Regardless of a serious outflow only a day earlier, Spot XRP ETFs have defied bearish sentiment, setting file buying and selling volumes and attracting contemporary inflows. This resilience and surge in investor demand is especially stunning given the current crash within the XRP value and the general downturn within the broader crypto market.

Associated Studying

XRP ETFs Defy Traits And Hit Document Quantity

XRP is making headlines after its ETF skilled contemporary inflows following a big outflow. Based on information from SoSoValue, XRP ETFs noticed a file $92.9 million drop on January 29, 2026. This marked the biggest discount since their launch on November 13, 2025.

Since changing into obtainable for buying and selling, XRP ETFs have registered solely three outflows, with the current $92.9 million lower being the third. This withdrawal was primarily pushed by Grayscale’s GXRP, which noticed a whopping $98.39 million go away the fund, partially offset by inflows into Franklin Templeton’s XRPZ, Bitwise’s XRP ETF, and Canary’s XRPC.

On the time of the outflow, the entire internet property of XRP ETFs fell to $1.21 billion from $1.39 billion the day earlier. The decline coincided with a drop in XRP’s value, which fell from $1.92 to $1.80 over 24 hours. Unexpectedly, XRP ETFs picked up only a day after the $92.9 million withdrawal. They recorded a every day whole internet influx of $16.79 million, though whole internet property nonetheless declined barely to $1.19 billion.

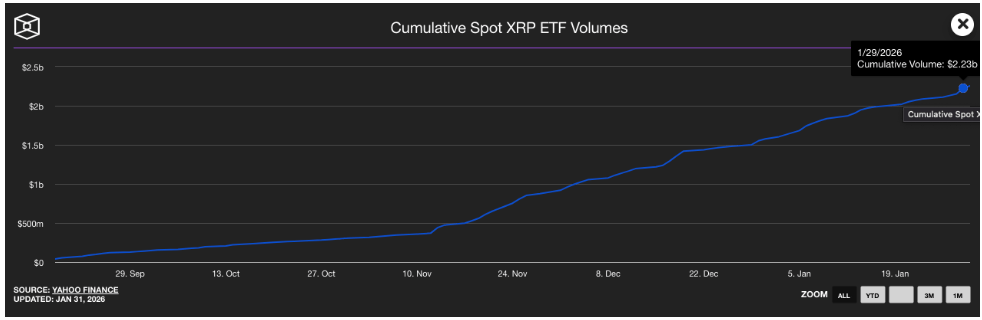

Extra impressively, Spot XRP ETFs achieved file buying and selling volumes regardless of the general downtrend. Information from The Block exhibits that XRP ETFs noticed their cumulative quantity rise to $2.23 billion from $2.15 billion simply someday after the $92.9 million every day outflow. Stories indicated that Bitwise’s XRP ETF had the best buying and selling quantity on the time, adopted by Grayscale’s GXRP, Franklin Templeton’s XRPZ, Canary’s XRPC, and 21Shares TOXR, in that order.

By way of whole Belongings Underneath Administration (AUM), XRP ETFs declined barely, falling from $1.48 billion to $1.32 billion following the January 29 outflow.

XRP Worth Continues Slide Amid Market Uncertainty

Whereas XRP ETFs are recovering from current outflows, the cryptocurrency’s value continues to say no, extending its losses from earlier this 12 months. Based on CoinMarketCap, XRP has dropped by greater than 11% over the previous week and slightly over 3% within the final 24 hours. Following this decline, its value now sits round $1.69, representing a greater than 15% fall from its $2 degree seen only a few weeks in the past.

Associated Studying

XRP’s every day buying and selling quantity can also be down by greater than 26.6% on the time of writing, indicating a possible decline in dealer confidence and rising uncertainty out there. Supporting this pattern, XRP’s Worry and Greed Index has fallen into the “Worry” zone. The broader crypto market is displaying related weak spot, with the index signaling excessive concern throughout main digital property.

Featured picture from Unsplash, chart from TradingView