Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

XRP is beginning to attract consideration once more as indicators of a possible breakout start to take form. With market sentiment step by step shifting and XRP holding key help ranges, analysts recommend that the stage could also be set for the subsequent impulse wave. If momentum continues to construct and demanding resistances are cleared, XRP may very well be on the verge of an explosive worth rally to $8.5.

Elliott Wave Factors To Main XRP Value Breakout

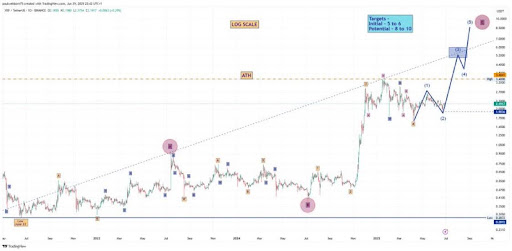

Paul Webborn, a crypto analyst on X (previously Twitter), has launched a brand new XRP forecast replace, reinforcing his bullish stance on the third-largest cryptocurrency. In his evaluation, the market professional reveals that XRP could also be getting into a robust impulse part, with projected targets doubtlessly reaching and even surpassing $8 within the present cycle.

Associated Studying

Webborn’s evaluation applies Elliott Wave Idea to trace XRP’s worth actions from its June 2022 low, figuring out that time as the beginning of a brand new bullish cycle. The chart supplies a visible roadmap of XRP’s subsequent strikes primarily based on the impulse wave construction.

The cryptocurrency is anticipated to expertise a short-term rise to preliminary targets under $8, adopted by a quick pullback earlier than a last rally that might push XRP to new all-time highs. Notably, the chart exhibits that main Waves A and B have already performed out, and XRP is now progressing by means of Wave C, which is unfolding in 5 intermediate waves.

Intermediate waves 1 by means of 4 seem full, with Wave 5 nonetheless forming. Webborn notes that this last fifth wave is anticipated to interrupt down into 5 smaller minor waves. Minor wave 3 is projected to push XRP towards the $5 and $6 vary, whereas the total extension of Wave C may carry it to between $8 and $10.

The analyst has set an invalidation degree at $1.90, which means any transfer under that might break the present bullish construction and presumably result in additional downward stress on the XRP worth. Webborn predicts that if the $1.90 degree is damaged, XRP may doubtlessly expertise a crash towards new lows round $0.287, marking greater than an 87% decline from its current market worth.

Nonetheless, the chart means that this low has already been reached, additional reinforcing the bullish narrative that the altcoin could also be on the verge of a serious upward breakout. Whereas Webborn has supplied no particular timeline for his optimistic forecast, the analyst believes that the approaching few months may very well be explosive because the market enters the subsequent part of the impulse.

Replace On Value Motion

These days, the XRP worth has maintained robust help above $2, displaying energy regardless of an prolonged consolidation interval. CoinMarketCap knowledge exhibits that the cryptocurrency is at the moment buying and selling at $2.22, reflecting a modest 1.35% rise over the previous day.

Associated Studying

Though XRP remains to be priced considerably under its all-time excessive, knowledge from CoinCodex exhibits that market sentiment stays extremely bullish. The cryptocurrency’s Concern and Greed Index additionally at the moment sits at 64, firmly within the ‘Greed’ zone.

Featured picture from Getty Pictures, chart from Tradingview.com