Bitcoin is holding regular above the $108,000 stage, sustaining a bullish construction regardless of repeated failures to interrupt by means of its all-time excessive close to $112,000. The value is consolidating in a good short-term vary, and whichever aspect breaks first will seemingly set the tone for the approaching weeks. This era of low volatility will be the calm earlier than the storm, as consumers and sellers put together for the following main transfer.

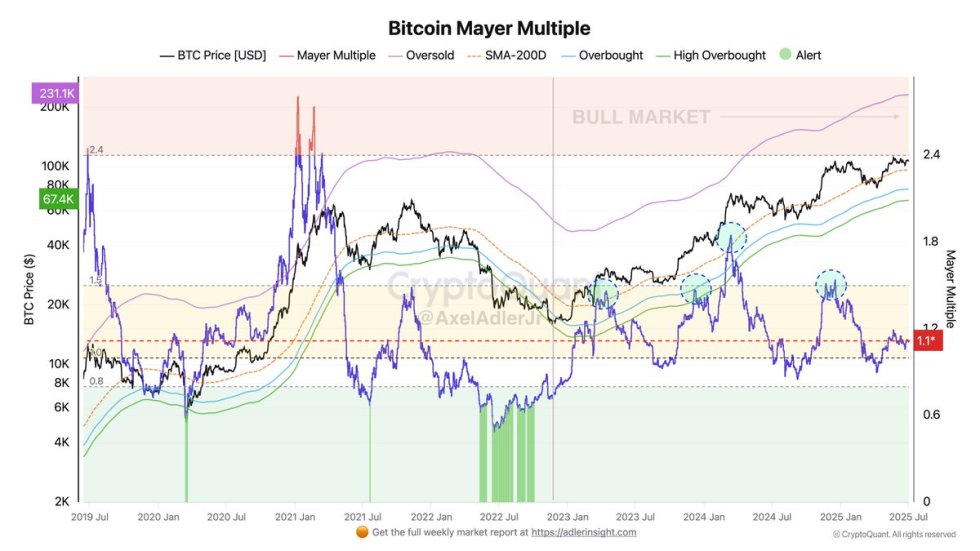

In response to information from CryptoQuant, the Mayer A number of — a traditional indicator that measures Bitcoin’s worth relative to its 200-day transferring common — at the moment stands at 1.1x. This places BTC within the “impartial” zone (0.8–1.5x), far beneath the overbought situations sometimes seen within the late phases of bull markets. Traditionally, readings beneath 1.5x counsel that Bitcoin nonetheless has important upside potential earlier than hitting speculative extremes.

Because the market awaits a breakout, traders are carefully watching this metric for affirmation that BTC remains to be undervalued in comparison with previous bull cycles. If Bitcoin can maintain its present ranges and push decisively above resistance, the impartial Mayer A number of studying might function a launchpad for a renewed bullish development — however failure to interrupt out could invite a wave of short-term promoting.

Bitcoin Holds Agency Amid Blended Indicators

Bitcoin worth motion has left many bulls annoyed, because the market continues to grind beneath its all-time excessive with out a clear breakout. After weeks of consolidation close to the $110K mark, merchants are bracing for a decisive transfer. Whereas the construction stays intact and help has held above $105K, the failure to push above earlier highs might improve the likelihood of a pointy correction, probably dragging BTC beneath essential demand ranges which have served as a flooring for the previous month.

On the macro entrance, uncertainty seems to be easing. Conflicts within the Center East are winding down, and US inventory markets proceed to set new all-time highs, signaling renewed threat urge for food. Nevertheless, not all alerts are bullish. Rising inflation and elevated US Treasury yields have reintroduced systemic threat issues, holding traders on alert.

Prime analyst Axel Adler provided a extra optimistic perspective, pointing to the Mayer A number of — a time-tested mannequin that compares BTC worth to its 200-day transferring common. At present sitting at 1.1x, the indicator stays firmly throughout the impartial zone (0.8–1.5x) and nicely beneath ranges traditionally related to market tops. Adler notes that this means Bitcoin remains to be buying and selling at a reduction to earlier bull markets, and will have important room to rally if momentum returns.

With blended macroeconomic information and a impartial valuation mannequin, Bitcoin’s subsequent transfer will rely upon whether or not bulls can reclaim management. A clear breakout above all-time highs would seemingly ignite a brand new part of worth discovery. However till then, warning prevails — the longer BTC stalls, the extra seemingly sellers will check help.

BTC Consolidates Under All-Time Excessive

Bitcoin continues to consolidate just under its all-time excessive, buying and selling at $108,474 on the time of writing. The three-day chart reveals worth motion tightly compressed between key ranges, with robust help at $103,600 and resistance at $109,300 — the latter being examined repeatedly over the past two weeks. This range-bound construction displays indecision as bulls try to interrupt larger, whereas bears fail to reclaim management.

Notably, BTC stays firmly above the 50-day (blue), 100-day (inexperienced), and 200-day (pink) transferring averages, indicating underlying energy within the development. Quantity stays reasonable, however it has picked up throughout upward strikes, suggesting continued buy-side curiosity close to help.

The longer BTC holds above $105K and maintains this larger low construction, the larger the likelihood of a breakout towards uncharted territory above $112K. Nevertheless, rejection on the $109K stage might result in one other retest of help zones. Momentum indicators, whereas not proven, are seemingly flattening, in line with the sideways motion.

Given the narrowing vary and rising pressure between help and resistance, a decisive transfer is imminent. Merchants ought to look ahead to a clear breakout above $109,300 or breakdown beneath $103,600 — both will seemingly outline Bitcoin’s course heading into Q3.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.