Bitcoin simply noticed its mining problem drop greater than 11%. That isn’t a small tweak. It’s the sharpest adverse adjustment for the reason that China mining ban in 2021.

This type of transfer indicators actual stress beneath the floor. Mining profitability has been squeezed onerous, and weaker operators are clearly feeling it. The issue minimize provides surviving miners some respiratory room for now.

(Supply: Bitbo)

However this reduction won’t final. If worth stays beneath stress or hash price swings once more, the stress may return rapidly.

DISCOVER: Prime 20 Crypto to Purchase in 2026

What the 11% Drop Means for Miners

The issue dropped to round 125.86 trillion at block 935,424. In easy phrases, it simply grew to become 11% simpler to mine Bitcoin than it was two weeks in the past.

That occurred as a result of a piece of hashrate went offline, largely on account of excessive vitality prices and operational pressure.

Issue Shock

Bitcoin mining problem simply dropped -11.16% — the most important adverse adjustment for the reason that July 2021 China mining ban crash.

This marks the tenth largest downward problem adjustment in Bitcoin’s historical past.

A serious reset in hash energy dynamics. pic.twitter.com/jJCb5ywUm6

— Maartunn (@JA_Maartun) February 12, 2026

However keep in mind, problem is backward-looking. It displays the final two weeks, not real-time situations. And there are already indicators that machines are coming again on-line. CoinWarz is even projecting a possible 12% snapback as quickly as subsequent week.

DISCOVER: Finest New Cryptocurrencies to Put money into 2026

What This Means for Bitcoin Worth

So is that this a purchase sign? Not proper now.

Traditionally, miner capitulation typically reveals up close to market bottoms. When weaker miners shut down and cease promoting, it may well sign that the worst of the compelled provide is behind us. That’s the bullish case.

However the stress remains to be actual. Miners have electrical energy payments and debt. When margins get tight, they promote what they mine as an alternative of holding it. That creates regular promoting stress, particularly in weak markets.

Large establishments play a special sport. Lengthy-term gamers have a tendency to make use of dips to build up, betting on restoration over years, not weeks. Nonetheless, current earnings throughout the sector present volatility is hitting everybody, from miners to giant holding companies.

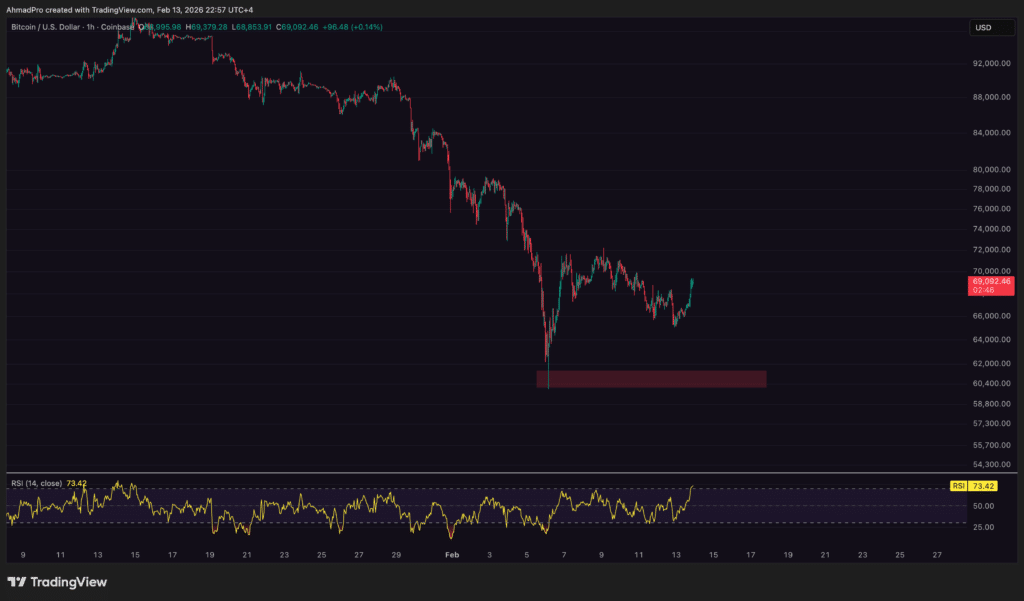

(Supply: BTCUSD / TradingView)

Now right here is the important thing danger. If problem jumps again up subsequent week and not using a significant worth rebound, miners get squeezed once more. That would restart the stress cycle.

Watch the subsequent adjustment round February 20. And preserve your eye on $60,000. If consumers can take up miner promoting there, the construction holds. If not, the market may face one other leg down.

DISCOVER: Prime Solana Meme Cash to Purchase in 2026

Comply with 99Bitcoins on X For the Newest Market Updates and Subscribe on YouTube For Each day Professional Market Evaluation.

The submit Bitcoin Mining Issue Plunges 11%, What It Means for Miners and BTC Worth appeared first on 99Bitcoins.