Key Takeaways:

The launch of Lido V3 on Ethereum Mainnet has permitted stVaults to now run on stEth.You’ll be able to stake on stVaults by creating a customized, optional-liquidity staking technique concentrating on organizations, node operators, in addition to builders.Staking has now been enabled in merchandise through Layer-2 networks, node operators and DeFi groups.

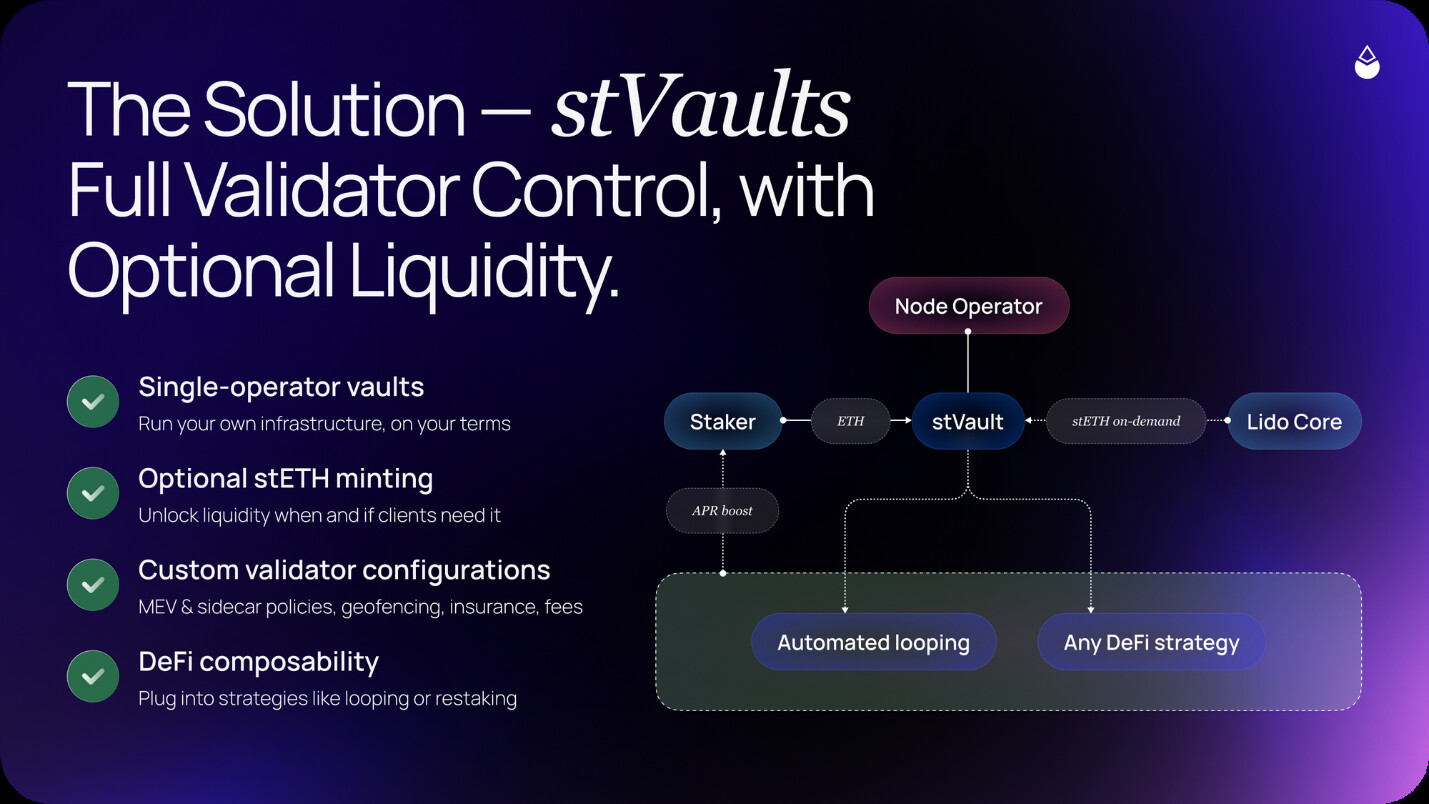

Lido V3 has been deployed to Ethereum mainnet and replaces one of many choices of liquid staking with a modular system in Lido. It additionally unleashes stVaults, an thrilling choice that permits deciding on any customized validator configuration however leaves stETH liquidity on name.

Lido V3 Expands Ethereum Staking Infrastructure

Lido V3 follows months of staged testing, public audits, and a managed comfortable launch. The improve doesn’t change Lido’s core protocol. Fairly than substituting it, it operates concurrently and extends the system to help many concurrent staking fashions.

On the middle of V3, there are stVaults. These are remoted staking environments the place vault homeowners outline validator operators, operational guidelines, charges, and danger parameters. Not like conventional pooled staking, stVaults permit customization with out forcing customers to surrender liquidity or DeFi entry.

Staked ETH in a vault can mint stETH, retaining positions usable throughout lending markets, collateral methods, and liquidity swimming pools. This construction permits numerous staking merchandise to coexist whereas feeding into the identical liquidity layer.

Learn Extra: TheDAO’s Main Return with $220M Ethereum Safety Fund

Operator-Pushed Staking Use Circumstances

The idea of the Northstake of utilizing stVaults as a basis to their Staking Vault Supervisor, which permits the establishments to stake in stVaults and operators, with out their belongings being mixed. Solstice is launching traceable and yield-conservative compliance-centric vaults all linked to the stETH house.

A brand new dose of flexibility is given to the node operators. As an alternative of selecting between both a pooled or illiquid delegate mannequin, they’re able to provoke customized merchandise on their very own infrastructure. An instance is P2P.org, which is designing particular stVaults that help customized coverage and clear studies of efficiency.

Learn Extra: Constancy Unveils “FIDD” Stablecoin, Coming into the Ethereum Ecosystem

Technique Design, DeFi Tooling, and L2 Integrations

stVaults as a Base Layer for Builders

Lido V3 opens up new capabilities to the methods of staking. Crazy staking the place rewards are compounded by lending markets, market-neutral buildings the place validation and danger administration are separated, are already being experimented with by groups.

To cut back launch friction, Lido launched the DeFi Wrapper toolkit. It contains sensible contracts for pooled vaults, connectors to yield methods, white-label interfaces, and customized ERC-20 vault tokens. Builders can ship merchandise rapidly or combine their very own methods for particular markets. Layer-2 networks also can embed staking immediately into consumer flows.

![Best Hyperliquid Referral Code in 2026: [HYPERLIQUIDREVIEW] Best Hyperliquid Referral Code in 2026: [HYPERLIQUIDREVIEW]](https://i0.wp.com/www.cryptoninjas.net/wp-content/uploads/hyperliquid-referral-code.jpg?w=350&resize=350,250&ssl=1)