CME Group goes totally crypto mode. Beginning Could 29, 2026, it would provide 24/7 buying and selling for its crypto futures and choices. No extra weekend gaps. No extra ready for conventional market hours.

This transfer closes the mismatch between Wall Avenue schedules and the always-on nature of crypto. And it comes as institutional demand continues to hit document ranges.

Conventional finance is lastly adjusting to crypto pace.

The crypto market doesn't sleep. Now, your threat administration doesn't should both.

24/7 buying and selling for Cryptocurrency futures and choices is coming Could 29*, so you may handle your threat when it’s essential to.

See what's altering.

https://t.co/DQt7os6uFX

*Pending regulatory evaluation pic.twitter.com/i6xjkJVffm

— CME Group (@CMEGroup) February 19, 2026

DISCOVER: Greatest New Cryptocurrencies to Put money into 2026

The Finish of the Weekend Hole

For years, there was a bizarre mismatch.

Bitcoin trades 24/7 on spot exchanges. However CME futures would shut down for the weekend. That’s how the well-known “CME hole” was born. Worth would transfer whereas Wall Avenue desks had been offline, then reopen with a soar.

No extra CME hole child

https://t.co/RJH5vgUKaD

— Crypto Child (@CryptoKid) February 19, 2026

Large gamers principally needed to watch from the sidelines between Friday and Sunday whereas crypto stored shifting.

That dynamic is about to vanish. With 24/7 futures buying and selling, establishments can hedge threat anytime, simply as retail merchants do. No extra compelled breaks whereas the market runs.

DISCOVER: Prime 20 Crypto to Purchase in 2026

Institutional Urge for food Hits Document Ranges

This isn’t about comfort. It’s about scale.

CME says demand for threat administration is at an all-time excessive. In 2025 alone, it processed $3T in quantity. That could be a severe measurement.

Every day quantity is up 47% yr over yr, averaging greater than 403,900 contracts. And it isn’t simply Bitcoin and Ether. The lineup now contains Solana, XRP, and newer contracts for Cardano, Chainlink, and Stellar.

Retail merchants may watch IBIT choices for hype. Establishments watch futures open curiosity. That’s the place actual leverage sits. Metrics like Cardano’s open curiosity reveal the extent of threat constructed into the system.

Bitcoin possession modified massively in 2025.

Extra in subsequent week’s report on Bitcoin adoption. pic.twitter.com/dyIk9e7rWt

— River (@River) February 17, 2026

With 24/7 entry, huge gamers now not should concern a weekend transfer they can not hedge. They’ll handle publicity in actual time.

Will This Tame Bitcoin Worth Volatility?

For normal buyers, this cuts each methods.

Weekends used to imply skinny liquidity. That’s the reason we obtained these wild swings and random rip-off wicks. With CME open 24/7, liquidity ought to deepen. That would clean out a few of that chaos. Some even argue that is one other step towards a extra mature, steady Bitcoin market.

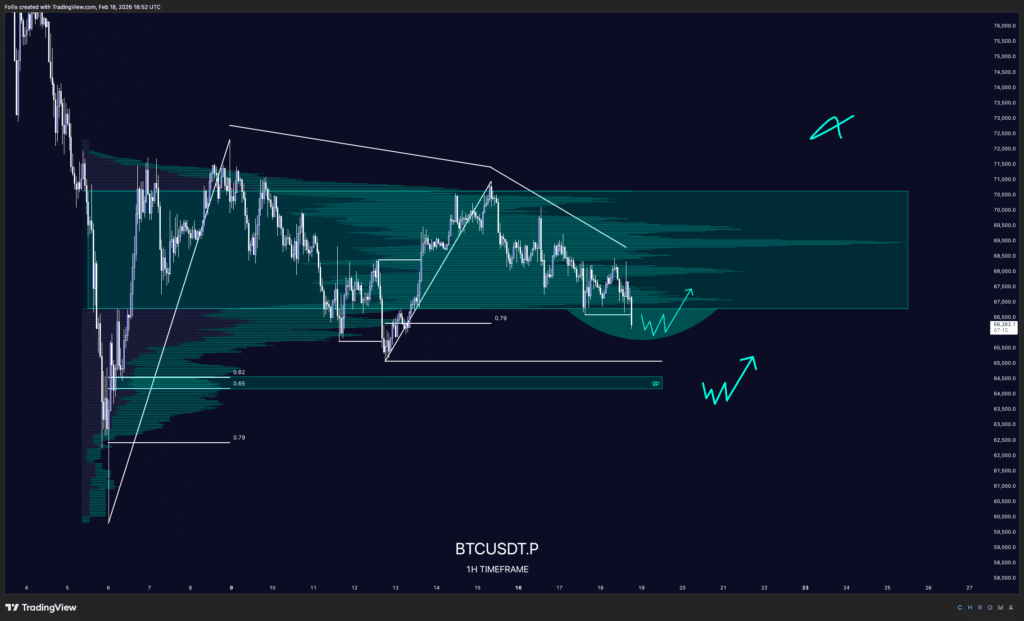

(Supply: BTCUSD / TradingView)

However decelerate.

If establishments can commerce at 3 a.m. on a Sunday, they will additionally react immediately to headlines. Which may cut back gaps whereas dashing up strikes. Volatility doesn’t disappear. It simply evolves.

If regulators log off, this goes stay in late Could. And that marks an actual shift in how Wall Avenue handles crypto.

DISCOVER: Prime Solana Meme Cash to Purchase in 2026

Comply with 99Bitcoins on X For the Newest Market Updates and Subscribe on YouTube For Every day Professional Market Evaluation.

The put up No Extra CME Hole? CME Group Launch 24/7 Buying and selling appeared first on 99Bitcoins.