The founding father of Capriole Investments has identified how Google searches associated to “Quantum Computing Bitcoin” peaked alongside the value high.

Bitcoin Noticed Elevated Curiosity In Quantum Risk Throughout Bull Run

In a brand new submit on X, Capriole Investments founder Charles Edwards has talked concerning the development within the Google search curiosity across the Quantum Computing menace to Bitcoin.

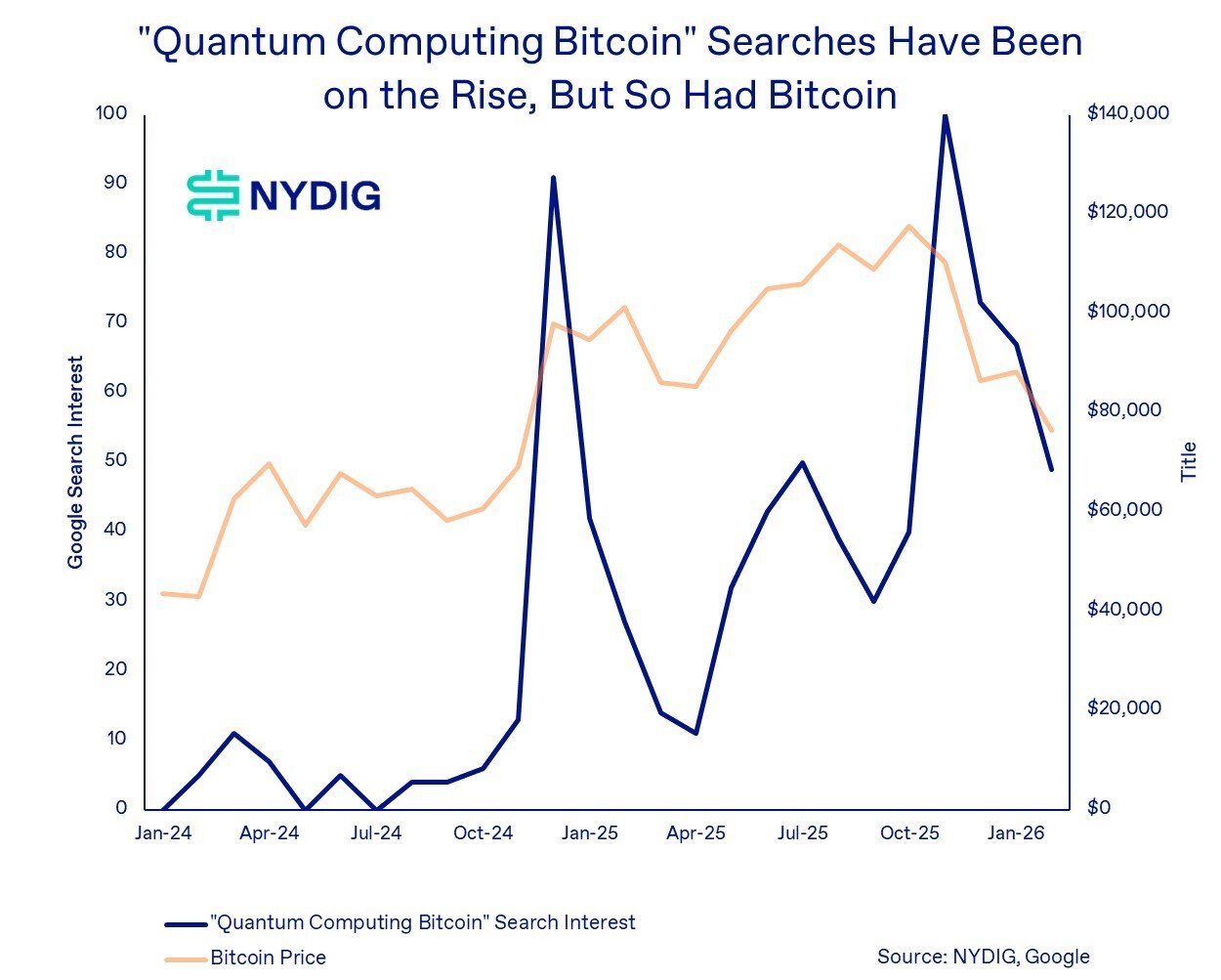

Beneath is the NYDIG chart cited by the analyst that traces up the Google search information for “Quantum Computing Bitcoin” in opposition to the cryptocurrency’s value trajectory.

Appears to be like like curiosity within the search time period hit a peak final yr | Supply: @caprioleio on X

As displayed within the graph, the Google search curiosity within the matter witnessed a pointy surge simply as final yr’s bull rally reached its peak. This is able to suggest that the value appreciation introduced with it danger analysis across the Quantum Computing menace to the cryptocurrency.

Quantum Computing is an rising expertise that would, in principle, exploit the vulnerabilities current in outdated BTC wallets to entry the tokens saved inside them and dump them available on the market.

The timeline associated to when Quantum Computing may turn into superior sufficient to do that stays but unsure, however it has nonetheless raised considerations amongst many within the BTC group. Edwards has been one of many loudest voices on the subject of this situation, urging the group to work collectively on an answer as quickly as attainable.

Primarily based on the Google search curiosity chart, the analyst has famous, “Analysis of the chance was at a maxima when value was, leading to derisking, a number one indicator to cost falling.” Shortly after the height within the metric, the asset noticed a bearish shift that has at present taken it under the $70,000 mark. “The Quantum menace drove Bitcoin down,” mentioned Edwards.

From the graph, it’s additionally seen {that a} related trajectory was seen in the course of the value surge that occurred in late 2024. Again then, the subject noticed barely decrease peak traction and light rapidly as soon as the cryptocurrency slowed down.

Curiosity within the matter has gone down this time in addition to Bitcoin has declined, however it nonetheless stays considerably above the low from early 2025, a possible signal that the ground curiosity within the danger has gone up. “The excellent news is, at the least this implies we’re beginning to get traction and a focus in the best locations to resolve the issue (Technique, Eth basis and so forth),” famous the Capriole founder.

Analyst Willy Woo has additionally made an X submit discussing the Quantum danger. Because the chart shared by Woo illustrates, the Bitcoin vs Gold value has damaged a twelve-year development just lately.

The development within the XAUBTC ratio over time | Supply: @willywoo on X

The XAUBTC ratio was in a state of downtrend for twelve years, however its worth noticed a reversal final yr and has since been rising. “The valuation development broke down as soon as QUANTUM got here into consciousness,” defined the analyst.

BTC Value

On the time of writing, Bitcoin is buying and selling round $68,600, down 2.4% during the last week.

The value of the coin appears to have been shifting sideways over the previous few days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.