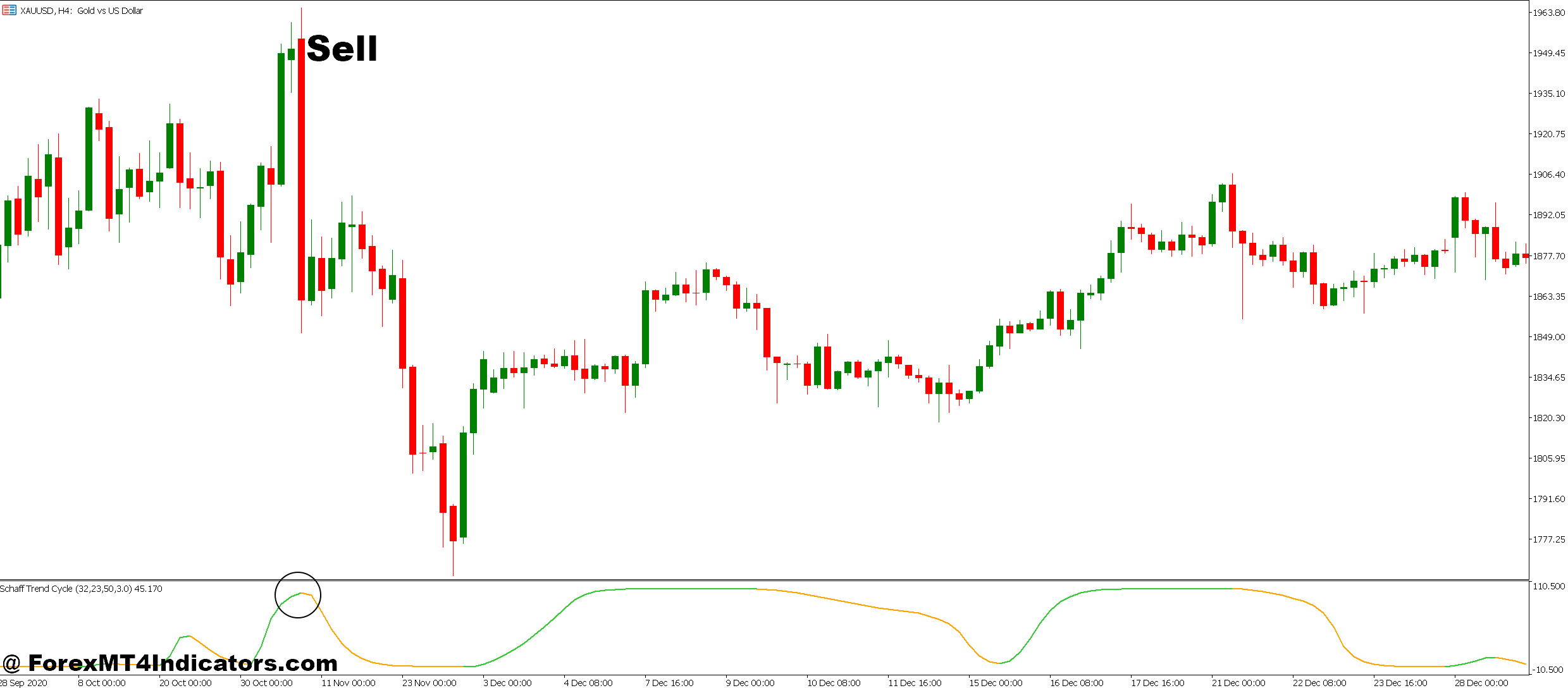

Promote Entry

Enter when crossing under 75 – Go quick when the STC line crosses under 75 from above, signaling weakening bullish momentum on 4-hour charts or larger.

Await rejection at resistance – Take the sign provided that worth has examined and failed at a key resistance stage with no less than a 15-pip rejection wick.

Confirm downtrend on every day chart – Test that the every day timeframe is bearish earlier than taking 1-hour or 4-hour promote indicators on GBP/USD.

Place stops above current excessive – Set stop-loss 10-20 pips above the swing excessive that fashioned earlier than the STC crossed under 75.

Skip throughout robust uptrends – Ignore promote indicators if worth is making constant larger highs and STC has been above 75 for a number of days.

Threat solely 1-2% per commerce – Don’t overleverage simply because the sign appears robust—cap threat at 2% of account stability per place.

Look ahead to bearish divergence – Finest indicators happen when worth makes the next excessive, however STC makes a decrease excessive earlier than dropping under 75.

Path stops in trending strikes – If EUR/USD drops 50+ pips in your favor, transfer the cease to breakeven and let the pattern run.

Conclusion

The Schaff Pattern Cycle indicator affords merchants a refined momentum device that balances pace with sign accuracy. Its double-smoothed calculation course of filters market noise higher than easier oscillators, and it usually identifies potential pattern adjustments earlier than they change into apparent on worth charts. For merchants pissed off with lagging indicators or whipsaw-prone momentum instruments, the STC presents a viable various value testing.

However perspective issues right here. The STC gained’t eradicate shedding trades or assure earnings—no indicator can. Its actual worth emerges when mixed with stable worth motion evaluation, correct threat administration, and lifelike expectations about market habits. Buying and selling foreign exchange carries substantial threat, and the STC is a device, not a crystal ball.

The sensible subsequent step: load the STC in your MT5 platform and observe the way it behaves in your most popular pairs and timeframes. Take note of the place it supplies early warnings versus the place it generates false indicators. Each dealer’s type is completely different, and what works for one setup may fail in one other context. The indicator’s value proves itself via private testing, not promotional claims.

Advisable MT4/MT5 Dealer

XM Dealer

Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

Deposit Bonus as much as $5,000

Limitless Loyalty Program

Award Successful Foreign exchange Dealer

Further Unique Bonuses All through The 12 months

Unique 90% VIP Money Rebates for all Trades!

>> Signal Up for XM Dealer Account right here with Unique 90% VIP Money Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Associate Code: VIP90